Is prepaid insurance an expense information

Home » Trending » Is prepaid insurance an expense informationYour Is prepaid insurance an expense images are available in this site. Is prepaid insurance an expense are a topic that is being searched for and liked by netizens now. You can Download the Is prepaid insurance an expense files here. Find and Download all royalty-free images.

If you’re searching for is prepaid insurance an expense pictures information linked to the is prepaid insurance an expense keyword, you have come to the ideal site. Our site always gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

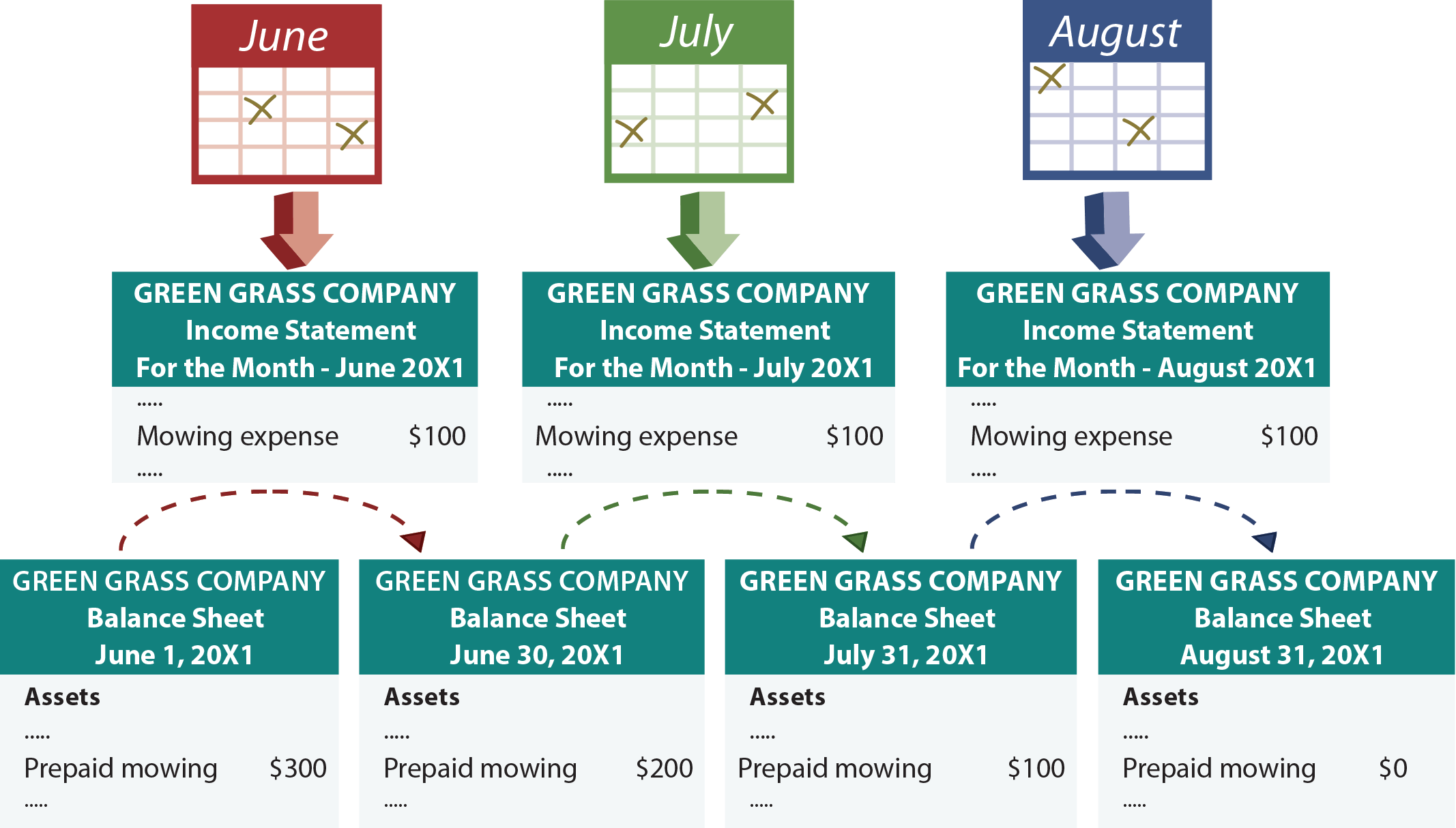

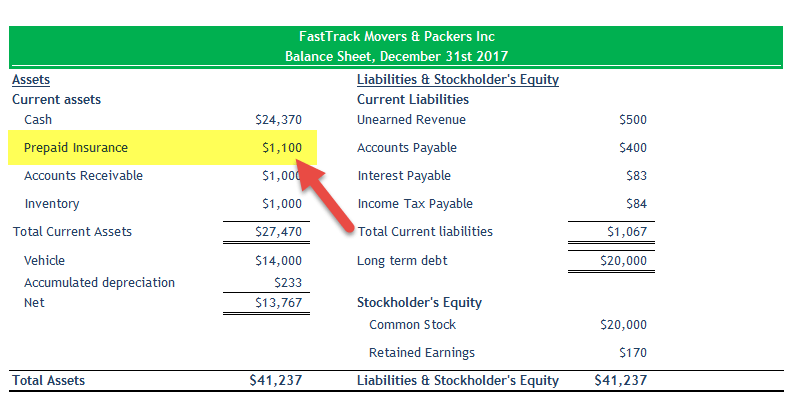

Is Prepaid Insurance An Expense. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. Thus, before we look at prepaid insurance, let’s look at a definition of prepaid expenses. Prepaid insurance is treated in the accounting records as an asset, which is gradually charged to expense over the period covered by the related insurance contract. Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a company�s balance sheet.

Prepaid Expenses Examples, Accounting for a Prepaid Expense From corporatefinanceinstitute.com

Prepaid Expenses Examples, Accounting for a Prepaid Expense From corporatefinanceinstitute.com

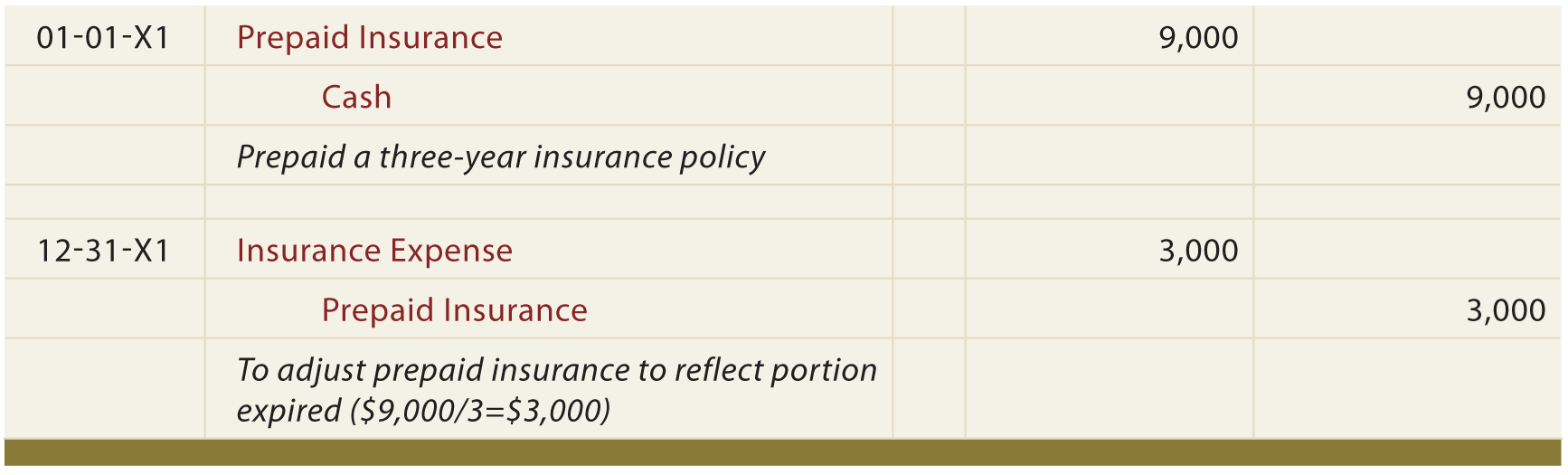

Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. And if the accident / insurance event occurs, the insurance company will bear all. Prepaid insurance is considered a prepaid expense. A prepaid expense is when a company makes a payment for goods or services that have not been used or received yet. The asset is converted to an expense for the period in which the prepaid is used.

Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement.

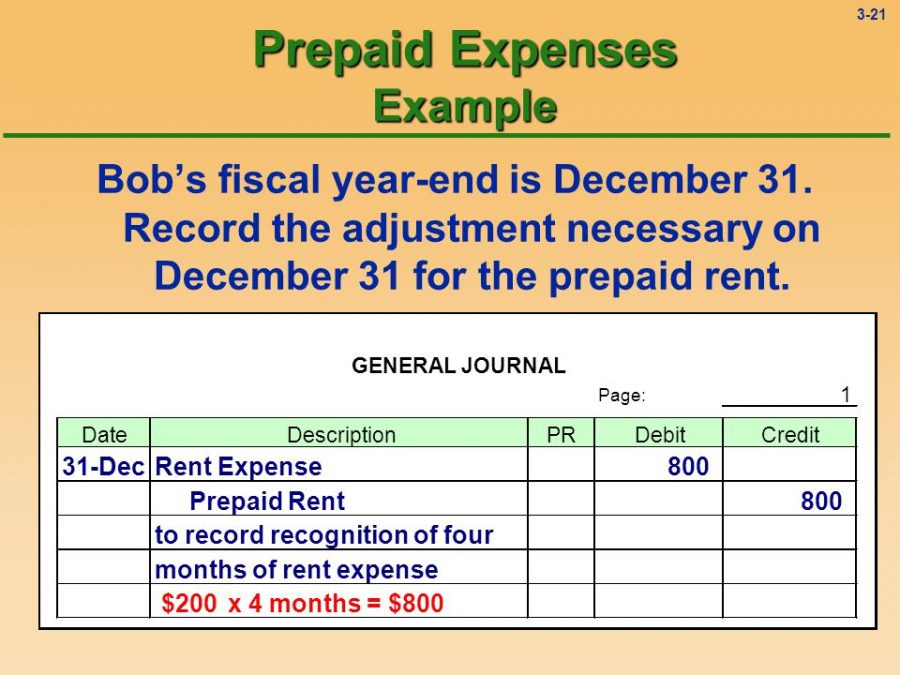

A prepaid insurance expense is the amount of premiums paid for insurance that are recorded in the balance sheet as assets at the time of payment because coverage has not started yet. Prepaid insurance vs insurance expense. At the end of june, your bookkeeper will need to make an adjusting journal entry to reflect that now you only have 11 months of prepaid insurance. And if the accident / insurance event occurs, the insurance company will bear all. If the delivery company in our example is using the accrual basis accounting method, then it’ll treat the prepaid insurance that hasn’t been used as an asset on its balance sheet until that amount is used up. Prepaid expenses are an asset, which means it is something that your business owns and have not spent yet.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

As the benefits of the expenses are recognized, the related asset account is decreased and expensed. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. If a business were to pay late, it would be at risk of having its insurance coverage terminated. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. Insurance is obviously an expense to a business.

Source: newsdailyarticles.com

Source: newsdailyarticles.com

The asset is converted to an expense for the period in which the prepaid is used. For example, company abc pays a $12,000 premium for directors and officers liability insurance for. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. This unexpired cost is reported in the current asset account prepaid insurance.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

A prepaid insurance expense is the amount of premiums paid for insurance that are recorded in the balance sheet as assets at the time of payment because coverage has not started yet. Prepaid insurance is considered a prepaid expense. Another example is office and computer supplies bought in bulk and then gradually used up over several weeks or months. The most common types of prepaid expenses are prepaid rent and prepaid insurance. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

And if the accident / insurance event occurs, the insurance company will bear all. A prepaid expense is initially recorded as an asset in a company’s accounting books and balance sheet. Insurance is obviously an expense to a business. At the end of june, your bookkeeper will need to make an adjusting journal entry to reflect that now you only have 11 months of prepaid insurance. These are future expenses that have been paid for in advance.

Source: wizxpert.com

Source: wizxpert.com

Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. A prepaid insurance expense is the amount of premiums paid for insurance that are recorded in the balance sheet as assets at the time of payment because coverage has not started yet. The asset is converted to an expense for the period in which the prepaid is used. When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company’s balance sheet. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months.

Source: inthesand-melissa.blogspot.com

Source: inthesand-melissa.blogspot.com

Prepaids are tracked in the accrual method of accounting, but not the cash method. Prepaid expenses are an asset, which means it is something that your business owns and have not spent yet. One of the more common forms of prepaid expenses is insurance, which is usually paid in advance. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. Prepaid insurance vs insurance expense.

Source: myralissettc.blogspot.com

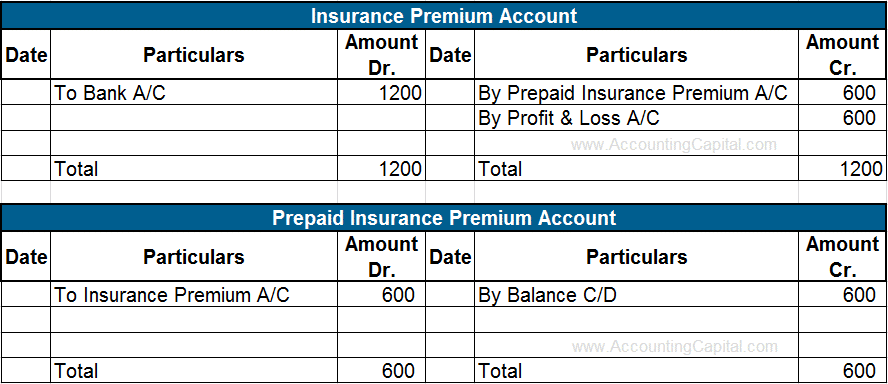

Prepaid insurance is commonly recorded, because insurance providers prefer to bill insurance in advance. Insurance premiums are paid in advance of the insurance policy period—which usually extends over 6 or 12 months. Another item commonly found in the prepaid expenses account is prepaid rent. One of the more common forms of prepaid expenses is insurance, which is usually paid in advance. Prepaids are tracked in the accrual method of accounting, but not the cash method.

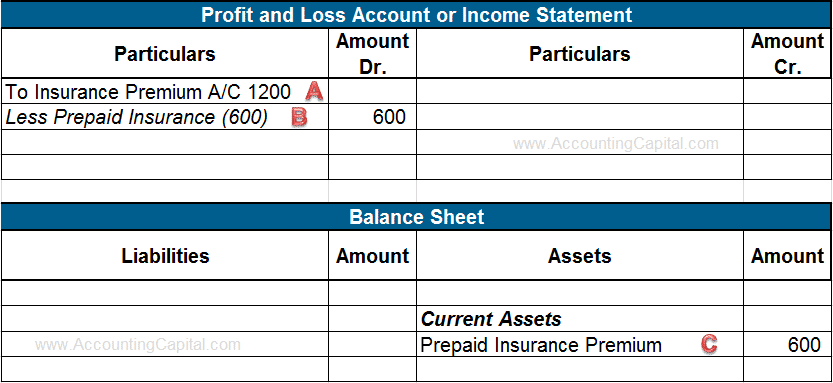

Source: accountingcapital.com

Source: accountingcapital.com

Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Is prepaid expense an asset or expense? Prepaid expenses are an asset, which means it is something that your business owns and have not spent yet. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. As the amount of prepaid insurance expires, the expired portion is moved from the current asset account prepaid insurance to the income statement.

Source: selfstudynotes.blogspot.com

Source: selfstudynotes.blogspot.com

Prepaid insurance is considered a prepaid expense. Prepaid insurance is considered a prepaid expense. For example, company abc pays a $12,000 premium for directors and officers liability insurance for. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. An example of a prepaid expense is insurance, which is frequently paid in advance for multiple future periods;

Source: accountingplay.com

Source: accountingplay.com

Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a company�s balance sheet. Unexpired or prepaid expenses are the expenses for which payments have been made but full benefits or services have not been received during that period. For example, company abc pays a $12,000 premium for directors and officers liability insurance for. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. Prepaid expenses are future expenses that are paid in advance.

Source: elijahsblog1.blogspot.com

Prepaid expenses are future expenses that are paid in advance. You may be able to set up a recurring journal entry in your accounting software that will complete this automatically. As the benefits of the expenses are recognized, the related asset account is decreased and expensed. Prepaid insurance vs insurance expense. An entity initially records this expenditure as a prepaid expense (an asset), and then charges it to expense over the usage period.

Source: tallygame.com

Source: tallygame.com

Is prepaid expense an asset or expense? For example, company abc pays a $12,000 premium for directors and officers liability insurance for. Is prepaid insurance an expense is a tool to reduce your risks. Prepaid insurance is the portion of an insurance premium that has been paid in advance and has not expired as of the date of a company�s balance sheet. Prepaid insurance is considered a prepaid expense.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

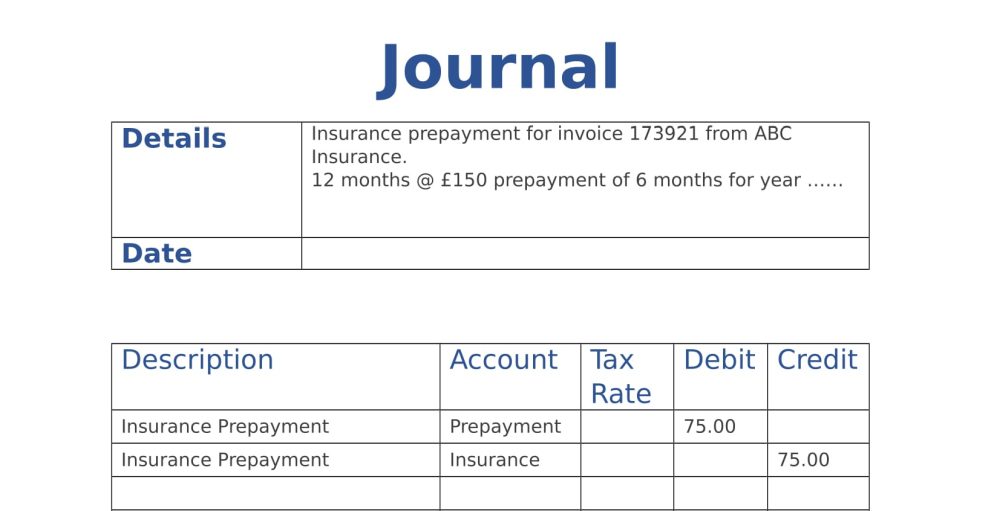

Your business has now actually incurred the insurance expense, so you can record that. A prepaid expense is initially recorded as an asset in a company’s accounting books and balance sheet. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset. In prepaid expenses we can take all those expenses which we have to pay every week, month, year and these are the property of any company or person, as we will debit expenses and credit prepaid expenses. A prepaid insurance expense is the amount of premiums paid for insurance that are recorded in the balance sheet as assets at the time of payment because coverage has not started yet.

Source: online-accounting.net

Source: online-accounting.net

Unexpired or prepaid expenses are the expenses for which payments have been made but full benefits or services have not been received during that period. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. If the delivery company in our example is using the accrual basis accounting method, then it’ll treat the prepaid insurance that hasn’t been used as an asset on its balance sheet until that amount is used up. Prepaid insurance is a current asset if coverage is used within one year of payment. For example, company abc pays a $12,000 premium for directors and officers liability insurance for.

Source: tutorstips.com

Source: tutorstips.com

A prepaid expense is when a company makes a payment for goods or services that have not been used or received yet. On the balance sheet, prepaid expenses are first recorded as an asset. Prepaid expenses are an asset, which means it is something that your business owns and have not spent yet. Prepaid insurance vs insurance expense. Prepaid expenses are future expenses that are paid in advance and hence recognized initially as an asset.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

When someone purchases prepaid insurance, the contract generally covers a period of time in the future. And if the accident / insurance event occurs, the insurance company will bear all. In prepaid expenses we can take all those expenses which we have to pay every week, month, year and these are the property of any company or person, as we will debit expenses and credit prepaid expenses. The most common types of prepaid expenses are prepaid rent and prepaid insurance. Thus, before we look at prepaid insurance, let’s look at a definition of prepaid expenses.

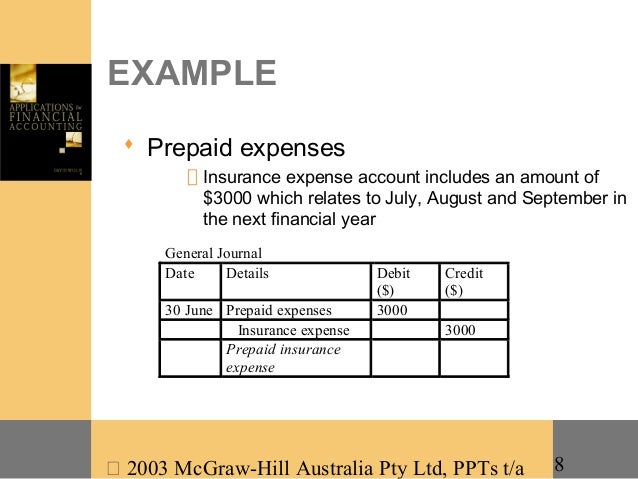

Source: slideshare.net

Source: slideshare.net

Insurance premiums are one example of prepaid expenses. An example of a prepaid expense is insurance, which is frequently paid in advance for multiple future periods; Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. A prepaid expense is initially recorded as an asset in a company’s accounting books and balance sheet. Prepaid insurance vs insurance expense.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

This means that even though the expense has been paid upfront, it is not considered an. Another example is office and computer supplies bought in bulk and then gradually used up over several weeks or months. Prepaid insurance is the insurance premium paid by a company in an accounting period that didn’t expire in the same accounting period. When someone purchases prepaid insurance, the contract generally covers a period of time in the future. Unexpired or prepaid expenses are the expenses for which payments have been made but full benefits or services have not been received during that period.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is prepaid insurance an expense by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.