Jumpstart insurance Idea

Home » Trend » Jumpstart insurance IdeaYour Jumpstart insurance images are available in this site. Jumpstart insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Jumpstart insurance files here. Download all royalty-free vectors.

If you’re searching for jumpstart insurance pictures information linked to the jumpstart insurance topic, you have pay a visit to the right blog. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Jumpstart Insurance. Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. Kate stillwell, now president of jumpstart parametric insurance at neptune, added: Neptune flood acquires jumpstart insurance. Flood insurtech neptune flood has acquired jumpstart, another insurtech that offers a parametric product for earthquake response.

Jumpstart Earthquake Insurance for HOAs YouTube From youtube.com

Jumpstart Earthquake Insurance for HOAs YouTube From youtube.com

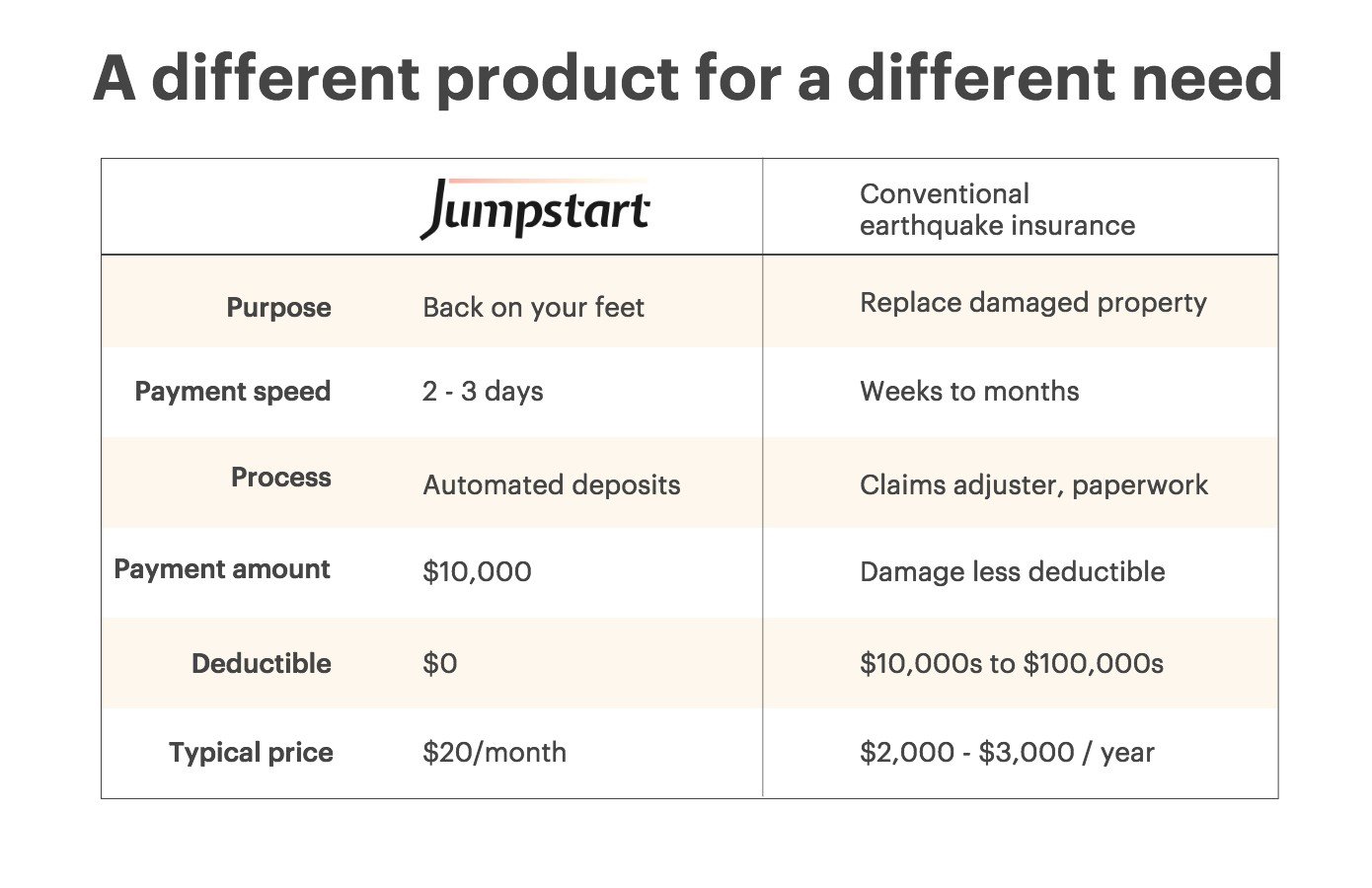

Jumpstart insurance solutions inc., offers earthquake insurance in california in the form of a parametric product, with payments linked to a formula. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage. On our blog, we dive into all the facts, discoveries, and lessons learned from this historic quake. “the team and i are thrilled for jumpstart and neptune to join forces. Jumpstart helps consumers weather the economic shock of a natural disaster, with a new type of insurance that pays right away regardless of damage. Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters.

In 1906, san francisco experienced one of the worst natural disasters in history, an earthquake of 7.9 magnitude.

In 1906, san francisco experienced one of the worst natural disasters in history, an earthquake of 7.9 magnitude. Neptune flood acquires jumpstart insurance. We earn recurring revenue without bearing risk, in partnership with reinsurers. Report this profile about my life�s work is to build resilience, particularly to natural disasters. Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. We believe this is due to lack of support, accountability, genuniely positive culture, and community.

Source: youtube.com

Source: youtube.com

Report this profile about my life�s work is to build resilience, particularly to natural disasters. Neptune flood acquires jumpstart insurance. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage. Eventbased insurance to help people recover from a natural disaster please evaluate the company’s performance. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of.

Source: temblor.net

Source: temblor.net

Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. 4 reviews of jumpstart insurance solutions jumpstart is exactly what we�ve been looking for! “the team and i are thrilled for jumpstart and neptune to join forces. Jumpstart is a surplus lines insurance broker with a mission to help people build financial resilience to disasters. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Jumpstart insurance solutions is based in oakland, california. Eventbased insurance to help people recover from a natural disaster please evaluate the company’s performance. Jumpstart leads contain key marketing demographics: Jumpstart insurance solutions inc., a licensed surplus lines insurance broker using lloyd’s capacity, will offer earthquake insurance in california in. We earn recurring revenue without bearing risk, in partnership with reinsurers.

Source: bbb.org

Source: bbb.org

Jumpstart’s model aims to get. On our blog, we dive into all the facts, discoveries, and lessons learned from this historic quake. Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. The policyholder receives the funds in a matter of days instead of weeks or months with no deductible, no adjusters, and no paperwork. Carrier and incumbent agency information;

Source: erynedhel.blogspot.com

Source: erynedhel.blogspot.com

Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. The policyholder receives the funds in a matter of days instead of weeks or months with no deductible, no adjusters, and no paperwork. The 7.9 magnitude 1906 san francisco earthquake left over half the population homeless and claimed the lives of. Jumpstart leads contain key marketing demographics: Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage.

Source: republic.co

Source: republic.co

Employee size and number of insured autos; In 1906, san francisco experienced one of the worst natural disasters in history, an earthquake of 7.9 magnitude. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage. We earn recurring revenue without bearing risk, in partnership with reinsurers.

Source: gust.com

Source: gust.com

Jumpstart is a surplus lines insurance broker with a mission to help people build financial resilience to disasters. They are making a first layer of ea. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage. Jumpstart insurance solutions inc., offers earthquake insurance in california in the form of a parametric product, with payments linked to a formula. We bought a conventional earthquake insurance policy, but were worried about the high deductible and the likelihood of not meeting that deductible in the case of an earthquake.

Source: youtube.com

Source: youtube.com

The 7.9 magnitude 1906 san francisco earthquake left over half the population homeless and claimed the lives of. We bought a conventional earthquake insurance policy, but were worried about the high deductible and the likelihood of not meeting that deductible in the case of an earthquake. Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. The policyholder receives the funds in a matter of days instead of weeks or months with no deductible, no adjusters, and no paperwork. The 7.9 magnitude 1906 san francisco earthquake left over half the population homeless and claimed the lives of.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Jumpstart insurance solutions is based in oakland, california. Most insurance agents & agency owners do not lack the hustle or drive to build a successful agency. “the team and i are thrilled for jumpstart and neptune to join forces. Jumpstart insurance solutions inc., offers earthquake insurance in california in the form of a parametric product, with payments linked to a formula. Neptune flood acquires jumpstart insurance.

Source: republic.co

Source: republic.co

Jumpstart insurance solutions inc., offers earthquake insurance in california in the form of a parametric product, with payments linked to a formula. Jumpstart leads contain key marketing demographics: Kate stillwell, now president of jumpstart parametric insurance at neptune, added: Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

They are making a first layer of ea. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of. On our blog, we dive into all the facts, discoveries, and lessons learned from this historic quake. Jumpstart insurance solutions is based in oakland, california. 4 reviews of jumpstart insurance solutions jumpstart is exactly what we�ve been looking for!

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Most insurance agents & agency owners do not lack the hustle or drive to build a successful agency. Report this profile about my life�s work is to build resilience, particularly to natural disasters. With limited reserves after buying a house (thank you bay area housing market.), jumpstart was the. “the team and i are thrilled for jumpstart and neptune to join forces. Kate stillwell, now president of jumpstart parametric insurance at neptune, added:

Source: republic.co

Source: republic.co

Yet, 92% of agents will fail in the first two years of their businesses. Jumpstart insurance solutions is based in oakland, california. Kate stillwell, now president of jumpstart parametric insurance at neptune, added: Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. Report this profile about my life�s work is to build resilience, particularly to natural disasters.

Source: erynedhel.blogspot.com

Source: erynedhel.blogspot.com

Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. Flood insurtech neptune flood has acquired jumpstart, another insurtech that offers a parametric product for earthquake response. In 1906, san francisco experienced one of the worst natural disasters in history, an earthquake of 7.9 magnitude. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage.

Source: erynedhel.blogspot.com

Source: erynedhel.blogspot.com

Jumpstart leads contain key marketing demographics: Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. Employee size and number of insured autos; We bought a conventional earthquake insurance policy, but were worried about the high deductible and the likelihood of not meeting that deductible in the case of an earthquake. Neptune was founded in 2017 and uses an ai engine to underwrite flood insurance.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Jumpstart’s model aims to get. Jumpstart is a surplus lines insurance broker with a mission to help you build financial resilience to natural disasters. We believe this is due to lack of support, accountability, genuniely positive culture, and community. Jumpstart helps consumers weather the economic shock of a natural disaster, with a new type of insurance that pays right away regardless of damage. Jumpstart’s model aims to get.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of. Of the $100b global opportunity, our $6b beachhead market is earthquake risk in california, where 9 in 10 are uninsured. Jumpstart’s model aims to get. In 1906, san francisco experienced one of the worst natural disasters in history, an earthquake of 7.9 magnitude. Report this profile about my life�s work is to build resilience, particularly to natural disasters.

Source: blog.jumpstartinsurance.com

Source: blog.jumpstartinsurance.com

Yet, 92% of agents will fail in the first two years of their businesses. Jumpstart helps consumers weather the economic shock of a natural disaster, with a new type of insurance that pays right away regardless of damage. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of. Neptune was founded in 2017 and uses an ai engine to underwrite flood insurance. Unlike traditional earthquake insurance, jumpstart uses a parametric approach to provide a set payout amount based on the quake intensity, rather than the cost of damage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title jumpstart insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.