Law of agency insurance Idea

Home » Trending » Law of agency insurance IdeaYour Law of agency insurance images are ready in this website. Law of agency insurance are a topic that is being searched for and liked by netizens now. You can Download the Law of agency insurance files here. Get all free photos.

If you’re searching for law of agency insurance pictures information connected with to the law of agency insurance interest, you have visit the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

Law Of Agency Insurance. The aca reimagined health care coverage in. Write short notes on the following: Note that there are two types of agency: Supreme court in national federation of independent business v.

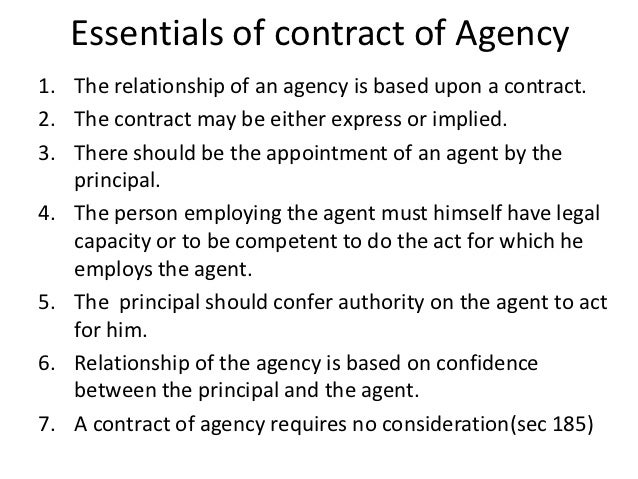

Credit agreements follows immediately after the insurance law component. To indemnify and reimburse the agent for. Supreme court in national federation of independent business v. The relationship of an agent and a principal may also arise by estoppel, necessity or operation of law. The law of agency is simply the law or legislation that relates to or governs the relationship between a person 1 and his agent (being a person who acts on the other ’ s behalf). Insurance agents are employed by the companies and the company gives necessary training to the agents.

A person or firm which acts as an intermediary in bringing together clients seeking insurance cover and insurance companies offering suitable policies.

Insurance agents are agents of insurance companies. The law of agency, insurance & credit agreements is a final year llb credit. And (4) in several states, contracts. The default enrolment option for this unit includes: The law of agency is when an agent is authorized to act on the behalf of the principal and to create a legal relationship with a third party. Insurance law (m05) provides candidates with knowledge and understanding of the laws which form the background to the operation of insurance, the system within which these laws operate and are administered and apply knowledge and skills to practical situations.

And (4) in several states, contracts. Supreme court in national federation of independent business v. Insurance agent law and legal definition. 67 limits to compensation for insurance agents and insurance brokers. Insurance is a contract in which one party (the insured) pays money (called a premium) and the other party promises to reimburse the first for certain types of losses (illness, property damage, or death) if they occur.

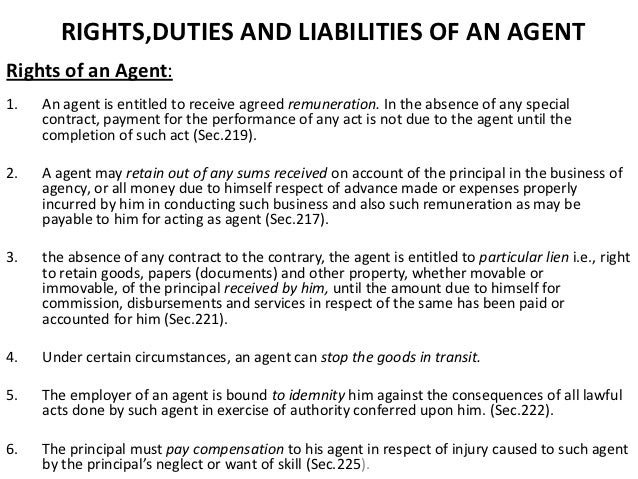

The law of agency is significant to insurance in large part because the only direct interaction most buyers of insurance have with the insurance company is through an agent or a broker, also called a producer another name for both agents and brokers. The default enrolment option for this unit includes: 68 powers of irda with reference to control of management of insurance companies, Discuss the duties of agent and principal separately. To pay the agent the commission or other agreed remuneration unless the agency relationship is gratuitous.

Latest version of the core learning content, in digital. The law of agency is simply the law or legislation that relates to or governs the relationship between a person 1 and his agent (being a person who acts on the other ’ s behalf). Discuss the duties of agent and principal separately. Not to willfully prevent or hinder the agent from earning his commission. Write short notes on the following:

In order to understand insurance law, it is useful to understand insurance first. Provisions relating to licensing of insurance agents and insurance intermediaries. Note that there are two types of agency: The relationship of an agent and a principal may also arise by estoppel, necessity or operation of law. The law of agency is significant to insurance in large part because the only direct interaction most buyers of insurance have with the insurance company is through an agent or a broker, also called a producer another name for both agents and brokers.

Source: officemuseum.com

Source: officemuseum.com

Signed into law in 2010, and largely upheld by the u.s. Generally insurance agents gives information of the insurance products of companies. The law of agency, insurance & credit agreements is a final year llb credit. Existence of agency is always a fact to be proved by tracing it to some act or agreement of the alleged principal. Insurance is a contract in which one party (the insured) pays money (called a premium) and the other party promises to reimburse the first for certain types of losses (illness, property damage, or death) if they occur.

Source: abebooks.com

Source: abebooks.com

The insurance law component will commence immediately after the law of agency component and will comprise approximately 8 lectures. Insurance agent law and legal definition. It is the law of agency and the agent�s contract with represented insurers that determine whether the individual is an agent of the company. The law of agency binds a principal by the authorized actions of the agent. (2) in many states, an agreement to pay a commission to a real estate broker;

![[AGENCY] [Dominion Insurance v. CA] Law Of Agency [AGENCY] [Dominion Insurance v. CA] Law Of Agency](https://imgv2-2-f.scribdassets.com/img/document/137369075/original/870c2b7e8d/1607956413?v=1)

The law of agency, insurance & credit agreements is a final year llb credit. Insurance is a contract in which one party (the insured) pays money (called a premium) and the other party promises to reimburse the first for certain types of losses (illness, property damage, or death) if they occur. Write short notes on the following: The law of agency component of the course will comprise approximately 12 lectures. And (4) in several states, contracts.

(3) in many states, authority given to an agent to sell real estate; 15.1.1 the law of agency plays an important role in commercial transactions, particularly with the advent of the modern company which, by a legal fiction, is regarded as having personality and may enter into transactions in its own right. The law of agency is when an agent is authorized to act on the behalf of the principal and to create a legal relationship with a third party. A person or firm which acts as an intermediary in bringing together clients seeking insurance cover and insurance companies offering suitable policies. Latest version of the core learning content, in digital.

Insurance agents are found both in the life insurance sector as. (1) a life insurance broker (not being also a general insurance broker) shall not, as agent of an insurer in respect of general insurance business, do any act, for or in relation to an intending insured, in respect of insurance other than life insurance unless he has first informed the intending insured that, in doing that act, he would be acting as agent of. In order to understand insurance law, it is useful to understand insurance first. These laws vary from state to state, but in general, agents must fulfill the wishes of their clients and communicate if they’re unable to do so. (1) actual, either express or implied, and (2) apparent.

Source: slideshare.net

Source: slideshare.net

Latest version of the core learning content, in digital. 15.1.1 the law of agency plays an important role in commercial transactions, particularly with the advent of the modern company which, by a legal fiction, is regarded as having personality and may enter into transactions in its own right. The law of agency is when an agent is authorized to act on the behalf of the principal and to create a legal relationship with a third party. And (4) in several states, contracts. Credit agreements follows immediately after the insurance law component.

Source: thelocalbrand.com

Source: thelocalbrand.com

The law of agency is simply the law or legislation that relates to or governs the relationship between a person 1 and his agent (being a person who acts on the other ’ s behalf). The law of agency is simply the law or legislation that relates to or governs the relationship between a person 1 and his agent (being a person who acts on the other ’ s behalf). If they fail to follow client instructions and don’t inform the client, agents could be sued. Note that there are two types of agency: To pay the agent the commission or other agreed remuneration unless the agency relationship is gratuitous.

Not to willfully prevent or hinder the agent from earning his commission. In some cases the agent may simply introduce the two parties to each other and receive a commission from the insurance company; The law of agency is simply the law or legislation that relates to or governs the relationship between a person 1 and his agent (being a person who acts on the other ’ s behalf). Discuss the duties of agent and principal separately. “the law of agency imposes certain duties both on the agent and the principal”.

Source: youtube.com

Source: youtube.com

No law enacted during the prior decade changed the shape of the insurance industry like the aca. Credit agreements follows immediately after the insurance law component. Insurance agents are employed by the companies and the company gives necessary training to the agents. The aca reimagined health care coverage in. And there are situations where an agency contract must be in writing:

Source: slideshare.net

Source: slideshare.net

Signed into law in 2010, and largely upheld by the u.s. Existence of agency is always a fact to be proved by tracing it to some act or agreement of the alleged principal. Credit agreements follows immediately after the insurance law component. Not being a real person, a company must act through people. Latest version of the core learning content, in digital.

Insurance agents are found both in the life insurance sector as. Insurance law (m05) provides candidates with knowledge and understanding of the laws which form the background to the operation of insurance, the system within which these laws operate and are administered and apply knowledge and skills to practical situations. 15.1.1 the law of agency plays an important role in commercial transactions, particularly with the advent of the modern company which, by a legal fiction, is regarded as having personality and may enter into transactions in its own right. The default enrolment option for this unit includes: The law of agency is significant to insurance in large part because the only direct interaction most buyers of insurance have with the insurance company is through an agent or a broker, also called a producer another name for both agents and brokers.

Source: hstutorial.com

Source: hstutorial.com

Insurance agents are employed by the companies and the company gives necessary training to the agents. Discuss the duties of agent and principal separately. Insurance agents are agents of insurance companies. Insurance agent legal obligations are the laws that agents must abide by in the course of their work. (1) actual, either express or implied, and (2) apparent.

In some cases the agent may simply introduce the two parties to each other and receive a commission from the insurance company; 15.1.1 the law of agency plays an important role in commercial transactions, particularly with the advent of the modern company which, by a legal fiction, is regarded as having personality and may enter into transactions in its own right. Or the agent may be employed by a particular insurance company to sell insurance. Insurance is a contract in which one party (the insured) pays money (called a premium) and the other party promises to reimburse the first for certain types of losses (illness, property damage, or death) if they occur. In order to understand insurance law, it is useful to understand insurance first.

(3) in many states, authority given to an agent to sell real estate; It is the law of agency and the agent�s contract with represented insurers that determine whether the individual is an agent of the company. Note that there are two types of agency: The default enrolment option for this unit includes: Insurance agent legal obligations are the laws that agents must abide by in the course of their work.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title law of agency insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.