Jonas is a whole life insurance policyowner information

Home » Trending » Jonas is a whole life insurance policyowner informationYour Jonas is a whole life insurance policyowner images are ready in this website. Jonas is a whole life insurance policyowner are a topic that is being searched for and liked by netizens now. You can Find and Download the Jonas is a whole life insurance policyowner files here. Download all free photos.

If you’re searching for jonas is a whole life insurance policyowner pictures information related to the jonas is a whole life insurance policyowner topic, you have pay a visit to the right blog. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that match your interests.

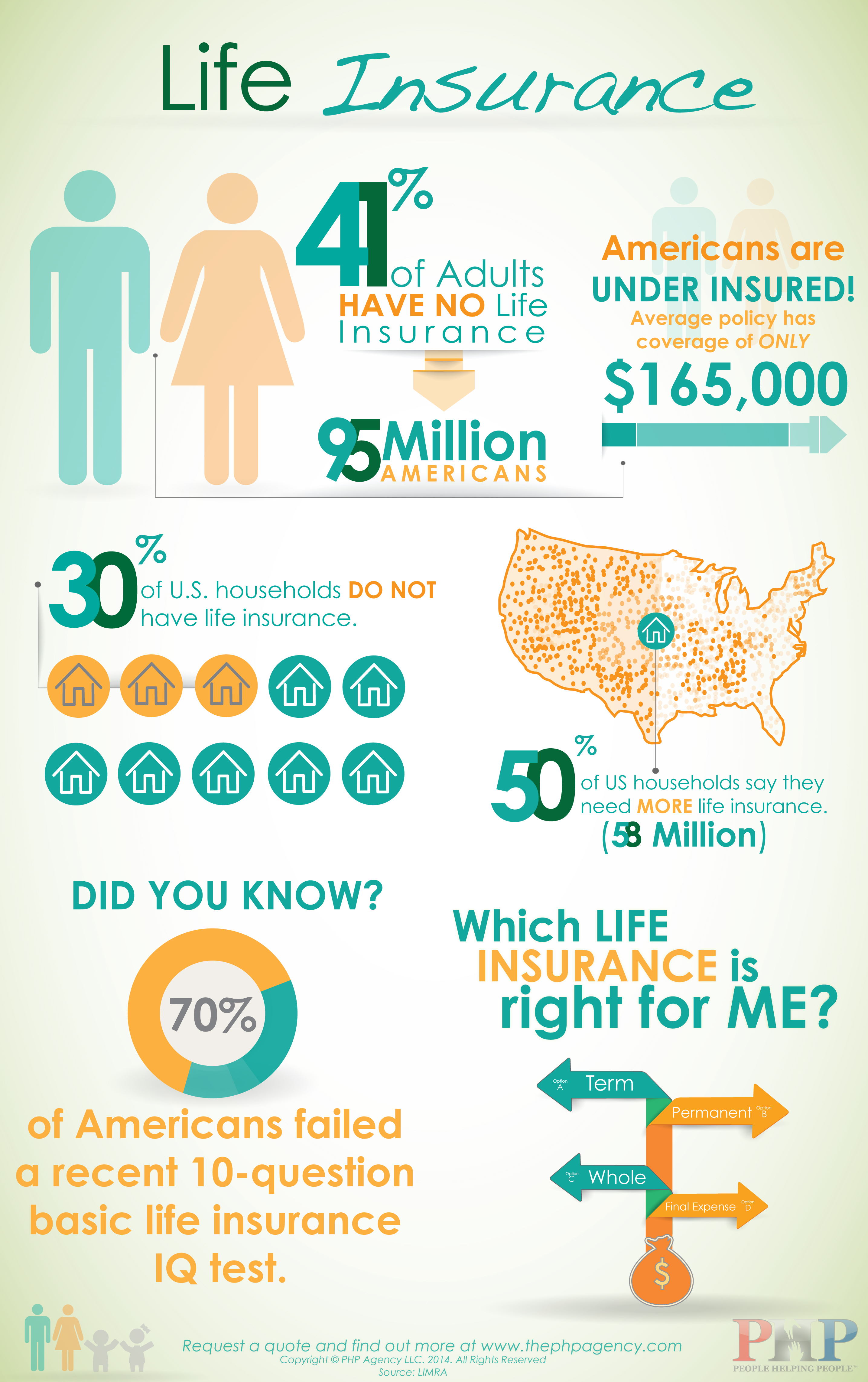

Jonas Is A Whole Life Insurance Policyowner. Asked apr 15 in history by rambino. In 2003, about 6.4 million individual life insurance policies bought were term and about 7.1 million were whole life. Jonas is a whole life insurance policy owner and would like to add coverage for his 2 children. Which of the following products would allow him to accomplish this?

Tax Benefits of Whole Life Insurance • The Insurance Pro Blog From theinsuranceproblog.com

Tax Benefits of Whole Life Insurance • The Insurance Pro Blog From theinsuranceproblog.com

Jonas is a whole life insurance policyowner and would like to add coverage for his two children. The policyowner is the person who has control over the policy. Which of the following products would allow him to accomplish this? This person is called the insured. It seems like my team and i are regularly answering questions regarding policy ownership and beneficiary designations. A nonparticipating whole life insurance policy was surrendered for its $20,000 cash value.

Charge fee can be charged to a policyowner when a life insurance policy is has not stated a settlement option, the beneficiary then would have the right.10 pages (16).

A life insurance policy normally contains a provision that restricts coverage in the event of death under all of the following situations except. These include the right to: What were the federal income tax consequences to the policy owner on receipt of the cash value? They also choose who the beneficiaries are and can change them at any time. You will receive the full cash value of the policy. A nonparticipating whole life insurance policy was surrendered for its $20,000 cash value.

Source: insurance-resource.ca

Source: insurance-resource.ca

What were the federal income tax consequences to the policy owner on receipt of the cash value? Jonas salk and albert sabin are most associated with: A whole life insurance policyowner does not wish to continue making premium payments. You will receive the full cash value of the policy. A life insurance policyowner has the right to control the economic benefits of the policy.

Source: krostrade.com

Source: krostrade.com

A life insurance policyowner does not have the right to collateral assignment a provision that allows a policyowner to temporarily give up ownership rights to secure a loan is called a(n) s buys a $10,000 whole life policy in 2003 and pays an annual premium of $100. In 2003, about 6.4 million individual life insurance policies bought were term and about 7.1 million were whole life. Whole life insurance, sometimes called permanent insurance, or ordinary life, is designed to stay in force throughout ones lifetime. What were the federal income tax consequences to the policy owner on receipt of the cash value? It�s designed to provide a death benefit for a specific period (e.g., 5, 10, 20, or even 30 years).

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Term life is sometimes called pure life insurance because there�s no cash value to the policy: Cash value life insurance is a type of permanent life insurance that includes an investment feature. Which of the following products would allow him to accomplish this? Life insurance products for groups. They are responsible for making sure the premiums are paid.

Source: sweeterandhotter.blogspot.com

$20,000 was received as a capital gain This person is called the insured. The insured might be the owner of the policy or might not. The policyowner is the person who has control over the policy. A life insurance policy normally contains a provision that restricts coverage in the event of death under all of the following situations except.

Source: wealthnation.io

Source: wealthnation.io

These include the right to: This person is called the insured. They also choose who the beneficiaries are and can change them at any time. These include the right to: What were the federal income tax consequences to the policy owner on receipt of the cash value?

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

The insured might be the owner of the policy or might not. Jonas is a whole life insurance policyowner and would like to add coverage for his two children. The policyowner is the person who has control over the policy. Life insurance products for groups. Jonas is a whole life insurance policy owner and would like to add coverage for his 2 children.

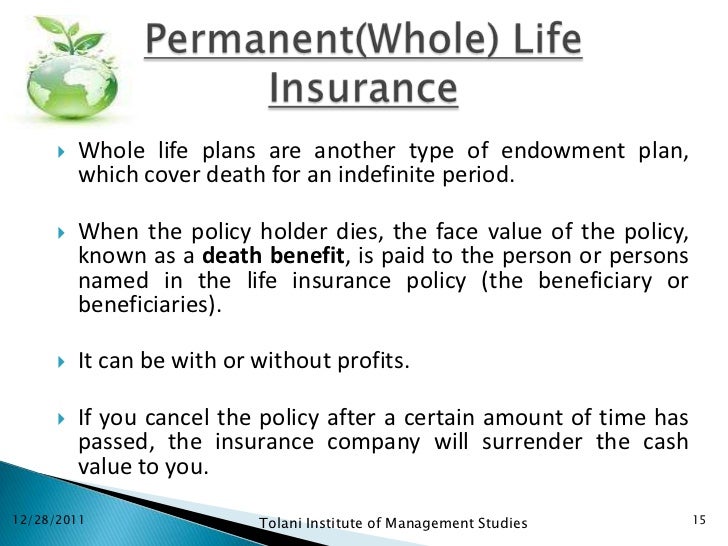

Whole life insurance, sometimes called permanent insurance, or ordinary life, is designed to stay in force throughout ones lifetime. Which of the following products would allow him to accomplish this? Charge fee can be charged to a policyowner when a life insurance policy is has not stated a settlement option, the beneficiary then would have the right.10 pages (16). The owner of a life insurance policy is the one who has the rights stipulated in the contract. Asked apr 15 in history by rambino.

Source: stone-hedgefinancialgroup.ca

Source: stone-hedgefinancialgroup.ca

Joanne has a $100,000 whole life policy with an accumulated $25,000 of cash value. What is the point of cash value in life insurance? Cash value life insurance is found in several fundamental formats. Surrender the policy for its cash value; A life insurance policy ensures the life of a person.

Source: revisi.net

Source: revisi.net

Term life is sometimes called pure life insurance because there�s no cash value to the policy: Jonas salk and albert sabin are most associated with: Jonas is a whole life insurance policyowner and would like to add coverage for his two children. Asked apr 15 in history by rambino. In the case of a cash value life policy, the policy owner owns cash values which is an asset that could be borrowed if needed or, the policy cash surrender value could be accessed if.

Source: esmalteando-blog.blogspot.com

Cash value life insurance is a type of permanent life insurance that includes an investment feature. Surrender the policy for its cash value; What is the point of cash value in life insurance? $20,000 was received as a capital gain Jonas salk and albert sabin are most associated with:

Source: tier1capital.com

Source: tier1capital.com

Which of the following products would allow him to accomplish this? A life insurance policyowner does not have the right to collateral assignment a provision that allows a policyowner to temporarily give up ownership rights to secure a loan is called a(n) s buys a $10,000 whole life policy in 2003 and pays an annual premium of $100. Charge fee can be charged to a policyowner when a life insurance policy is has not stated a settlement option, the beneficiary then would have the right.10 pages (16). The owner of a life insurance policy is the one who has the rights stipulated in the contract. $20,000 was received as a capital gain

Traditionally, whole life insurance is a consumer demanded product that offers more than just a death benefit by permitting the policyholder to build equity in the policy. Which of the following products would allow him to accomplish this? Charge fee can be charged to a policyowner when a life insurance policy is has not stated a settlement option, the beneficiary then would have the right.10 pages (16). $20,000 was received as a capital gain Joanne has a $100,000 whole life policy with an accumulated $25,000 of cash value.

Source: npa1.org

Source: npa1.org

They are responsible for making sure the premiums are paid. Asked apr 16 in business by phenomono. Joanne has a $100,000 whole life policy with an accumulated $25,000 of cash value. What were the federal income tax consequences to the policy owner on receipt of the cash value? It�s designed to provide a death benefit for a specific period (e.g., 5, 10, 20, or even 30 years).

Source: financialsavingspro.com

Source: financialsavingspro.com

Jonas salk and albert sabin are most associated with: Cash value life insurance is found in several fundamental formats. You will receive the full cash value of the policy. The total premiums paid had totaled $16,000. Surrender the policy for its cash value;

Source: lifeinsurance411.org

Source: lifeinsurance411.org

Jonas is a whole life insurance policyowner and would like to add coverage for his two children. The purpose of whole life insurance is to provide coverage for the insured, for their entire lifetime. The owner can have outright ownership of the policy or just (15). Whole life insurance, sometimes called permanent insurance, or ordinary life, is designed to stay in force throughout ones lifetime. You will receive the full cash value of the policy.

Source: orlandotouch.com

Source: orlandotouch.com

What were the federal income tax consequences to the policy owner on receipt of the cash value? The total premiums paid had totaled $16,000. They also choose who the beneficiaries are and can change them at any time. What were the federal income tax consequences to the policy owner on receipt of the cash value? Surrender the policy for its cash value;

Source: revisi.net

Source: revisi.net

Whole life is sometimes called permanent life insurance, and it encompasses several subcategories, including traditional whole life, universal life, variable life and variable universal life. In 2003, about 6.4 million individual life insurance policies bought were term and about 7.1 million were whole life. Jonas is a whole life insurance policy owner and would like to add coverage for his 2 children. A nonparticipating whole life insurance policy was surrendered for its $20,000 cash value. Whole life insurance, sometimes called permanent insurance, or ordinary life, is designed to stay in force throughout ones lifetime.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title jonas is a whole life insurance policyowner by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.