Is long term care insurance tax deductible in 2014 information

Home » Trend » Is long term care insurance tax deductible in 2014 informationYour Is long term care insurance tax deductible in 2014 images are available in this site. Is long term care insurance tax deductible in 2014 are a topic that is being searched for and liked by netizens now. You can Download the Is long term care insurance tax deductible in 2014 files here. Find and Download all free photos.

If you’re looking for is long term care insurance tax deductible in 2014 pictures information related to the is long term care insurance tax deductible in 2014 interest, you have pay a visit to the right site. Our website frequently gives you suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

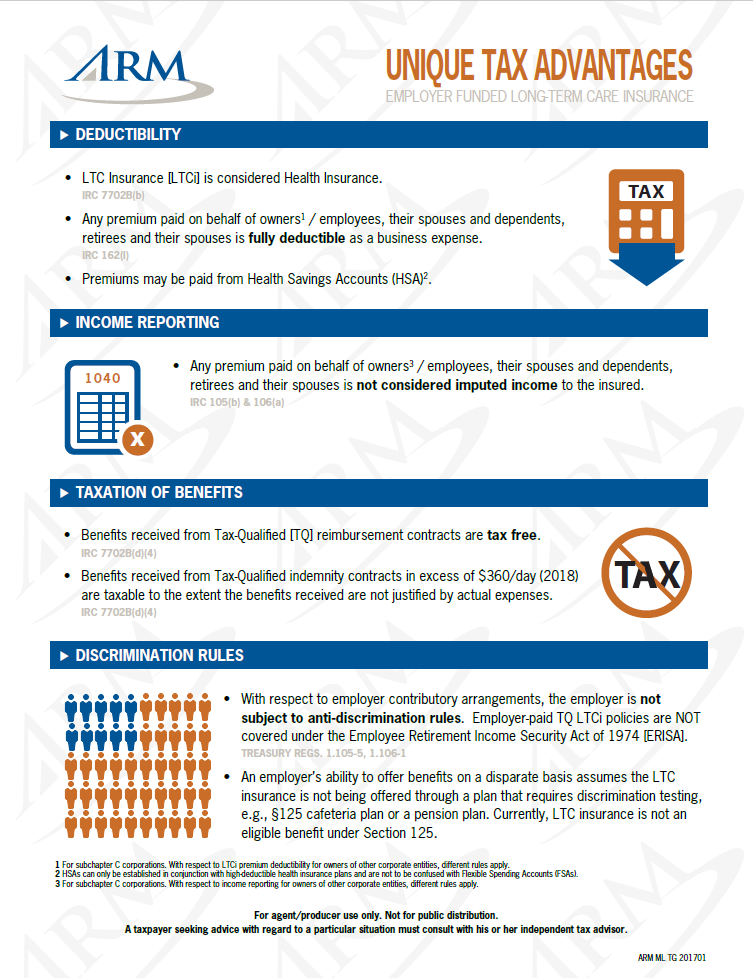

Is Long Term Care Insurance Tax Deductible In 2014. Always consult a professional tax advisor to. A credit may not be claimed under ors 315.610 (long term care insurance) for tax years beginning on or after january 1, 2015. What is a tax qualified long term care policy? So, yes, long term care insurance is tax deductible.

A Tax Break for LongTermCare Insurance Premiums? Kiplinger From kiplinger.com

A Tax Break for LongTermCare Insurance Premiums? Kiplinger From kiplinger.com

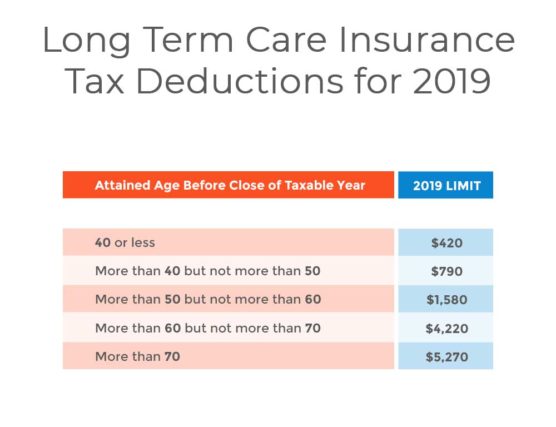

People age 70 and older will be able to count up to $4,550 in premiums as deductible medical expenses. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. 2014 long term care insurance tax deductions announced. Historically existing policy options and hybrid policy options provide tax deductibility. It is, however, important for you to understand the nature of these premiums before you settle for one. A credit may not be claimed under ors 315.610 (long term care insurance) for tax years beginning on or after january 1, 2015.

Finally, compare your total expenses to the agi threshold.

What is a tax qualified long term care policy? 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. People age 70 and older will be able to count up to $4,550 in premiums as deductible medical expenses. This year’s limit is $10,540.00. The amount depends on the age of the taxpayer at the end of the year. Any qualified policy covering long term care services that was approved in new york and issued before january 1, 1997, also qualifies for favorable tax.

Source: houayxairiverside.com

Source: houayxairiverside.com

The irs limits the amount of the deduction based on age. For example, new york offers a tax credit up to $1,500 for taxpayers whose adjusted gross income is below $250,000 beginning in 2020. This year’s limit is $10,540.00. 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. If the amount you pay exceeds the limit, you can�t deduct more than that stated limit.

However, policies that were purchased before january 1, 1997, are grandfathered and considered as tax. 2014 long term care insurance tax deductions announced. If the amount you pay exceeds the limit, you can�t deduct more than that stated limit. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. However, policies that were purchased before january 1, 1997, are grandfathered and considered as tax.

Finally, compare your total expenses to the agi threshold. Always consult a professional tax advisor to. Los angeles, ca — the american association for long term care insurance, a national trade group, announced approval of increased tax deductions for long term care insurance policies purchased in 2014. What is a tax qualified long term care policy? Finally, compare your total expenses to the agi threshold.

Source: ltcnews.com

Source: ltcnews.com

There is a limit on how large a premium can be deducted. Finally, compare your total expenses to the agi threshold. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. Premiums, costs, and expenses are deductible for self, spouse, and dependents. It is, however, important for you to understand the nature of these premiums before you settle for one.

Source: prweb.com

“for taxable years beginning in 2014, the limitations have been increased. Additionally, each state has its own rules governing the credits and tax deductions for long term care insurance. Historically existing policy options and hybrid policy options provide tax deductibility. Los angeles, ca — the american association for long term care insurance, a national trade group, announced approval of increased tax deductions for long term care insurance policies purchased in 2014. If you itemize deductions, you are able to deduct the amount of expenses that exceed 7.5% of your agi.

Source: archapple.com

Source: archapple.com

So, yes, long term care insurance is tax deductible. It is, however, important for you to understand the nature of these premiums before you settle for one. Premiums, costs, and expenses are deductible for self, spouse, and dependents. For example, new york offers a tax credit up to $1,500 for taxpayers whose adjusted gross income is below $250,000 beginning in 2020. There is a limit on how large a premium can be deducted.

Source: seniormarketsales.com

Source: seniormarketsales.com

If the amount you pay exceeds the limit, you can�t deduct more than that stated limit. What is a tax qualified long term care policy? The amount depends on the age of the taxpayer at the end of the year. 2014 long term care insurance tax deductions announced. Los angeles, ca — the american association for long term care insurance, a national trade group, announced approval of increased tax deductions for long term care insurance policies purchased in 2014.

Source: impresshow.blogspot.com

Source: impresshow.blogspot.com

To claim the deduction, your medical expenses have to be more than 7.5 percent of your adjusted gross income. What is a tax qualified long term care policy? 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. The irs limits the amount of the deduction based on age.

Source: altcp.org

Source: altcp.org

“for taxable years beginning in 2014, the limitations have been increased. Finally, compare your total expenses to the agi threshold. However, policies that were purchased before january 1, 1997, are grandfathered and considered as tax. It is, however, important for you to understand the nature of these premiums before you settle for one. What is a tax qualified long term care policy?

Source: esmaltinhosdatrin.blogspot.com

Source: esmaltinhosdatrin.blogspot.com

This year’s limit is $10,540.00. Premiums, costs, and expenses are deductible for self, spouse, and dependents. 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. There is a limit on how large a premium can be deducted. The amount depends on the age of the taxpayer at the end of the year.

Source: kevinwenke.com

Source: kevinwenke.com

Additionally, each state has its own rules governing the credits and tax deductions for long term care insurance. The amount depends on the age of the taxpayer at the end of the year. However, policies that were purchased before january 1, 1997, are grandfathered and considered as tax. There is a limit on how large a premium can be deducted. For example, new york offers a tax credit up to $1,500 for taxpayers whose adjusted gross income is below $250,000 beginning in 2020.

Source: ltcinsuranceconsultants.com

Source: ltcinsuranceconsultants.com

It is, however, important for you to understand the nature of these premiums before you settle for one. What is a tax qualified long term care policy? Los angeles, ca — the american association for long term care insurance, a national trade group, announced approval of increased tax deductions for long term care insurance policies purchased in 2014. People age 70 and older will be able to count up to $4,550 in premiums as deductible medical expenses. Finally, compare your total expenses to the agi threshold.

Source: esmaltinhosdatrin.blogspot.com

Source: esmaltinhosdatrin.blogspot.com

Premiums, costs, and expenses are deductible for self, spouse, and dependents. The amount depends on the age of the taxpayer at the end of the year. 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. What is a tax qualified long term care policy? Additionally, each state has its own rules governing the credits and tax deductions for long term care insurance.

Source: esmaltinhosdatrin.blogspot.com

Always consult a professional tax advisor to. Finally, compare your total expenses to the agi threshold. A credit may not be claimed under ors 315.610 (long term care insurance) for tax years beginning on or after january 1, 2015. As of 2021, insurance deductibles will be 5 percent of your adjusted gross income. If the amount you pay exceeds the limit, you can�t deduct more than that stated limit.

Source: milvidlaw.com

Source: milvidlaw.com

The amount depends on the age of the taxpayer at the end of the year. “for taxable years beginning in 2014, the limitations have been increased. There is a limit on how large a premium can be deducted. Any qualified policy covering long term care services that was approved in new york and issued before january 1, 1997, also qualifies for favorable tax. This year’s limit is $10,540.00.

Source: trustedchoice.com

Source: trustedchoice.com

However, policies that were purchased before january 1, 1997, are grandfathered and considered as tax. There is a limit on how large a premium can be deducted. “for taxable years beginning in 2014, the limitations have been increased. The irs limits the amount of the deduction based on age. Historically existing policy options and hybrid policy options provide tax deductibility.

Source: impresshow.blogspot.com

Source: impresshow.blogspot.com

There is a limit on how large a premium can be deducted. People age 70 and older will be able to count up to $4,550 in premiums as deductible medical expenses. 2015 c.701 §39] state could not recalculate tax for tax year closed to review in order to prevent elective carry forward of tax credit to tax year subject to review. This year’s limit is $10,540.00. Always consult a professional tax advisor to.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is long term care insurance tax deductible in 2014 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.