Level premium life insurance Idea

Home » Trend » Level premium life insurance IdeaYour Level premium life insurance images are ready. Level premium life insurance are a topic that is being searched for and liked by netizens today. You can Download the Level premium life insurance files here. Find and Download all free images.

If you’re looking for level premium life insurance images information linked to the level premium life insurance keyword, you have pay a visit to the right site. Our website always provides you with hints for viewing the highest quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

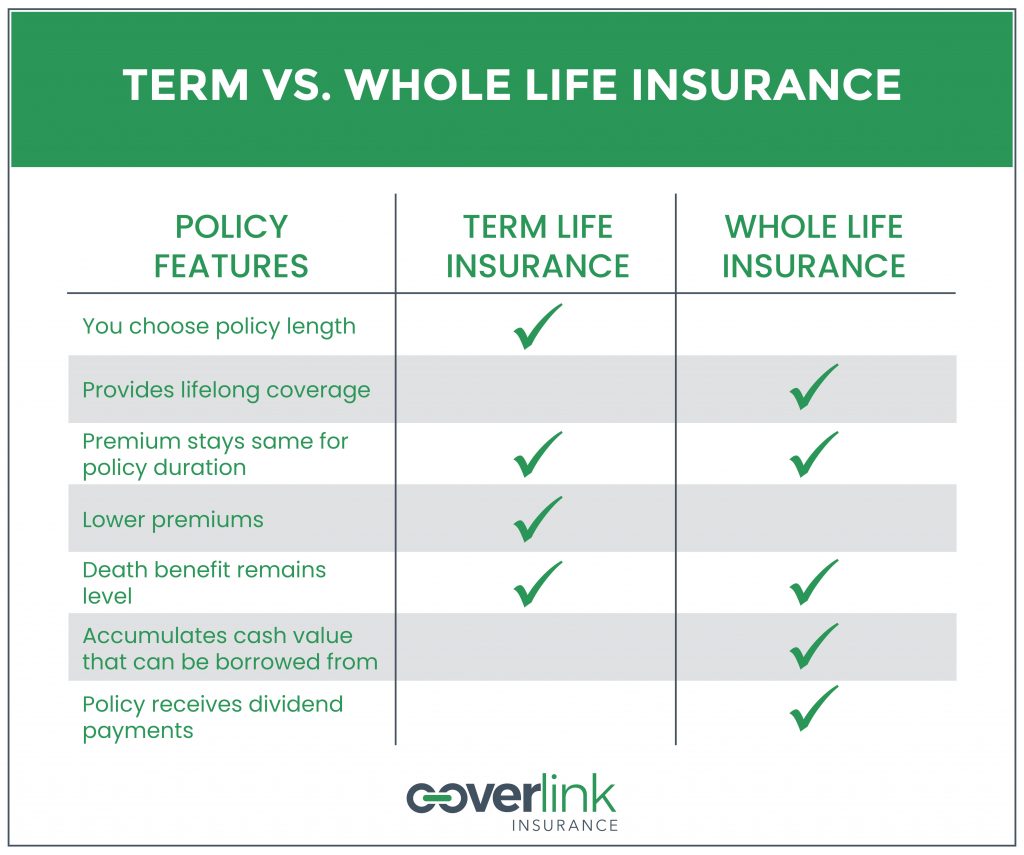

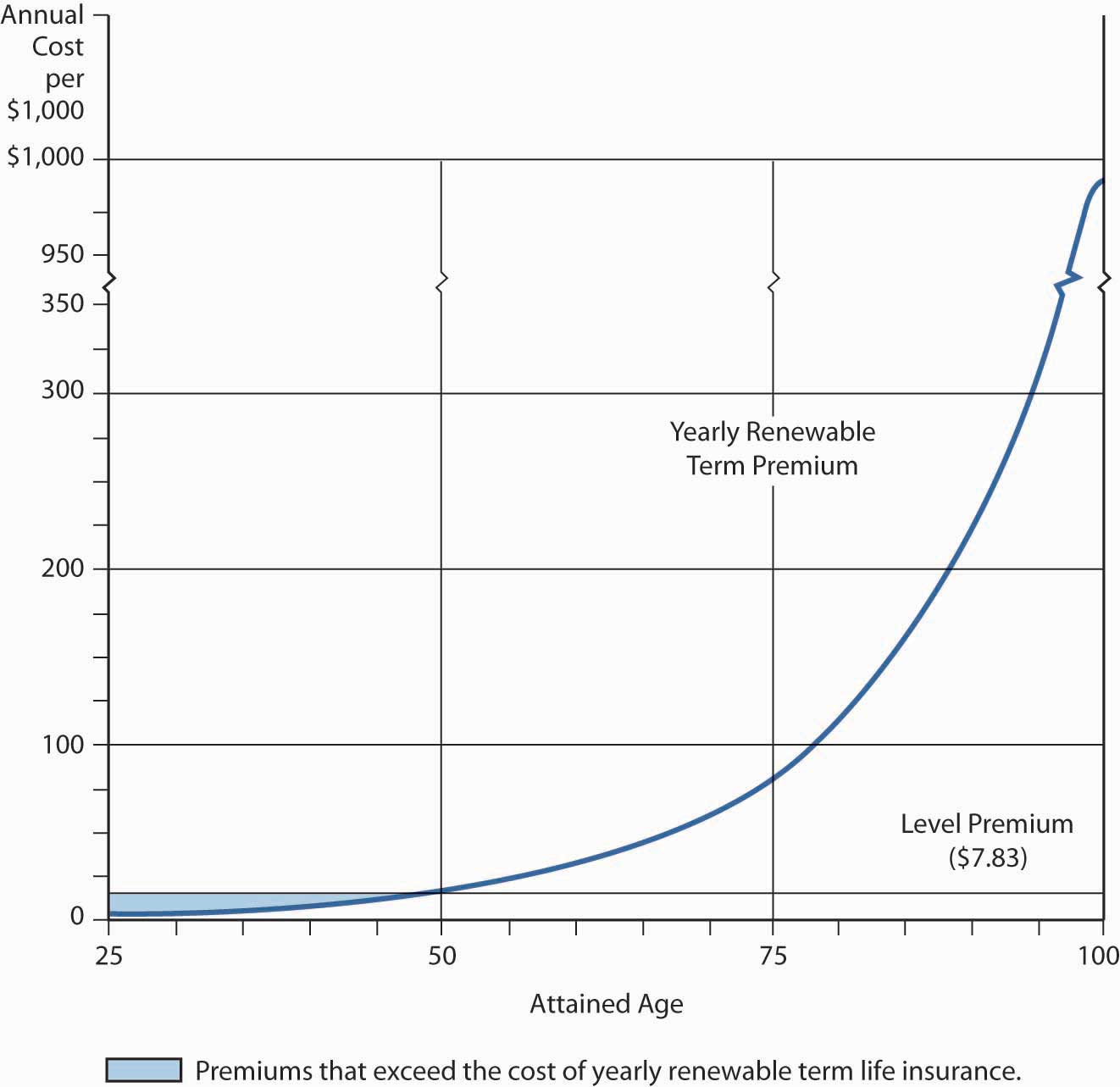

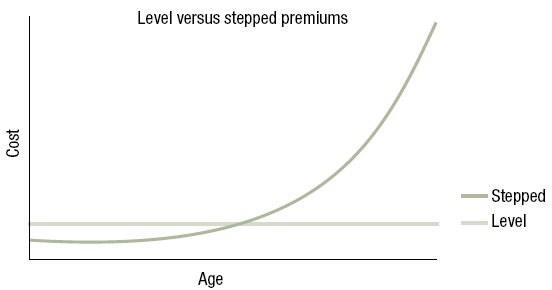

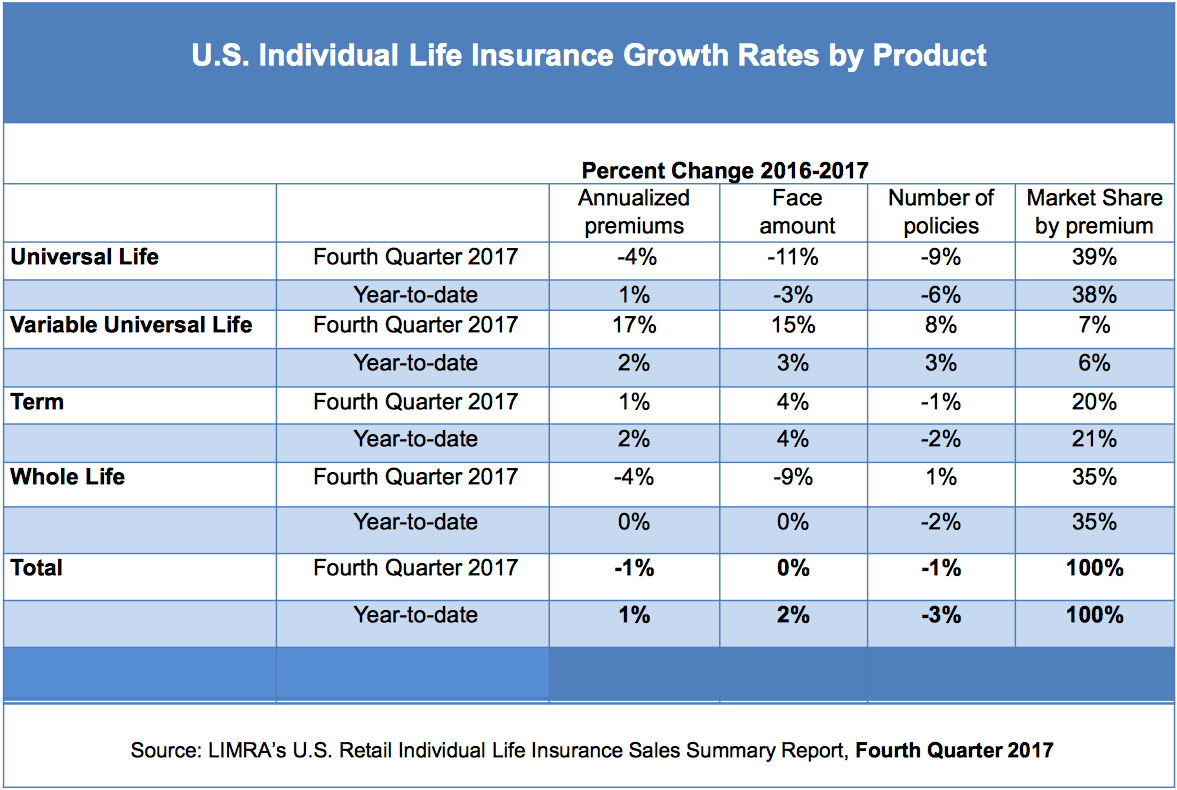

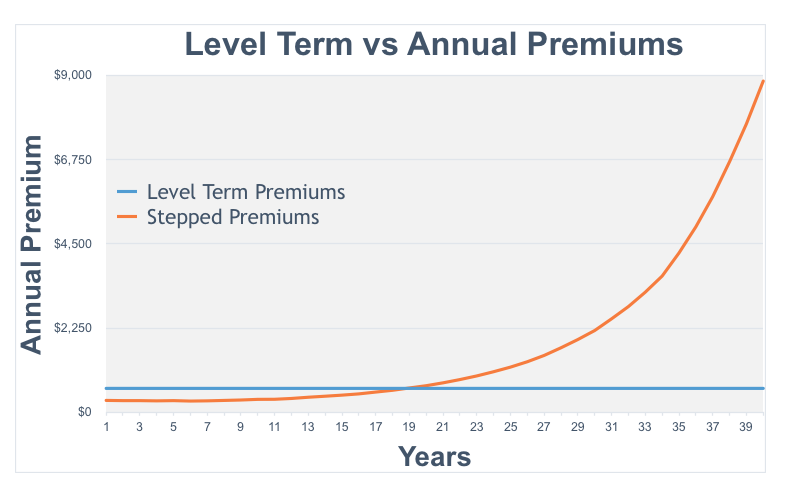

Level Premium Life Insurance. In reality, level premium insurance helps families to focus on financial protection at a lower cost. The main reason is that level premium life insurance starts off at a higher premium but does not increase each year. A level premium policy is a life insurance policy that keeps the same premium rate for the duration of the entire policy. It is sold in terms (policy period) of typically five years to thirty years once the policy is issued, the premium cannot change during the policy term once the policy is issued, the death benefit remains the same during the policy term

How Can Whole Life Insurance Premiums Remain Level? Bank From bankonyourself.com

How Can Whole Life Insurance Premiums Remain Level? Bank From bankonyourself.com

With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price. Advertisement insuranceopedia explains level premium Level premium life insurance is the better financial choice over the longer term. Level premium live insurance will save you thousands of dollars over the longer term. The marathon petroleum level premium life insurance plan has no savings The term level premium basically means that you are going to have the same premium payment for the entire life of the policy.

Level premium whole life is the most affordable whole life option that has the potential to pay dividends.

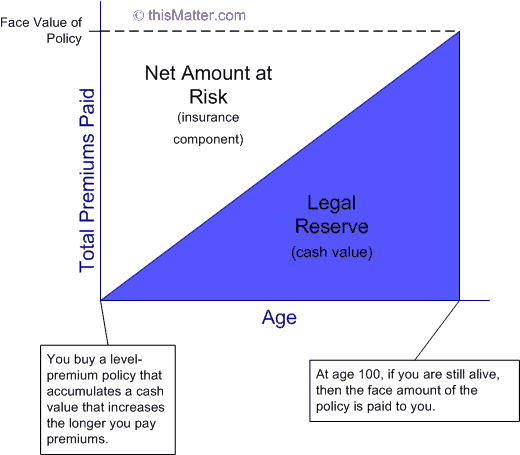

This plan is closed to new participants. Level premium whole life policy, level premium term life insurance, universal life insurance premiums increase, what is an insurance premium, single premium universal life insurance, universal life insurance premium calculator, universal life insurance premium chart, life insurance level premium tempe, scottsdale, chandler, gilbert home purchase the passenger or. Guaranteed cash value your policy will have a guaranteed cash value that grows over time. It differs from other types of life insurance policies, which have premiums that rise over the years. They offer the only true no. The premium amount is determined by a number of variables, including your age,.

Source: bankonyourself.com

Source: bankonyourself.com

Level premiums will cost more to begin with, but the premium you are charged will be based on your age at the time you took out that cover. With a level premium, you pay the same amount for the life of the policy. The premium amount is determined by a number of variables, including your age,. Level premiums will cost more to begin with, but the premium you are charged will be based on your age at the time you took out that cover. Advertisement insuranceopedia explains level premium

Source: circlecitysnark.blogspot.com

Source: circlecitysnark.blogspot.com

Advertisement insuranceopedia explains level premium The premium for a life insurance policy is calculated using illustration software provided by the insurance company. Level premiums will cost more to begin with, but the premium you are charged will be based on your age at the time you took out that cover. They offer the only true no. With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price.

Source: sproutt.com

Source: sproutt.com

Following the formula previously given, this yields a present value for the temporary life annuity due of $7.88. It is sold in terms (policy period) of typically five years to thirty years once the policy is issued, the premium cannot change during the policy term once the policy is issued, the death benefit remains the same during the policy term With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price. Terms are usually 10, 15, 20, and 30. The premium amount is determined by a number of variables, including your age,.

Source: revisi.net

Source: revisi.net

The premium for a life insurance policy is calculated using illustration software provided by the insurance company. The main reason is that level premium life insurance starts off at a higher premium but does not increase each year. Terms are usually 10, 15, 20, and 30. If you plan on keeping your life insurance for more than 10 years then Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”).

Source: healthmarkets.com

Source: healthmarkets.com

Premium payments often start at a higher level than policies with similar coverage but are ultimately worth more than. Terms are usually 10, 15, 20, and 30. Choose the coverage amount and length of coverage that’s right for. Bestow is the one of the newest entries into the field of level term life insurance. With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price.

Source: rethinkgroup.co.nz

Source: rethinkgroup.co.nz

In reality, level premium insurance helps families to focus on financial protection at a lower cost. In reality, level premium insurance helps families to focus on financial protection at a lower cost. Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”). Best level premium life insurance companies bestow. Choose the coverage amount and length of coverage that’s right for.

Source: npa1.org

Source: npa1.org

Best level premium life insurance companies bestow. Level premium whole life is the most affordable whole life option that has the potential to pay dividends. Premium payments often start at a higher level than policies with similar coverage but are ultimately worth more than. Level premium whole life policy, level premium term life insurance, universal life insurance premiums increase, what is an insurance premium, single premium universal life insurance, universal life insurance premium calculator, universal life insurance premium chart, life insurance level premium tempe, scottsdale, chandler, gilbert home purchase the passenger or. Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”).

Source: researchgate.net

Source: researchgate.net

Level term policies have the following distinctions from all other types of life insurance: The term level premium basically means that you are going to have the same premium payment for the entire life of the policy. Bestow is the one of the newest entries into the field of level term life insurance. With a level premium, you pay the same amount for the life of the policy. The marathon petroleum level premium life insurance plan has no savings

Source: saylordotorg.github.io

Source: saylordotorg.github.io

What is a level premium? Level premium whole life is the most affordable whole life option that has the potential to pay dividends. After 20 years, the level premium pattern makes out 12% of this client’s income, versus 41% in the case of the 10% compulsory premium pattern. Level premium life insurance is the better financial choice over the longer term. Premium payments often start at a higher level than policies with similar coverage but are ultimately worth more than.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

This plan is closed to new participants. Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”). Advertisement insuranceopedia explains level premium Choose the coverage amount and length of coverage that’s right for. Level premium life insurance is the better financial choice over the longer term.

Source: insurancebase.co.nz

Source: insurancebase.co.nz

With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price. Level premium life insurance is the better financial choice over the longer term. Advertisement insuranceopedia explains level premium Level term policies have the following distinctions from all other types of life insurance: Life insurance is a means of providing a measure of financial protection to your beneficiaries in the event of your death.

Source: thismatter.com

Source: thismatter.com

The premium for a life insurance policy is calculated using illustration software provided by the insurance company. The marathon petroleum level premium life insurance plan has no savings Advertisement insuranceopedia explains level premium If you plan on keeping your life insurance for more than 10 years then In reality, level premium insurance helps families to focus on financial protection at a lower cost.

Source: npa1.org

Source: npa1.org

Guaranteed protection if you choose, your whole life coverage will last your entire lifetime and pay a death benefit when you pass away. This plan is closed to new participants. Choose the coverage amount and length of coverage that’s right for. The main reason is that level premium life insurance starts off at a higher premium but does not increase each year. Life insurance is a means of providing a measure of financial protection to your beneficiaries in the event of your death.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Guaranteed protection if you choose, your whole life coverage will last your entire lifetime and pay a death benefit when you pass away. The premium for a life insurance policy is calculated using illustration software provided by the insurance company. Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”). A level premium is a type of insurance premium that is regularly associated with term life insurance. Level premiums will cost more to begin with, but the premium you are charged will be based on your age at the time you took out that cover.

Source: harman.com.au

Source: harman.com.au

Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”). Bestow is the one of the newest entries into the field of level term life insurance. Guaranteed protection if you choose, your whole life coverage will last your entire lifetime and pay a death benefit when you pass away. Guaranteed cash value your policy will have a guaranteed cash value that grows over time. With a level premium, you pay the same amount for the life of the policy.

Source: insurance-forums.com

Source: insurance-forums.com

Features of the marathon oil company level premium plan as of january 1, 2010 (“predecessor plan”). Premiums are typically guaranteed and fixed for the specified term. The premium for a life insurance policy is calculated using illustration software provided by the insurance company. What is a level premium? With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price.

Source: insurancebase.co.nz

Source: insurancebase.co.nz

Choose the coverage amount and length of coverage that’s right for. They offer the only true no. Level premium life insurance is the better financial choice over the longer term. After 20 years, the level premium pattern makes out 12% of this client’s income, versus 41% in the case of the 10% compulsory premium pattern. Following the formula previously given, this yields a present value for the temporary life annuity due of $7.88.

Source: aafpins.com

Source: aafpins.com

With a level premium, you keep your rate for the length of your policy, but with a variable payment, your life insurance can hike with time, illness, age, and your lifestyle, potentially costing you much more than a slightly higher fixed price. The main reason is that level premium life insurance starts off at a higher premium but does not increase each year. What is a level premium? They offer the only true no. With a level premium, you pay the same amount for the life of the policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title level premium life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.