Land liability insurance information

Home » Trend » Land liability insurance informationYour Land liability insurance images are ready in this website. Land liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Land liability insurance files here. Download all free photos and vectors.

If you’re searching for land liability insurance pictures information linked to the land liability insurance keyword, you have come to the right site. Our site always provides you with hints for downloading the highest quality video and image content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Land Liability Insurance. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small piece vacant land ranges from $27 to $49 per month mainly based on location and size (acerage). Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence. Veracity insurance offers a general liability policy for vacant lands or lots. Vacant land liability insurance, also known as landowners liability insurance, is another type of policy that may be beneficial for landowners.

Property Damage Liability Insurance coverage quotes From general.com

Property Damage Liability Insurance coverage quotes From general.com

Vacant land insurance is a smart investment. Smart choice for landowners who use their property for hunting and fishing. Third party injuries due to. Land insurance protects you against being sued for negligence or liability related to the land that you own. Although our vacant land protection facility is intended for residential vacant land, surewise can also arrange liability insurance for your commercial vacant land. Another case may be a tree falling on a neighbouring property.

Third party injuries due to.

Vacant land insurance cannot be purchased if there are any structures on the property. You may indeed own land for your own personal purposes, or for. Smart choice for landowners who use their property for hunting and fishing. It covers the land owners for all sums that they become legally liable to pay as damages including claimants� costs and expenses in respect of: The land owners insurance policy protects you against liability claims made against you in respect of your legal liability arising out of the ownership of a piece of land. Accidental physical loss of or physical damage to property.

Source: slideshare.net

Source: slideshare.net

Land liability insurance covers the landowner in question for the sum of all damages that they become legally liable to pay should someone make a claim against them. You’ll need this if you employ any members of staff who work on or visit the land, such as an estate manager. Our team of liability insurance experts can provide you with professional advice and arrange prompt insurance protection for you. Get a land insurance quote. Third party injuries due to.

Source: general.com

Source: general.com

Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence. The cost is the same and coverage begins the. Land liability insurance cover kicks in to help pay medical expenses for injured third parties, or legal defense and court judgments made against you for other damages, up to the limits stated in your policy. Landowners liability insurance covers your legal liability towards members of the public following an accident or incident whilst on the insured’s land. You’ll need this if you employ any members of staff who work on or visit the land, such as an estate manager.

Source: birnbeckinsurance.co.uk

Source: birnbeckinsurance.co.uk

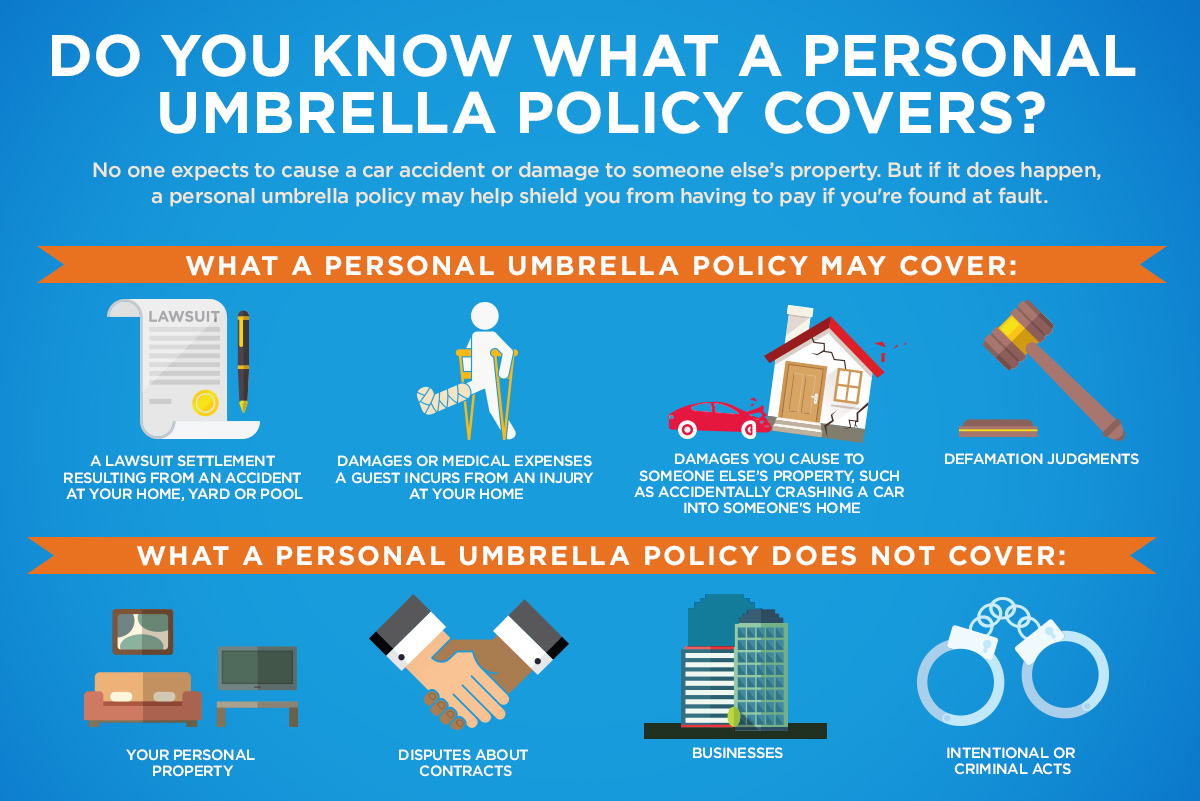

Or when they sustain bodily injury while on your property. Land liability insurance or landowners insurance covers a wide range of land uses including insurance for farm land, car parks, development sites, fields, moorland, residents land, rough country, undeveloped pasture, woodland, vacant land, private roads, resident’s roads and. It is designed to cover your financial liability for bodily injury or damage to other people’s property. The coverage of vacant land liability insurance. Third party injuries due to.

Source: coolbuzz.org

Source: coolbuzz.org

Another case may be a tree falling on a neighbouring property. Accidental injury to any person. Do i need liability insurance as a. Select a policy start date that best serves your needs! If you are looking for land liability insurance, then you have come to the right place.

Source: slideshare.net

Source: slideshare.net

The land owners insurance policy protects you against liability claims made against you in respect of your legal liability arising out of the ownership of a piece of land. Our team of liability insurance experts can provide you with professional advice and arrange prompt insurance protection for you. The coverage of vacant land liability insurance. Or when they sustain bodily injury while on your property. Select a policy start date that best serves your needs!

Source: slideserve.com

Source: slideserve.com

Our team of liability insurance experts can provide you with professional advice and arrange prompt insurance protection for you. Which is why it’s necessary to have land liability insurance to protect your investment and your own finances. If this person were injured by the horse in question, or their car is damaged by a falling branch on your private road, then a land liability policy would cover the court costs incurred, such as solicitor’s fees, and compensation that would need to be paid out if you were to lose the case. Liability insurance cost for vacant land starts as low as $12 per month for as much as $1,000,000 per occurrence and $2,000,000 aggregate limits of liability. Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence.

Source: howmuch.net

Source: howmuch.net

Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence. Or when they sustain bodily injury while on your property. Also known as property owners liability or public liability for land, this insurance will cover you for negligence in connection with the ownership of your land. Do i need liability insurance as a. Land liability insurance cover kicks in to help pay medical expenses for injured third parties, or legal defense and court judgments made against you for other damages, up to the limits stated in your policy.

Source: study.com

Source: study.com

Accidental physical loss of or physical damage to property. While homeowner�s insurance covers just the home and structures existing on the property, vacant land liability insurance covers instances that occur on vacant property, national real estate insurance group writes. Land liability insurance or landowners insurance covers a wide range of land uses including insurance for farm land, car parks, development sites, fields, moorland, residents land, rough country, undeveloped pasture, woodland, vacant land, private roads, resident’s roads and. Do i need liability insurance as a. Although our vacant land protection facility is intended for residential vacant land, surewise can also arrange liability insurance for your commercial vacant land.

Also, it protects the owner when sued by someone over damage done to their property. Vacant land insurance is a smart investment. The cost is the same and coverage begins the. Land insurance protects you against being sued for negligence or liability related to the land that you own. Liability insurance cost for vacant land starts as low as $12 per month for as much as $1,000,000 per occurrence and $2,000,000 aggregate limits of liability.

Source: absoluteinsurance.ca

Source: absoluteinsurance.ca

Get a land insurance quote. At this point your land insurance will kick in and either refute the claim or pay out if you were negligent. Standard liability will protect you up to £1 million, but. Vacant land insurance is a type of public liability insurance. Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence.

Simon”) Source: sites.google.com

Vacant land liability insurance, also known as landowners liability insurance, is another type of policy that may be beneficial for landowners. Our team of liability insurance experts can provide you with professional advice and arrange prompt insurance protection for you. Obstruction, trespass, nuisance or interference with any right of way, air, light or water or other easement. Land insurance protects you against being sued for negligence or liability related to the land that you own. Third party injuries due to.

Source: insuranceagentsofnj.com

Source: insuranceagentsofnj.com

Do i need liability insurance as a. Accidental physical loss of or physical damage to any property. At this point your land insurance will kick in and either refute the claim or pay out if you were negligent. Or when they sustain bodily injury while on your property. Obstruction, trespass, nuisance or interference with any right of way, air, light or water or other easement.

Source: slideserve.com

Source: slideserve.com

Vacant land insurance is a smart investment. The coverage of vacant land liability insurance. Land liability cover to suit you. Standard liability will protect you up to £1 million, but. If you are looking for land liability insurance, then you have come to the right place.

Source: goodtogoinsurance.org

Source: goodtogoinsurance.org

At landliability.ie we provide public liability insurance for all types of land, including private roads, undeveloped pasture, woodland and even residents associations. Our team of liability insurance experts can provide you with professional advice and arrange prompt insurance protection for you. Do i need liability insurance as a. Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence. It is designed to cover your financial liability for bodily injury or damage to other people’s property.

Source: allstate.com

Source: allstate.com

Get a land insurance quote. Liability insurance provides protection from claims brought about from third parties in the event of injury to or damage to their property caused by the insured’s negligence. Accidental physical loss of or physical damage to property. The coverage of vacant land liability insurance. An existing insurance policy may not cover the lot or the owner�s liability while the land is vacant.

Source: fashionstance.blogspot.com

At landliability.ie we provide public liability insurance for all types of land, including private roads, undeveloped pasture, woodland and even residents associations. We provide property owners liability insurance for land owners with fast access to quotes for a wide variety of properties across the united kingdom and elsewhere. You’ll need this if you employ any members of staff who work on or visit the land, such as an estate manager. This policy will cover you for any injury to a third party on your land, even due to negligence. Another case may be a tree falling on a neighbouring property.

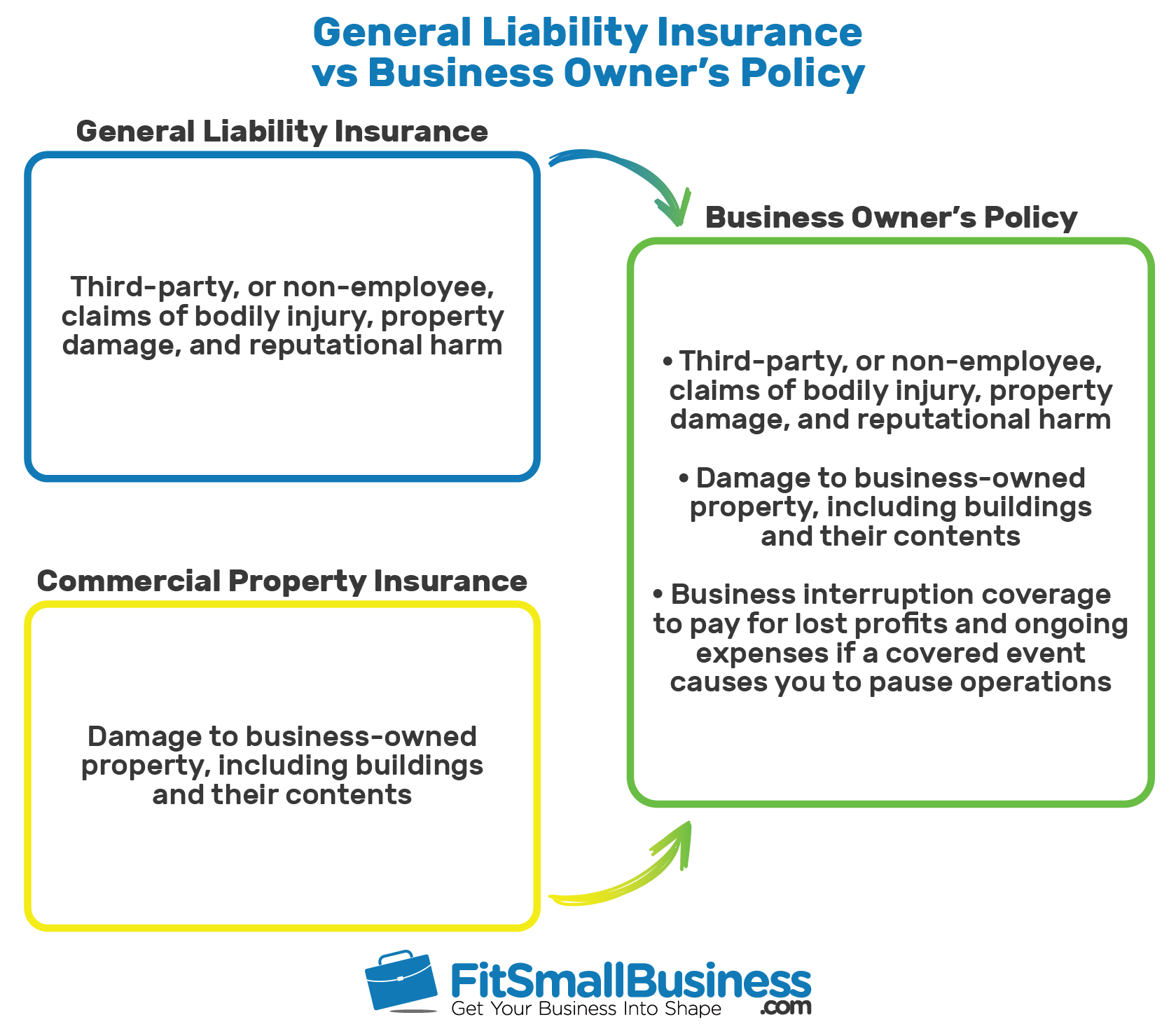

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

At landliability.ie we provide public liability insurance for all types of land, including private roads, undeveloped pasture, woodland and even residents associations. Accidental physical loss of or physical damage to property. Third party injuries due to. Also known as property owners liability or public liability for land, this insurance will cover you for negligence in connection with the ownership of your land. The land owners insurance policy protects you against liability claims made against you in respect of your legal liability arising out of the ownership of a piece of land.

Source: pathwaysbyamica.com

Source: pathwaysbyamica.com

Accidental injury to any person. Vacant land insurance is a type of public liability insurance. At this point your land insurance will kick in and either refute the claim or pay out if you were negligent. The coverage of vacant land liability insurance. Vacant land liability insurance, also known as landowners liability insurance, is another type of policy that may be beneficial for landowners.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title land liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.