Key man insurance cost Idea

Home » Trend » Key man insurance cost IdeaYour Key man insurance cost images are available. Key man insurance cost are a topic that is being searched for and liked by netizens today. You can Get the Key man insurance cost files here. Find and Download all royalty-free vectors.

If you’re searching for key man insurance cost pictures information connected with to the key man insurance cost topic, you have pay a visit to the right blog. Our website frequently provides you with hints for viewing the highest quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

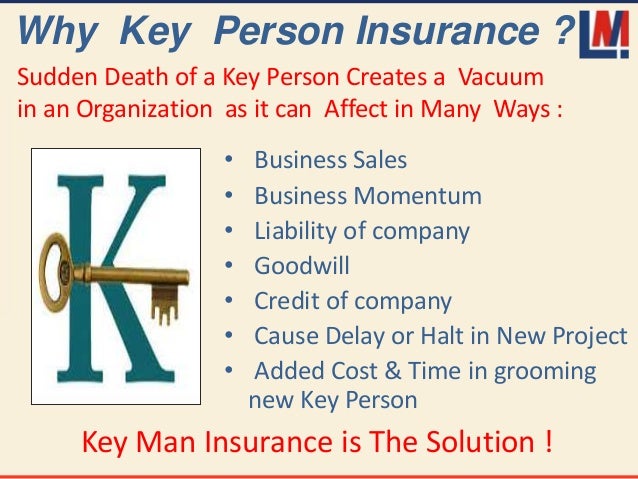

Key Man Insurance Cost. Type of policy and amount of coverage: There are specific metrics used for estimating how much to purchase in key person insurance. The terms of your policy are a crucial component that influences key person insurance cost. Bear in mind that premiums may be higher for more valuable businesses, and premiums may fluctuate depending on the key person’s contributions to the firm.

How Much Does Key Man Insurance Cost fjedafe From fjedafe.blogspot.com

How Much Does Key Man Insurance Cost fjedafe From fjedafe.blogspot.com

There are specific metrics used for estimating how much to purchase in key person insurance. Type of policy and amount of coverage: If a key person dies or contracts a severe illness under key person insurance, it can provide a business with working capital required to: The cost of key person insurance depends on several factors directly related to your company and the terms of the policy sheet. Determining the amount of coverage necessary depends on the size of your business and the key person�s contribution to your bottom line. Let’s discuss these and see what logic insurers commonly use when calculating premiums.

Contribution (£) of key person to the net profit of the business multiplied by years to recovery.

The cost of key person insurance depends on several factors directly related to your company and the terms of the policy sheet. The monthly or annual premium for keyman life insurance is worked out using: What is the average cost of key man life insurance? It’s calculated much like normal term life insurance. The amount of coverage the health history of each key person the type and term of the policy the types of policies chosen the underwriting risk how can we help? Insurance costs key person insurance — like any other form of insurance — varies in price from person to person.

Source: youtube.com

Source: youtube.com

Age, gender, and health of key person Determining the amount of coverage necessary depends on the size of your business and the key person�s contribution to your bottom line. Cost of key man life insurance the cost of key man life insurance depends on: The cost of key person life insurance primarily depends on the following factors: In principle, you should aim at purchasing enough key man insurance such that the impact that comes with the loss of the insured employee is almost zero.

Source: carrickaland.com.au

Source: carrickaland.com.au

Type of policy and amount of coverage: Determining the amount of coverage necessary depends on the size of your business and the key person�s contribution to your bottom line. There are specific metrics used for estimating how much to purchase in key person insurance. You may be able to get key person insurance from as little as £2 or £2.50 a week, however, this is not reflective of all business types and sizes, and may only apply to a fraction of companies. Fund the recruitment or training of a replacement.

Source: blogpapi.com

Source: blogpapi.com

Contribution (£) of key person to the gross profit of the business multiplied by years to recovery. The exact price of key person insurance will depend on whether it is being used to cover life only, or if it is being combined with critical illness and protection of income. *total key person cover (excluding loans) should not exceed 2 x average gross profit or 5 x average net. Premiums range from less than $100 to a few thousand dollars per month. When a key figure passes away or is unable to work for the company due to a critical illness, for example, this can have a severe impact on the business, resulting in lost profit, the added cost and process of looking for a replacement, and any other losses to the business as a result.

Source: fjedafe.blogspot.com

Source: fjedafe.blogspot.com

The amount of coverage the health history of each key person the type and term of the policy the types of policies chosen the underwriting risk how can we help? Type of policy and amount of coverage: Contribution (£) of key person to the net profit of the business multiplied by years to recovery. Cost of key man life insurance the amount of coverage to place on an employee depends on the business as well as the employee you are insuring. Premiums range from less than $100 to a few thousand dollars per month.

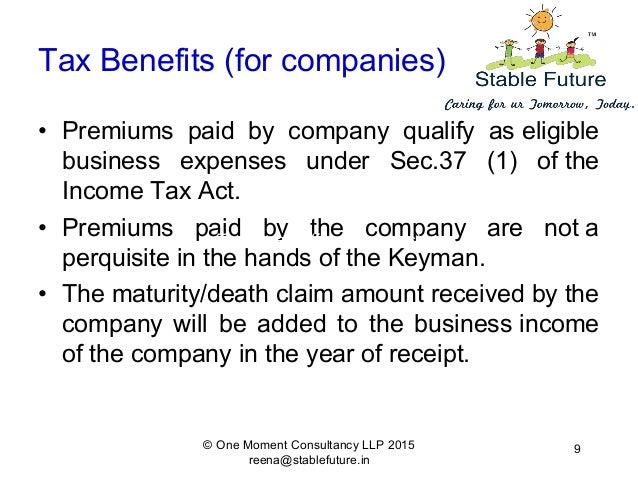

Source: slideshare.net

Source: slideshare.net

Let’s discuss these and see what logic insurers commonly use when calculating premiums. Premiums range from less than $100 to a few thousand dollars per month. However, the end cost will depend on the specificity of your keyman insurance policy. The monthly premiums will depend on how old the person is, if they smoke, the amount of cover and the term. The exact price of key person insurance will depend on whether it is being used to cover life only, or if it is being combined with critical illness and protection of income.

Source: dtfs.ca

Source: dtfs.ca

Age, gender, and health of key person Cost of key man life insurance the amount of coverage to place on an employee depends on the business as well as the employee you are insuring. What is the average cost of key man life insurance? Ask your insurance agent for recommendations on policy coverage. The cost of key man insurance is based on each individual life assured.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

Key person policy premiums range from $100 to several thousand dollars monthly depending on numerous factors: Key person policy premiums range from $100 to several thousand dollars monthly depending on numerous factors: Cost of key man life insurance the amount of coverage to place on an employee depends on the business as well as the employee you are insuring. Premiums range from less than $100 to a few thousand dollars per month. The terms of your policy are a crucial component that influences key person insurance cost.

Source: youtube.com

Source: youtube.com

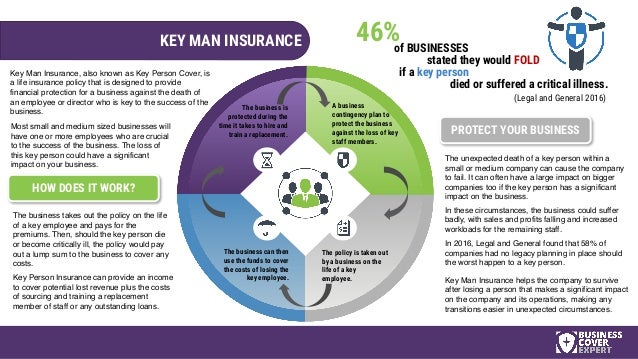

Key benefits the business is a beneficiary to the policy and receives money for covering up for any losses suffered, debts incurred and costs borne for finding and hiring a suitable replacement when the owner passes away. What is the average cost of key man life insurance? Compare prices for amounts such as $250,000, $500,000, $1 million, etc. Key benefits the business is a beneficiary to the policy and receives money for covering up for any losses suffered, debts incurred and costs borne for finding and hiring a suitable replacement when the owner passes away. Key man insurance is a life assurance policy which covers the life of a key figure in a business.

![Key Person Insurance The Scoop [Best Coverages + 2020 Rates] Key Person Insurance The Scoop [Best Coverages + 2020 Rates]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/effortlessins-live/2020/03/3f949db9-keypersoninsurance-1024x647.png) Source: effortlessinsurance.com

Source: effortlessinsurance.com

The exact price of key person insurance will depend on whether it is being used to cover life only, or if it is being combined with critical illness and protection of income. If a key person suffers a major injury, illness, or death, key person insurance can help maintain profitability and cover some losses incurred. That is where keyman insurance comes in to protect your business and your family. Term life insurance policies are less expensive than permanent insurance, as they offer coverage for a fixed period of time and don’t accumulate a cash value. Cost of key man life insurance the amount of coverage to place on an employee depends on the business as well as the employee you are insuring.

Source: blogpapi.com

Source: blogpapi.com

The monthly premiums will depend on how old the person is, if they smoke, the amount of cover and the term. *total key person cover (excluding loans) should not exceed 2 x average gross profit or 5 x average net. Determining the amount of coverage necessary depends on the size of your business and the key person�s contribution to your bottom line. Cost of key man life insurance the amount of coverage to place on an employee depends on the business as well as the employee you are insuring. For example, if a key employee makes $100,000/year, a key man insurance policy on that employee may not be underwritten with a face value exceeding $1 million.

Source: simplelifeinsure.com

Source: simplelifeinsure.com

Term life insurance policies are less expensive than permanent insurance, as they offer coverage for a fixed period of time and don’t accumulate a cash value. For businesses just starting out, it’s common for key shareholders to forego a salary in the first few years, or take a very small salary until the business gets its footing. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. Key person policy premiums range from $100 to several thousand dollars monthly depending on numerous factors: Compare prices for amounts such as $250,000, $500,000, $1 million, etc.

Source: slideshare.net

Source: slideshare.net

The cost of key person life insurance primarily depends on the following factors: How much does keyman insurance cost in 2022? The exact price of key person insurance will depend on whether it is being used to cover life only, or if it is being combined with critical illness and protection of income. The monthly premiums will depend on how old the person is, if they smoke, the amount of cover and the term. The average cost of key person insurance is $816 per year or $68 per month.

Source: moneymonkeys.net

Source: moneymonkeys.net

This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. It’s calculated much like normal term life insurance. Bear in mind that premiums may be higher for more valuable businesses, and premiums may fluctuate depending on the key person’s contributions to the firm. How much does keyman insurance cost in 2022? Key benefits the business is a beneficiary to the policy and receives money for covering up for any losses suffered, debts incurred and costs borne for finding and hiring a suitable replacement when the owner passes away.

Source: insurancegeek.com

Source: insurancegeek.com

Insurance costs key person insurance — like any other form of insurance — varies in price from person to person. Key person policy premiums range from $100 to several thousand dollars monthly depending on numerous factors: Contribution (£) of key person to the gross profit of the business multiplied by years to recovery. This might include the cost of replacing the employee, as well as losses from a decreased ability to do business. Age, gender, and health of key person

Source: slideserve.com

Source: slideserve.com

Bear in mind that premiums may be higher for more valuable businesses, and premiums may fluctuate depending on the key person’s contributions to the firm. Key man insurance is a life assurance policy which covers the life of a key figure in a business. Ask your insurance agent for recommendations on policy coverage. If a key person suffers a major injury, illness, or death, key person insurance can help maintain profitability and cover some losses incurred. Fund the recruitment or training of a replacement.

Source: slideshare.net

Source: slideshare.net

Let’s discuss these and see what logic insurers commonly use when calculating premiums. Term life insurance policies are less expensive than permanent insurance, as they offer coverage for a fixed period of time and don’t accumulate a cash value. If a key person dies or contracts a severe illness under key person insurance, it can provide a business with working capital required to: Type of policy and amount of coverage: Cost of key man life insurance the cost of key man life insurance depends on:

Source: geinsuranceforlife.com

Source: geinsuranceforlife.com

Key person insurance is a risk management strategy, called risk transferring, that deliberately passes on risk to another party (the insurance company). Cost of key man life insurance the cost of key man life insurance depends on: What is the average cost of key man life insurance? Fund the recruitment or training of a replacement. Contribution (£) of key person to the gross profit of the business multiplied by years to recovery.

Source: slideshare.net

Source: slideshare.net

For example, if a key employee makes $100,000/year, a key man insurance policy on that employee may not be underwritten with a face value exceeding $1 million. *total key person cover (excluding loans) should not exceed 2 x average gross profit or 5 x average net. Term life insurance policies are less expensive than permanent insurance, as they offer coverage for a fixed period of time and don’t accumulate a cash value. However, the end cost will depend on the specificity of your keyman insurance policy. The three main metrics include the employee’s compensation, the amount of.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title key man insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.