Is webull fdic insured Idea

Home » Trending » Is webull fdic insured IdeaYour Is webull fdic insured images are available. Is webull fdic insured are a topic that is being searched for and liked by netizens today. You can Get the Is webull fdic insured files here. Get all royalty-free images.

If you’re searching for is webull fdic insured pictures information related to the is webull fdic insured keyword, you have visit the ideal site. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

Is Webull Fdic Insured. The fdic insures depositors who have money in united states bank accounts. Existing insurance products are inadequate to cover potential losses if an exchange fails and / or digital wallets are hacked. Webull review 2020 find all about webull! I believe anything around 500,000 is insured by the fdic.

Is Robinhood SIPC And FDIC Insured? Investing Simple From investingsimple.com

Is Robinhood SIPC And FDIC Insured? Investing Simple From investingsimple.com

Am i reading it right? If they we’re screwing people over with withdrawals they would get sued the daylights out of and get shut down. Webull offers free stock trades and that’s one of. Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). An explanatory brochure is available upon request or at www.sipc.org.

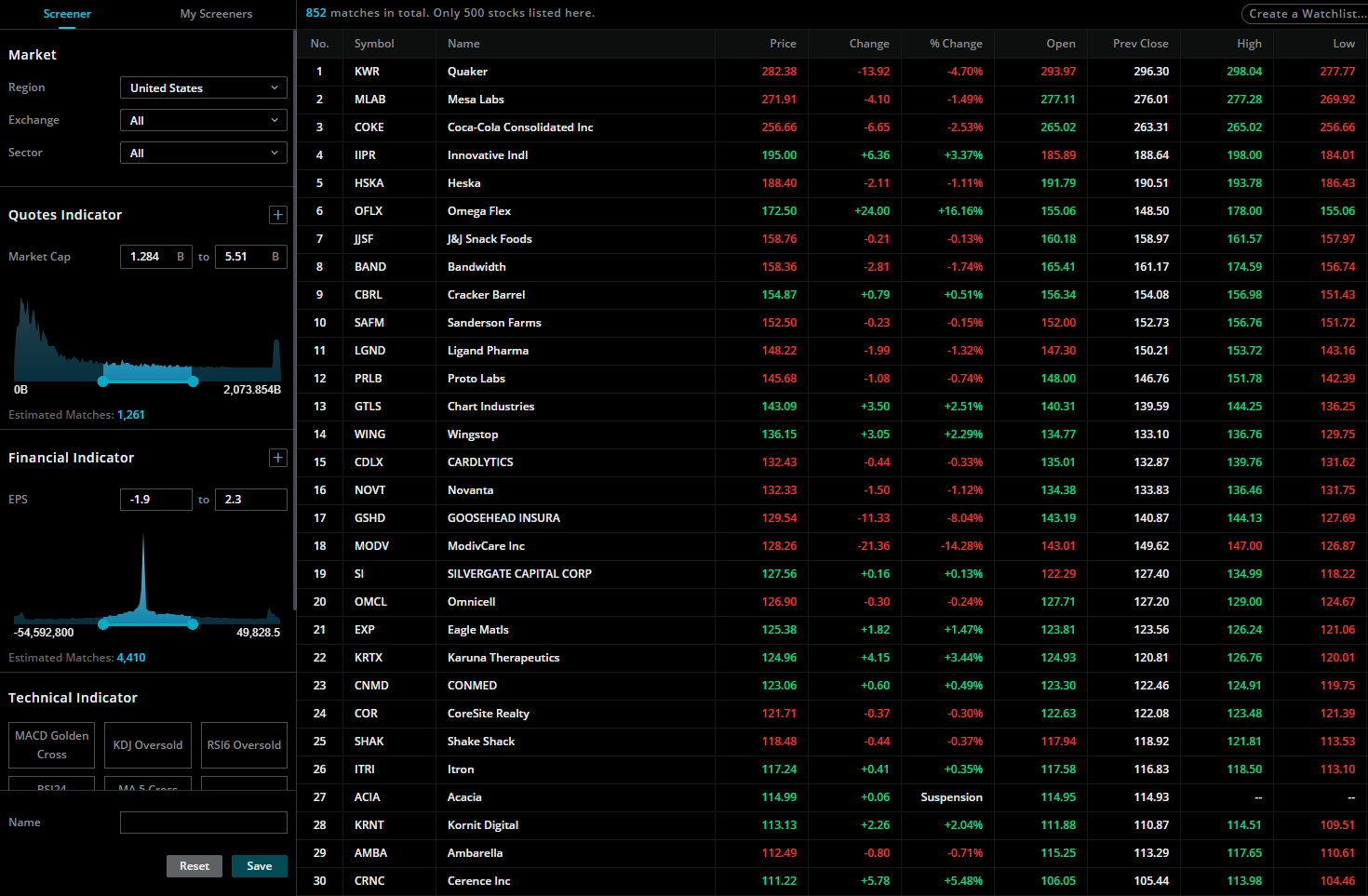

The web user interface will be slightly more confusing on webull, as it’s built for experienced traders.

Webull is a subsidiary of fumi technology, a chinese company based in hunan. Fdic insurance is only for consumer accounts held in us banks. Instead, webull accounts are protected by the sipc (securities investor protection corporation), which covers up to $500,000 in equity,of which up to $250,000 can be cash in. An explanatory brochure is available upon request or at www.sipc.org. Instead, webull accounts are protected by the sipc (securities investor protection corporation), which covers up to $500,000 in. Webull�s clearing house, apex clearing, has an additional policy in place.

Source: paten31h.blogspot.com

Source: paten31h.blogspot.com

Webull�s clearing house, apex clearing, has an additional policy in place. The coverage scope of sipc protection is $500,000, which includes $250,000 coverage for cash. Webull is a subsidiary of fumi technology, a chinese company based in hunan. Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. Is webull better than robinhood?

Source: rambahrambah.blogspot.com

Source: rambahrambah.blogspot.com

Am i reading it right? An explanatory brochure is available upon request or at www.sipc.org. You agree that all information, communications, materials coming from webull investments limited are unsolicited and must be kept private, confidential and protected from any disclosure. Webull is a subsidiary of fumi technology, a chinese company based in hunan. We are not fdic insured.

Source: bankcheckingsavings.com

Source: bankcheckingsavings.com

Our clearing firm, apex clearing corp., has purchased an additional insurance policy. Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. The federal deposit insurance corporation (fdic) is a federal agency that insures consumer deposits in u.s. Webull offers free stock trades and that’s one of. The web user interface will be slightly more confusing on webull, as it’s built for experienced traders.

![M1 Finance vs. Webull Brokerage Comparison [2021 Review] M1 Finance vs. Webull Brokerage Comparison [2021 Review]](https://572906-1868771-raikfcquaxqncofqfm.stackpathdns.com/wp-content/uploads/2020/05/webull-interface-stocks-2048x1053.png) Source: optimizedportfolio.com

Source: optimizedportfolio.com

I see a disclosure i have to agree. Contrast this with webull�s disturbing disclaimer: Our clearing firm, apex clearing corp., has purchased an additional insurance policy. The coverage scope of sipc protection is $500,000, which includes $250,000 coverage for cash. Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s.

Source: capprihnos.com.ar

Source: capprihnos.com.ar

I prefer webull over robinhood because webull offers better watchlists, free paper trading, and advanced charts for day and swing traders. The fdic insures depositors who have money in united states bank accounts. I believe anything around 500,000 is insured by the fdic. I see a disclosure i have to agree to that i understand webull uses apex crypto and that apex is not fdic insured, etc. Instead, webull accounts are protected by the sipc (securities investor protection corporation), which covers up to $500,000 in equity,of which up to $250,000 can be cash in.

Source: investingsimple.com

Source: investingsimple.com

Founded in 2017, the company is regulated by the us securities and exchange commission (sec) and the financial industry regulatory authority (finra) as well as the hong kong securities and futures commission (sfc). We are not fdic insured. Our clearing firm, apex clearing corp., has purchased an additional insurance policy. The coverage scope of sipc protection is $500,000, which includes $250,000 coverage for cash. Webull�s clearing house, apex clearing, has an additional policy in place.

Source: webull.com

Source: webull.com

An explanatory brochure is available upon request or at www.sipc.org. Webull is insured but not fdic because it�s not a bank. Our clearing firm, apex clearing corp., has purchased an additional insurance policy. Accounts holding cryptocurrencies are not protected by [sipc or fdic coverage]. I see a disclosure i have to agree.

![M1 Finance vs. Webull Brokerage Comparison [2021 Review] M1 Finance vs. Webull Brokerage Comparison [2021 Review]](https://3ptzbr2ry8d91s0x1b14ym91-wpengine.netdna-ssl.com/wp-content/uploads/2020/05/webull-trade-screen.png) Source: optimizedportfolio.com

Source: optimizedportfolio.com

If you are still curious to lean more, here�s what would happen in the unlikely event that webull goes out of business. I prefer webull over robinhood because webull offers better watchlists, free paper trading, and advanced charts for day and swing traders. Unlike its competitor robinhood, webull also doesn’t offer any kind of bank sweep program that would automatically grant fdic coverage (robinhood offers this for its cash management feature, which also allows clients to. The federal deposit insurance corporation (fdic) is a federal agency that insures consumer deposits in u.s. Webull is a member in good standing.

Source: tradingstrategyguides.com

Source: tradingstrategyguides.com

Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Webull is insured but not fdic because it�s not a bank. If you are still curious to lean more, here�s what would happen in the unlikely event that webull goes out of business. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Is webull better than robinhood?

Source: topratedfirms.com

Source: topratedfirms.com

Webull is not a bank, and therefore, it is not a member of the fdic. Webull also adds a desktop application that m1 doesn’t have. Webull is insured but not fdic because it�s not a bank. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Contrast this with webull�s disturbing disclaimer:

![M1 Finance vs. Webull Brokerage Comparison [2021 Review] M1 Finance vs. Webull Brokerage Comparison [2021 Review]](https://3ptzbr2ry8d91s0x1b14ym91-wpengine.netdna-ssl.com/wp-content/uploads/2020/05/webull-stock-screener.png) Source: optimizedportfolio.com

Source: optimizedportfolio.com

Webull review 2020 find all about webull! Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. I believe anything around 500,000 is insured by the fdic. Webull offers free stock trades and that’s one of. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

Source: bankcheckingsavings.com

Source: bankcheckingsavings.com

Webull is insured but not fdic because it�s not a bank. If they were a scam they would not have been verified as a legitimate brokerage there is a long and lengthy process to get approved. Webull�s clearing house, apex clearing, has an additional policy in place. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash).

Source: investingsimple.com

Source: investingsimple.com

Our clearing firm, apex clearing corp., has purchased an additional insurance policy. We are not a licensed bank or a security firm. Yeah well fidelity is fdic insured and they�re not a bank. So they aren’t trying to screw you. Contrast this with webull�s disturbing disclaimer:

Source: brokerage-review.com

Source: brokerage-review.com

Is webull better than robinhood? Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Our clearing firm, apex clearing corp., has purchased an additional insurance policy. The fdic insures depositors who have money in united states bank accounts. As a result, webull’s customers’ assets are covered for up to $500,000 in investments and up to $250,000 for cash investments.

Source: tradingstrategyguides.com

Source: tradingstrategyguides.com

Webull financial is a member of sipc, meaning your securities are sipc insured. I see a disclosure i have to agree to that i understand webull uses apex crypto and that apex is not fdic insured, etc. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. The federal deposit insurance corporation (fdic) is a federal agency that insures consumer deposits in u.s.

Source: topratedfirms.com

Source: topratedfirms.com

I see a disclosure i have to agree to that i understand webull uses apex crypto and that apex is not fdic insured, etc. An explanatory brochure is available upon request or at www.sipc.org. I see a disclosure i have to agree to that i understand webull uses apex crypto and that apex is not fdic insured, etc. What set them above competitors. Webull financial is a member of sipc, meaning your securities are sipc insured.

![M1 Finance vs. Webull Brokerage Comparison [2021 Review] M1 Finance vs. Webull Brokerage Comparison [2021 Review]](https://www.optimizedportfolio.com/wp-content/uploads/2020/05/webull-interface-markets-1536x773.png) Source: optimizedportfolio.com

Source: optimizedportfolio.com

I see a disclosure i have to agree. Also, as webull is not a bank, it is not a member of the fdic (federal deposit insurance corporation), which insures consumer deposits in u.s. Webull financial llc is a member of sipc, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). The web user interface will be slightly more confusing on webull, as it’s built for experienced traders. Is webull better than robinhood?

Source: scatteredwordsandmelodies.blogspot.com

Source: scatteredwordsandmelodies.blogspot.com

We are not fdic insured. Our clearing firm, apex clearing corp., has purchased an additional insurance policy. Existing insurance products are inadequate to cover potential losses if an exchange fails and / or digital wallets are hacked. The coverage scope of sipc protection is $500,000, which includes $250,000 coverage for cash. An explanatory brochure is available upon request or at www.sipc.org.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is webull fdic insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.