Is whole life insurance worth it reddit information

Home » Trend » Is whole life insurance worth it reddit informationYour Is whole life insurance worth it reddit images are ready. Is whole life insurance worth it reddit are a topic that is being searched for and liked by netizens today. You can Find and Download the Is whole life insurance worth it reddit files here. Find and Download all royalty-free images.

If you’re looking for is whole life insurance worth it reddit images information connected with to the is whole life insurance worth it reddit interest, you have visit the ideal blog. Our site always provides you with hints for viewing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that match your interests.

Is Whole Life Insurance Worth It Reddit. Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life. Always get term life policies. Having life insurance when you die is that purpose. This cash value grows over time, and you may be able to access this amount during your lifetime.

Is whole life insurance worth it? Most people regret From pinterest.com

Is whole life insurance worth it? Most people regret From pinterest.com

Whole life is the most expensive type of permanent insurance and there are other types that aren’t super expensive and have premiums very similar to term. Whole life insurance isn’t a fit for everyone, but it has tax advantages and can supplement retirement income. Whole life insurance protects your money from creditors. This cash value grows over time, and you may be able to access this amount during your lifetime. For most people, whole life insurance isn�t worth it. To be fair, there are rare situations where they make sense, but 99% of the time a whole life policy is a very bad financial decision.

It might not be at a very good rate, but at least it accumulates.

Because these policies are permanent, they’re far more expensive than a term. Having life insurance when you die is that purpose. When you pay your premium, part of the money goes toward the death benefit. Insurance products, including both fixed and whole life insurance as well as annuities are tax deferred much the same as a retirement account. There are a couple of reasons for that, but mostly it’s because you’re not just paying for insurance here. They are inappropriate for the vast majority of people on this planet, including physicians.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

For most people, whole life insurance isn�t worth it. Whole life maximum age is 85. Is whole life insurance worth it? Always get term life policies. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: howinforme.blogspot.com

Source: howinforme.blogspot.com

What is whole life insurance? Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life. What is whole life insurance? Whole life is the most expensive type of permanent insurance and there are other types that aren’t super expensive and have premiums very similar to term. Whole life maximum age is 85.

Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

Mass mutual has also always paid their dividends, and the dividend return over the last 20 years bottomed out at 6.85% and maxed out at over 13% (i forget the exact number). Learn about the costs and other key details associated with investing in whole life insurance. Its tax benefits pale in comparison to retirement accounts. Whole life insurance isn’t a fit for everyone, but it has tax advantages and can supplement retirement income. Whole life maximum age is 85.

Source: pinterest.com

Source: pinterest.com

Whole life insurance is a type of permanent life insurance. The simple answer is that it depends. Always get term life policies. A life insurance policy on someone with no earnings or someone with no dependent beneficiaries can be a waste of money. Because these policies are permanent, they’re far more expensive than a term.

Source: pinterest.com

Source: pinterest.com

Is it a good investment? What is whole life insurance? It can sometimes be wise to buy term life insurance when you�re in your twenties, as you�ll lock in a much lower rate than you would later in life (assuming you�re healthy overall). The rest of the money goes into a savings account, making up your policy’s cash value. The simple answer is that it depends.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Always get term life policies. Term life insurance is designed to cover you for a set term, hence its name. Whole life plans are generally more expensive than term life. Whole life has a purpose, and investment is not that purpose, even if it has an investment component. If you can�t do that, or don�t want to, then you might be better off buying whole life insurance.

Source: wealthstrategist.net

Source: wealthstrategist.net

Any gains acquired from whatever investment is included in the product are not taxed annually, but rather as ordinary income at the time they are withdrawn from the insurance policy however long down the road that might be. Whole life plans are generally more expensive than term life. Any gains acquired from whatever investment is included in the product are not taxed annually, but rather as ordinary income at the time they are withdrawn from the insurance policy however long down the road that might be. Cash value life insurance, such as whole life insurance, universal life insurance, and variable life insurance are products designed to be sold, not bought. This cash value grows over time, and you may be able to access this amount during your lifetime.

Source: riskquoter.com

Source: riskquoter.com

But it also has much lower premiums for permanent coverage, particularly for those over age 50. For most people, whole life insurance isn�t worth it. Any gains acquired from whatever investment is included in the product are not taxed annually, but rather as ordinary income at the time they are withdrawn from the insurance policy however long down the road that might be. Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life. There is no whole life minimum age.

Source: trustedchoice.com

Source: trustedchoice.com

Insurance products, including both fixed and whole life insurance as well as annuities are tax deferred much the same as a retirement account. Insurance products, including both fixed and whole life insurance as well as annuities are tax deferred much the same as a retirement account. The rest of the money goes into a savings account, making up your policy’s cash value. This cash value grows over time, and you may be able to access this amount during your lifetime. Is it a good investment?

Source: pinterest.com

Source: pinterest.com

Whole life insurance is a great asset class. It can sometimes be wise to buy term life insurance when you�re in your twenties, as you�ll lock in a much lower rate than you would later in life (assuming you�re healthy overall). I have a tiny old whole life life insurance policy (i know.) i opened for a friend about 10 years ago. Its tax benefits pale in comparison to retirement accounts. There are 10 reasons why it isn�t a great asset class, not even as a “bond replacement”.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Whole life policies are borderline scams. Whole life policies are borderline scams. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Whole life insurance is a type of permanent life insurance. Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life.

Source: everquote.com

Source: everquote.com

What is whole life insurance? I have a hybrid of term and whole life insurance, and it costs me (late 20s) less than it would cost me for half the insurance amount in my 50s (and i value life insurance, so i plan on having it now until then). Everyone always thinks that their whole life insurance is amazing, and then they realize the hidden costs, clawbacks, rebates that they�ll never actually get, and all the other little things that put more money into the company�s pocket. Whole life insurance protects your money from creditors. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: saberinvest.com

Source: saberinvest.com

There are guarantees on cash, death benefit, and premium. Whole life maximum age is 85. Whole life policies are borderline scams. There are 10 reasons why it isn�t a great asset class, not even as a “bond replacement”. Cash value life insurance, such as whole life insurance, universal life insurance, and variable life insurance are products designed to be sold, not bought.

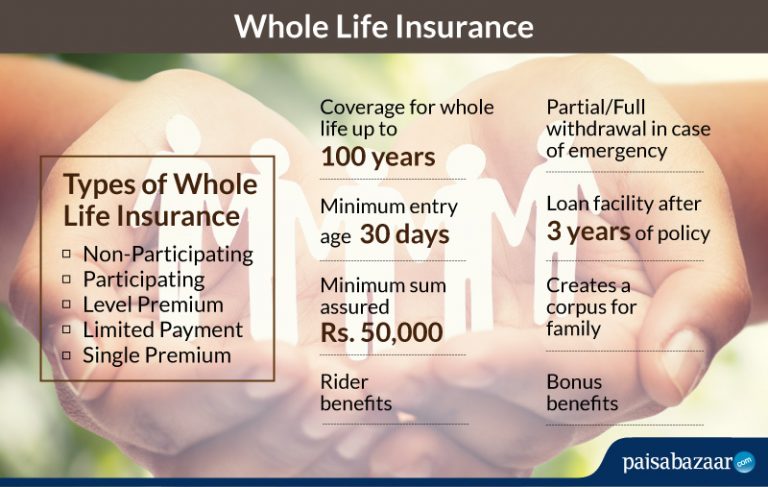

Source: paisabazaar.com

Source: paisabazaar.com

I have a hybrid of term and whole life insurance, and it costs me (late 20s) less than it would cost me for half the insurance amount in my 50s (and i value life insurance, so i plan on having it now until then). The policy accumulates cash value as the years go by. Its tax benefits pale in comparison to retirement accounts. When you pay your premium, part of the money goes toward the death benefit. The minimum whole life death benefit is $25,000.

Source: enzlo.com

Source: enzlo.com

Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life. The minimum whole life death benefit is $25,000. Any gains acquired from whatever investment is included in the product are not taxed annually, but rather as ordinary income at the time they are withdrawn from the insurance policy however long down the road that might be. Many or all of the products featured here are from our. Whole life insurance is a great asset class.

Source: paisabazaar.com

Source: paisabazaar.com

It might not be at a very good rate, but at least it accumulates. Cash value life insurance, such as whole life insurance, universal life insurance, and variable life insurance are products designed to be sold, not bought. Is whole life insurance worth it? Insurance products, including both fixed and whole life insurance as well as annuities are tax deferred much the same as a retirement account. Whole life insurance (sometimes called cash value insurance) is a type of coverage that—you guessed it—lasts your whole life.

Source: dokumen.tips

Source: dokumen.tips

Is it a good investment? It might not be at a very good rate, but at least it accumulates. Whole life insurance isn’t a fit for everyone, but it has tax advantages and can supplement retirement income. The policy accumulates cash value as the years go by. There is no whole life minimum age.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title is whole life insurance worth it reddit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.