Legal difference between designated insured and additional insured information

Home » Trend » Legal difference between designated insured and additional insured informationYour Legal difference between designated insured and additional insured images are ready. Legal difference between designated insured and additional insured are a topic that is being searched for and liked by netizens today. You can Get the Legal difference between designated insured and additional insured files here. Download all royalty-free images.

If you’re searching for legal difference between designated insured and additional insured images information related to the legal difference between designated insured and additional insured interest, you have come to the right blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

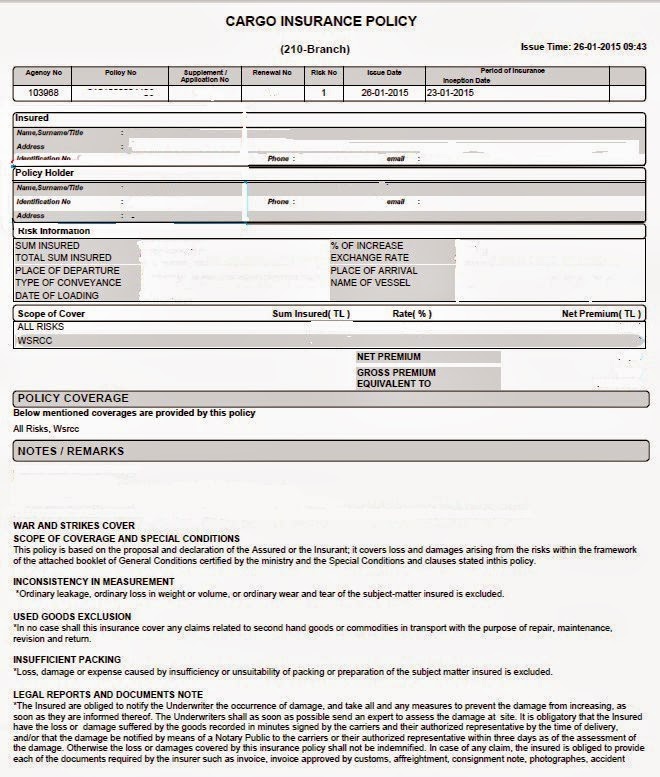

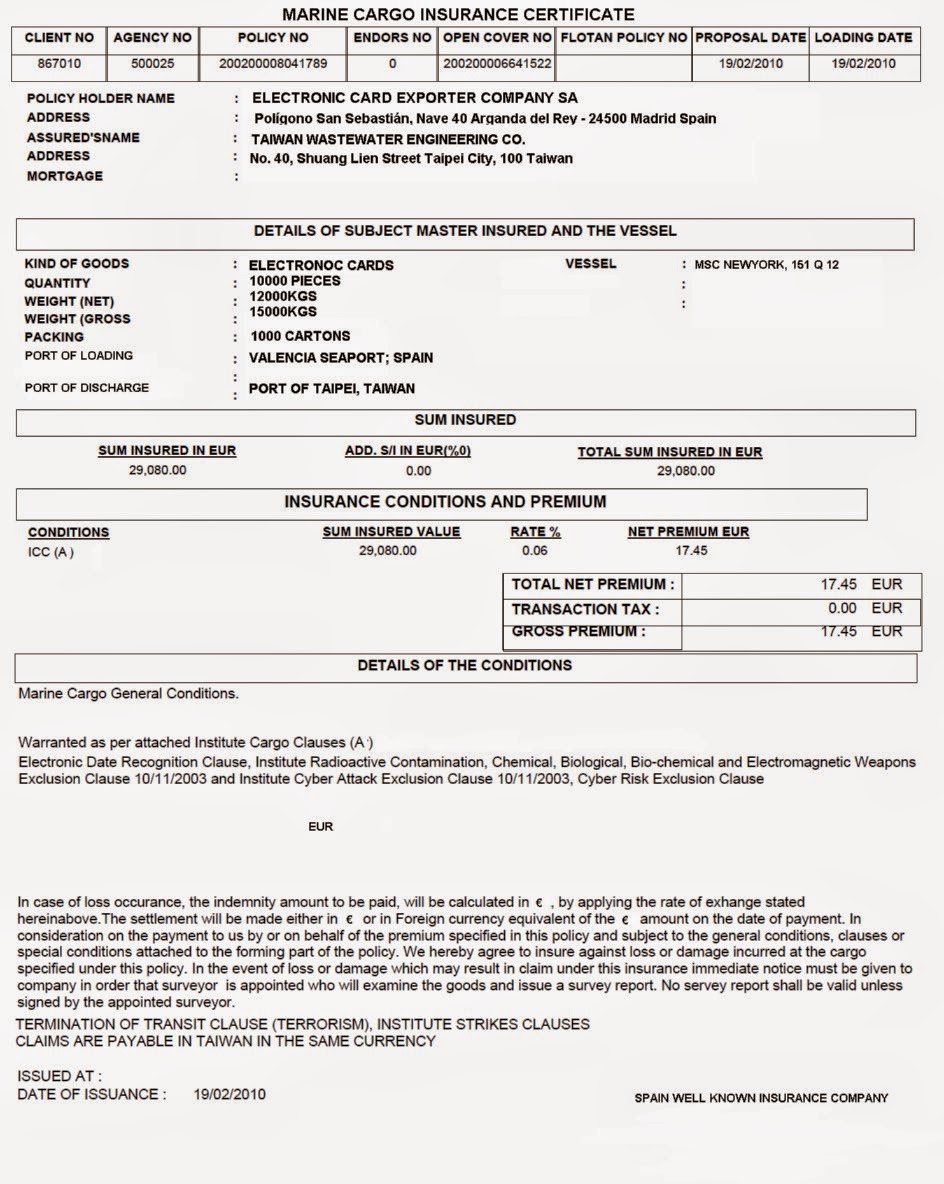

Legal Difference Between Designated Insured And Additional Insured. When the original policyholder requests that another company be added to their insurance policy,. If that seems tricky, you can think of it like this. An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. Lot more interesting detail can be read here.

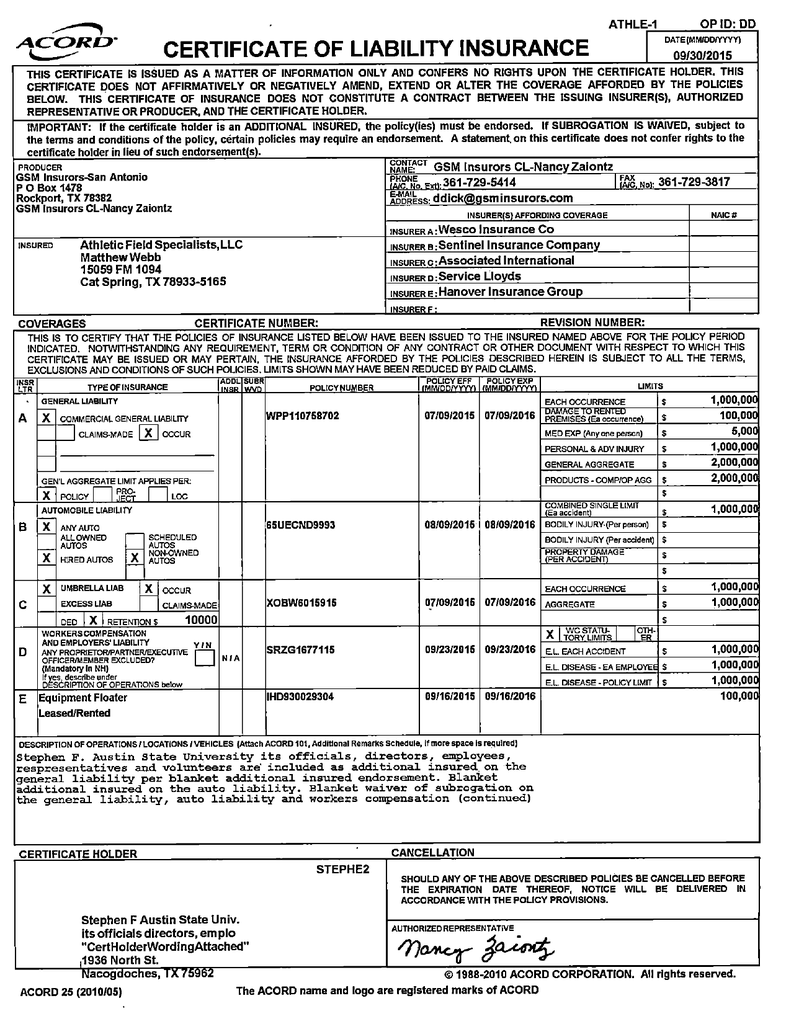

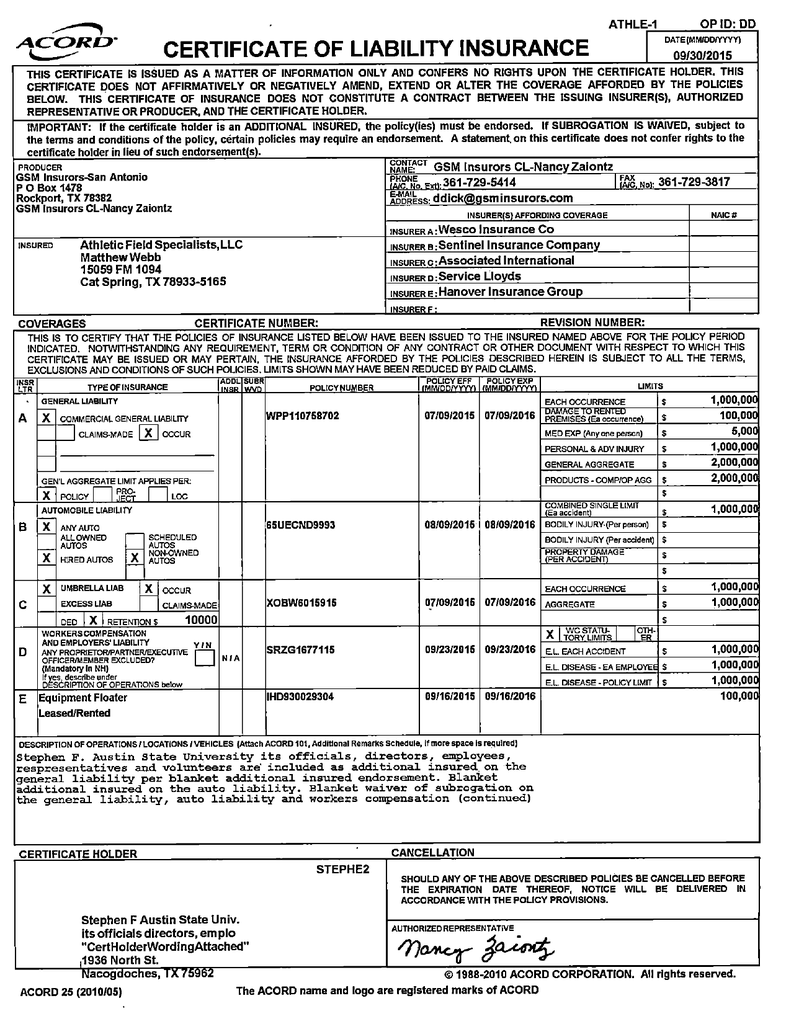

Blanket Additional Insured And Notice Of Cancellation From wallsites.co

Blanket Additional Insured And Notice Of Cancellation From wallsites.co

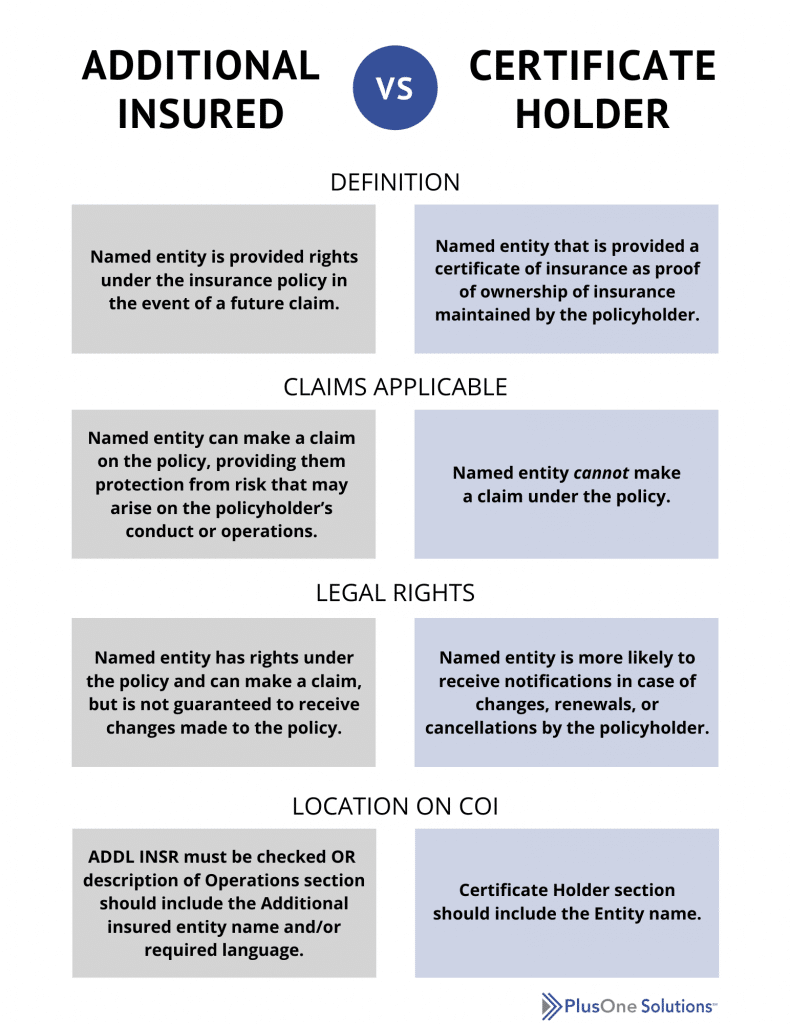

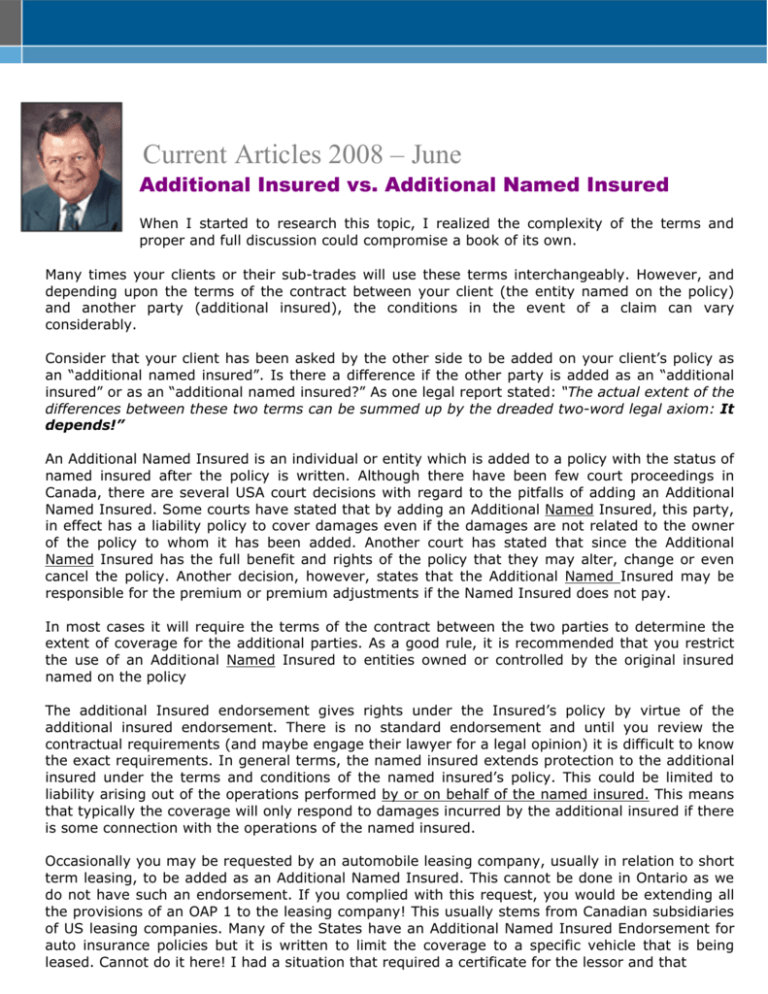

What is an additional insured? By naming the indemnitee as an. (2) a person or organization added to a policy after the policy is written with the status of named insured. In most cases it’s to the advantage of both parties to be designated as an additional insured, as long as both parties are aligned regarding the amount of coverage being sought. An additional insured is an entity who is not the policyholder, but is entitled to some of the benefits of the policy because of a direct business relationship to the named insured. If that seems tricky, you can think of it like this.

Additional insured — a person or organization not automatically included as an insured under an insurance policy who is included or added as an insured under the policy at the request of the named insured.

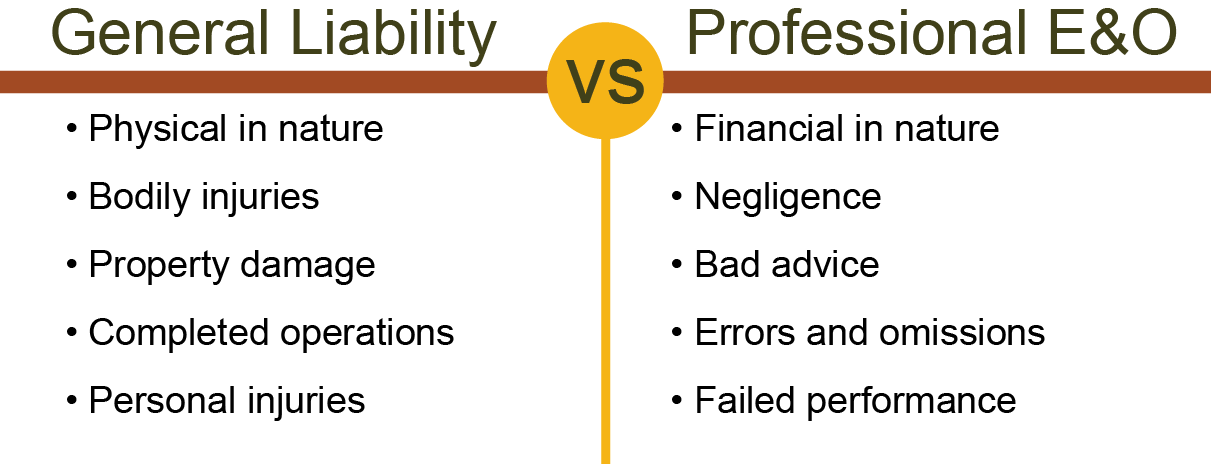

What is the difference between designated insured and additional insured? Designated insured endorsement — an optional endorsement available for commercial auto policies that allows for listing entities who ask to be named insureds for vicarious liability under the policy. An additional insured is an entity who is not the policyholder, but is entitled to some of the benefits of the policy because of a direct business relationship to the named insured. If that seems tricky, you can think of it like this. An additional insured in insurance is used to refer to a third party (individual or entity) that is added to a particular insurance policy through an endorsement. An additional insured is a party that does not qualify as an insured under the standard gl.

Source: plusonesolutions.net

Source: plusonesolutions.net

By naming the indemnitee as an. Designated insured endorsement — an optional endorsement available for commercial auto policies that allows for listing entities who ask to be named insureds for vicarious liability under the policy. In most cases it’s to the advantage of both parties to be designated as an additional insured, as long as both parties are aligned regarding the amount of coverage being sought. What is vicarious liability in insurance? • the additional insured is a person or party that only holds liability interest in the asset that is being insured.

Source: differencebetween.net

Source: differencebetween.net

(additional insured afforded coverage for liability due to their fault even where an indemnity agreement is invalid). More specifically, for them, only incidents that are related to the primary policy holder’s work and responsibilities are covered. An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. Many businesses cover other parties under their liability policies to fulfill contractual obligations. A named insured is entitled to 100% of the benefits and coverage provided by the policy.

Source: parkerlawfirm.com

Irmi defines “additional named insured” as: When the original policyholder requests that another company be added to their insurance policy,. Pรกgina 2 what is the difference between designated insured and additional insured? They must be added by an endorsement that changes the “who is an insured” section of the policy. For example, some situations may require an endorsement that protects the additional insured only when work is being performed, while others also need coverage for completed operations.

Source: keydifferences.com

Source: keydifferences.com

An additional insured is someone who is not the owner of the policy but who, under certain circumstances, may be entitled to some of the benefits and. In most cases it’s to the advantage of both parties to be designated as an additional insured, as long as both parties are aligned regarding the amount of coverage being sought. An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. More specifically, for them, only incidents that are related to the primary policy holder’s work and responsibilities are covered. Each person or organization indicated above is an insured for liability coverage, but only to the extent that person or organization qualifies as an insured under the who is insured provision contained in section ii of the coverage form.

Source: pdffiller.com

Source: pdffiller.com

What is the difference between designated insured and additional insured? More specifically, for them, only incidents that are related to the primary policy holder’s work and responsibilities are covered. What is vicarious liability in insurance? An additional insured in insurance is used to refer to a third party (individual or entity) that is added to a particular insurance policy through an endorsement. Main differences between the two a named insured is always covered, while an additional insured has certain limitations.

Source: enriquecimientodelosmasjovenes.blogspot.com

Source: enriquecimientodelosmasjovenes.blogspot.com

•an additional insured is person or organization that is protected as an insured by liability insurance, usually someone else’s insurance; •an additional insured is person or organization that is protected as an insured by liability insurance, usually someone else’s insurance; This means an additional insured party holds partial ownership of (or has an interest in) what’s being insured. An additional insured is a party that does not qualify as an insured under the standard gl. An additional insured is provided coverage under the named insured’s policy by virtue of an additional insured endorsement.

Source: studylib.net

Source: studylib.net

An additional insured in insurance is used to refer to a third party (individual or entity) that is added to a particular insurance policy through an endorsement. What is vicarious liability in insurance? An additional insured in insurance is used to refer to a third party (individual or entity) that is added to a particular insurance policy through an endorsement. An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. Designated insured endorsement — an optional endorsement available for commercial auto policies that allows for listing entities who ask to be named insureds for vicarious liability under the policy.

Source: thebalancesmb.com

Source: thebalancesmb.com

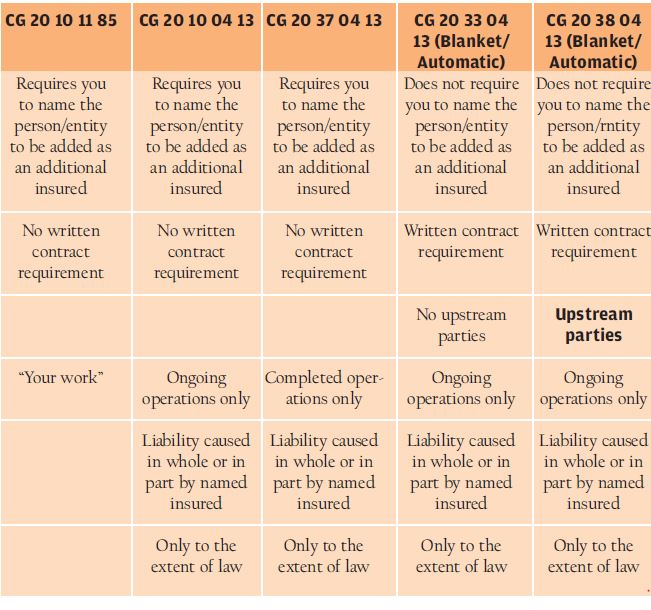

There are several different types of additional insured endorsements, so be very clear about your relationship to the person requesting additional insured status. Additional insured endorsements limit coverage to a specific relationship or set of circumstances. Additional insured — a person or organization not automatically included as an insured under an insurance policy who is included or added as an insured under the policy at the request of the named insured. An additional insured is provided coverage under the named insured’s policy by virtue of an additional insured endorsement. An additional insured is a party added to a liability policy at the request of the named insured.

Source: insurancejournal.com

Source: insurancejournal.com

By naming the indemnitee as an. Additional insureds are additional entities listed on a named insured’s policy. The main contractor is named as an “additional insured” on the certificate of insurance and is actually given coverage, and has rights. Irmi defines “additional named insured” as: What is a designated additional insured?

Source: thebalancesmb.com

Source: thebalancesmb.com

More specifically, for them, only incidents that are related to the primary policy holder’s work and responsibilities are covered. By naming the indemnitee as an. The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. (2) a person or organization added to a policy after the policy is written with the status of named insured. What’s the difference between designated insured and additional insured?

Source: advancedontrade.com

Source: advancedontrade.com

Links for irmi online subscribers only: Additional insured endorsements limit coverage to a specific relationship or set of circumstances. Links for irmi online subscribers only: The policy itself should further define the extent of the roles of the additional insureds. An additional insured is provided coverage under the named insured’s policy by virtue of an additional insured endorsement.

Source: pdffiller.com

Source: pdffiller.com

For example, a commercial property owner decides to sell his or her building, but the buyer cannot secure a standard mortgage. This means an additional insured party holds partial ownership of (or has an interest in) what’s being insured. Additional insured endorsements limit coverage to a specific relationship or set of circumstances. The scope of coverage provided to an additional insured depends on the language in the endorsement. The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage.

Source: ca-20-48-02-99.pdffiller.com

Source: ca-20-48-02-99.pdffiller.com

They must be added by an endorsement that changes the “who is an insured” section of the policy. When the original policyholder requests that another company be added to their insurance policy,. A named insured is entitled to 100% of the benefits and coverage provided by the policy. Designated insured endorsement — an optional endorsement available for commercial auto policies that allows for listing entities who ask to be named insureds for vicarious liability under the policy. Each person or organization indicated above is an insured for liability coverage, but only to the extent that person or organization qualifies as an insured under the who is insured provision contained in section ii of the coverage form.

Source: templateroller.com

Source: templateroller.com

An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. What is an additional insured? We’ve discussed the topic of additional insured many times in the past, but as a refresher, let’s first review the difference between being an additional insured and a named insured: An additional insured is different from an additional named insured, who is a person or organization listed as a named insured on the policy and carries the same rights and responsibilities as the first named insured. Owner entitled to coverage under engineer’s cgl policy when listed as additional insured, even though indemnity agreement did not provide for indemnity of the loss.

Source: blog.tsibinc.com

The endorsement in question is titled designated insured endorsement, and reads as follows: Additional insured — a person or organization not automatically included as an insured under an insurance policy who is included or added as an insured under the policy at the request of the named insured. By naming the indemnitee as an. The main contractor is named as an “additional insured” on the certificate of insurance and is actually given coverage, and has rights. In order to add an additional insured, the additional entity must contractually agree to indemnify the named insured.

Source: advancedontrade.com

Source: advancedontrade.com

An additional insured is provided coverage under the named insured’s policy by virtue of an additional insured endorsement. Additional insureds are usually covered via endorsements. Why is it important to get it right? What is the difference between designated insured and additional insured? For example, some situations may require an endorsement that protects the additional insured only when work is being performed, while others also need coverage for completed operations.

Source: generalliabilityshop.com

Source: generalliabilityshop.com

(2) a person or organization added to a policy after the policy is written with the status of named insured. In order to add an additional insured, the additional entity must contractually agree to indemnify the named insured. A named insured is entitled to 100% of the benefits and coverage provided by the policy. What is a designated additional insured? An additional insured is a party added to a liability policy at the request of the named insured.

Source: wallsites.co

Source: wallsites.co

(additional insured afforded coverage for liability due to their fault even where an indemnity agreement is invalid). An additional insured is an entity who is not the policyholder, but is entitled to some of the benefits of the policy because of a direct business relationship to the named insured. The policy itself should further define the extent of the roles of the additional insureds. But the car thing i have tried to get rid of it but i owe more. A named insured is entitled to 100% of the benefits and coverage provided by the policy.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title legal difference between designated insured and additional insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.