Key man life insurance tax treatment Idea

Home » Trend » Key man life insurance tax treatment IdeaYour Key man life insurance tax treatment images are ready. Key man life insurance tax treatment are a topic that is being searched for and liked by netizens today. You can Download the Key man life insurance tax treatment files here. Find and Download all royalty-free images.

If you’re looking for key man life insurance tax treatment pictures information linked to the key man life insurance tax treatment topic, you have pay a visit to the right site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Key Man Life Insurance Tax Treatment. This represents one of the major factors that decides whether or not you pay tax on keyman. When filing taxes, every business looks for as many deductions as possible, and looking to deduct your key man life insurance premiums is no exception. Yes, business owners can take a key man life insurance tax deduction. 264(a)(1) provides, no deduction shall be allowed for premiums on any life insurance policy.

Professional Indemnity Insurance Hong Kong Trusted Union From trustedunion.com

Professional Indemnity Insurance Hong Kong Trusted Union From trustedunion.com

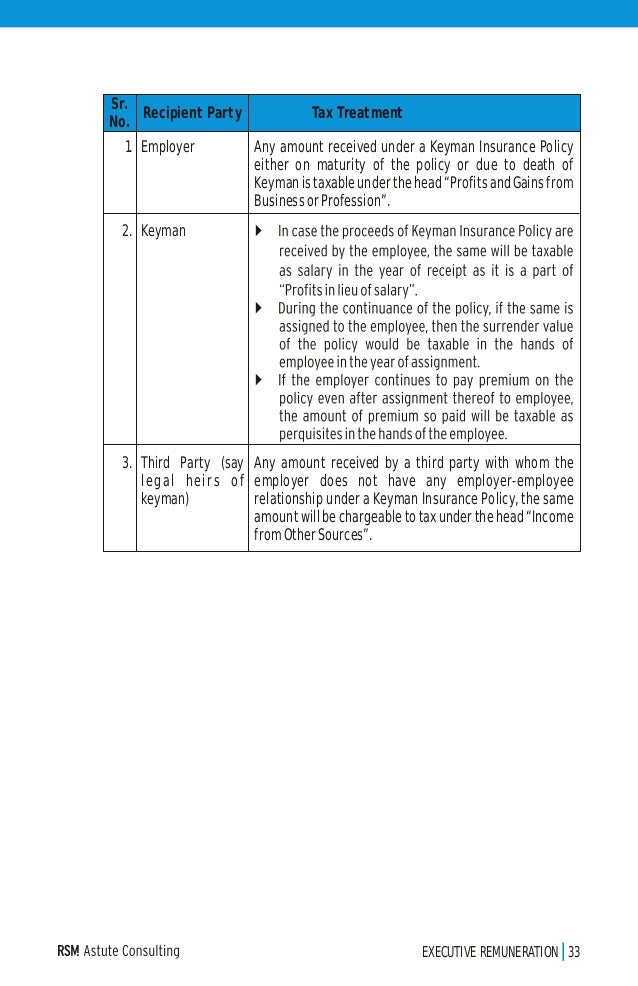

Keyman insurance is essentially insurance taken out by an employer in his/her own favour against the death, sickness or injury of an employee (the keyman) whose services are vital to the success of the employer.s business. Hmrc, keyman insurance and tax. 264(a)(1) provides, no deduction shall be allowed for premiums on any life insurance policy. A key man policy can also be an employee benefit, if the company transfers the life insurance policy to the executive or insured employee. In case of death of a keyman the company gets money to cope up with the loss. Resultantly, the tax treatment would be same whether it is an employer employee policy or.

Keyman insurance is essentially insurance taken out by an employer in his/her own favour against the death, sickness or injury of an employee (the keyman) whose services are vital to the success of the employer.s business.

There are many rules surrounding how key man insurance is taxed. Unfortunately, not all companies are treated equal when it comes to the way hmrc will tax the premiums or any payouts on a claim made. Yes, business owners can take a key man life insurance tax deduction. In this case, the employee is the beneficiary. Additionally, your business needs to be aware. A quick guide to key man life insurance tax treatment.

Source: trustedunion.com

Source: trustedunion.com

If the insured employee passes away, the key man policy’s death benefit would be paid to the company free of income tax in most cases. Your business owns and pays for a key person insurance policy regardless of how you ultimately use any payout you receive. Key man life insurance can help your business lower the risk of disruptions to productivity by paying a death benefit if a critical employee passes away. However, the deduction is only available if those premiums are charged to the insured employee as taxable income. If the taxpayer is directly or indirectly a beneficiary under the policy or contract. the tax treatment of death benefits.

Source: legalandgeneral.com

Source: legalandgeneral.com

Yes, business owners can take a key man life insurance tax deduction. In the same way that the tax treatment of damages claimed in a legal action is determined by the nature of the loss they are to make good, insurance proceeds (35). This is true if the company moves the life insurance policy to the. For those people who are looking for a personal tax efficient life insurance you may want to consider a relevant life policy or just give us a call on 020 7112 8844. However, before you write off corporate owned insurance premiums, you need to fully understand how the irs is going to treat this issue.

Source: insurancepolicynukiseki.blogspot.com

Source: insurancepolicynukiseki.blogspot.com

For those people who are looking for a personal tax efficient life insurance you may want to consider a relevant life policy or just give us a call on 020 7112 8844. Is key man insurance tax efficient? However, if you’re not taking out the policy for the benefit of the business, then it. Key man insurance tax rules. The tax treatment of a key man policy is often a concern for a lot of our customers.

Source: delington.com

Source: delington.com

A key man life insurance policy can also come with employee benefits. The average cost of key person insurance is $816 per year or $68 per month. It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. In the same way that the tax treatment of damages claimed in a legal action is determined by the nature of the loss they are to make good, insurance proceeds (35). Additionally, your business needs to be aware.

Source: glistrategies.com

Source: glistrategies.com

The tax issues associated with key person term life insurance are relatively unambiguous. 264(a)(1) provides, no deduction shall be allowed for premiums on any life insurance policy. If the taxpayer is directly or indirectly a beneficiary under the policy or contract. the tax treatment of death benefits. This is true if the company moves the life insurance policy to the. Hmrc, keyman insurance and tax.

Source: businesscoverexpert.com

Source: businesscoverexpert.com

The taxation of key man, or key person insurance as it is now often referred to, is by no means straightforward. If the taxpayer is directly or indirectly a beneficiary under the policy or contract. the tax treatment of death benefits. This guide seeks to explain how you might expect to be taxed on your. It�s worth noting that there is no clear legislation on this topic, and there is no guarantee that a business can claim tax. Insurance may be taken on the life of an employee or a director who is a “key” person to cover the risk of loss of business income.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Yes, business owners can take a key man life insurance tax deduction. Additionally, your business needs to be aware. Unfortunately, not all companies are treated equal when it comes to the way hmrc will tax the premiums or any payouts on a claim made. For those people who are looking for a personal tax efficient life insurance you may want to consider a relevant life policy or just give us a call on 020 7112 8844. This guide seeks to explain how you might expect to be taxed on your.

Source: mykeymaninsurance.com

Source: mykeymaninsurance.com

It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. When filing taxes, every business looks for as many deductions as possible, and looking to deduct your key man life insurance premiums is no exception. You�ll need to purchase a separate key person policy for each of your key employees. Key man life insurance helps companies reduce the risk of business disruption by paying a death benefit if critical employees pass away.

Source: limitedcompanyhelp.com

Source: limitedcompanyhelp.com

The average cost of key person insurance is $816 per year or $68 per month. The average cost of key person insurance is $816 per year or $68 per month. Unfortunately, not all companies are treated equal when it comes to the way hmrc will tax the premiums or any payouts on a claim made. Your business owns and pays for a key person insurance policy regardless of how you ultimately use any payout you receive. Tax treatment of key man life insurance.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Insurance may be taken on the life of an employee or a director who is a “key” person to cover the risk of loss of business income. It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. However, the deduction is only available if those premiums are charged to the insured employee as taxable income. A quick guide to key man life insurance tax treatment. Resultantly, the tax treatment would be same whether it is an employer employee policy or.

Source: areas.ch

Source: areas.ch

Hmrc, keyman insurance and tax. If the taxpayer is directly or indirectly a beneficiary under the policy or contract. the tax treatment of death benefits. Is key man insurance tax efficient? Historically, �key man� insurance has generally been viewed as tax deductible, and in 1944, when sir john anderson made the changes, he stated that premiums can be treated as admissible deductions in certain situations. If the insured employee passes away, the key man policy’s death benefit would be paid to the company free of income tax in most cases.

Source: trustedunion.com

Source: trustedunion.com

However, despite this, hmrc taxes keyman insurance differently depending on who it deems the ultimate beneficiary of the payout. How hmrc taxes key man insurance is complicated. It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. The cost of key man life insurance is not tax deductible; Unfortunately, not all companies are treated equal when it comes to the way hmrc will tax the premiums or any payouts on a claim made.

Source: businesscoverexpert.com

Source: businesscoverexpert.com

It’s governed largely by a set of guidelines laid out more than 70 years ago known as the anderson rules. Of course you can always check out the hmrc website for the latest information key man insurance taxation. If the insured employee passes away, the key man policy’s death benefit would be paid to the company free of income tax in most cases. Key man insurance tax rules. The term “key man” insurance is used in the industry to denote insurance on the life of a director, partner, employer or other “key” person associated with the (34).

Source: limitedcompanyhelp.com

Source: limitedcompanyhelp.com

Key man life insurance helps companies reduce the risk of business disruption by paying a death benefit if critical employees pass away. Business owners usually want to know, what are the key man life insurance tax implications “or” is critical person insurance tax deductible? Historically, �key man� insurance has generally been viewed as tax deductible, and in 1944, when sir john anderson made the changes, he stated that premiums can be treated as admissible deductions in certain situations. Keyman insurance, tax and hmrc. If the taxpayer is directly or indirectly a beneficiary under the policy or contract. the tax treatment of death benefits.

Source: social-network-daily-journal.com

Source: social-network-daily-journal.com

Of course you can always check out the hmrc website for the latest information key man insurance taxation. The term “key man” insurance is used in the industry to denote insurance on the life of a director, partner, employer or other “key” person associated with the (34). Also, the company is entitled to deducting the insurance premiums if they are thought to be part of the taxable income of the employee. In case of death of a keyman the company gets money to cope up with the loss. Is key man insurance tax efficient?

Source: dreamstime.com

Source: dreamstime.com

Yes, business owners can take a key man life insurance tax deduction. The general rule is that proceeds received from a life insurance policy are generally excluded from income and the premiums are generally nondeductible. Also, the company is entitled to deducting the insurance premiums if they are thought to be part of the taxable income of the employee. Keyman insurance, tax and hmrc. Key man insurance tax rules.

Source: trustedunion.com

Source: trustedunion.com

When filing taxes, every business looks for as many deductions as possible, and looking to deduct your key man life insurance premiums is no exception. When filing taxes, every business looks for as many deductions as possible, and looking to deduct your key man life insurance premiums is no exception. This represents one of the major factors that decides whether or not you pay tax on keyman. The average cost of key person insurance is $816 per year or $68 per month. The general rule is that proceeds received from a life insurance policy are generally excluded from income and the premiums are generally nondeductible.

Source: dreamstime.com

Source: dreamstime.com

Yes, business owners can take a key man life insurance tax deduction. The cost of key man life insurance is not tax deductible; Keyman insurance, tax and hmrc. Key man insurance tax rules. How hmrc taxes key man insurance is complicated.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title key man life insurance tax treatment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.