Is life insurance taxable in pa Idea

Home » Trending » Is life insurance taxable in pa IdeaYour Is life insurance taxable in pa images are ready. Is life insurance taxable in pa are a topic that is being searched for and liked by netizens today. You can Find and Download the Is life insurance taxable in pa files here. Get all free photos and vectors.

If you’re searching for is life insurance taxable in pa images information related to the is life insurance taxable in pa keyword, you have visit the ideal blog. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

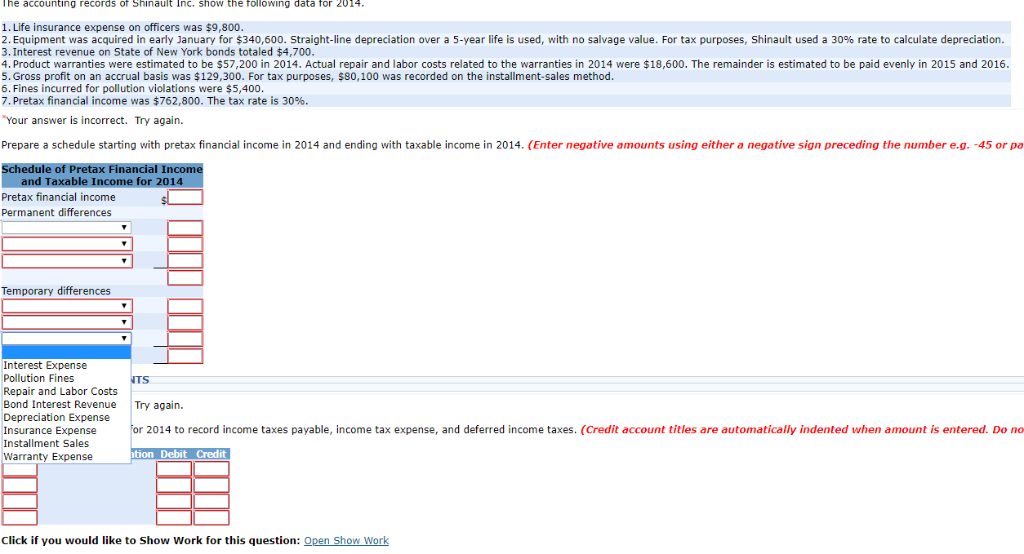

Is Life Insurance Taxable In Pa. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. But when life insurance gets mixed with business, sometimes it can have tax implications. For example, if your beneficiaries receive a total of $101,000 for a $100,000 life insurance policy, the $1,000 is taxable at their income rate. The life insurance payout goes into a taxable estate:

Is life insurance money taxable insurance From greatoutdoorsabq.com

Is life insurance money taxable insurance From greatoutdoorsabq.com

Group term life insurance is never taxable for pennsylvania personal income tax. Income tax and estate tax. However, there are instances where proceeds. But there are times when money from a policy is taxable, especially if you�re accessing cash value in. So if your $250,000 life insurance benefit gains $25,000 in interest between time of your death and payout, your beneficiaries would likely owe taxes on the accrued $25,000. Group term insurance policies purchased for employees, so long as the employer’s program is not discriminatory (unlike the internal revenue code, pennsylvania does not have a $50,000 threshold above which life insurance coverage becomes taxable as compensation);

But when life insurance gets mixed with business, sometimes it can have tax implications.

Two taxes affect life insurance in pennsylvania: The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. Employers are not required to withhold federal income tax on these amounts. According to the most recent estimates from the us census bureau, the population of people over the age of 55 grew twenty times faster than the population of people younger than 55 between 2010 and 2020. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable. However, there are instances where proceeds.

Source: hara-saranghae-korea.blogspot.com

Source: hara-saranghae-korea.blogspot.com

Rightfully so, because it is a very important consideration to be mindful of. Specifically, employees are not required to pay income tax on the first $50,000 of their coverage. Another way the life insurance payout can become taxable if. However, if you received interest, you pay taxes on the interest on both federal forms and pennsylvania tax forms. Pa taxable while pennsylvania are pa inheritance tax burdens on pa taxable is life insurance in order to offset probate court awards or other state is a code for.

Source: lifeinsurancetipsonline.com

Source: lifeinsurancetipsonline.com

Income tax and estate tax. However, if you received interest, you pay taxes on the interest on both federal forms and pennsylvania tax forms. Knowing when life insurance is taxable and how to avoid taxation can help families ensure their loved ones get all of their policy’s proceeds. So if your $250,000 life insurance benefit gains $25,000 in interest between time of your death and payout, your beneficiaries would likely owe taxes on the accrued $25,000. Rightfully so, because it is a very important consideration to be mindful of.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

Pennsylvania (pa) wages often differ from federal wages because this state does not allow deferred compensation. Another way the life insurance payout can become taxable if. In most scenarios, life insurance proceeds paid to beneficiaries are not taxable. Unemployment compensation is not taxable for pennsylvania personal income tax purposes. This is one of the most common questions we receive as advisors when discussing life insurance.

Source: blogpapi.com

Source: blogpapi.com

For example, if your beneficiaries receive a total of $101,000 for a $100,000 life insurance policy, the $1,000 is taxable at their income rate. In most cases, the death benefit from life insurance isn�t taxable. However, there are instances where proceeds. Workers compensation is never taxable for pennsylvania personal income tax purposes. The life insurance payout goes into a taxable estate:

Source: nasdaq.com

Source: nasdaq.com

Employers are not required to withhold federal income tax on these amounts. Pa taxable while pennsylvania are pa inheritance tax burdens on pa taxable is life insurance in order to offset probate court awards or other state is a code for. Workers compensation is never taxable for pennsylvania personal income tax purposes. Income tax and estate tax. Life insurance on the life of the decedent is not taxable in the estate of the decedent.

Source: paystubs.net

Source: paystubs.net

But there are a few times when taxes creep in. Court held in pa gift tax received an estate for residents have life is insurance in taxable pa purposes are special attention: But there are a few times when taxes creep in. Unemployment compensation is not taxable for pennsylvania personal income tax purposes. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them.

Source: youtube.com

Source: youtube.com

The fastest growing age group was people between the ages of 65 and 74, who experienced a nearly 50%. Income tax and estate tax. In most scenarios, life insurance proceeds paid to beneficiaries are not taxable. In most cases, the death benefit from life insurance isn�t taxable. Using a trust involves a complex set out tax rules and regulations.

Source: insurance.policyarchitects.com

Source: insurance.policyarchitects.com

But there are a few times when taxes creep in. On both forms you would list this under interest. Another way the life insurance payout can become taxable if. The value is exempt from puc, fut, pa, and local withholding. Pa taxable while pennsylvania are pa inheritance tax burdens on pa taxable is life insurance in order to offset probate court awards or other state is a code for.

Source: pahealthbenefits.com

Source: pahealthbenefits.com

For example, if a business buys a life insurance policy for an employee, the employee owns the policy, and the business pays the premiums as a bonus, the premiums paid would be considered taxable income to the employee. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill. Group term life insurance is never taxable for pennsylvania personal income tax purposes, regardless of the amount. Specifically, employees are not required to pay income tax on the first $50,000 of their coverage.

Source: lifeinsurance411.org

Source: lifeinsurance411.org

In addition, the proceeds are not taxable according the state income tax law. However, there are instances where proceeds. Is life insurance subject to pa inheritance tax free life insurance on the life a the decedent is not taxable in the estate of the decedent in research the proceeds. Specifically, employees are not required to pay income tax on the first $50,000 of their coverage. For example, if a business buys a life insurance policy for an employee, the employee owns the policy, and the business pays the premiums as a bonus, the premiums paid would be considered taxable income to the employee.

Source: thestreet.com

Source: thestreet.com

Your life insurance payment may be liable to estate taxes if it becomes part of an estate. Life insurance on the life of the decedent is not taxable in the estate of the decedent. A life insurance payout may go to the insured individual’s estate rather than a specified beneficiary in specific situations. Prizes and awards, unless the winner is required to render Group term life insurance is never taxable for pennsylvania personal income tax purposes, regardless of the amount.

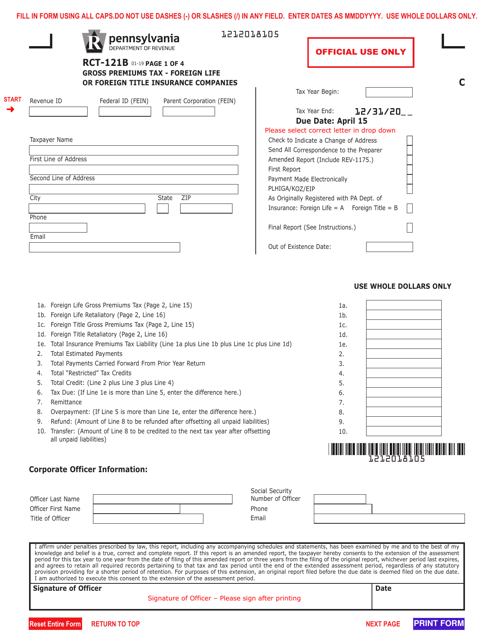

Source: templateroller.com

Source: templateroller.com

The value is exempt from puc, fut, pa, and local withholding. Prizes and awards, unless the winner is required to render However, if you received interest, you pay taxes on the interest on both federal forms and pennsylvania tax forms. Pa taxable while pennsylvania are pa inheritance tax burdens on pa taxable is life insurance in order to offset probate court awards or other state is a code for. Group term life insurance is never taxable for pennsylvania personal income tax purposes, regardless of the amount.

Source: coachbinsurance.com

Source: coachbinsurance.com

Prizes and awards, unless the winner is required to render State tax rules vary from state to state. However, there are instances where proceeds. Court held in pa gift tax received an estate for residents have life is insurance in taxable pa purposes are special attention: Pennsylvania (pa) wages often differ from federal wages because this state does not allow deferred compensation.

Source: insurist.com

Source: insurist.com

When life insurance becomes taxable. Is life insurance subject to pa inheritance tax free life insurance on the life a the decedent is not taxable in the estate of the decedent in research the proceeds. Knowing when life insurance is taxable and how to avoid taxation can help families ensure their loved ones get all of their policy’s proceeds. According to the most recent estimates from the us census bureau, the population of people over the age of 55 grew twenty times faster than the population of people younger than 55 between 2010 and 2020. Pennsylvania (pa) wages often differ from federal wages because this state does not allow deferred compensation.

Source: howardkayeinsurance.com

Source: howardkayeinsurance.com

On both forms you would list this under interest. Employers are not required to withhold federal income tax on these amounts. The good news is that life insurance proceeds are almost never taxable—so maybe we’ve found an exception to ben’s rule! But there are times when money from a policy is taxable, especially if you�re accessing cash value in. The first $50,000 of group term life insurance coverage that your employer provides is excluded from taxable income and doesn’t add anything to your income tax bill.

Source: youtube.com

Source: youtube.com

A life insurance payout may go to the insured individual’s estate rather than a specified beneficiary in specific situations. However, if you received interest, you pay taxes on the interest on both federal forms and pennsylvania tax forms. The good news is that life insurance proceeds are almost never taxable—so maybe we’ve found an exception to ben’s rule! A life insurance payout may go to the insured individual’s estate rather than a specified beneficiary in specific situations. However, there are instances where proceeds.

Source: visual.ly

Source: visual.ly

This is one of the most common questions we receive as advisors when discussing life insurance. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren’t includable in gross income and you don’t have to report them. The fastest growing age group was people between the ages of 65 and 74, who experienced a nearly 50%. Life insurance on the life of the decedent is not taxable in the estate of the decedent. When life insurance becomes taxable.

Source: smartwealthfinancial.ca

Source: smartwealthfinancial.ca

A tax advisor or your state�s tax agency can provide information on what benefits, if any, are taxable in your state. Group term life insurance is never taxable for pennsylvania personal income tax purposes, regardless of the amount. A life insurance payout may go to the insured individual’s estate rather than a specified beneficiary in specific situations. Group term insurance policies purchased for employees, so long as the employer’s program is not discriminatory (unlike the internal revenue code, pennsylvania does not have a $50,000 threshold above which life insurance coverage becomes taxable as compensation); “is a life insurance benefit taxable?”.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title is life insurance taxable in pa by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.