Landlord additional insured Idea

Home » Trend » Landlord additional insured IdeaYour Landlord additional insured images are ready in this website. Landlord additional insured are a topic that is being searched for and liked by netizens today. You can Download the Landlord additional insured files here. Get all free images.

If you’re looking for landlord additional insured images information connected with to the landlord additional insured keyword, you have pay a visit to the ideal blog. Our site frequently provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more informative video articles and graphics that fit your interests.

Landlord Additional Insured. “caused in whole or in part.” here’s a good drafting tip for leases and other. Otherwise, the landlord is on its own. Additional insured would have to have a vested financial interest in the physical property you insure. Adding a landlord as an additional insured on a business’s general liability policy.

Landlord Tenant Required Insurance Certificate of From youtube.com

Landlord Tenant Required Insurance Certificate of From youtube.com

However, the landlord is an animal and has a history of forcibly. Name of person or organization (additional insured): In the event of a lawsuit, many parties can be named as defendants, including the landlord. An “additional insured” is a person or entity other than the named insured who is protected under the terms of the insurance policy sometimes referred to as the “loss payee. Generally, the purpose of an “additional insured” endorsement is to provide insurance coverage to individuals or entities other than the purchaser of the policy. A landlord would typically want to be an additional insured on a tenant’s general liability insurance policy, but would not need to be listed on a commercial property policy for the tenant’s business personal property, since the landlord has no financial stake in that property.

However, if the tenant’s policy covers the building itself.

This requirement is a standard feature in commercial leases. Section ii œ who is an insured. Adding “additional insured” verbiage on a landlord’s policy means the coverage is extended not only to the owner of the property, but also to the management company. The landlord, though an additional insured on its tenant’s policy, has coverage only if the claim is caused by its tenant’s acts or omissions. For example, many commercial lease agreements require not only that a tenant procure insurance to cover a variety of risks, but that the landlord be named as an additional insured. Additional insured endorsement should cover a tenant�s operations a recent federal case shows that, when arranging additional insured (ai) coverage for a landlord, it would be a good idea to obtain an endorsement covering liabilities arising out of the tenant�s operations in the leased space.

Source: youtube.com

Source: youtube.com

Additional insured œ owners, lessees or contractors œ automatic status when required in construction agreement with you. Adding a landlord as an additional insured on a business’s general liability policy. A type of status associated with general liability insurance policies that provides coverage to other individuals/groups that were not initially named. For example, many commercial lease agreements require not only that a tenant procure insurance to cover a variety of risks, but that the landlord be named as an additional insured. Generally, the purpose of an “additional insured” endorsement is to provide insurance coverage to individuals or entities other than the purchaser of the policy.

Source: youtube.com

Source: youtube.com

In the event of a lawsuit, many parties can be named as defendants, including the landlord. Generally, the purpose of an “additional insured” endorsement is to provide insurance coverage to individuals or entities other than the purchaser of the policy. Additional insured would have to have a vested financial interest in the physical property you insure. The landlord, though an additional insured on its tenant’s policy, has coverage only if the claim is caused by its tenant’s acts or omissions. Adding a landlord as an additional insured on a business’s general liability policy.

Source: themortgageclinicuk.co.uk

Source: themortgageclinicuk.co.uk

One is and additional insured the other is an additional interest. “ typically an endorsement to the policy is added to cover additional insureds. A landlord would typically want to be an additional insured on a tenant’s general liability insurance policy, but would not need to be listed on a commercial property policy for the tenant’s business personal property, since the landlord has no financial stake in that property. Landlords feel this protection is like “a belt and suspenders.” Additional insured landlord iso form why bring your own insurance when you can have a tenant (or landlord) name you as an additional insurer based on its own commercial general liability policy?

Source: raintreepm.com

“ typically an endorsement to the policy is added to cover additional insureds. Section ii œ who is an insured. An “additional insured” is a person or entity other than the named insured who is protected under the terms of the insurance policy sometimes referred to as the “loss payee. A type of status associated with general liability insurance policies that provides coverage to other individuals/groups that were not initially named. This endorsement provides insured status to the insured�s landlord for liability arising out of the ownership, maintenance, or use of the part of the premises rented to the insured during the lease duration.

Source: safeguardme.com

Source: safeguardme.com

In the event of a lawsuit, many parties can be named as defendants, including the landlord. In the event of a lawsuit, many parties can be named as defendants, including the landlord. After all, isn�t it obvious that if the insured (tenant or landowner) has good coverage, adding your own name in addition to the policyholder should. What many don�t know is that there are 2 different types. Since they don�t you can not add them t.

Source: thebalancesmb.com

Source: thebalancesmb.com

The landlord additional insured endorsement, along with the lease indemnity agreement, is designed to protect the building owner from liability claims that result from the tenant’s activities. For example, many commercial lease agreements require not only that a tenant procure insurance to cover a variety of risks, but that the landlord be named as an additional insured. Adding a landlord as an additional insured on a business’s general liability policy. If you rent a business property, you may need to add your landlord as an additional insured on a commercial tenant insurance policy. Another significant limitation arises out of the policy’s phrasing:

Source: voleyball-games.blogspot.com

Source: voleyball-games.blogspot.com

This requirement is a standard feature in commercial leases. However, if the tenant’s policy covers the building itself. Additional insured would have to have a vested financial interest in the physical property you insure. An “additional insured” is a person or entity other than the named insured who is protected under the terms of the insurance policy sometimes referred to as the “loss payee. After all, isn�t it obvious that if the insured (tenant or landowner) has good coverage, adding your own name in addition to the policyholder should.

Source: pinterest.com

Source: pinterest.com

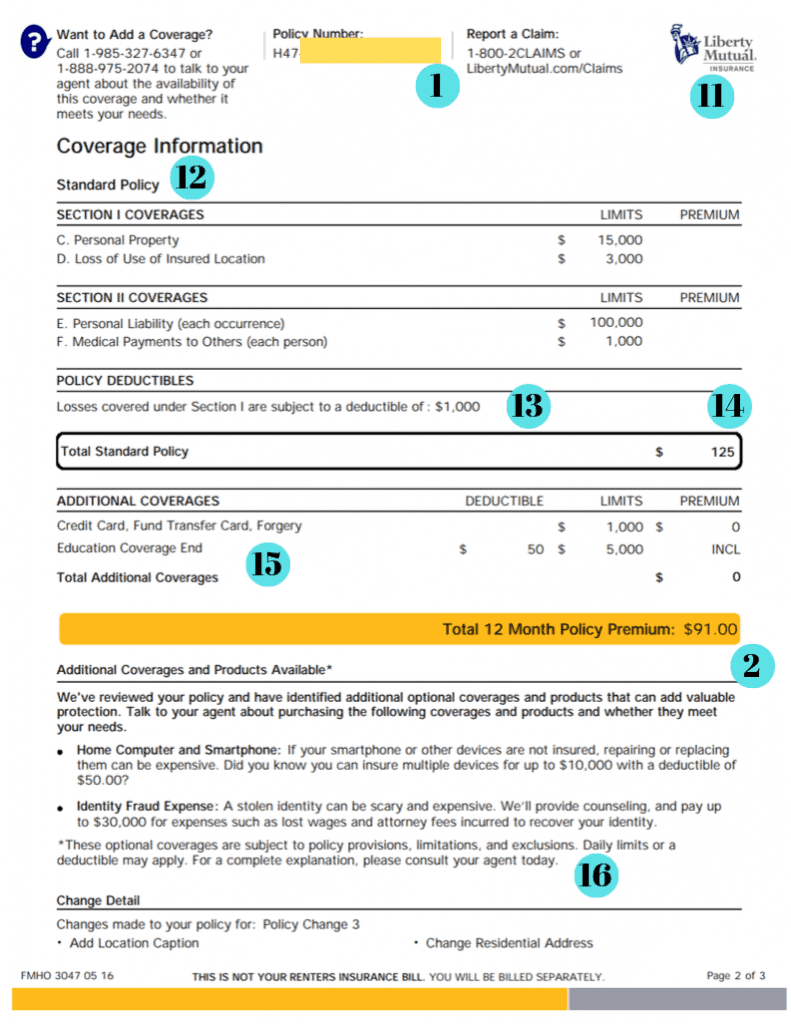

This endorsement modifies insurance provided under the following: The landlord additional insured endorsement, along with the lease indemnity agreement, is designed to protect the building owner from liability claims that result from the tenant’s activities. This endorsement modifies insurance provided under the following: Generally, property managers have no financial interest in the property, but they do have a very insurable interest from liabilities resulting from personal injury due to. My landlord is requiring that i obtain renters insurance and add them as an additional insured for me to renew for another year.

Source: 1strateins.com

Source: 1strateins.com

Additional insured landlord iso form why bring your own insurance when you can have a tenant (or landlord) name you as an additional insurer based on its own commercial general liability policy? Additional insured landlord iso form why bring your own insurance when you can have a tenant (or landlord) name you as an additional insurer based on its own commercial general liability policy? Landlords will generally want to be added as an additional insured on your policy so that any claims that arise out of your operations and/or general use of your premises, especially liability claims, will be covered under your policy first. The standard additional insured endorsement commonly issued to landlords ( iso cg2011) has recently been revised. Adding a landlord as an additional insured on a business’s general liability policy.

Source: hdainsurance.com

Source: hdainsurance.com

Additional insured endorsement should cover a tenant�s operations a recent federal case shows that, when arranging additional insured (ai) coverage for a landlord, it would be a good idea to obtain an endorsement covering liabilities arising out of the tenant�s operations in the leased space. What many don�t know is that there are 2 different types. Another significant limitation arises out of the policy’s phrasing: A type of status associated with general liability insurance policies that provides coverage to other individuals/groups that were not initially named. In the event of a lawsuit, many parties can be named as defendants, including the landlord.

Source: pinterest.com

Source: pinterest.com

Commercial general liability coverage part. My landlord is requiring that i obtain renters insurance and add them as an additional insured for me to renew for another year. After all, isn�t it obvious that if the insured (tenant or landowner) has good coverage, adding your own name in addition to the policyholder should. Otherwise, the landlord is on its own. Generally, property managers have no financial interest in the property, but they do have a very insurable interest from liabilities resulting from personal injury due to.

Source: verricoagency.com

Source: verricoagency.com

Name of person or organization (additional insured): Since they don�t you can not add them t. If you rent a business property, you may need to add your landlord as an additional insured on a commercial tenant insurance policy. However, if the tenant’s policy covers the building itself. Generally, the purpose of an “additional insured” endorsement is to provide insurance coverage to individuals or entities other than the purchaser of the policy.

Source: youngandtheinvested.com

Source: youngandtheinvested.com

However, if the tenant’s policy covers the building itself. A landlord would typically want to be an additional insured on a tenant’s general liability insurance policy, but would not need to be listed on a commercial property policy for the tenant’s business personal property, since the landlord has no financial stake in that property. Name of person or organization (additional insured): After all, isn�t it obvious that if the insured (tenant or landowner) has good coverage, adding your own name in addition to the policyholder should. Renters insurance naming the landlord as an additional insured on commercial insurance policies, this is common, but there is rarely a reason to add a landlord to a renters policy from the renter�s point of view.

Source: pinterest.com

Source: pinterest.com

Except for the insurance described in subparagraph 14(a)(iii) above, all such insurance required to be maintained by tenant shall name landlord as an additional insured and shall be written by the new mexico public school insurance authority, if permitted by law for nmpsia to do so. Except for the insurance described in subparagraph 14(a)(iii) above, all such insurance required to be maintained by tenant shall name landlord as an additional insured and shall be written by the new mexico public school insurance authority, if permitted by law for nmpsia to do so. One is and additional insured the other is an additional interest. Commercial general liability coverage part. This requirement is a standard feature in commercial leases.

Source: realtyworldtoday.com

Source: realtyworldtoday.com

Generally, property managers have no financial interest in the property, but they do have a very insurable interest from liabilities resulting from personal injury due to. Since they don�t you can not add them t. Additional insured endorsement should cover a tenant�s operations a recent federal case shows that, when arranging additional insured (ai) coverage for a landlord, it would be a good idea to obtain an endorsement covering liabilities arising out of the tenant�s operations in the leased space. In the event of a lawsuit, many parties can be named as defendants, including the landlord. The insurance policy or policies for the insurance required in sections 6.2.1 and 6.2.2 above shall name.

Source: marshillpropertymanagement.com

Source: marshillpropertymanagement.com

In the event of a lawsuit, many parties can be named as defendants, including the landlord. The landlord additional insured endorsement, along with the lease indemnity agreement, is designed to protect the building owner from liability claims that result from the tenant’s activities. Adding “additional insured” verbiage on a landlord’s policy means the coverage is extended not only to the owner of the property, but also to the management company. We sought this form actively beginning in 2000. Section ii œ who is an insured.

Source: youtube.com

Source: youtube.com

However, if the tenant’s policy covers the building itself. Another significant limitation arises out of the policy’s phrasing: “ typically an endorsement to the policy is added to cover additional insureds. Additional insured œ owners, lessees or contractors œ automatic status when required in construction agreement with you. Landlords will generally want to be added as an additional insured on your policy so that any claims that arise out of your operations and/or general use of your premises, especially liability claims, will be covered under your policy first.

Source: stokleyproperties.net

Source: stokleyproperties.net

Commercial general liability coverage part. Adding a landlord as an additional insured on a business’s general liability policy. In the event of a lawsuit, many parties can be named as defendants, including the landlord. One is and additional insured the other is an additional interest. We sought this form actively beginning in 2000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title landlord additional insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.