Kpi insurance information

Home » Trend » Kpi insurance informationYour Kpi insurance images are available. Kpi insurance are a topic that is being searched for and liked by netizens today. You can Get the Kpi insurance files here. Download all royalty-free photos.

If you’re looking for kpi insurance pictures information related to the kpi insurance interest, you have visit the ideal site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly hunt and locate more informative video content and images that match your interests.

Kpi Insurance. Locations in chamberlain and kennebec serving south dakota & nebraska. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Use these insurance kpis and metrics to learn how to balance the risks and rewards that are part and parcel of the insurance business. Our compliance kpis can act as important, leading indicators of potential risk.

Kpis Of Insurance Companies ABINSURA From abinsura.blogspot.com

Kpis Of Insurance Companies ABINSURA From abinsura.blogspot.com

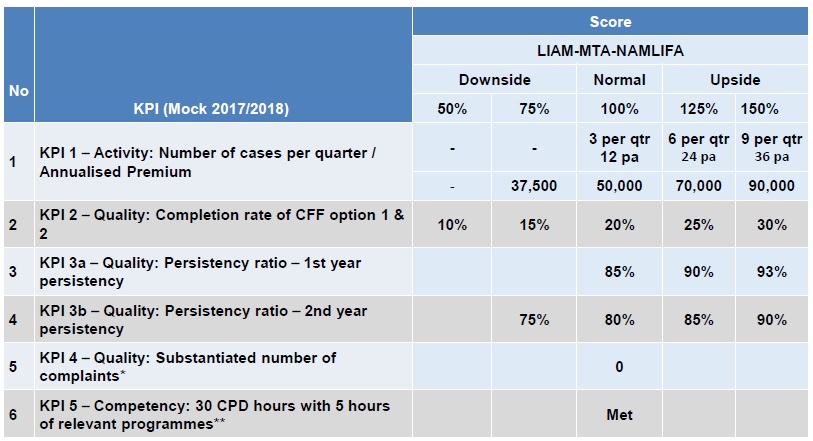

Kpi insurance industry in this ppt file, you can ref materials for kpi insurance industry such as list of kpis, performance appraisal metrics, job skills, kras, bsc…. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Opening at 8:30 am on monday. For more kpi insurance industry materials such as free 4 ebooks below, please visit: Key performance indicators (kpis) are metrics that help you understand your personal or organizational performance. Kelli is very helpful with finding the best insurance rates for my insurance needs.

This measures the percentage of policies pending approval when compared to the total number of policies established.

For more kpi insurance industry materials such as free 4 ebooks below, please visit: Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Opening at 8:30 am on monday. Claim settlement cycle time 6. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. The net income ratio measures how effective your organization is at generating profit on each dollar of earned premium.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

For more kpi insurance industry materials such as free 4 ebooks below, please visit: An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. We have used kpi for bonding as well as insuring a house we have remodeled that is not on a permanent foundation yet. What is an insurance kpi? Ebitda the first kpi you will want to create is ebitda, which stands for earnings.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Opening at 8:30 am on monday. Example kpis for finance and insurance finance accounting costs accounts payable accounts payable turnover They help you understand the current business strategy and what you can do to reach your goals. What are the key performance indicators for insurance companies?. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

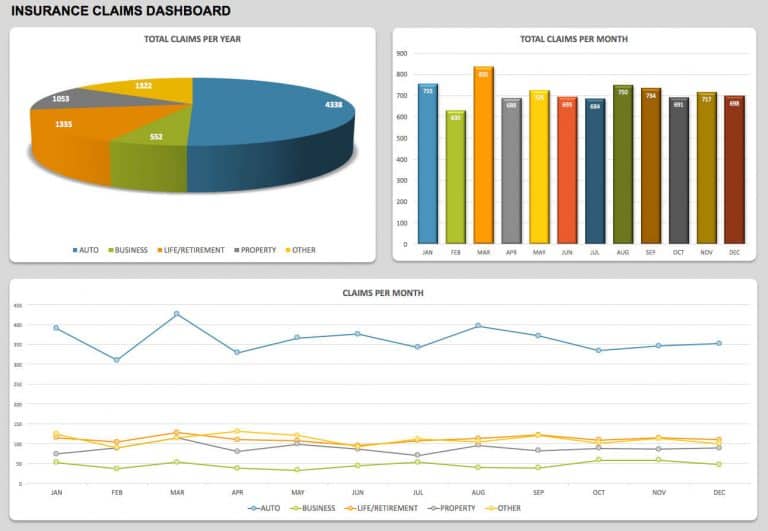

Average value according to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. The claims ratio kpi measures the number of claims in a period and divides that by the earned premium for the same period. These sample kpis reflect common metrics for both departments and industries. Locations in chamberlain and kennebec serving south dakota & nebraska.

Source: dig-in.com

Source: dig-in.com

These sample kpis reflect common metrics for both departments and industries. Ebitda the first kpi you will want to create is ebitda, which stands for earnings. Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Insurance kpi dashboards help you identify areas of success and improvement, which means you can make educated decisions based on numbers instead of hunches. This kpi is used to measure the profitability of your organization and is primarily used for internal comparison.

Source: geekdashboard.com

Source: geekdashboard.com

This kpi is used to measure the profitability of your organization and is primarily used for internal comparison. This kpi is used to measure the profitability of your organization and is primarily used for internal comparison. An analysis of the currently reported kpis across the top 10 insurance entities based on publicly available financial statements gives an indication of the most critical disclosed kpis in the industry. What are some examples of kpis that an agency might track? Here are 6 insurance kpis that are broadly applicable:

Source: boldbi.com

Source: boldbi.com

Post ifrs 17 compliance, these kpis are set to undergo changes to keep pace with the new measurement yardsticks for measuring the financial. Average value according to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. What are some examples of kpis that an agency might track? This measures the percentage of policies pending approval when compared to the total number of policies established. As an insurance agent, you may be wondering what kpis you need to keep an eye on to make sure your business is growing.

Source: slideshare.net

Source: slideshare.net

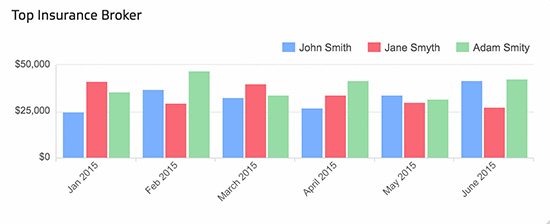

As an insurance agent, you may be wondering what kpis you need to keep an eye on to make sure your business is growing. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Ebitda the first kpi you will want to create is ebitda, which stands for earnings. The claims ratio kpi measures the number of claims in a period and divides that by the earned premium for the same period. Use this insurance kpi to determine if you’re hitting sales targets.

Source: klipfolio.com

Source: klipfolio.com

Average cost per claim measures how much your organization pays out for each claim filed by your customers. What are some examples of kpis that an agency might track? With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. Post ifrs 17 compliance, these kpis are set to undergo changes to keep pace with the new measurement yardsticks for measuring the financial.

Source: abnasia.org

Source: abnasia.org

What is an insurance kpi? What is an insurance kpi? Our compliance kpis can act as important, leading indicators of potential risk. They help you understand the current business strategy and what you can do to reach your goals. 15 metrics for growth key performance indicators or kpis provide you with an overview of how well your organization is performing.

Source: ibm.com

Source: ibm.com

This measures the percentage of policies pending approval when compared to the total number of policies established. By using these insurance kpis and metrics business leaders can learn how to balance the risks and rewards that direct the future insurance business. 15 metrics for growth key performance indicators or kpis provide you with an overview of how well your organization is performing. Here are 6 insurance kpis that are broadly applicable: They help you understand the current business strategy and what you can do to reach your goals.

Source: boldbi.com

Source: boldbi.com

With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. What are some examples of kpis that an agency might track? These kpis include contract rate, bind rate, retention rate, and so on.

Source: insuranceclaimszoekiya.blogspot.com

Source: insuranceclaimszoekiya.blogspot.com

Average cost per claim measures how much your organization pays out for each claim filed by your customers. These kpis include contract rate, bind rate, retention rate, and so on. The key is to track activities that lead to success. Kpi insurance industry in this ppt file, you can ref materials for kpi insurance industry such as list of kpis, performance appraisal metrics, job skills, kras, bsc…. Post ifrs 17 compliance, these kpis are set to undergo changes to keep pace with the new measurement yardsticks for measuring the financial.

Source: klipfolio.com

Source: klipfolio.com

Average cost per claim measures how much your organization pays out for each claim filed by your customers. Use these insurance kpis and metrics to learn how to balance the risks and rewards that are part and parcel of the insurance business. Ebitda the first kpi you will want to create is ebitda, which stands for earnings. What are the key performance indicators for insurance companies?. Average cost per claim measures how much your organization pays out for each claim filed by your customers.

Source: pinterest.com

Source: pinterest.com

Claim settlement cycle time 6. Finance and insurance kpis we’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Locations in chamberlain and kennebec serving south dakota & nebraska. The key is to track activities that lead to success. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful.

Source: insightsoftware.com

Source: insightsoftware.com

What are the key performance indicators for insurance companies?. These kpis include contract rate, bind rate, retention rate, and so on. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. What are some examples of kpis that an agency might track? Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Claim settlement cycle time 6. Key performance indicators (kpis) are metrics that help you understand your personal or organizational performance. Kelli is very helpful with finding the best insurance rates for my insurance needs. Kpi123.com • list of free 2436 kpis • top 28 performance appraisal forms • 11.

Source: opsdog.com

Source: opsdog.com

The key is to track activities that lead to success. Average cost per claim measures how much your organization pays out for each claim filed by your customers. An analysis of the currently reported kpis across the top 10 insurance entities based on publicly available financial statements gives an indication of the most critical disclosed kpis in the industry. Kpi123.com • list of free 2436 kpis • top 28 performance appraisal forms • 11. Opening at 8:30 am on monday.

Source: powerbi.microsoft.com

Source: powerbi.microsoft.com

Average value according to verisk analytics, the average auto collision claim is $3,160, while the insurance research council found that the average homeowner’s insurance claim is $626. This is a typical insurance kpi used to evaluate how efficiently various teams in your company are working together. Here are 6 insurance kpis that are broadly applicable: Our compliance kpis can act as important, leading indicators of potential risk. Example kpis for finance and insurance finance accounting costs accounts payable accounts payable turnover

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title kpi insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.