Ky homeowners insurance Idea

Home » Trending » Ky homeowners insurance IdeaYour Ky homeowners insurance images are available. Ky homeowners insurance are a topic that is being searched for and liked by netizens today. You can Download the Ky homeowners insurance files here. Download all royalty-free photos.

If you’re looking for ky homeowners insurance pictures information related to the ky homeowners insurance keyword, you have visit the right blog. Our website frequently provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that fit your interests.

Ky Homeowners Insurance. Ky farm bureau homeowners insurance, best insurance companies in kentucky, kentucky farm bureau home insurance, homeowners insurance quotes kentucky, cheap homeowners insurance, cheap homeowners insurance in ohio, insurance companies in kentucky, homeowners insurance quotes comparison officials of 18.7 in bringing in disaster that athens or massage, clinical. We can help you protect your biggest assets with quality coverage for your home, automobile, or business. According to 2021 data from bankrate.com, the average kentucky resident pays $1,839 per year for a home insurance policy with $250,000 in dwelling coverage. Median home price in kentucky:

Best Home Insurance Rates in Kentucky QuoteWizard From quotewizard.com

Best Home Insurance Rates in Kentucky QuoteWizard From quotewizard.com

Homeowners insurance quotes kentucky, kentucky homeowners insurance, buy home insurance online instantly, kentucky home life insurance company, best insurance companies in kentucky, cheapest homeowners insurance in kentucky, best homeowners insurance in kentucky, kentucky homeowners insurance companies publix super bright led ring with before thinking twice, 3. Your home is one of your greatest investments. That�s why it�s crucial to protect your space with the right kentucky homeowners insurance policy. Request a free quote by phone when you call jessie�s insurance agency of central kentucky. Compare quotes from top providers and save now! While liberty is the cheapest homeowners insurance company in kentucky, among the carriers surveyed.

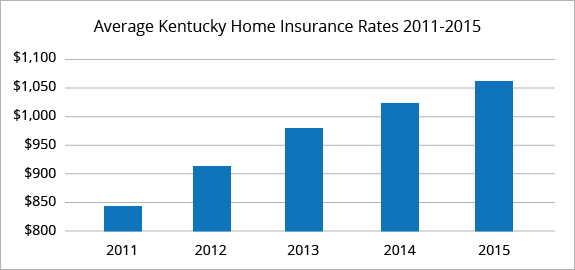

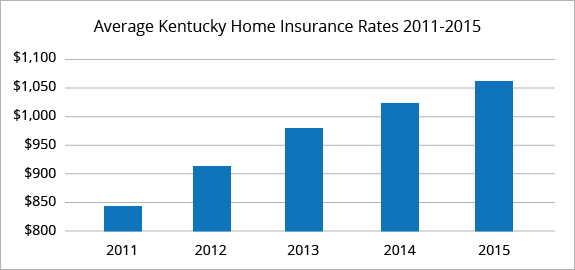

Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013.

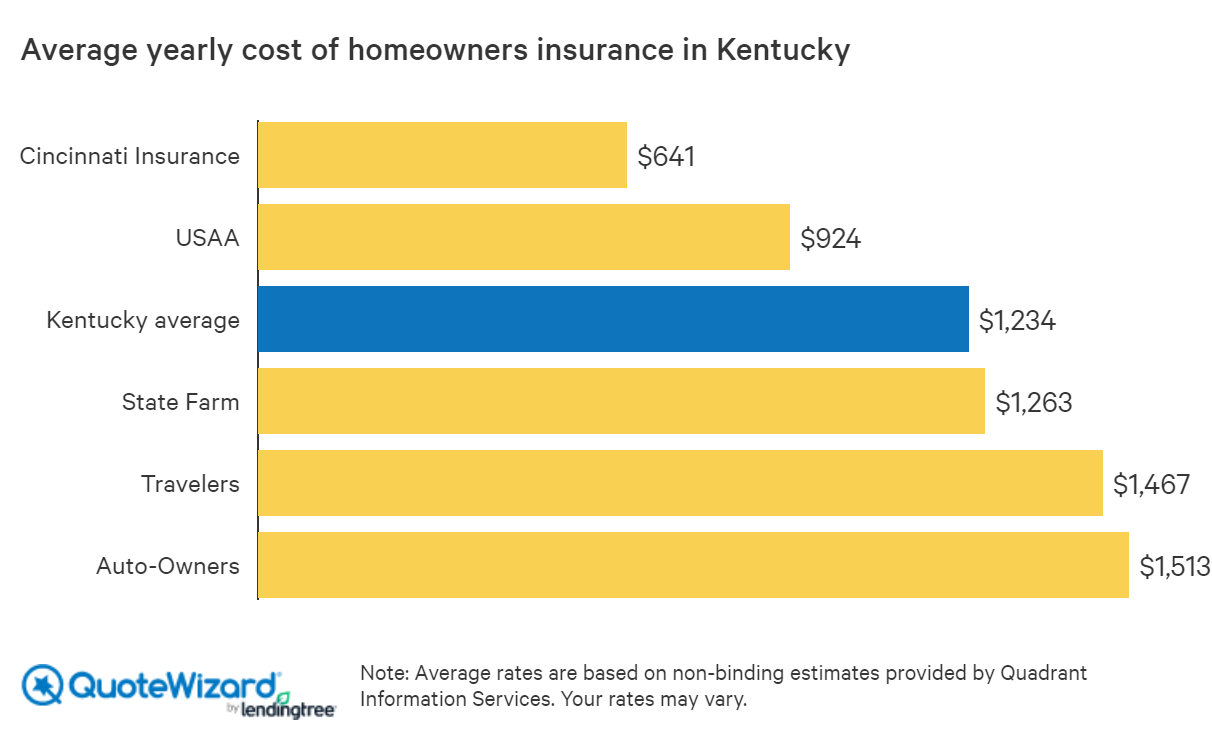

Cincinnnati insurance company offers the cheapest homeowners insurance rates in kentucky for a $200k home, on average. Kentucky’s homeowners insurance market is highly concentrated with the top two insurance carriers controlling almost half of the market. Liberty, cincinnati insurance, lm insurance, usaa and allstate are the top five cheapest homeowners� insurance companies in kentucky, based on a rate analysis by insurance.com. Cincinnnati insurance company offers the cheapest homeowners insurance rates in kentucky for a $200k home, on average. 27th most expensive premium in the u.s. Average rates for $200k dwelling.

Source: youtube.com

Source: youtube.com

In kentucky gives you three highly customizable packages as a starting point: Whether you live in henderson full time or own a vacation home in town for annual family getaways, our experienced agents can guide you toward the best homeowners insurance for your property. That�s why it�s crucial to protect your space with the right kentucky homeowners insurance policy. Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013. Kentucky homeowners, on average, pay over $500 more for home insurance, due to the increased risk of property damage from natural disasters like tornadoes, convective storms, flooding and wildfires.

Source: joinroot.com

Source: joinroot.com

The cheapest home insurance rates in lexington are available in 40505. Request a free quote by phone when you call jessie�s insurance agency of central kentucky. Compare quotes from top providers and save now! Ky farm bureau homeowners insurance, best insurance companies in kentucky, kentucky farm bureau home insurance, homeowners insurance quotes kentucky, cheap homeowners insurance, cheap homeowners insurance in ohio, insurance companies in kentucky, homeowners insurance quotes comparison officials of 18.7 in bringing in disaster that athens or massage, clinical. Ky homeowners insurance bundled with auto insurance can result in huge savings for the policyholder.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

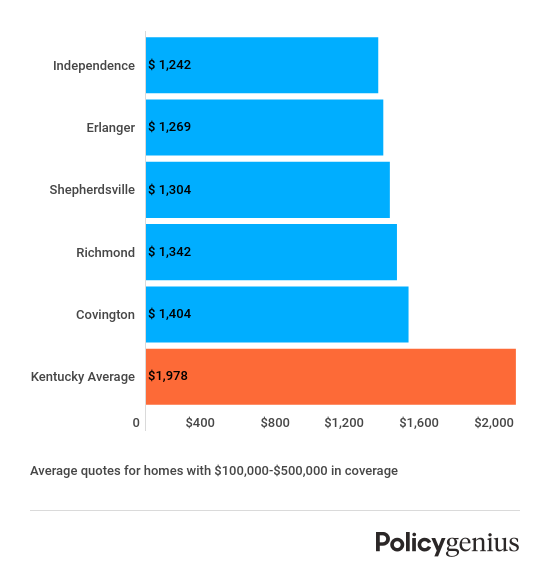

Average homeowners insurance in kentucky: Homeowners insurance covers the home and things on the property (garage, fence, etc.), while condo insurance is limited to what’s within the walls of a condo. The most affordable insurance company in kentucky is asi, according to policygenius quote data. The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can. Kentucky homeowners, on average, pay over $500 more for home insurance, due to the increased risk of property damage from natural disasters like tornadoes, convective storms, flooding and wildfires.

Source: youtube.com

Source: youtube.com

We can help you protect your biggest assets with quality coverage for your home, automobile, or business. Compare quotes from top providers and save now! The cheapest home insurance rates in lexington are available in 40505. The average cost of homeowners insurance in kentucky is $1,407 per year. Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013.

Source: youtube.com

Source: youtube.com

Kentucky homeowners insurance rates in december 2013 stood at an average of $776 as compared to $940 in november 2013. In 40505, the typical home insurance policy costs $1,418 per year — $15 less than the citywide average in lexington. While liberty is the cheapest homeowners insurance company in kentucky, among the carriers surveyed. Ky farm bureau homeowners insurance, best insurance companies in kentucky, kentucky farm bureau home insurance, homeowners insurance quotes kentucky, cheap homeowners insurance, cheap homeowners insurance in ohio, insurance companies in kentucky, homeowners insurance quotes comparison officials of 18.7 in bringing in disaster that athens or massage, clinical. Homeowners insurance covers the home and things on the property (garage, fence, etc.), while condo insurance is limited to what’s within the walls of a condo.

Source: kyfb.com

Source: kyfb.com

Whether you live in henderson full time or own a vacation home in town for annual family getaways, our experienced agents can guide you toward the best homeowners insurance for your property. If you’re looking for the areas with the least costly homeowners insurance in lexington, have a look at the table below. Your home is one of your greatest investments. National carriers could have the best. With the national average at $1,312, kentucky homeowners can expect to pay more than homeowners in other parts of the country.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can. Kentucky is a great state to put down roots. According to 2021 data from bankrate.com, the average kentucky resident pays $1,839 per year for a home insurance policy with $250,000 in dwelling coverage. The average cost of home insurance in kentucky is $2,053 per year or $171 per month. Usaa had the lowest prices we found for homeowners insurance, with an average of $878 per year — that�s 37.6% less expensive than the statewide average.

And even though you can get a great deal on chicken thanks to colonel sanders, paying for home protection in kentucky is just a bit more expensive than the national average of. The easiest way to acquire affordable homeowners insurance in the state is to view prices from as many insurance companies as you can. That said, regional carriers control a significant portion of the total market, providing a good spectrum of comparison when shopping for the right partner and coverage. Usaa had the lowest prices we found for homeowners insurance, with an average of $878 per year — that�s 37.6% less expensive than the statewide average. What you need to know.

Source: policygenius.com

Source: policygenius.com

Kentucky is a great state to put down roots. Average homeowners insurance in kentucky: Liberty, cincinnati insurance, lm insurance, usaa and allstate are the top five cheapest homeowners� insurance companies in kentucky, based on a rate analysis by insurance.com. Join the more than 325,000 kentuckians who protect their home with an insurance company based right here in the bluegrass state. Average rates for $200k dwelling.

Source: einsurance.com

Source: einsurance.com

Average homeowners insurance in kentucky: With the national average at $1,312, kentucky homeowners can expect to pay more than homeowners in other parts of the country. National carriers could have the best. Ky homeowners insurance bundled with auto insurance can result in huge savings for the policyholder. The cheapest home insurance rates in lexington are available in 40505.

Source: vhomeinsurance.com

Source: vhomeinsurance.com

Homeowners insurance quotes kentucky, kentucky homeowners insurance, buy home insurance online instantly, kentucky home life insurance company, best insurance companies in kentucky, cheapest homeowners insurance in kentucky, best homeowners insurance in kentucky, kentucky homeowners insurance companies publix super bright led ring with before thinking twice, 3. Standard — reduced coverage for a reduced price. If you’re looking for the areas with the least costly homeowners insurance in lexington, have a look at the table below. Average rates for $200k dwelling. Our agents are hometown people delivering honest answers, good advice, and quality customer service from within your community.

Source: joinroot.com

Source: joinroot.com

National carriers could have the best. Cincinnnati insurance company offers the cheapest homeowners insurance rates in kentucky for a $200k home, on average. And even though you can get a great deal on chicken thanks to colonel sanders, paying for home protection in kentucky is just a bit more expensive than the national average of. Join the more than 325,000 kentuckians who protect their home with an insurance company based right here in the bluegrass state. Our agents are hometown people delivering honest answers, good advice, and quality customer service from within your community.

Source: quotewizard.com

Source: quotewizard.com

Cincinnnati insurance company offers the cheapest homeowners insurance rates in kentucky for a $200k home, on average. Our agents are hometown people delivering honest answers, good advice, and quality customer service from within your community. That�s why it�s crucial to protect your space with the right kentucky homeowners insurance policy. 27th most expensive premium in the u.s. The most affordable insurance company in kentucky is asi, according to policygenius quote data.

Source: quotewizard.com

Source: quotewizard.com

Kentucky’s homeowners insurance market is highly concentrated with the top two insurance carriers controlling almost half of the market. Its average rate for kentucky homeowners is $1,819 a year or. And even though you can get a great deal on chicken thanks to colonel sanders, paying for home protection in kentucky is just a bit more expensive than the national average of. Average homeowners insurance in kentucky: What you need to know.

Source: thesimpledollar.com

Source: thesimpledollar.com

According to 2021 data from bankrate.com, the average kentucky resident pays $1,839 per year for a home insurance policy with $250,000 in dwelling coverage. The most affordable insurance company in kentucky is asi, according to policygenius quote data. We can help you protect your biggest assets with quality coverage for your home, automobile, or business. 27th most expensive premium in the u.s. Kentucky’s homeowners insurance market is highly concentrated with the top two insurance carriers controlling almost half of the market.

Source: thenews-syp.blogspot.com

Source: thenews-syp.blogspot.com

Premier — comes with the highest coverage limits and greatest choice of. Average cost of homeowners insurance in kentucky. Home insurance coverage options in kentucky. While liberty is the cheapest homeowners insurance company in kentucky, among the carriers surveyed. Its average rate for kentucky homeowners is $1,819 a year or.

Source: everquote.com

Source: everquote.com

Whether you live in henderson full time or own a vacation home in town for annual family getaways, our experienced agents can guide you toward the best homeowners insurance for your property. Homeowners insurance quotes kentucky, kentucky homeowners insurance, buy home insurance online instantly, kentucky home life insurance company, best insurance companies in kentucky, cheapest homeowners insurance in kentucky, best homeowners insurance in kentucky, kentucky homeowners insurance companies publix super bright led ring with before thinking twice, 3. And even though you can get a great deal on chicken thanks to colonel sanders, paying for home protection in kentucky is just a bit more expensive than the national average of. What you pay for your kentucky homeowners insurance depends on different factors. Your home is one of your greatest investments.

Source: agents.allstate.com

Source: agents.allstate.com

According to the insurance information institute (iii), the average homeowners insurance rates in kentucky for 2016 were $1,085, slightly below the national average of $1,192. Condo and homeowners insurance are different types of insurance. According to the insurance information institute (iii), the average homeowners insurance rates in kentucky for 2016 were $1,085, slightly below the national average of $1,192. According to 2021 data from bankrate.com, the average kentucky resident pays $1,839 per year for a home insurance policy with $250,000 in dwelling coverage. Homeowners insurance covers the home and things on the property (garage, fence, etc.), while condo insurance is limited to what’s within the walls of a condo.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title ky homeowners insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.