Life insurance 2 year clause information

Home » Trend » Life insurance 2 year clause informationYour Life insurance 2 year clause images are ready. Life insurance 2 year clause are a topic that is being searched for and liked by netizens today. You can Download the Life insurance 2 year clause files here. Find and Download all royalty-free images.

If you’re searching for life insurance 2 year clause images information linked to the life insurance 2 year clause topic, you have come to the right site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

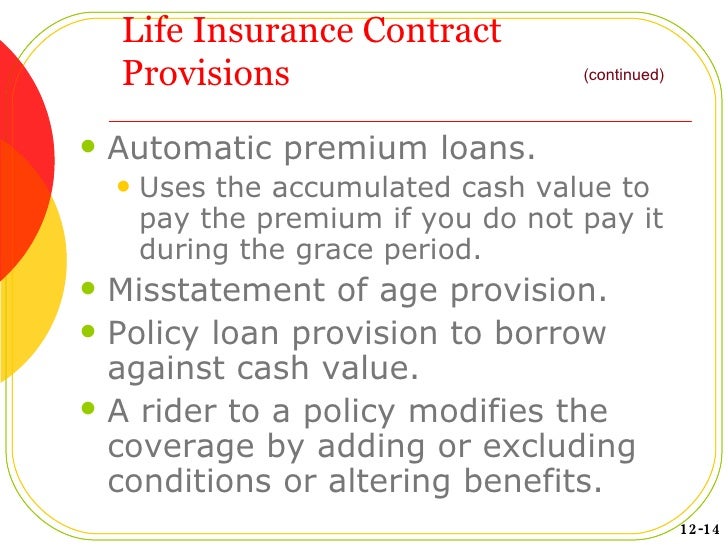

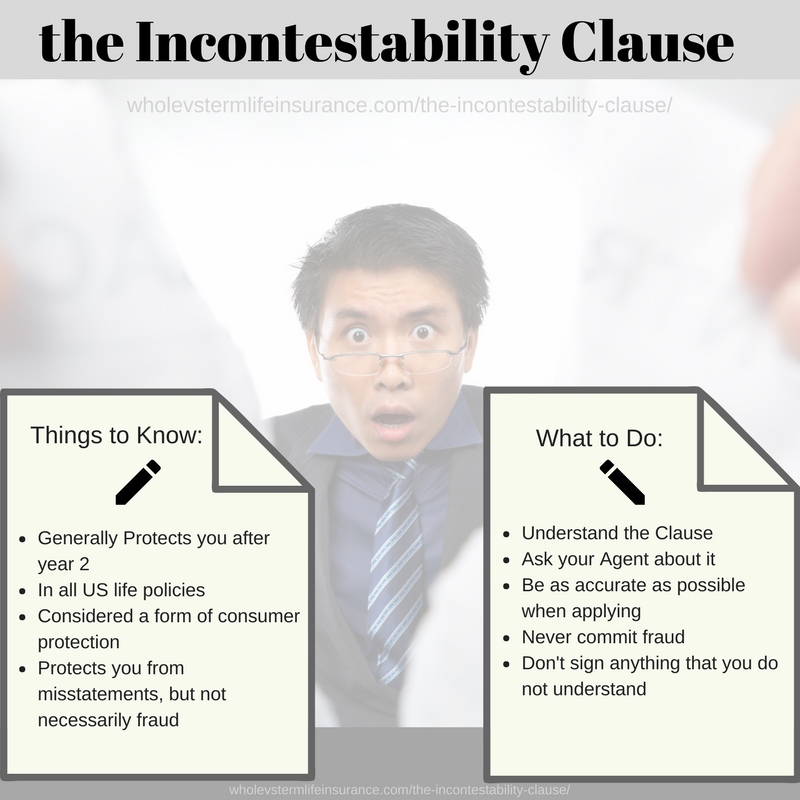

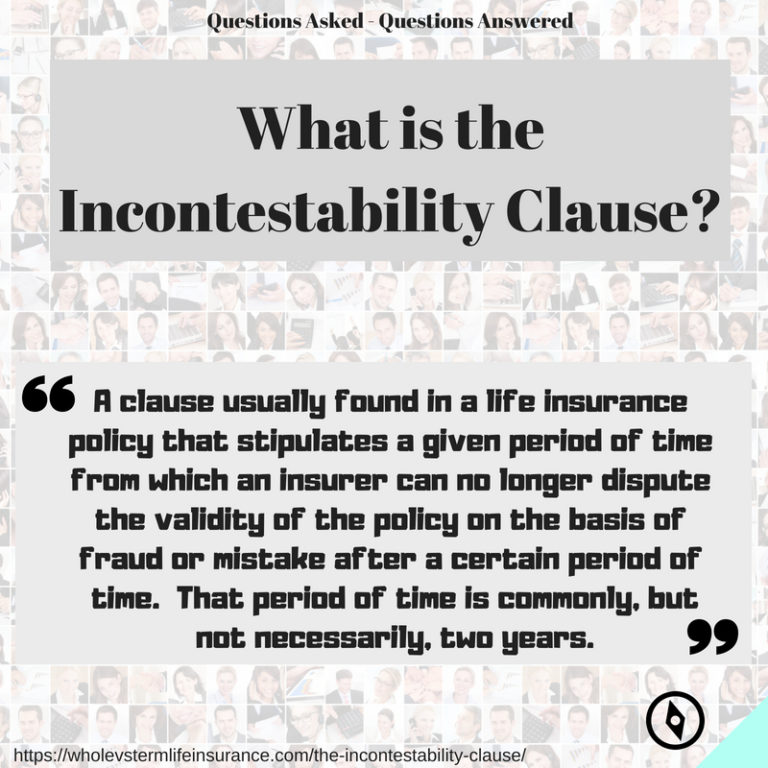

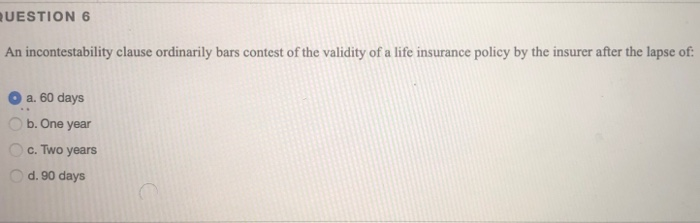

Life Insurance 2 Year Clause. This means that if you are a beneficiary on a life insurance. In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary. The purpose of an incontestability requirement is to protect you from a challenge to the validity of your policy long after the policy has been issued. For that reason, you need to.

What�s A Life Insurance Incontestability Clause In 2020 From blogpapi.com

What�s A Life Insurance Incontestability Clause In 2020 From blogpapi.com

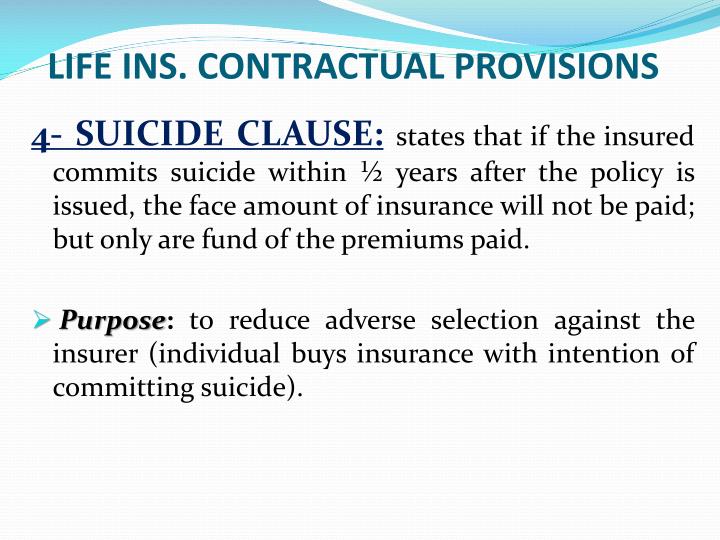

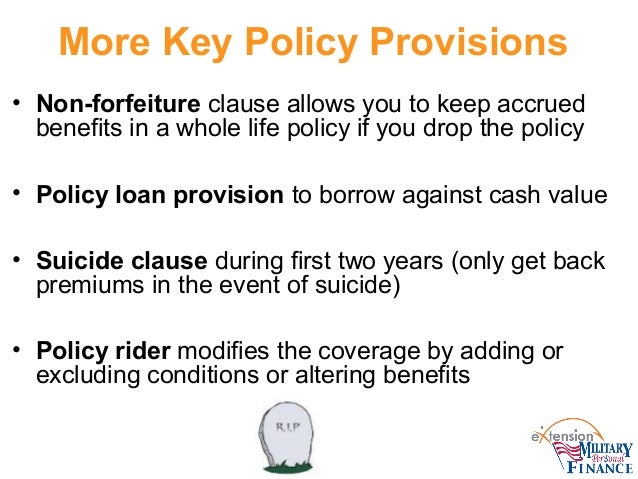

This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information on your application — for example, stating that you don’t smoke when, in fact, you do. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years. You can die any way want (including suicide), and the insurance. While this may ruin most people’s image of life insurance companies, they really aren’t looking for a way not to pay claims. In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary.

That means that a claim can’t be denied once the two years are up due to misrepresentation or error.

It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. So any claim due to suicide within this period will be rejected without any explanations. See all ( 30) term life insurance. Under the suicide clause, the life insurance company won’t pay the death benefit and will return premiums if the insured commits suicide within the first two years of the policy. Voluntary selection of the first 1x. What is a 2 year life insurance clause?

Source: smartasset.com

Source: smartasset.com

While this may ruin most people’s image of life insurance companies, they really aren’t looking for a way not to pay claims. This is life insurance with a 2 year waiting period. Companies will typically not pay a death benefit if the policyholder commits suicide. Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years. Find the best life insurance offers for you.

Source: awesomemovies4us.blogspot.com

Source: awesomemovies4us.blogspot.com

*please enter valid us zip. The corporation shall purchase term life insurance on the life of the employee having a face value of four times the employee’s salary (to be changed as salary adjustments are made) or the face value of life insurance that can be purchased based upon the employee’s health history with the corporation paying the standard premium rate for term. After two years, the policy is said to be “incontestable“. For that reason, you need to. Instead, if you die in the first 2 years, they may receive only 30% to 40% during the first year, or 60% to 70% of the death benefit if you die during the second year.

Source: slideshare.net

Source: slideshare.net

Voluntary selection of the first 1x. Find the best life insurance offers for you. So any claim due to suicide within this period will be rejected without any explanations. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. This means that if you are a beneficiary on a life insurance.

Fort worth insurance lawyers need to be aware of a life insurance policy’s incontestability clause. A beneficiary should not just give up the fight. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. *please enter valid us zip. This means that if you are a beneficiary on a life insurance.

Source: slideserve.com

Source: slideserve.com

In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. If you pass away in the first two years of your life insurance coverage, the insurance company has a right to contest or question your claim. Instead, if you die in the first 2 years, they may receive only 30% to 40% during the first year, or 60% to 70% of the death benefit if you die during the second year. If a suicide happens more than two years after getting a life insurance policy, the life.

Source: slideshare.net

Source: slideshare.net

The main aim of life insurance is to transfer wealth to your heirs or to provide liquidity to your family. This is life insurance with a 2 year waiting period. After two years, the policy is said to be “incontestable“. A beneficiary should not just give up the fight. This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information on your application — for example, stating that you don’t smoke when, in fact, you do.

Source: blogpapi.com

Source: blogpapi.com

This law states that your insurance company cannot contest the validity of your life insurance policy after it has been in force for two years from its date of issue. So any claim due to suicide within this period will be rejected without any explanations. Florida�s two year life insurance contestability clause. The contestability period runs for two years in most states and one year in others, and. *please enter valid us zip.

Source: alburolaw.com

Source: alburolaw.com

Under the suicide clause, the life insurance company won’t pay the death benefit and will return premiums if the insured commits suicide within the first two years of the policy. The main aim of life insurance is to transfer wealth to your heirs or to provide liquidity to your family. After two years, the policy will pay out even if the cause of death is suicide. The 2 year life insurance contestability clause is simply a way to protect life insurance companies from evidence of misrepresentation. It could impact you, and at the very least, you should know the ins and outs of how it works.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. After two years, the policy is said to be “incontestable“. In such a case, their liability is usually limited to a refund of premiums. However, if suicide happens post this period of one/two years, the death claims will be payable as per the policy terms and considered death benefits. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

It could impact you, and at the very least, you should know the ins and outs of how it works. In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary. The life insurance contestability period is a short window in which insurance companies can investigate and deny claims. Can someone dispute a life insurance beneficiary? Under the suicide clause, the life insurance company won’t pay the death benefit and will return premiums if the insured commits suicide within the first two years of the policy.

Source: clips-khrime.blogspot.com

Source: clips-khrime.blogspot.com

*please enter valid us zip. So any claim due to suicide within this period will be rejected without any explanations. October 21, 2017 | mark s. The main aim of life insurance is to transfer wealth to your heirs or to provide liquidity to your family. For that reason, you need to.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

*please enter valid us zip. It is to be noted that certain companies keep this stated period up to a maximum of 2 years in some cases. The period is two years in most states and one year in others. After two years, the policy is said to be “incontestable“. A beneficiary should not just give up the fight.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

The corporation shall purchase term life insurance on the life of the employee having a face value of four times the employee’s salary (to be changed as salary adjustments are made) or the face value of life insurance that can be purchased based upon the employee’s health history with the corporation paying the standard premium rate for term. All life insurance policies must contain an incontestability clause, which is a provision that the policy will be incontestable after it has been in force during. In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary. Companies will typically not pay a death benefit if the policyholder commits suicide. For that reason, you need to.

Source: chegg.com

Source: chegg.com

Fort worth insurance lawyers need to be aware of a life insurance policy’s incontestability clause. This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information on your application — for example, stating that you don’t smoke when, in fact, you do. In addition, the employer shall make available employee paid optional life insurance coverage at 1x, 2x, 3x, and 4x base annual salary. If a suicide happens more than two years after getting a life insurance policy, the life. Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years.

Source: lifeinsurancelawfirm.com

Source: lifeinsurancelawfirm.com

Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years. So any claim due to suicide within this period will be rejected without any explanations. Florida statute section 627.455 states that every life insurance contract is incontestable after it has been in force during the lifetime of the insured for a period of 2 years from its date of issue. Instead, if you die in the first 2 years, they may receive only 30% to 40% during the first year, or 60% to 70% of the death benefit if you die during the second year. It begins as soon as a policy goes into effect.

Source: slideshare.net

Source: slideshare.net

Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years. Most life insurance policies also have two year suicide clauses in them, which say the carrier doesn’t pay the death claim if you commit suicide within the first two years. This is life insurance with a 2 year waiting period. A beneficiary should not just give up the fight. Florida�s two year life insurance contestability clause.

Source: broadridgeadvisor.com

Source: broadridgeadvisor.com

The purpose of an incontestability requirement is to protect you from a challenge to the validity of your policy long after the policy has been issued. So any claim due to suicide within this period will be rejected without any explanations. A beneficiary should not just give up the fight. While this may ruin most people’s image of life insurance companies, they really aren’t looking for a way not to pay claims. After two years, the policy will pay out even if the cause of death is suicide.

Source: escolaarteescola.blogspot.com

Source: escolaarteescola.blogspot.com

If a suicide happens more than two years after getting a life insurance policy, the life. This means that the insurance company may investigate the details of your medical history to make sure you didn’t misrepresent information on your application — for example, stating that you don’t smoke when, in fact, you do. An incontestability clause is written into most life insurance policies and states that a claim can’t be investigated after two years. It begins as soon as a policy goes into effect. So any claim due to suicide within this period will be rejected without any explanations.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance 2 year clause by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.