Key financial ratios for insurance companies pdf Idea

Home » Trend » Key financial ratios for insurance companies pdf IdeaYour Key financial ratios for insurance companies pdf images are available in this site. Key financial ratios for insurance companies pdf are a topic that is being searched for and liked by netizens now. You can Find and Download the Key financial ratios for insurance companies pdf files here. Get all royalty-free photos.

If you’re looking for key financial ratios for insurance companies pdf pictures information connected with to the key financial ratios for insurance companies pdf keyword, you have visit the ideal site. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and images that match your interests.

Key Financial Ratios For Insurance Companies Pdf. We enjoy them as fun companions, and we deeply love them for the joy they bring to our lives. Each key credit factor is evaluated based on application of guidelines by rating category that were established within these criteria, as well as use of peer analysis. They are our members of the furdy family. High ratios can usually occur either because of underpricing and/or because of unexpected high claims.

What Is a Financial Ratio? The Complete Beginner’s Guide From medium.com

What Is a Financial Ratio? The Complete Beginner’s Guide From medium.com

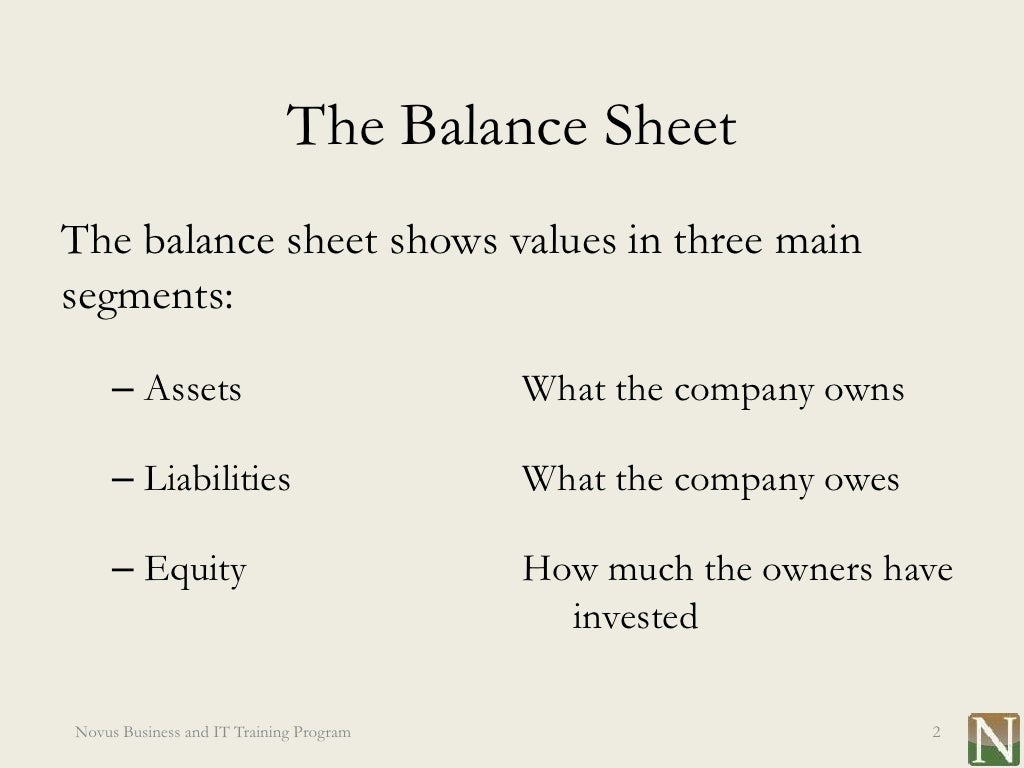

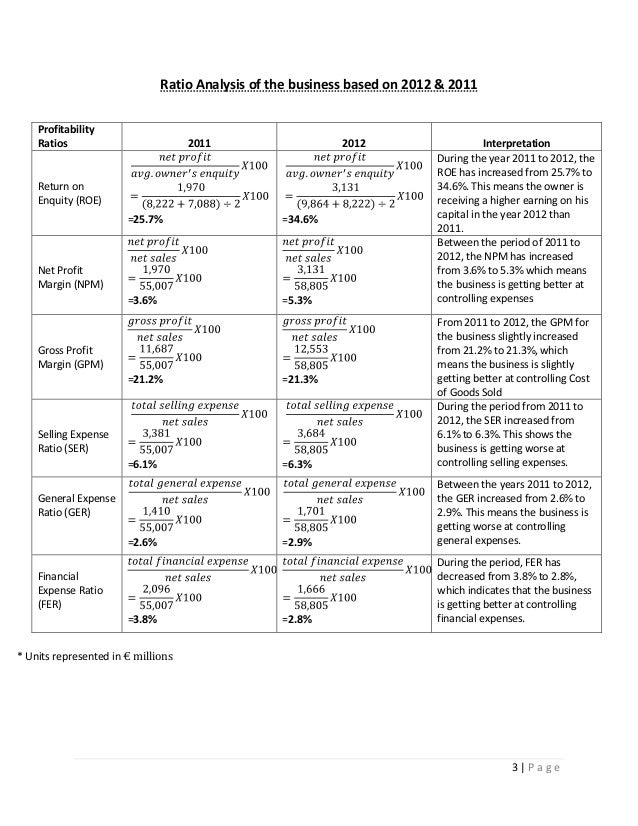

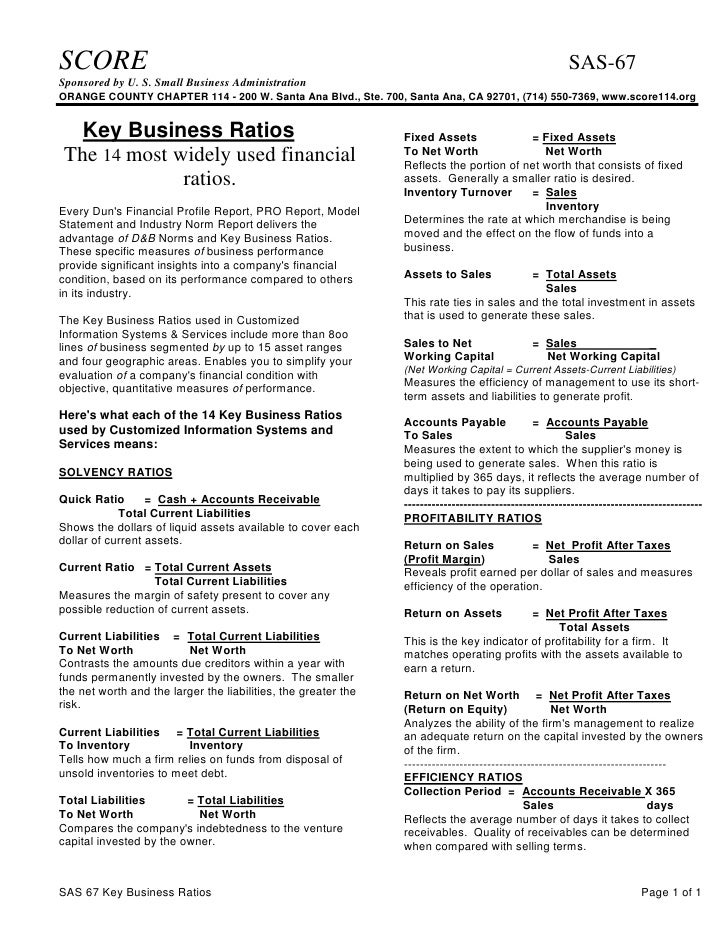

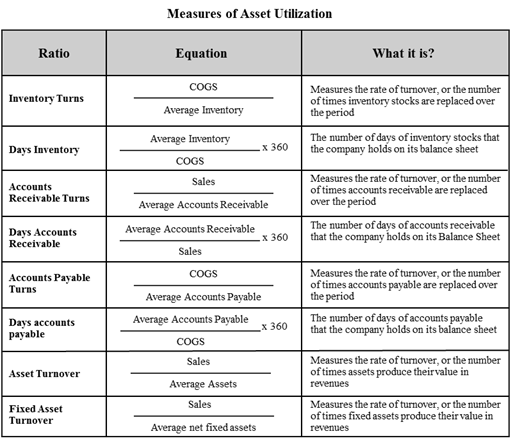

The paper contains three sections. Serial 2012 2011 2010 2009 2008 no. Corporate finance ratios are quantitative measures that are used to assess businesses. On the flipside, a combined ratio of more than 100% represents an �underwriting loss�, which means an insurer is reliant on investment income to square the ledger. Each key credit factor is evaluated based on application of guidelines by rating category that were established within these criteria, as well as use of peer analysis. 1) liquidity, 2) solvency, 3) profitability, 4) financial efficiency, and 5) repayment capacity.

The current ratio, also known as the working capital ratio, measures the capability of a business to.

This ratio does not reflect capital gains or income taxes. The current ratio, also known as the working capital ratio, measures the capability of a business to. The paper contains three sections. A liquidity ratio provides information on a company�s ability to meet its short−term, Key financial ratios for insurance companies pdf. Key financial ratios the thorough valuation analyst will consider and compute five categories of ratios:

Source: trc.com.my

Source: trc.com.my

These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. Banks, insurance and financial investment firms have specific ratios, which are different from those traditionally used to analyze industrial companies. When we assess a company�s financial condition, we want to know if it is able to meet its financial obligations. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. There are six aspects of operating performance and financial condition we can evaluate from financial ratios:

Source: medium.com

Source: medium.com

Each key credit factor is evaluated based on application of guidelines by rating category that were established within these criteria, as well as use of peer analysis. Key financial ratios the thorough valuation analyst will consider and compute five categories of ratios: In particular, ev is not a suitable metric for financial institutions because interest is a critical component of both revenue and expenses. All the ratios described below can be 1) liquidity, 2) solvency, 3) profitability, 4) financial efficiency, and 5) repayment capacity.

Source: multiplyillustration.com

Source: multiplyillustration.com

Expense ratio reflects the efficiency of insurance operations. The total amount of claims paid out to policyholders by the insurance company as a percentage of total premium earned over the same time period. This ratio does not reflect capital gains or income taxes. However, managers, analysts and regulators utilize financial ratios based on the accounting products to describe and understand Another very common ratio is the interest coverage ratio (formula 19.15), which is simply the earnings before interest and tax in relation to interest charges over the same period.

![[PDF] Ratios Made Simple A Beginners Guide To The Key [PDF] Ratios Made Simple A Beginners Guide To The Key](https://s-media-cache-ak0.pinimg.com/736x/df/a3/01/dfa30186f62f1a020541bba334abf664.jpg) Source: shethetheory.blogspot.com

Source: shethetheory.blogspot.com

This ratio does not reflect capital gains or income taxes. High ratios can usually occur either because of underpricing and/or because of unexpected high claims. 12 1 2.0 ratio analysis of insurance company agrani insurance company: These factors are net income, combined ratio and policyholder surplus. Determining an insurance company’s financial strength and stability.

However, managers, analysts and regulators utilize financial ratios based on the accounting products to describe and understand They are our members of the furdy family. A ratio below 100 percent represents a measure of profitability and the efficiency of an insurance firms underwriting efficiency. The products ofthe accounting system end with financial state ments. On the flipside, a combined ratio of more than 100% represents an �underwriting loss�, which means an insurer is reliant on investment income to square the ledger.

Source: researchgate.net

Source: researchgate.net

Expense ratio reflects the efficiency of insurance operations. However, managers, analysts and regulators utilize financial ratios based on the accounting products to describe and understand A liquidity ratio provides information on a company�s ability to meet its short−term, Each key credit factor is evaluated based on application of guidelines by rating category that were established within these criteria, as well as use of peer analysis. There are six aspects of operating performance and financial condition we can evaluate from financial ratios:

Source: analystprep.cn

Source: analystprep.cn

Each key credit factor is evaluated based on application of guidelines by rating category that were established within these criteria, as well as use of peer analysis. When we assess a company�s financial condition, we want to know if it is able to meet its financial obligations. An efficient and profitable manner. Key financial ratios for insurance companies pdf. For each insurer are determined and published the basic profitability tests:

Source: multiplyillustration.com

Source: multiplyillustration.com

The paper contains three sections. Combined ratio = ( loss ratio + expense ratio ) On the flipside, a combined ratio of more than 100% represents an �underwriting loss�, which means an insurer is reliant on investment income to square the ledger. Corporate finance ratios are quantitative measures that are used to assess businesses. Combined ratio loss ratio + expense ratio underwriting profitability of an insurance company after factoring claims expenses and operating expenses of the insurer.

Source: slideshare.net

Source: slideshare.net

An efficient and profitable manner. € e analysis will be made for 23 companies which is 85% of total number of insurance companies in croatia in 2011 and 95,95% of gross written premium of all insurance companies (croatian financial services supervisory agency, 2011). Expense ratio for an insurer is analyzed by class of business, along with the trend of the same. We enjoy them as fun companions, and we deeply love them for the joy they bring to our lives. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions.

Source: bwsws.com

Source: bwsws.com

High ratios can usually occur either because of underpricing and/or because of unexpected high claims. 1) liquidity, 2) solvency, 3) profitability, 4) financial efficiency, and 5) repayment capacity. This ratio does not reflect capital gains or income taxes. Key financial ratios the thorough valuation analyst will consider and compute five categories of ratios: Common liquidity ratios include the following:

Source: scubadivingpat.com

Source: scubadivingpat.com

These factors are net income, combined ratio and policyholder surplus. Ratios above 100 percnet denote a failure to earn sufficient premiums to cover expected claims. When we assess a company�s financial condition, we want to know if it is able to meet its financial obligations. There are three important indicators that you can look at to help determine an insurance company’s financial strength and stability. Net income is a company’s total earnings.

Source: insightsoftware.com

Source: insightsoftware.com

For each insurer are determined and published the basic profitability tests: In particular, ev is not a suitable metric for financial institutions because interest is a critical component of both revenue and expenses. The total amount of claims paid out to policyholders by the insurance company as a percentage of total premium earned over the same time period. Westend61 / getty images our furry friends are not just, well, friends. Whilst there are countless ratios quoted by finance analysts (and most have their uses), for the purpose of this fact sheet, the focus will be on 17 ratios covering 5 key areas of the business, being:

Whilst there are countless ratios quoted by finance analysts (and most have their uses), for the purpose of this fact sheet, the focus will be on 17 ratios covering 5 key areas of the business, being: 12 1 2.0 ratio analysis of insurance company agrani insurance company: Ratios above 100 percnet denote a failure to earn sufficient premiums to cover expected claims. Financial ratios and metrics defined within the rating guidelines are differentiated as core and complementary, with core ratios typically receiving greater emphasis. The current ratio current ratio formula the current ratio formula is = current assets / current liabilities.

Source: alberta.ca

Source: alberta.ca

Whilst there are countless ratios quoted by finance analysts (and most have their uses), for the purpose of this fact sheet, the focus will be on 17 ratios covering 5 key areas of the business, being: The current ratio, also known as the working capital ratio, measures the capability of a business to. 12 1 2.0 ratio analysis of insurance company agrani insurance company: Combined ratio = ( loss ratio + expense ratio ) We enjoy them as fun companions, and we deeply love them for the joy they bring to our lives.

Source: quora.com

Key financial ratios of sbi life insurance company (in rs. Another very common ratio is the interest coverage ratio (formula 19.15), which is simply the earnings before interest and tax in relation to interest charges over the same period. When we assess a company�s financial condition, we want to know if it is able to meet its financial obligations. A ratio below 100 percent represents a measure of profitability and the efficiency of an insurance firms underwriting efficiency. Key financial ratios for insurance companies pdf.

Source: slideshare.net

Source: slideshare.net

However, managers, analysts and regulators utilize financial ratios based on the accounting products to describe and understand Combined ratio loss ratio + expense ratio underwriting profitability of an insurance company after factoring claims expenses and operating expenses of the insurer. Key financial ratios for insurance companies pdf. Key financial ratios of sbi life insurance company (in rs. On the flipside, a combined ratio of more than 100% represents an �underwriting loss�, which means an insurer is reliant on investment income to square the ledger.

Source: pinterest.co.uk

Source: pinterest.co.uk

A liquidity ratio provides information on a company�s ability to meet its short−term, 1) liquidity, 2) solvency, 3) profitability, 4) financial efficiency, and 5) repayment capacity. Expense ratio for an insurer is analyzed by class of business, along with the trend of the same. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. The current ratio current ratio formula the current ratio formula is = current assets / current liabilities.

Source: mbaboost.com

Source: mbaboost.com

Net income is a company’s total earnings. High ratios can usually occur either because of underpricing and/or because of unexpected high claims. These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions. Key financial ratios for insurance companies pdf. An efficient and profitable manner.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title key financial ratios for insurance companies pdf by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.