Life and health insurance policies are what kind of contracts Idea

Home » Trend » Life and health insurance policies are what kind of contracts IdeaYour Life and health insurance policies are what kind of contracts images are ready in this website. Life and health insurance policies are what kind of contracts are a topic that is being searched for and liked by netizens today. You can Find and Download the Life and health insurance policies are what kind of contracts files here. Get all free photos and vectors.

If you’re looking for life and health insurance policies are what kind of contracts images information linked to the life and health insurance policies are what kind of contracts topic, you have come to the ideal site. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Life And Health Insurance Policies Are What Kind Of Contracts. Without insurable interest, a life insurance policy would be considered a wagering contract. The major types of life insurance contracts are term, whole life, and universal life, but innumerable combinations of these basic types are sold. If an individual acquires a life insurance policy insuring her life for $500,000, that is the amount payable at death. A valued contract pays a stated sum regardless of the actual loss incurred.

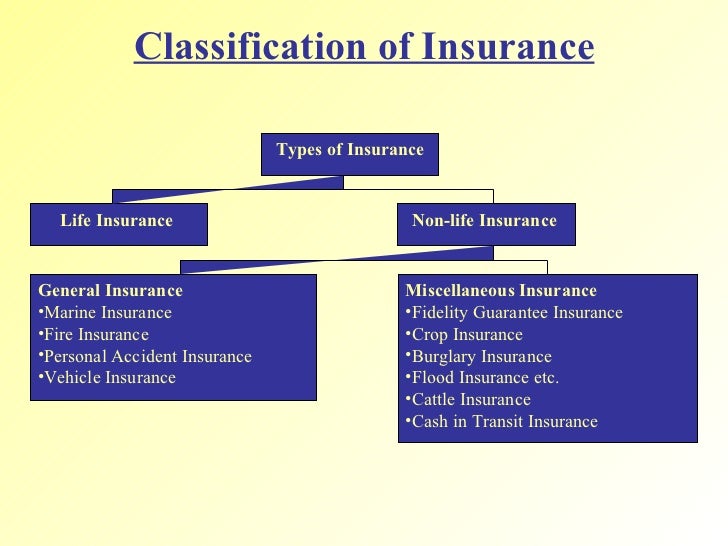

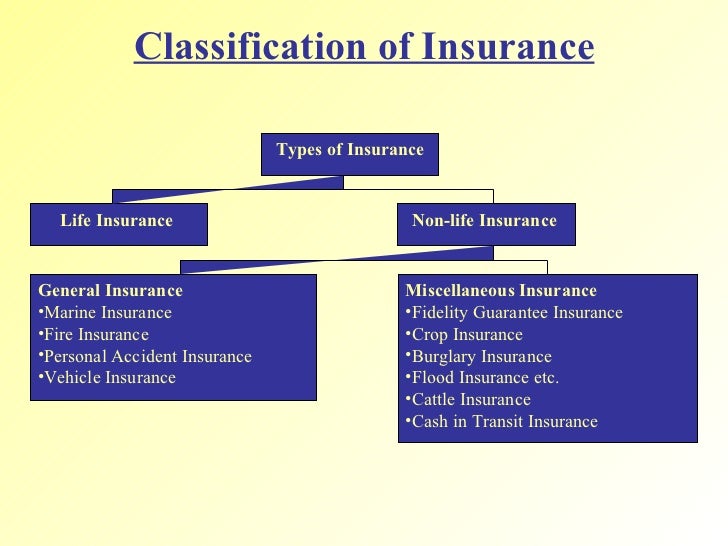

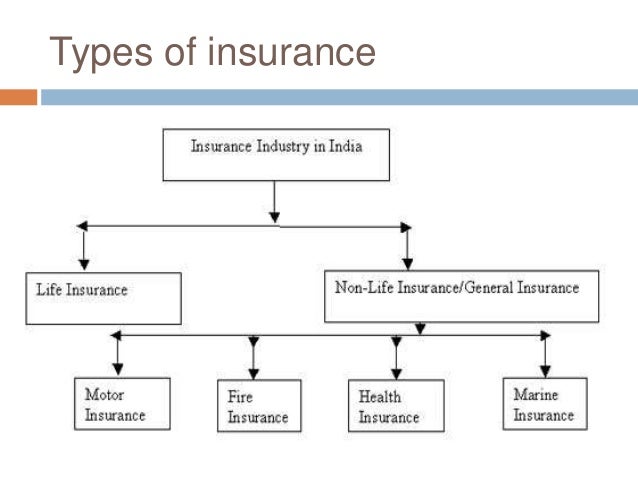

Working of insurance From slideshare.net

Working of insurance From slideshare.net

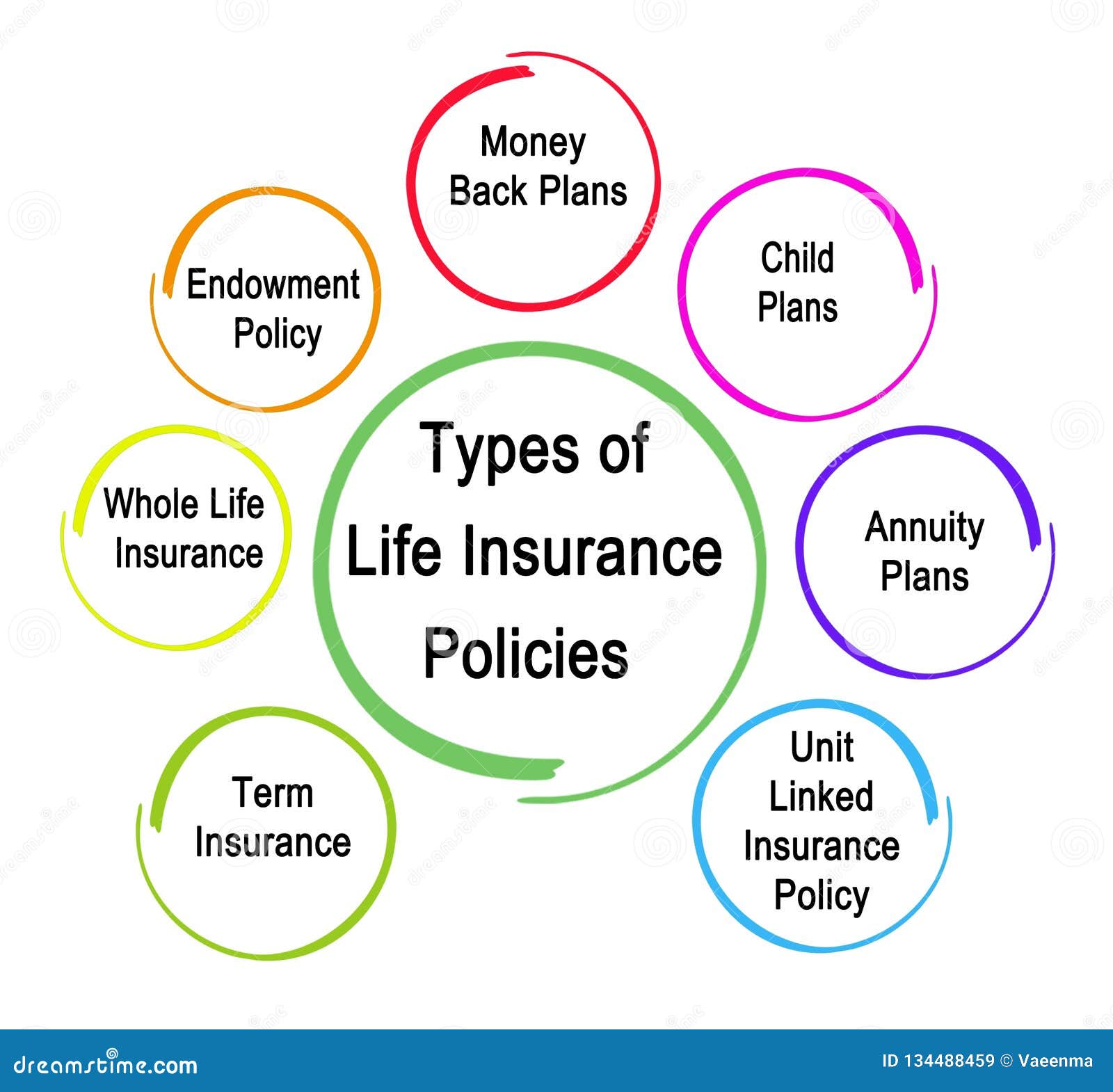

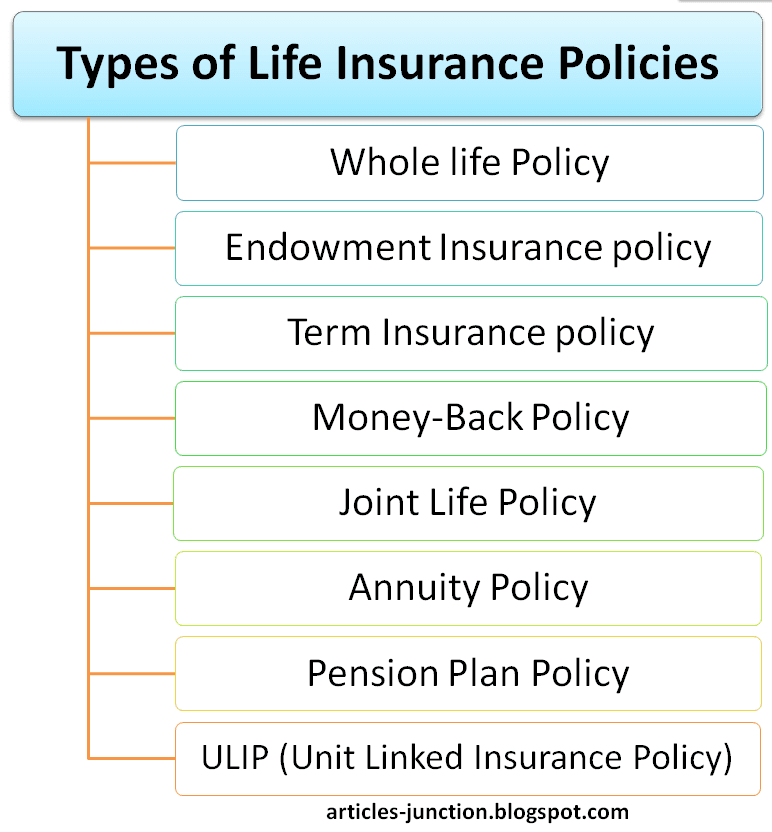

In this blog, we will tell you about different kinds of life insurance policies and their benefits so that you can make an informed decision while getting a life insurance policy. The contract between the employer and the health care professional, whether physician or a hospital, spells out the kind of services to be provided. As a fiduciary, the agent has an obligation to act in the best interest of the insured. In fire insurance, the insurable interest must exist from the date of the proposal to the date of completion of the contract whether by death or by the expiry of the term. An insurance contract is an agreement with your provider that you will pay premiums for coverage in exchange for guaranteed payment in the event of a loss. In contrast, in case of a general insurance, payouts are made in an unexpected loss such as an accident or a theft or a sudden liability.

In this blog, we will tell you about different kinds of life insurance policies and their benefits so that you can make an informed decision while getting a life insurance policy.

Depending on the contract, other events such as terminal illness or critical illness can. In life insurances, insurable interest must exist at the time of proposal. If one party to a contract might receive considerably more in value than he or. Although e was married with three children at the time of death, the primary beneficiary is still f. Term of contract and payment. But, before that let’s understand what a life insurance policy is.

Source: gabankruptcylawyersnetwork.com

Source: gabankruptcylawyersnetwork.com

If one party to a contract might receive considerably more in value than he or. Insurance companies can also contract with ppos to offer services to insureds. The most common of these features are listed here: Protection under these contracts expires at the end of the stated period, with no cash value remaining. Buying life or health insurance is a smart decision.

Source: wisegeek.com

Source: wisegeek.com

Unlike, term plans, which are for a specified term. Types of insurance consumers will encounter most often are auto insurance, homeowners insurance, umbrella insurance and life insurance. A contract of adhesion is prepared by one of the parties (insurer) and accepted or rejected by the other party (insured). Insurance solutions designed for your future. Term insurance contracts, issued for specified periods of years, are the simplest.

Source: pinterest.com

Source: pinterest.com

The agent must be able to explain the important features of these policies to the insured. There are essentially two kinds of heath insurance: There are only two main policy categories to choose from: This is the reason that the insured property, insurance policy, or policy. The most common of these features are listed here:

Source: insureye.com

Source: insureye.com

The agent must be knowledgeable about the features and provisions of various insurance policies and the use of these insurance contracts. The major types of life insurance contracts are term, whole life, and universal life, but innumerable combinations of these basic types are sold. A life insurance distribution system available to residents of wisconsin. Depending on the contract, other events such as terminal illness or critical illness can. There are only two main policy categories to choose from:

Source: goldencare.com

Source: goldencare.com

Each takes out a $500,000 life insurance policy on the other, naming himself as primary beneficiary. Protection under these contracts expires at the end of the stated period, with no cash value remaining. Buying life or health insurance is a smart decision. There are only two main policy categories to choose from: What kinds of health insurance are there?

Source: dreamstime.com

Source: dreamstime.com

Life & health insurance information. Term life insurance and permanent life insurance.term life insurance (the most popular type of life insurance) lasts for a specific amount of time, while whole life insurance (the most popular. Performance is conditioned upon a future occurrence. If an individual acquires a life insurance policy insuring her life for $500,000, that is the amount payable at death. A whole life insurance policy covers the life assured for whole life, or in some cases, up to the age of 100 years.

Source: articles-junction.blogspot.com

Source: articles-junction.blogspot.com

The elements of an insurance contract are the standard conditions that must be satisfied or agreed upon by both parties of the contract (the insured and the insurance company). Though all contracts share fundamental concepts and basic elements, insurance contracts typically possess a number of characteristics not widely found in other types of contractual agreements. Performance is conditioned upon a future occurrence. Shopping for life insurance can seem overwhelming, but deciding which type of policy you need is simple. Without insurable interest, a life insurance policy would be considered a wagering contract.

Source: iedunote.com

Source: iedunote.com

Life insurance gives a payout in case the policyholder dies. Life insurance is simply a contract between the policyholder and the insurance company. What kind of life insurance policy issued by a mutual insurer provides a return of divisible surplus. It shows you recognize how important it is to protect everything in your life that you value. E and f eventually terminate their business, and four months later e dies.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Insurance policies are not drawn up through negotiations, and an insured has little to say about its provisions. Types of insurance consumers will encounter most often are auto insurance, homeowners insurance, umbrella insurance and life insurance. The correct answer is insurable interest. Shopping for life insurance can seem overwhelming, but deciding which type of policy you need is simple. Unlike, term plans, which are for a specified term.

Source: vinzite.com

Source: vinzite.com

The major types of life insurance contracts are term, whole life, and universal life, but innumerable combinations of these basic types are sold. Endowment life insurance plans provide you with a dual combination of protection and savings. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law. Depending on the contract, other events such as terminal illness or critical illness can. Protection under these contracts expires at the end of the stated period, with no cash value remaining.

Source: rolandholaw.com

Source: rolandholaw.com

The agent must be knowledgeable about the features and provisions of various insurance policies and the use of these insurance contracts. But, before that let’s understand what a life insurance policy is. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). Shopping for life insurance can seem overwhelming, but deciding which type of policy you need is simple. What kind of life insurance policy issued by a mutual insurer provides a return of divisible surplus.

Source: slideshare.net

Source: slideshare.net

The contract between the employer and the health care professional, whether physician or a hospital, spells out the kind of services to be provided. Depending on the contract, other events such as terminal illness or critical illness can. In this blog, we will tell you about different kinds of life insurance policies and their benefits so that you can make an informed decision while getting a life insurance policy. What kinds of health insurance are there? As a fiduciary, the agent has an obligation to act in the best interest of the insured.

Source: slideshare.net

Source: slideshare.net

Insurance policies are considered aleatory contracts because. What kind of life insurance policy issued by a mutual insurer provides a return of divisible surplus. The contract between the employer and the health care professional, whether physician or a hospital, spells out the kind of services to be provided. Although these plans differ, they both cover an array of medical, surgical and hospital expenses. Insurance policies are considered aleatory contracts because.

Source: moneytalkgo.com

Source: moneytalkgo.com

The agent must be knowledgeable about the features and provisions of various insurance policies and the use of these insurance contracts. In life insurances, insurable interest must exist at the time of proposal. Although these plans differ, they both cover an array of medical, surgical and hospital expenses. Term insurance contracts, issued for specified periods of years, are the simplest. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law.

Source: soulflame-zine.blogspot.com

Source: soulflame-zine.blogspot.com

What kinds of health insurance are there? What kind of life insurance policy issued by a mutual insurer provides a return of divisible surplus. An insurance contract is an agreement with your provider that you will pay premiums for coverage in exchange for guaranteed payment in the event of a loss. Insurance solutions designed for your future. Protection under these contracts expires at the end of the stated period, with no cash value remaining.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Types of insurance consumers will encounter most often are auto insurance, homeowners insurance, umbrella insurance and life insurance. Life insurance (or life assurance, especially in the commonwealth of nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policy holder). In life insurances, insurable interest must exist at the time of proposal. What kinds of health insurance are there? But that’s where the similarities end.

Source: lestwinsworld.com

Source: lestwinsworld.com

The agent must be knowledgeable about the features and provisions of various insurance policies and the use of these insurance contracts. Without insurable interest, a life insurance policy would be considered a wagering contract. The major types of life insurance contracts are term, whole life, and universal life, but innumerable combinations of these basic types are sold. The agent must be able to explain the important features of these policies to the insured. Insurance policies are considered aleatory contracts because.

Source: pinterest.com

Source: pinterest.com

Life insurance gives a payout in case the policyholder dies. The contract between the employer and the health care professional, whether physician or a hospital, spells out the kind of services to be provided. Insurance solutions designed for your future. Life insurance gives a payout in case the policyholder dies. In terms of insurance, these are the fundamental conditions of the insurance contract that bind both parties, validate the policy, and make it enforceable by law.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life and health insurance policies are what kind of contracts by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.