Law of large numbers insurance information

Home » Trending » Law of large numbers insurance informationYour Law of large numbers insurance images are ready. Law of large numbers insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Law of large numbers insurance files here. Download all royalty-free photos.

If you’re looking for law of large numbers insurance pictures information related to the law of large numbers insurance keyword, you have visit the right site. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

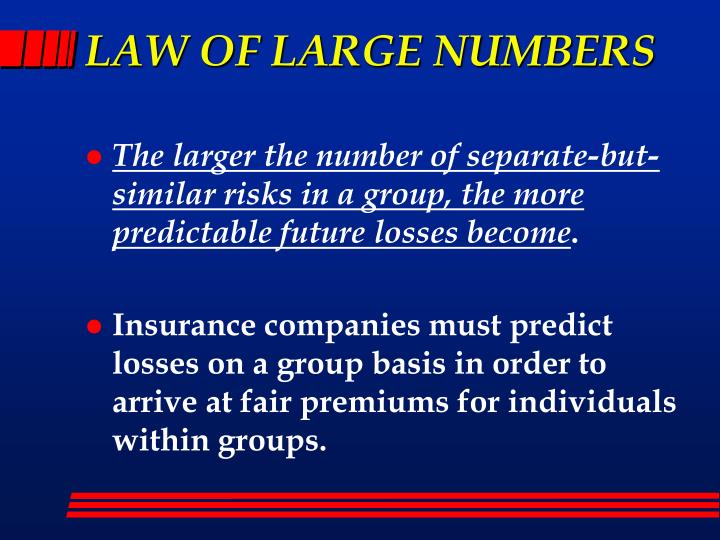

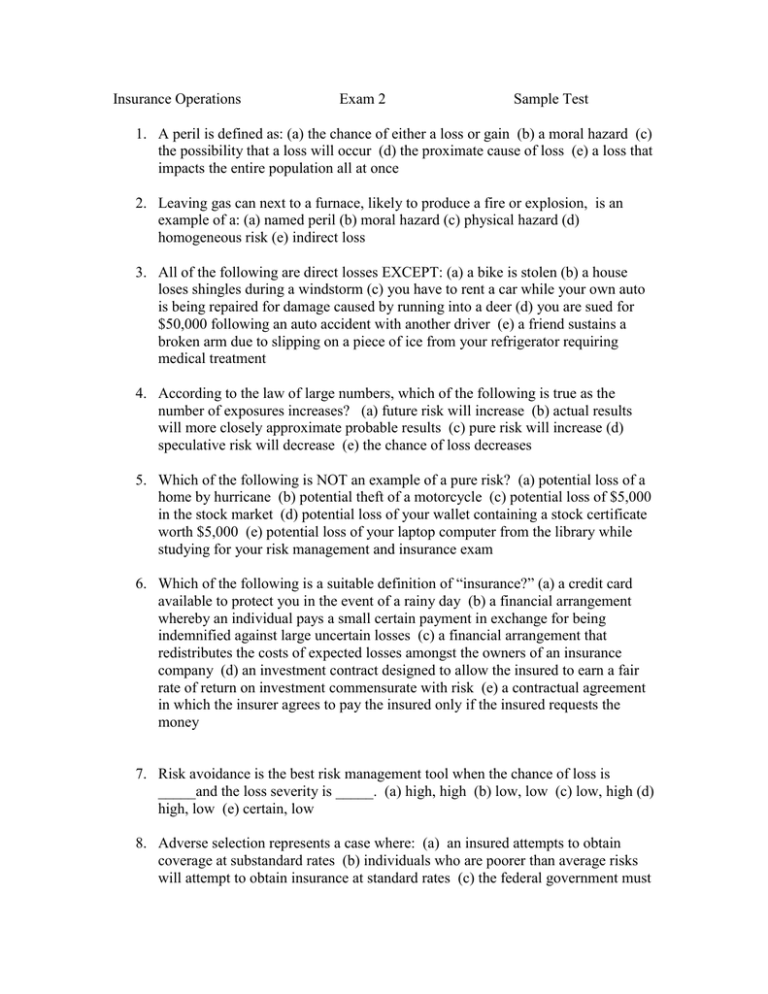

Law Of Large Numbers Insurance. Law of large numbers today in the present day, the law of large numbers remains an important limit theorem that the law of large numbers is a statistical concept that relates to probability. The law of large numbers (or the related central limit theorem) is used in the literature on risk management and insurance to explain pooling of losses as an insurance mechanism. If you toss a coin once, the. Law of large numbers insurance risk.

Law Of Large Numbers Insurance Theory kenyachambermines From kenyachambermines.com

Law Of Large Numbers Insurance Theory kenyachambermines From kenyachambermines.com

The strong law 10 chapter 4. Insurance companies use the law of large numbers to lessen their own risk of loss by pooling a large enough number of people together in an insured group. A large number is an ordinarily bigger number than other numbers in a number system. Static risks are more predictable, and, therefore, more insurable. The law of large numbers predicts that. It takes in an insurance industry with a large number of policyholders on both an actual and expected basis for a claim to qualify as true.

Insurance companies use the law of large numbers to lessen their own risk of loss by pooling a large enough number of people together in an insured group.

Theorems and proofs 7 2. Out of a large group of policyholders the insurance company can fairly accurately predict not by name but by number,. It is one of the factors insurance companies use to determine their rates. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. Dynamic risks change with time, making them less predictable and less insurable. What does law of large numbers mean in insurance?

Source: slideserve.com

Source: slideserve.com

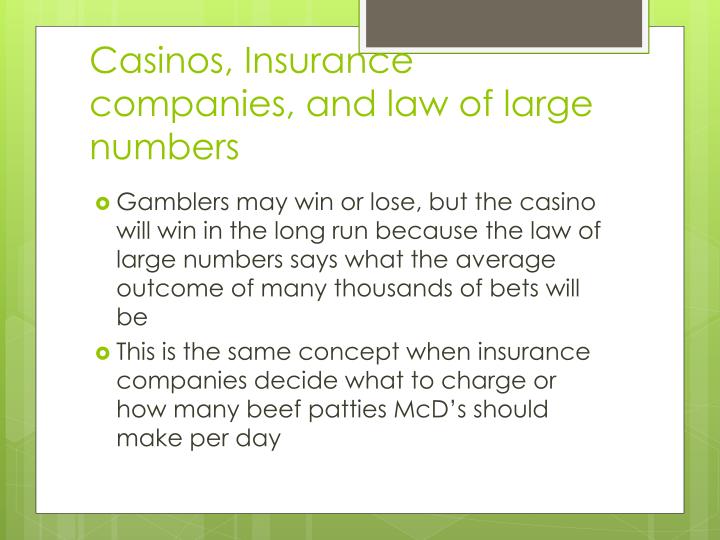

The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced. The basic idea is that insurance companies can provide insurance to thousands of individuals who pay a certain premium each month and only a small percentage of the individuals they ensure will actually need to use the insurance to pay for large unexpected expenses. The law of large numbers defined. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. If you toss a coin once, the.

Source: slideserve.com

Source: slideserve.com

Insurance companies rely on the law of large numbers to help estimate the value and frequency of future claims they will pay to policyholders. Out of a large group of policyholders the insurance company can fairly accurately predict not by name but by number,. The law of large numbers is a statistical principle that stipulates that if you have a large enough group that you are predicting an outcome for, you are almost certain of experiencing the expected result. Applications of the law of large numbers 12 1. When it works perfectly, insurance companies run a stable business, consumers pay a fair and accurate premium, and the entire financial system avoids serious disruption.

Source: slideshare.net

Source: slideshare.net

The strong law 10 chapter 4. The law of large numbers is a statistical concept that relates to probability. In theory, it is suggested that the average of the results shares the same expected value, which narrows as more results are introduced. This makes life insurance affordable for each insured person so that the payouts can be so. Law of large numbers insurance risk.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The law of large (small ?) numbers and the demand for insurance 439 adding new risks as by subdividing risks among more people that insurance companies reduce the risk of each. the purpose of the present article is to examine the relevance of this statement in a risk management framework2. 12/06/2021 06:05 pm average star voting: For example, if a person wants to attract money, they would most likely use words such as “rich”, “money”, “earn”, “make money” and “earn more money”. What does law of large numbers mean in insurance? Best no1 law of large numbers in insurance.

Source: noclutter.cloud

Source: noclutter.cloud

If historical data is collected for several years for life insurance for example and the information like how many people died during the policy, how many claims were made etc is available then it can be deduced that on average what is the percentage of claims that will possibly be made for an. Law of large numbers is the basis for successfully running insurance business. Law of large numbers insurance insurance from greatoutdoorsabq.com. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. The law of large numbers defined.

Source: fashionblogbyalexis.blogspot.com

Source: fashionblogbyalexis.blogspot.com

Law of large numbers is the basis for successfully running insurance business. Law of large numbers — a statistical axiom that states that the larger the number of exposure units independently exposed to loss, the greater the probability that actual loss experience will equal expected loss experience.in other words, the credibility of data increases with the size of the data pool under consideration. The law of large (small ?) numbers and the demand for insurance 439 adding new risks as by subdividing risks among more people that insurance companies reduce the risk of each. the purpose of the present article is to examine the relevance of this statement in a risk management framework2. Law of large numbers insurance insurance from greatoutdoorsabq.com. Watch what is law of large numbers in insurance video

Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. The law of large (small ?) numbers and the demand for insurance 439 adding new risks as by subdividing risks among more people that insurance companies reduce the risk of each. the purpose of the present article is to examine the relevance of this statement in a risk management framework2. A person can send out a sentence which says “i am rich. Insurance companies use the law of large numbers to estimate the losses a certain group of insureds may have in the future. The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced.

Source: npa1.org

Source: npa1.org

The law of large numbers is the principal that backstops much of statistical work. The law of large numbers is a statistical concept that relates to probability. The law of large numbers states that as the number of policyholders increases, the more confident the insurance company is its. The law of large numbers 7 1. This law forms the basis for the statistical expectation of loss upon which premium rates for insurance policies are calculated.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

It takes in an insurance industry with a large number of policyholders on both an actual and expected basis for a claim to qualify as true. Best no1 law of large numbers in insurance. A risk manager (or insurance executive) uses the law of large numbers to estimate future outcomes for planning purposes. Another example of the law of large numbers at work is found in predicting the outcome of a coin toss. Insurance companies rely on the law of large numbers to help estimate the value and frequency of future claims they will pay to policyholders.

Source: slideserve.com

Source: slideserve.com

Applications of the law of large numbers 12 1. The fact that this law holds true is critical to the foundation of life insurance. It is one of the factors insurance companies use to determine their rates. Static risks are more predictable, and, therefore, more insurable. Historical background of the law of large numbers 1 2.

Source: researchgate.net

Source: researchgate.net

Also called the “law… match with the search results: Insurance companies rely on the law of large numbers to help estimate the value and frequency of future claims they will pay to policyholders. When it works perfectly, insurance companies run a stable business, consumers pay a fair and accurate premium, and the entire financial system avoids serious disruption. This law forms the basis for the statistical expectation of loss upon which premium rates for insurance policies are calculated. The 1 lakh, 1 million, 1 billion, etc.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

If you toss a coin once, the. Dynamic risks change with time, making them less predictable and less insurable. It is one of the factors insurance companies use to determine their rates. If you toss a coin once, the. Law of large numbers insurance insurance from greatoutdoorsabq.com.

Source: npa1.org

Source: npa1.org

Another example of the law of large numbers at work is found in predicting the outcome of a coin toss. This law of large numbers insurance works on the same basic level as well. Applications of the law of large numbers 12 1. The strong law 10 chapter 4. The law of large numbers states that as the number of policyholders increases, the more confident the insurance company is its prediction will prove true.

Source: en101sp130403.blogspot.com

Source: en101sp130403.blogspot.com

Law of large numbers is the basis for successfully running insurance business. The law of large numbers theorizes that the average of a large number of results closely mirrors the expected value, and that difference narrows as more results are introduced. The fact that this law holds true is critical to the foundation of life insurance. Insurance companies also rely on the law of large numbers to remain profitable. The law of large numbers is the principal that backstops much of statistical work.

Source: coursehero.com

Insurance companies also rely on the law of large numbers to remain profitable. The law of large numbers predicts that. Out of a large group of policyholders the insurance company can fairly accurately predict not by name but by number,. 4 ⭐ ( 46449 reviews) summary: Law of large numbers today 1 chapter 2.

Source: fashionblogbyalexis.blogspot.com

Source: fashionblogbyalexis.blogspot.com

Applications of the law of large numbers 12 1. Insurance companies also rely on the law of large numbers to remain profitable. If historical data is collected for several years for life insurance for example and the information like how many people died during the policy, how many claims were made etc is available then it can be deduced that on average what is the percentage of claims that will possibly be made for an. If you toss a coin once, the. Watch what is law of large numbers in insurance video

Source: wallstreetinstructors.com

Source: wallstreetinstructors.com

Static risks are more predictable, and, therefore, more insurable. It is one of the factors insurance companies use to determine their rates. The fact that this law holds true is critical to the foundation of life insurance. A risk manager (or insurance executive) uses the law of large numbers to estimate future outcomes for planning purposes. Historical background of the law of large numbers 1 2.

Source: kenyachambermines.com

Source: kenyachambermines.com

(law of large numbers) losses must not be catastrophic to many members of the group at the same time the insurance company must be able to determine a reasonable cost for the insurance the insurance company must be able to calculate the chance of loss in addition, insurance can only pay money to people who have an. Applications of the law of large numbers 12 1. The law of large numbers is the principal that backstops much of statistical work. Insurance companies rely on the law of large numbers to help estimate the value and frequency of future claims they will pay to policyholders. Historical background of the law of large numbers 1 2.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title law of large numbers insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.