Leased equipment insurance information

Home » Trending » Leased equipment insurance informationYour Leased equipment insurance images are ready in this website. Leased equipment insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Leased equipment insurance files here. Download all free photos.

If you’re looking for leased equipment insurance images information connected with to the leased equipment insurance topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for viewing the highest quality video and picture content, please kindly search and locate more informative video articles and graphics that fit your interests.

Leased Equipment Insurance. Coverage options are available for: Our insurance plans for leased equipment offer coverage against accidental damage (cracked screens/liquid damage), theft and more. Among other things, the policy provides the necessary protection against perils such as fire, vandalism, theft and flood. In the unfortunate event that equipment is damaged or lost and a customer needs to make a claim, they may find that the leased equipment is not insured at all, or, if it is, they have a large excess to pay on their business insurance policy that renders the claim unviable.

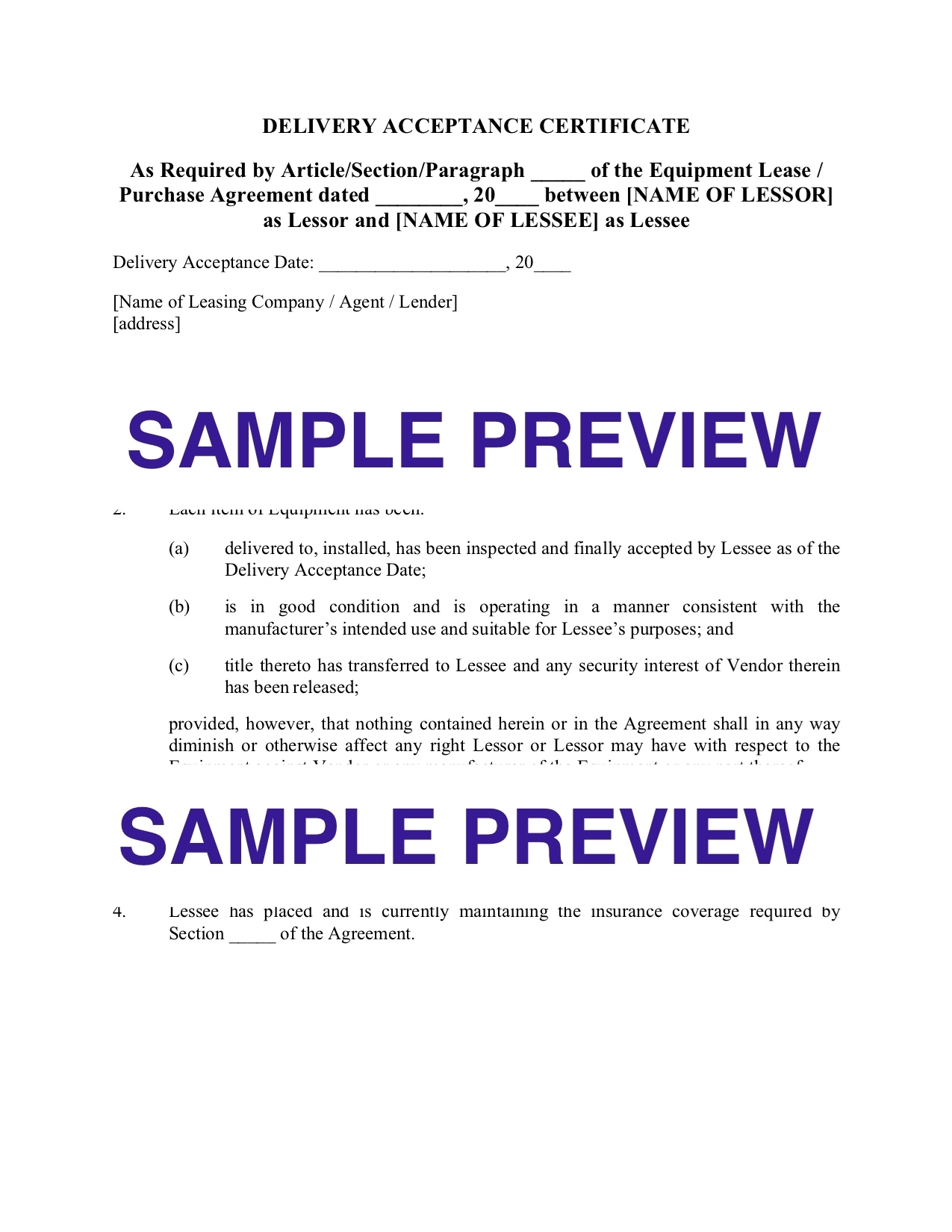

Equipment lease agreement in Word and Pdf formats From dexform.com

Equipment lease agreement in Word and Pdf formats From dexform.com

This coverage follows the equipment when it in transit from jobsite to jobsite. The insurance cover distinguishes the rentals f om the ented All you have to do is ring your business insurance broker for advice. Is rented, leased or borrowed machinery included on your policy? It may also require the lessee to insure the leased item under a property policy. Customized insurance solutions for niche equipment marketplaces.

He served as sponsor of changes to acord 23 throughout the process that began in early 2007.

That depends on the company and type of policy you have. Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life. Leased/rented equipment • rental expense of substitute equipment • borrowed equipment • contractor’s equipment plus endorsement broadens your policy by adding several additional coverages at nominal limits to address your incidental exposures • loss of business income and/or extra expense as a result of a loss to your covered equipment Learn more about equipment insurance coverage. Coverage options are available for: All you have to do is pay the insurance charge on your periodic lease invoice.

Source: accesswire.com

Source: accesswire.com

All you have to do is pay the insurance charge on your periodic lease invoice. How to save money on leased equipment insurance add to business insurance policy. Securing the equipment usually involves a written contract in which the leasing company will ask the contractor to provide proof of insurance. And yes, you can make money from partnering with worth ave. This is leased equipment coverage.

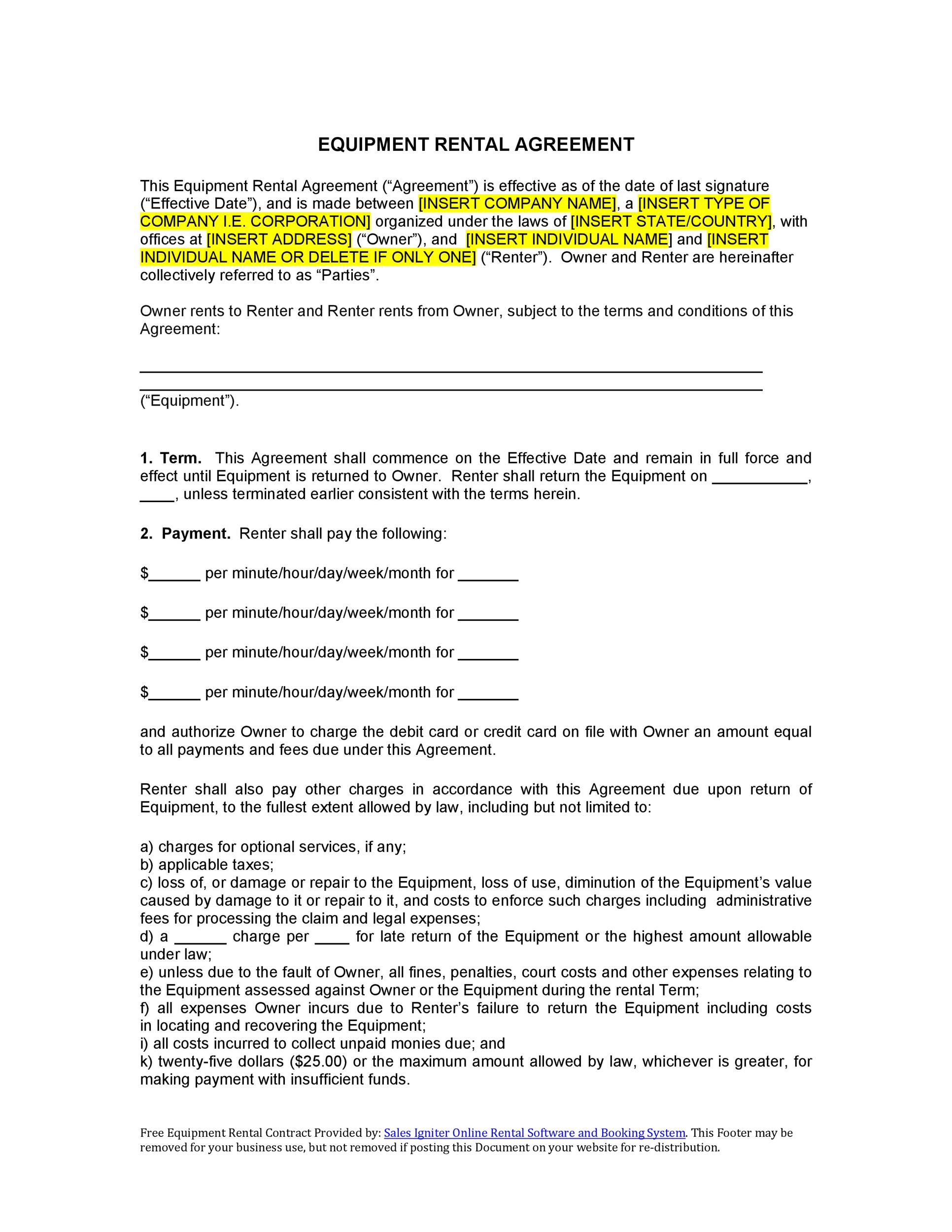

Source: contract-template.org

Source: contract-template.org

The leased equipment is not red for comme cial events of loss. All you have to do is ring your business insurance broker for advice. If you are leasing equipment, you shall procure and continuously maintain and pay for (i) all risk insurance against loss of and damage to the equipment for not less than the full replacement value of each unit, naming us as loss payee, and (ii) public liability and property damage insurance insuring against third party personal and property. Protection for your business if equipment breaks down. Our insurance plans for leased equipment offer coverage against accidental damage (cracked screens/liquid damage), theft and more.

Source: financialservicesolutions.co.uk

Source: financialservicesolutions.co.uk

It may also require the lessee to insure the leased item under a property policy. This insurance also covers tools and equipment purchased, rented, leased or borrowed after the policy�s effective date for a period of time. Our insurance plans for leased equipment offer coverage against accidental damage (cracked screens/liquid damage), theft and more. The leasing company has to be named as the loss payee, and the dollar amount the machine needs to be insured for has to be declared. If you do not provide proof of your own insurance policy, the equipment will be automatically covered under the leasing company�s insurance policy.

Source: stridecap.com

Source: stridecap.com

Leased/rented equipment • rental expense of substitute equipment • borrowed equipment • contractor’s equipment plus endorsement broadens your policy by adding several additional coverages at nominal limits to address your incidental exposures • loss of business income and/or extra expense as a result of a loss to your covered equipment He served as sponsor of changes to acord 23 throughout the process that began in early 2007. As an option, we offer coverage for rental or lease payments that continue while repairs are being made to damaged leased equipment. Typically, the lease states that the lessee is responsible for any loss or damage the machines sustain during the term of the lease. Customized insurance solutions for niche equipment marketplaces.

Source: tcsequipmentfinance.com

Source: tcsequipmentfinance.com

Depending on the exact terms of a contractors liability insurance policy’s coverage, this coverage may protect rented and leased equipment from fire, theft, vandalism, flood, and other perils. The insurance cover distinguishes the rentals f om the ented It can also cover small tools, employees’ equipment and clothing, and borrowed equipment. As an option, we offer coverage for rental or lease payments that continue while repairs are being made to damaged leased equipment. In many cases, it covers equipment that is.

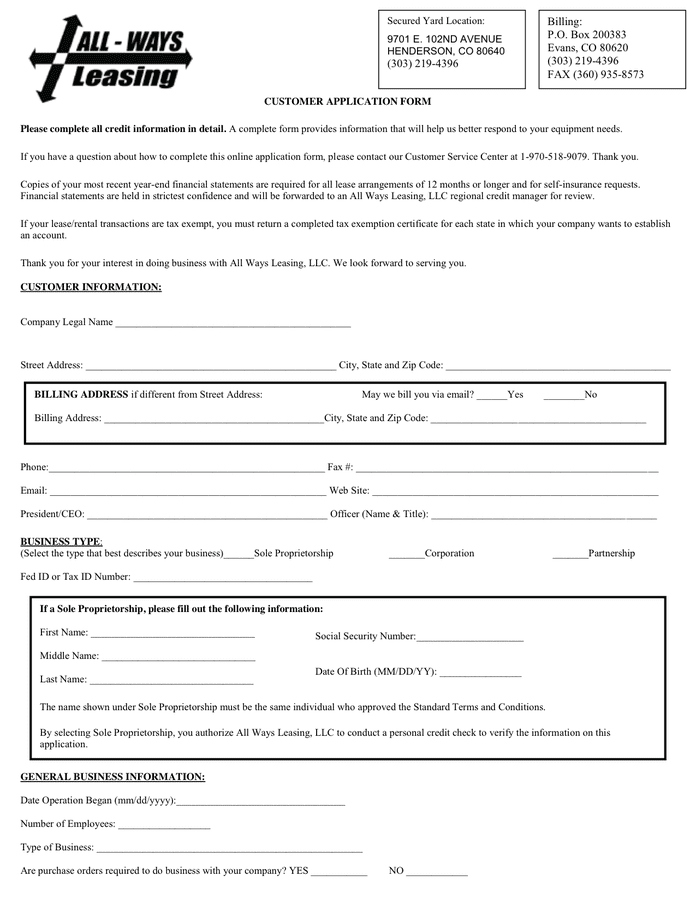

Source: dexform.com

Source: dexform.com

Some policies automatically include that coverage and others only include the coverage if you specifically list the equipment at the time it’s borrowed, rented or leased. The insurance cover distinguishes the rentals f om the ented Typically, the lease states that the lessee is responsible for any loss or damage the machines sustain during the term of the lease. Lease insurance (and its affiliate, lease insurance international) which provides lease insurance programs for over 25 equipment leasing and financing companies. This coverage follows the equipment when it in transit from jobsite to jobsite.

Source: dexform.com

Source: dexform.com

Our insurance plans for leased equipment offer coverage against accidental damage (cracked screens/liquid damage), theft and more. Protection for your business if equipment breaks down. All you have to do is pay the insurance charge on your periodic lease invoice. Typically, the lease states that the lessee is responsible for any loss or damage the machines sustain during the term of the lease. Customized insurance solutions for niche equipment marketplaces.

Source: sampletemplates.com

Source: sampletemplates.com

Depending on the exact terms of a contractors liability insurance policy’s coverage, this coverage may protect rented and leased equipment from fire, theft, vandalism, flood, and other perils. That depends on the company and type of policy you have. Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life. We ask for a separate rate and deposit premium, with annual premium adjustment based on the insured’s annual expenditures. It may also require the lessee to insure the leased item under a property policy.

Source: steadfastnz.nz

Source: steadfastnz.nz

Equipment insurance without insurance cover during the term of a lease, the loss or damage to unprotected equipment can prove costly both to you and your customer’s business. Coverage for your investment, whether owned or leased, to keep equipment protected from loss throughout its useful life. The leased equipment is not red for comme cial events of loss. Protection for your business if equipment breaks down. Lease insurance (and its affiliate, lease insurance international) which provides lease insurance programs for over 25 equipment leasing and financing companies.

Source: sampletemplates.com

Source: sampletemplates.com

If you are leasing equipment, you shall procure and continuously maintain and pay for (i) all risk insurance against loss of and damage to the equipment for not less than the full replacement value of each unit, naming us as loss payee, and (ii) public liability and property damage insurance insuring against third party personal and property. That depends on the company and type of policy you have. If you are leasing equipment, you shall procure and continuously maintain and pay for (i) all risk insurance against loss of and damage to the equipment for not less than the full replacement value of each unit, naming us as loss payee, and (ii) public liability and property damage insurance insuring against third party personal and property. Lease insurance (and its affiliate, lease insurance international) which provides lease insurance programs for over 25 equipment leasing and financing companies. Rental expense leased or rented contractors equipment employees� tools unscheduled mobile equipment replacement cost valuation on covered property (not more than 5 years old) no overload exclusion endorsements available for waterborne coverage contractors equipment insurance target clients

Source: review2.wintrust.us

Source: review2.wintrust.us

Leased equipment clause this insurance is extended to cover loss of or damage to equipment and apparatus not owned by the assured but installed for use on the vessel and for which the assured has assumed contractual liability, whether such equipment or apparatus be in nature of Protection for your business if equipment breaks down. Some policies automatically include that coverage and others only include the coverage if you specifically list the equipment at the time it’s borrowed, rented or leased. For more information about our equipment coverage options, select a. Learn more about equipment insurance coverage.

Source: colby-group.com

Source: colby-group.com

It may also require the lessee to insure the leased item under a property policy. We also cover equipment leased, rented or loaned to your customers. The leasing company has to be named as the loss payee, and the dollar amount the machine needs to be insured for has to be declared. In many cases, it covers equipment that is. The insurance cover distinguishes the rentals f om the ented

Source: megadox.com

Source: megadox.com

The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience. If you are leasing equipment, you shall procure and continuously maintain and pay for (i) all risk insurance against loss of and damage to the equipment for not less than the full replacement value of each unit, naming us as loss payee, and (ii) public liability and property damage insurance insuring against third party personal and property. Lease insurance (and its affiliate, lease insurance international) which provides lease insurance programs for over 25 equipment leasing and financing companies. All you have to do is ring your business insurance broker for advice. As an option, we offer coverage for rental or lease payments that continue while repairs are being made to damaged leased equipment.

Source: review2.wintrust.us

Source: review2.wintrust.us

If equipment sustains damage in a covered incident, this coverage might help pay for any recovery, repairs, or lost revenue associated with the claim. Lease insurance (and its affiliate, lease insurance international) which provides lease insurance programs for over 25 equipment leasing and financing companies. He served as sponsor of changes to acord 23 throughout the process that began in early 2007. All you have to do is pay the insurance charge on your periodic lease invoice. Does contractors� equipment insurance cover theft?

Source: dexform.com

Source: dexform.com

Coverage options are available for: Securing the equipment usually involves a written contract in which the leasing company will ask the contractor to provide proof of insurance. If you are leasing equipment, you shall procure and continuously maintain and pay for (i) all risk insurance against loss of and damage to the equipment for not less than the full replacement value of each unit, naming us as loss payee, and (ii) public liability and property damage insurance insuring against third party personal and property. The leased equipment is not red for comme cial events of loss. How to save money on leased equipment insurance add to business insurance policy.

Source: ekmcconkey.com

Source: ekmcconkey.com

Coverage options are available for: For more information about our equipment coverage options, select a. Some policies automatically include that coverage and others only include the coverage if you specifically list the equipment at the time it’s borrowed, rented or leased. If equipment sustains damage in a covered incident, this coverage might help pay for any recovery, repairs, or lost revenue associated with the claim. How to save money on leased equipment insurance add to business insurance policy.

Source: templatelab.com

Source: templatelab.com

Our insurance plans for leased equipment offer coverage against accidental damage (cracked screens/liquid damage), theft and more. All you have to do is ring your business insurance broker for advice. That depends on the company and type of policy you have. It provides broad coverage for tools, clothing and heavy equipment in the contractor�s possession at the time of the policy effective date. Leased/rented equipment • rental expense of substitute equipment • borrowed equipment • contractor’s equipment plus endorsement broadens your policy by adding several additional coverages at nominal limits to address your incidental exposures • loss of business income and/or extra expense as a result of a loss to your covered equipment

Source: blog.gogc.com

Source: blog.gogc.com

A contractors insurance policy can extend beyond simply covering equipment; The leasing company has to be named as the loss payee, and the dollar amount the machine needs to be insured for has to be declared. Leased/rented equipment • rental expense of substitute equipment • borrowed equipment • contractor’s equipment plus endorsement broadens your policy by adding several additional coverages at nominal limits to address your incidental exposures • loss of business income and/or extra expense as a result of a loss to your covered equipment And yes, you can make money from partnering with worth ave. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small equipment rental businesses ranges from $37 to $99 per month based on location, type of equipment rented, payroll, sales and experience.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title leased equipment insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.