Level funded insurance information

Home » Trend » Level funded insurance informationYour Level funded insurance images are ready in this website. Level funded insurance are a topic that is being searched for and liked by netizens now. You can Get the Level funded insurance files here. Find and Download all royalty-free photos.

If you’re looking for level funded insurance pictures information related to the level funded insurance interest, you have visit the right blog. Our website frequently provides you with hints for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Level Funded Insurance. Level funding is simply a financial structure inside the health insurance policy. The company doesn’t rely on an insurance company to assume risk and. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. This is a conservative approach that gives employers the ability to win if they have a good claims year.

LevelFunded Insurance Plans H Group Benefits From hgroupbenefits.com

LevelFunded Insurance Plans H Group Benefits From hgroupbenefits.com

Administrative costs — these costs are fixed and charged per employee. The company doesn’t rely on an insurance company to assume risk and. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. This is a conservative approach that gives employers the ability to win if they have a good claims year. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. They will remain the same regardless of claims.

With level funding insurance, employers pay a set amount each month to a carrier.

Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. This is a conservative approach that gives employers the ability to win if they have a good claims year. Level funding is simply a financial structure inside the health insurance policy. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation.

Source: ixshealth.com

Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. Annually in group health coverage.

Source: bradenbenefits.com

Source: bradenbenefits.com

Level funded plans typically include stop loss insurance automatically. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. Annually in group health coverage. In the simplest of terms, the total monthly premium is divided into three buckets. With level funding insurance, employers pay a set amount each month to a carrier.

Source: frf.memberbenefits.com

Source: frf.memberbenefits.com

In the simplest of terms, the total monthly premium is divided into three buckets. In the simplest of terms, the total monthly premium is divided into three buckets. The company doesn’t rely on an insurance company to assume risk and. So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group.

Source: bradenbenefits.com

Source: bradenbenefits.com

Level funding is simply a financial structure inside the health insurance policy. Administrative costs — these costs are fixed and charged per employee. They will remain the same regardless of claims. So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. In a level funded health insurance plan, you’ll still pay a premium to an insurance company, but you’ll assume more risk.

Source: youtube.com

Source: youtube.com

Annually in group health coverage. In a level funded health insurance plan, you’ll still pay a premium to an insurance company, but you’ll assume more risk. This is a conservative approach that gives employers the ability to win if they have a good claims year. They will remain the same regardless of claims. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage.

Source: hgroupbenefits.com

Source: hgroupbenefits.com

In the simplest of terms, the total monthly premium is divided into three buckets. Level funded plans typically include stop loss insurance automatically. Administrative costs — these costs are fixed and charged per employee. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. Annually in group health coverage.

Source: youtube.com

Source: youtube.com

Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. With level funding insurance, employers pay a set amount each month to a carrier. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. The company doesn’t rely on an insurance company to assume risk and. Annually in group health coverage.

Source: ixshealth.com

Source: ixshealth.com

The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. Level funding is simply a financial structure inside the health insurance policy. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. Level funded plans typically include stop loss insurance automatically. The company doesn’t rely on an insurance company to assume risk and.

Source: mmains.net

Source: mmains.net

In the simplest of terms, the total monthly premium is divided into three buckets. With level funding insurance, employers pay a set amount each month to a carrier. Level funding is simply a financial structure inside the health insurance policy. The company doesn’t rely on an insurance company to assume risk and. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group.

Source: youtube.com

Source: youtube.com

So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. Level funded plans typically include stop loss insurance automatically.

Source: groupbenefitsexperts.com

Source: groupbenefitsexperts.com

Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims.

Source: precisionwellness.io

Source: precisionwellness.io

So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. With level funding insurance, employers pay a set amount each month to a carrier. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. In a level funded health insurance plan, you’ll still pay a premium to an insurance company, but you’ll assume more risk. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group.

Source: bradenbenefits.com

Source: bradenbenefits.com

Level funding is simply a financial structure inside the health insurance policy. Annually in group health coverage. So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. Level funded plans typically include stop loss insurance automatically.

Source: washingtontechnology.org

Source: washingtontechnology.org

In the simplest of terms, the total monthly premium is divided into three buckets. So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. This is a conservative approach that gives employers the ability to win if they have a good claims year. Administrative costs — these costs are fixed and charged per employee.

Source: youtube.com

Source: youtube.com

The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims. With level funding insurance, employers pay a set amount each month to a carrier. Level funding is simply a financial structure inside the health insurance policy. The first bucket, the claims fund, is an amount set aside to cover expected claims expense for the group. They will remain the same regardless of claims.

Source: pfichicago.com

Source: pfichicago.com

This is a conservative approach that gives employers the ability to win if they have a good claims year. In a level funded health insurance plan, you’ll still pay a premium to an insurance company, but you’ll assume more risk. This is a conservative approach that gives employers the ability to win if they have a good claims year. Level funded plans typically include stop loss insurance automatically. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims.

Source: precisionwellness.io

Source: precisionwellness.io

So you won’t have to pay more for medical claims throughout the year or at the end of your plan year, even if you have high medical claims costs. Level funding is simply a financial structure inside the health insurance policy. The company doesn’t rely on an insurance company to assume risk and. Your company is collecting premiums to fund the expected claims while having stop loss insurance in place should a claim exceed expectation. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy.

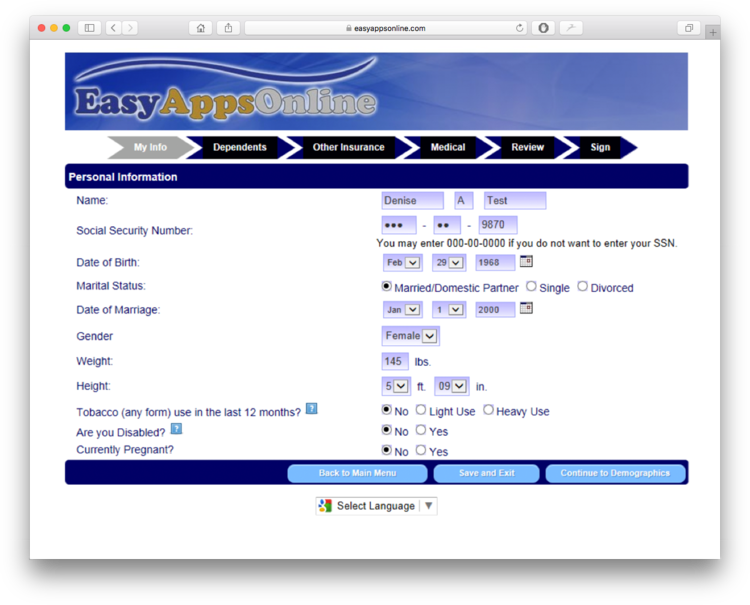

Source: easyappsonline.com

Source: easyappsonline.com

Level funded plans typically include stop loss insurance automatically. Level funded plans provide additional protection from large catastrophic medical claims with a stop loss insurance policy. The company doesn’t rely on an insurance company to assume risk and. Costs deducted from the account can include claims, administrative expenses, and premiums for stop loss insurance coverage. The amount it pays into the fund is based on an estimate of how much money the employer is likely to have to pay out in claims.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title level funded insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.