Is renters insurance tax deductible Idea

Home » Trending » Is renters insurance tax deductible IdeaYour Is renters insurance tax deductible images are ready in this website. Is renters insurance tax deductible are a topic that is being searched for and liked by netizens now. You can Find and Download the Is renters insurance tax deductible files here. Download all royalty-free images.

If you’re looking for is renters insurance tax deductible pictures information connected with to the is renters insurance tax deductible topic, you have visit the right site. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

Is Renters Insurance Tax Deductible. While renters insurance is tax deductible, you can only deduct it if you operate a business out of your home. Check out the insider guide to the best renters insurance companies. The renters insurance deductible is the part you pay on a claim. If you currently work for a company and are a remote employee, you won’t be able to.

Is Homeowners Insurance Tax Deductible? EINSURANCE From einsurance.com

Is Homeowners Insurance Tax Deductible? EINSURANCE From einsurance.com

Is landlord insurance an allowable expense? Renters insurance is tax deductible as long as you operate a business from your home and have set aside a workspace or room for it. Mortgage insurance protects you in case you can’t make your mortgage payments. Is homeowners insurance tax deductible for a rental property? The deduction applies to basic homeowners insurance as well as special peril and liability insurance. If you currently work for a company and are a remote employee, you won’t be able to.

Never is homeowner’s insurance tax deductible your main home.

While renters insurance is tax deductible, you can only deduct it if you operate a business out of your home. Others won’t need to itemize their deductions at all, if the standard deduction exceeds the amount they’re eligible to deduct. While you should get tax advice from the proper professionals, irs topic 455 can give you more information as well. Cryptocurrency price today in usd; For example, state farm (1). If you have a rental property or rent out your primary residence from time to time, you may be able to deduct your insurance costs from your taxes.

Source: linkworthydesigns.blogspot.com

You don’t use your home for business You then may deduct a portion or your renters insurance, based on the dimensions of the space where you operate your business relative to the total size of the premises. Lenders can stipulate that homeowners get an insurance policy before securing their mortgage. Never is homeowner’s insurance tax deductible your main home. If you have a rental property or rent out your primary residence from time to time, you may be able to deduct your insurance costs from your taxes.

Source: linkworthydesigns.blogspot.com

Source: linkworthydesigns.blogspot.com

You then may deduct a portion or your renters insurance, based on the dimensions of the space where you operate your business relative to the total size of the premises. You then may deduct a portion or your renters insurance, based on the dimensions of the space where you operate your business relative to the total size of the premises. You may solely declare a deduction for those who use the house solely and commonly for enterprise functions. For example, state farm (1). Most renters insurance coverages include a deductible, and all coverages are subject to limits.

Source: pinterest.ca

Source: pinterest.ca

For most people, renters insurance isn’t tax deductible. Others won’t need to itemize their deductions at all, if the standard deduction exceeds the amount they’re eligible to deduct. Never is homeowner’s insurance tax deductible your main home. For example, if you have a jewelry business and a room in your apartment is dedicated to that business, you can deduct the cost of. It�s deducted from your payout.

Source: einsurance.com

Source: einsurance.com

Mortgage insurance protects you in case you can’t make your mortgage payments. It�s deducted from your payout. If you are currently paying pmi as part of your mortgage, you can deduct that amount though 2010, under existing federal law. Is renters insurance coverage tax deductible? Cryptocurrency price today in euro;

Source: einsurance.com

Source: einsurance.com

The deduction applies to basic homeowners insurance as well as special peril and liability insurance. If you are currently paying pmi as part of your mortgage, you can deduct that amount though 2010, under existing federal law. While renters insurance is tax deductible, you can only deduct it if you operate a business out of your home. Renters insurance is only tax deductible if you work from a home office used exclusively for business purposes. Is homeowners insurance tax deductible for a rental property?

Source: revisi.net

Source: revisi.net

A renters insurance deductible is the portion you pay on a claim. Private mortgage insurance tax deduction. Standard renters insurance policies don’t usually cover business expenses, so consider purchasing a business property rider. If in the new location the individual is required to have renters insurance by her property management, the cost of the same may be deductible as a moving expense per the above. When renters insurance is not tax deductible.

Source: rentersinsuranceshitarin.blogspot.com

Source: rentersinsuranceshitarin.blogspot.com

You then may deduct a portion or your renters insurance, based on the dimensions of the space where you operate your business relative to the total size of the premises. Is landlord insurance an allowable expense? Renters insurance coverage is perhaps tax deductible for those who use a part of your private home for enterprise and work for your self. Renters insurance is only tax deductible if you work from a home office used exclusively for business purposes. Renters insurance coverage is mostly not tax deductible.

Source: ictsd.org

Source: ictsd.org

Renters insurance coverage is perhaps tax deductible for those who use a part of your private home for enterprise and work for your self. Lenders can stipulate that homeowners get an insurance policy before securing their mortgage. Mortgage insurance protects you in case you can’t make your mortgage payments. Is insurance on a rental property tax deductible? Umbrella insurance policies that offer extra liability insurance are also a deductible expense along with mortgage insurance and.

Source: bankrate.com

Source: bankrate.com

As a landlord, you can claim certain costs as a business expense when calculating. Cryptocurrency price today in euro; Is renters insurance coverage tax deductible? Others won’t need to itemize their deductions at all, if the standard deduction exceeds the amount they’re eligible to deduct. Renters insurance is not tax deductible except in the following situations:

Source: einsurance.com

Source: einsurance.com

Mortgage insurance protects you in case you can’t make your mortgage payments. Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options. The renters insurance deductible is the part you pay on a claim. Umbrella insurance policies that offer extra liability insurance are also a deductible expense along with mortgage insurance and. Plus, if you have renters insurance, you may also be eligible to deduct a portion of your premium (though that may not amount to a large.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

Cryptocurrency price today in euro; Is homeowners insurance tax deductible for a rental property? Private mortgage insurance tax deduction. Plus, if you have renters insurance, you may also be eligible to deduct a portion of your premium (though that may not amount to a large. Renting a home is considered work, so the income is taxable, which makes expenses for that property a business expense that can be.

Source: insuredasap.com

Source: insuredasap.com

Cryptocurrency price today in usd; Renters insurance is not tax deductible except in the following situations: Renters insurance coverage is perhaps tax deductible for those who use a part of your private home for enterprise and work for your self. Plus, if you have renters insurance, you may also be eligible to deduct a portion of your premium (though that may not amount to a large. For example, state farm (1).

Source: imbillionaire.net

Source: imbillionaire.net

You don’t use your home for business You then may deduct a portion or your renters insurance, based on the dimensions of the space where you operate your business relative to the total size of the premises. For example, if you have a jewelry business and a room in your apartment is dedicated to that business, you can deduct the cost of. Lenders can stipulate that homeowners get an insurance policy before securing their mortgage. Private mortgage insurance tax deduction.

Source: americanlandlord.com

Source: americanlandlord.com

If you have a rental property or rent out your primary residence from time to time, you may be able to deduct your insurance costs from your taxes. Renters insurance coverage is mostly not tax deductible. While you should get tax advice from the proper professionals, irs topic 455 can give you more information as well. If in the new location the individual is required to have renters insurance by her property management, the cost of the same may be deductible as a moving expense per the above. The renters insurance deductible is the part you pay on a claim.

Source: revisi.net

Source: revisi.net

The renters insurance deductible is the part you pay on a claim. If you have a rental property or rent out your primary residence from time to time, you may be able to deduct your insurance costs from your taxes. Is renters insurance coverage tax deductible? Renting a home is considered work, so the income is taxable, which makes expenses for that property a business expense that can be. Mortgage insurance protects you in case you can’t make your mortgage payments.

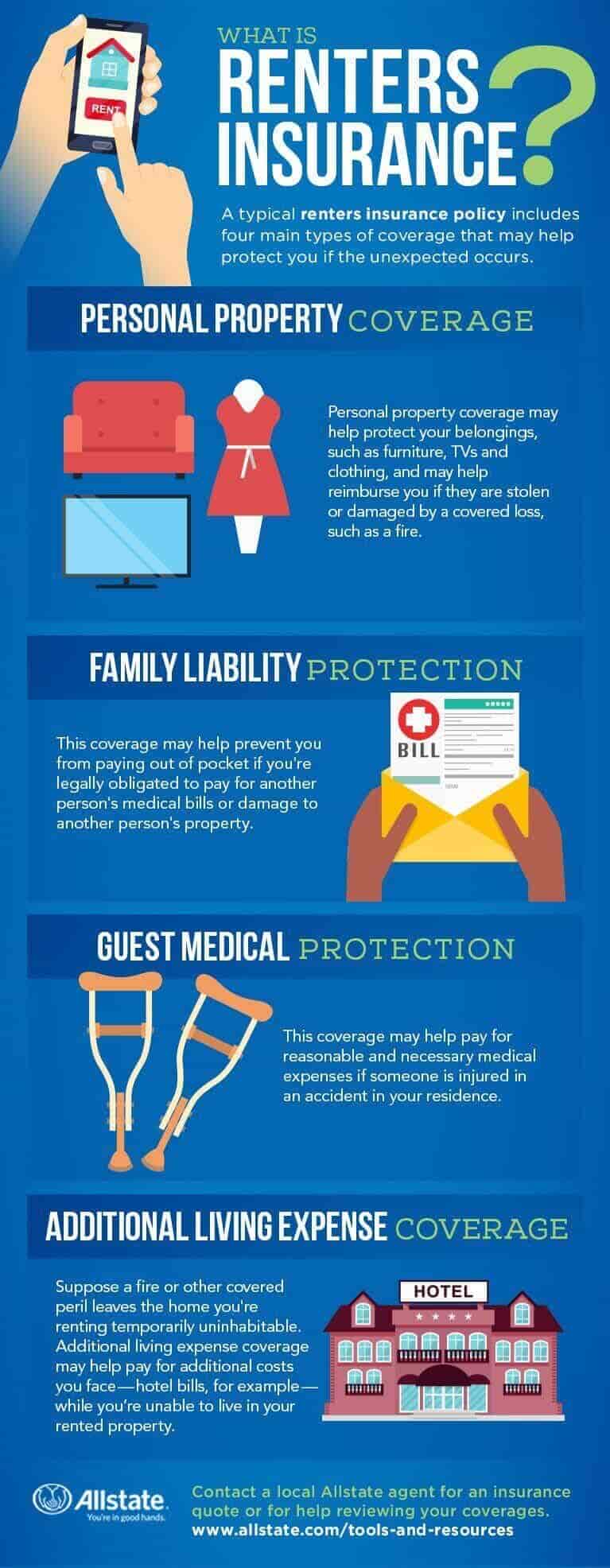

Source: allstate.com

Source: allstate.com

Cryptocurrency price today in euro; For example, state farm (1). Is landlord insurance an allowable expense? Typically, renters insurance deductibles will be $500 or $1,000, but insurers will often provide a range of options. Plus, if you have renters insurance, you may also be eligible to deduct a portion of your premium (though that may not amount to a large.

Source: revisi.net

Source: revisi.net

Renters insurance is generally not tax deductible. Renting a home is considered work, so the income is taxable, which makes expenses for that property a business expense that can be. You may solely declare a deduction for those who use the house solely and commonly for enterprise functions. If in the new location the individual is required to have renters insurance by her property management, the cost of the same may be deductible as a moving expense per the above. It�s deducted from your payout.

Source: linkworthydesigns.blogspot.com

Source: linkworthydesigns.blogspot.com

Cryptocurrency price today in usd; You may solely declare a deduction for those who use the house solely and commonly for enterprise functions. It is deducted from your payment. Cryptocurrency price today in usd; Mortgage insurance protects you in case you can’t make your mortgage payments.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is renters insurance tax deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.