J let her life insurance policy lapse Idea

Home » Trending » J let her life insurance policy lapse IdeaYour J let her life insurance policy lapse images are ready in this website. J let her life insurance policy lapse are a topic that is being searched for and liked by netizens today. You can Get the J let her life insurance policy lapse files here. Find and Download all royalty-free photos.

If you’re searching for j let her life insurance policy lapse pictures information related to the j let her life insurance policy lapse interest, you have visit the right site. Our site frequently gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

J Let Her Life Insurance Policy Lapse. The lapse rate on life policies is one of the central parameters in the managerial framework for both term (fixed maturity) and whole life products: For example in france, there are 35% of tax on capital gains of the contract if the withdrawal happens before the 4th year, 15% between the fifth and the 7th year, and only 7.5%. Needless to say, permanent policies have the strongest lapse rate. Simply put, a lapse occurs when premium payments on a life insurance policy are missed and, depending on the type of insurance, the cash value is exhausted.

Afford Anything Ask Paula No Spouse, No Family How Do From podcasts.apple.com

Afford Anything Ask Paula No Spouse, No Family How Do From podcasts.apple.com

You could contact the company and ask about making up. If you stop paying those premiums your policy will lapse, meaning you lose your life insurance coverage and your beneficiaries won’t get any life insurance money when you die. When someone buys a life insurance policy, the life insurance company’s obligation to pay out to their beneficiaries is contingent upon whether the insured paid their premiums. A lapse in coverage will occur if the insured fails to pay their premiums. At the time of lapse the contract for future benefit is no longer active but not void. If you can�t pay your life insurance premium due to unforeseen circumstances, you should be aware of the penalties.

At the time of lapse the contract for future benefit is no longer active but not void.

For example in france, there are 35% of tax on capital gains of the contract if the withdrawal happens before the 4th year, 15% between the fifth and the 7th year, and only 7.5%. Modeling precisely lapse behavior is therefore important for insurer�s liquidity and profitability. The impact is determined by the type of policy and coverage you have, as well as the terms and conditions of the policy. A life insurance policy may typically be reinstated within 30 days of a lapse without additional paperwork, underwriting, or attestations of health. “lapse” is shorthand for a “lapse in coverage,” which means the policy will no longer pay a death benefit for the insured person. Michael hartmann, a life insurance expert and ceo of findyourpolicy.com, adds.

Source: nypost.com

Source: nypost.com

What happens when a life insurance policy lapses. She can reestablish coverage under which provision? Chassels (“father”), unambiguously required her to do so, and mother and husband let the policy lapse before she died. However, the policyholder faces potential penalties. Some life insurance companies do check to see if you’ve had coverage lapses in the past.

Source: resettoo.com

Source: resettoo.com

The life policy can be reissued if the policy premiums are repaid and made current. Lapsed insurance policy could be bad. “life insurance is intended to cover the financial needs of our loved ones in the event of an untimely. Michael hartmann, a life insurance expert and ceo of findyourpolicy.com, adds. She can reestablish coverage under which of the following provisions?

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

For example in france, there are 35% of tax on capital gains of the contract if the withdrawal happens before the 4th year, 15% between the fifth and the 7th year, and only 7.5%. (“husband”), failed to maintain a life insurance policy on mother’s life for the benefit of her minor child (“child”). For example in france, there are 35% of tax on capital gains of the contract if the withdrawal happens before the 4th year, 15% between the fifth and the 7th year, and only 7.5%. At the time of lapse the contract for future benefit is no longer active but not void. A life insurance policy will lapse when both premium payments are missed and cash surrender value is exhausted if it is a permanent life insurance policy.

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

She can reestablish coverage under which provision? As already mentioned, the policyholder may choose to surrender her life insurance policy in order to immediately retrieve the cash value. When someone buys a life insurance policy, the life insurance company’s obligation to pay out to their beneficiaries is contingent upon whether the insured paid their premiums. At the time of lapse the contract for future benefit is no longer active but not void. The lapse rate on life policies is one of the central parameters in the managerial framework for both term (fixed maturity) and whole life products:

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

A policy lapse won’t happen immediately after one missed payment. A policy lapse won’t happen immediately after one missed payment. When your policy lapses, you’ll have to pay for any losses out of pocket. If you stop making insurance payments, your policy will lapse and your home will be unprotected after a fire, storm, or burglary. $50,000 minus any outstanding policy loans.

Source: podtail.com

Source: podtail.com

She can reestablish coverage under which provision? It’s smart to ask the question before you let the larger policies lapse. However, the policyholder faces potential penalties. What happens when a life insurance policy lapses. When someone buys a life insurance policy, the life insurance company’s obligation to pay out to their beneficiaries is contingent upon whether the insured paid their premiums.

Source: azquotes.com

Source: azquotes.com

Mother’s divorce and agreement with the child’s father, loren j. When someone buys a life insurance policy, the life insurance company’s obligation to pay out to their beneficiaries is contingent upon whether the insured paid their premiums. “if the cash value can no longer sustain the premiums, the policy will eventually lapse and no longer be in force.” term life insurance, on the other hand, has no cash value to tap and will lapse right away. She can reestablish coverage under which of the following provisions? What happens when a life insurance policy lapses.

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

As already mentioned, the policyholder may choose to surrender her life insurance policy in order to immediately retrieve the cash value. When your policy lapses, you’ll have to pay for any losses out of pocket. Your coverage will lapse if you stop paying your premiums. A policy lapse won’t happen immediately after one missed payment. You could contact the company and ask about making up.

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

Michael hartmann, a life insurance expert and ceo of findyourpolicy.com, adds. The consideration clause in a life insurance policy indicates that a policyowner’s consideration consists of a completed application and It’s smart to ask the question before you let the larger policies lapse. If the policy lapses, the life insurance company will not pay the insured’s beneficiaries. The life policy can be reissued if the policy premiums are repaid and made current.

Source: bobatoo.co.uk

Source: bobatoo.co.uk

Some life insurance companies do check to see if you’ve had coverage lapses in the past. She can reestablish coverage under which provision? Michael hartmann, a life insurance expert and ceo of findyourpolicy.com, adds. “if the cash value can no longer sustain the premiums, the policy will eventually lapse and no longer be in force.” term life insurance, on the other hand, has no cash value to tap and will lapse right away. A lapse means a life insurance policy is no longer an active contract due to missed premium payments.

Source: saturdayeveningpost.com

Source: saturdayeveningpost.com

When someone buys a life insurance policy, the life insurance company’s obligation to pay out to their beneficiaries is contingent upon whether the insured paid their premiums. She can reestablish coverage under which of the following provisions? As a result, the $250,000 in policy proceeds that the child should have. If you can�t pay your life insurance premium due to unforeseen circumstances, you should be aware of the penalties. (c) lapse or termination for nonpayment of premium.

Source: j9lotterysignupodds.com

Source: j9lotterysignupodds.com

When you take out a life insurance policy, you pay a premium to keep the policy active. Your coverage will lapse if you stop paying your premiums. What happens when a life insurance policy lapses. Mother’s divorce and agreement with the child’s father, loren j. If you stop making insurance payments, your policy will lapse and your home will be unprotected after a fire, storm, or burglary.

Source: marisayuniartymrkar.blogspot.com

Source: marisayuniartymrkar.blogspot.com

Mother’s divorce and agreement with the child’s father, loren j. Not all homeowners insurance providers allow for late payments. She can reestablish coverage under which of the following provisions? “life insurance is intended to cover the financial needs of our loved ones in the event of an untimely. If you stop making insurance payments, your policy will lapse and your home will be unprotected after a fire, storm, or burglary.

Source: marisayuniartymrkar.blogspot.com

Source: marisayuniartymrkar.blogspot.com

(c) lapse or termination for nonpayment of premium. What happens when a life insurance policy lapses. She can reestablish coverage under which provision? If you stop making insurance payments, your policy will lapse and your home will be unprotected after a fire, storm, or burglary. Michael hartmann, a life insurance expert and ceo of findyourpolicy.com, adds.

Source: marisayuniartymrkar.blogspot.com

Source: marisayuniartymrkar.blogspot.com

If you can�t pay your life insurance premium due to unforeseen circumstances, you should be aware of the penalties. When your policy lapses, you’ll have to pay for any losses out of pocket. When a person or persons lapse a policy they typically have not paid premiums to continue contract benefit as outlined in the premium benefit page of the life insurance contract. What happens when a life insurance policy lapses. A life insurance policy will lapse when both premium payments are missed and cash surrender value is exhausted if it is a permanent life insurance policy.

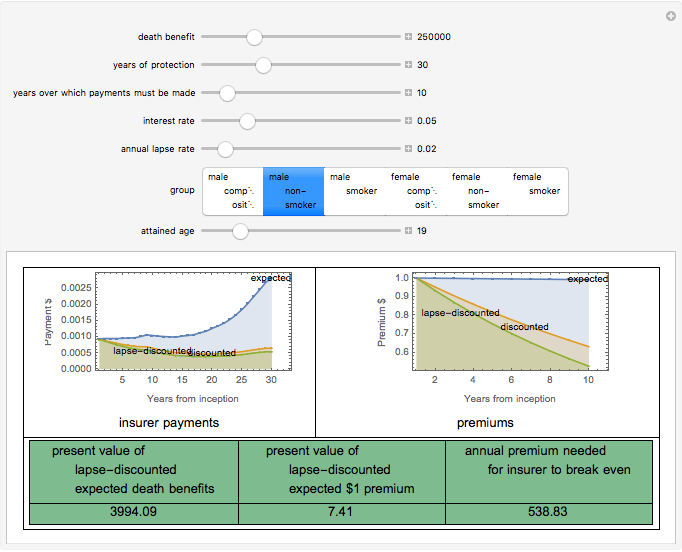

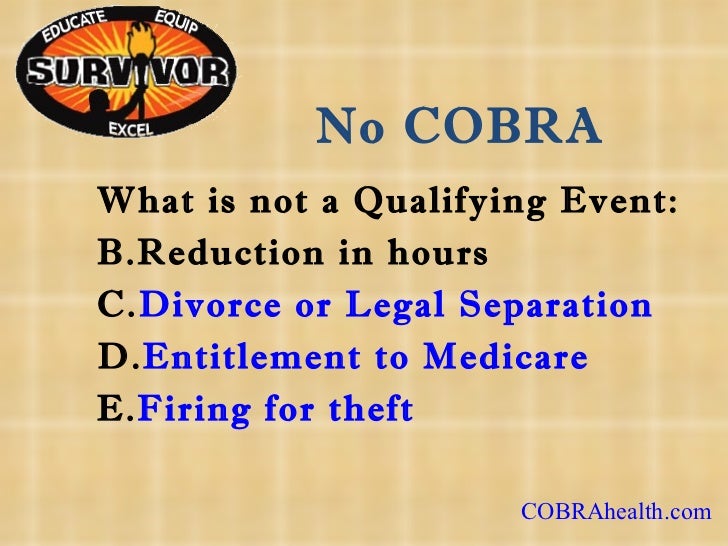

Source: slideshare.net

Source: slideshare.net

When your policy lapses, you’ll have to pay for any losses out of pocket. “life insurance is intended to cover the financial needs of our loved ones in the event of an untimely. However, the policyholder faces potential penalties. As many as 25% of people with these policies allow them to lapse in the first 3 years. For example in france, there are 35% of tax on capital gains of the contract if the withdrawal happens before the 4th year, 15% between the fifth and the 7th year, and only 7.5%.

Source: pinterest.com

Source: pinterest.com

J let her life insurance policy lapse 8 months ago due to nonpayment. At the time of lapse the contract for future benefit is no longer active but not void. The life policy can be reissued if the policy premiums are repaid and made current. “life insurance is intended to cover the financial needs of our loved ones in the event of an untimely. When your policy lapses, you’ll have to pay for any losses out of pocket.

Source: podcasts.apple.com

Source: podcasts.apple.com

A lapse means a life insurance policy is no longer an active contract due to missed premium payments. The consideration clause in a life insurance policy indicates that a policyowner’s consideration consists of a completed application and It’s smart to ask the question before you let the larger policies lapse. You could contact the company and ask about making up. $50,000 minus any outstanding policy loans.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title j let her life insurance policy lapse by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.