Life insurance accelerated death benefit Idea

Home » Trend » Life insurance accelerated death benefit IdeaYour Life insurance accelerated death benefit images are available. Life insurance accelerated death benefit are a topic that is being searched for and liked by netizens today. You can Download the Life insurance accelerated death benefit files here. Download all free images.

If you’re searching for life insurance accelerated death benefit images information linked to the life insurance accelerated death benefit keyword, you have come to the ideal site. Our website frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and locate more informative video content and images that fit your interests.

Life Insurance Accelerated Death Benefit. The payment depends on your policy�s face value, the terms of your contract, and the state you live in. However, there is a major drawback. The accelerated death benefit rider allows policyholders to tap into their existing insurance policy in the event that they develop some type of terminal illness or other serious medical condition. Some insurance companies automatically include an accelerated death benefit rider in your life insurance policy at no added cost.

"Accelerated Death Benefit" or "Living Benefit" Rider in From youtube.com

"Accelerated Death Benefit" or "Living Benefit" Rider in From youtube.com

Typically, the insurance company sets a maximum benefit amount based on life expectancy, and the policyholder makes the final decision on how much of a financial advance they require. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. An accelerated death benefit (adb), known as accelerated death benefit rider or terminal illness rider, is a supplemental insurance product that allows a life insurance policy owner to receive cash advances against their death benefit. Accelerated death benefits can be as high as 95% of the death benefit. Some companies will permit you to accelerate 100 percent of your policy�s face value, but will. How much of my life insurance policy can i collect early?

An accelerated death benefit, or adb, allows you to access a portion of your life insurance policy’s payout early if you’re sick.

Accelerated death benefits can be as high as 95% of the death benefit. An accelerated death benefit (adb), known as accelerated death benefit rider or terminal illness rider, is a supplemental insurance product that allows a life insurance policy owner to receive cash advances against their death benefit. A life insurance accelerated death benefit may also be called a living benefit rider or a terminal illness benefit. In general, accelerated benefits can range from 25 to 95 percent of the death benefit. It makes a portion of the death benefit, which would ordinarily go to the policy’s beneficiaries, available during the policyholder’s lifetime in some circumstances. An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness.

Source: simplyinsurance.com

Source: simplyinsurance.com

An accelerated death benefit (adb) is a benefit that can be attached to a life insurance policy that enables the policyholder to receive cash advances against the. Accelerated death benefits can be as high as 95% of the death benefit. Some companies will permit you to accelerate 100 percent of your policy�s face value, but will. An accelerated death benefit (adb)—also referred to as a living benefit—is a feature of a life insurance policy that pays a percentage of the death benefit early (up to the full benefit in some cases) if qualifying conditions are met. However, there is a major drawback.

Source: bestlifequote.com

Source: bestlifequote.com

An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness. The accelerated death benefit is a way to access some of your life insurance benefits while undergoing medical care near the end of your life. If you have a life insurance policy that includes one, you can potentially obtain a portion of the death. An accelerated death benefit (adb) is a benefit that can be attached to a life insurance policy that enables the policyholder to receive cash advances against the. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive.

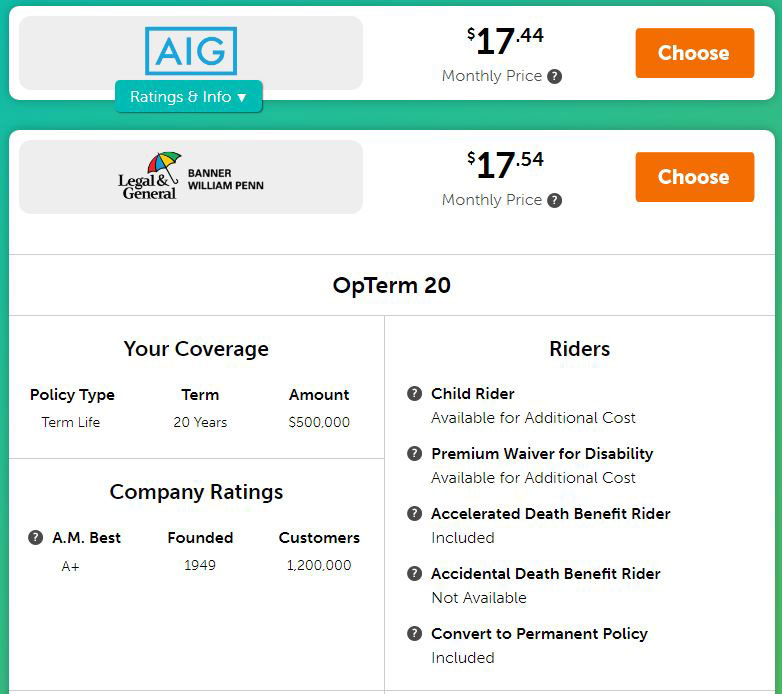

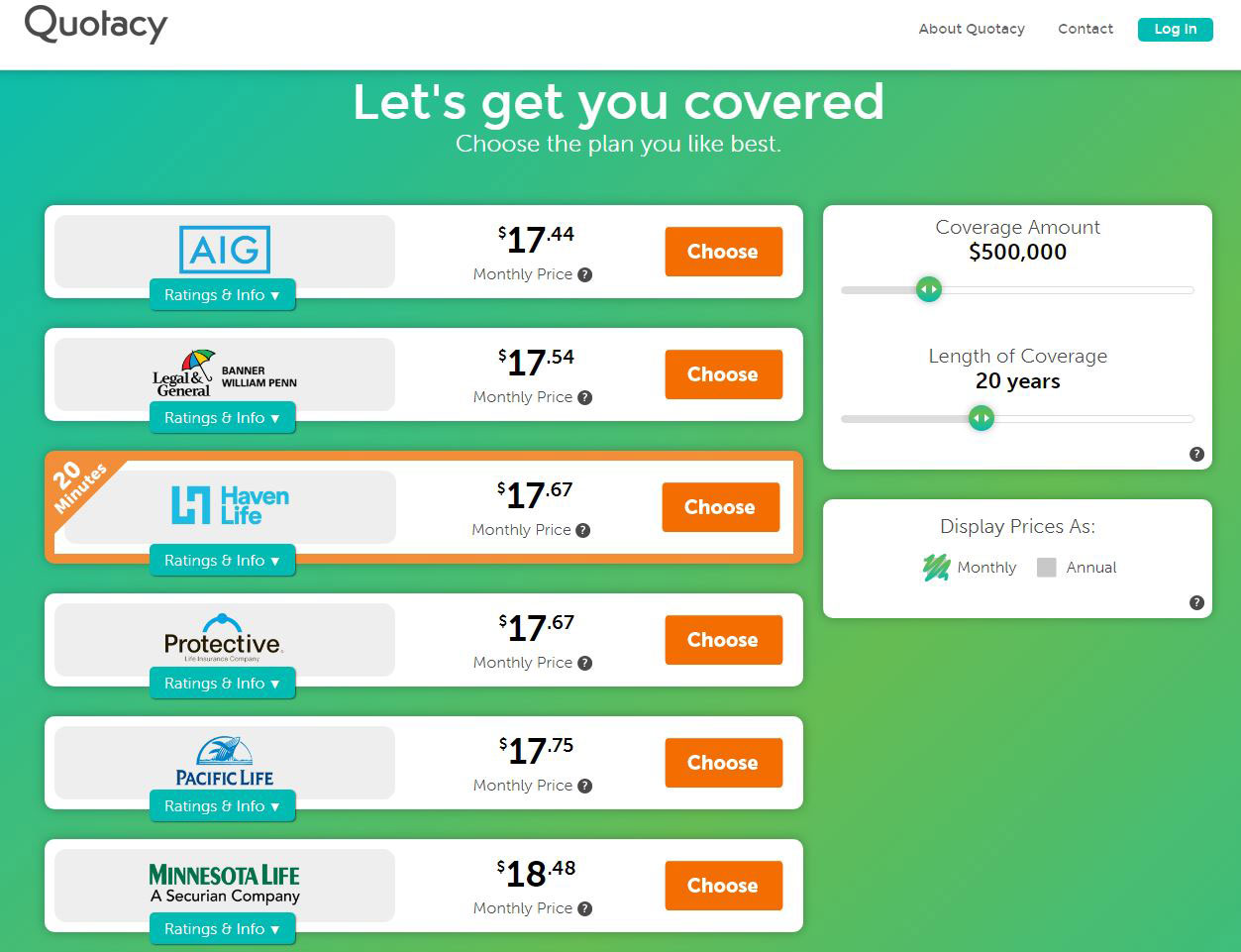

Source: quotacy.com

Source: quotacy.com

What are accelerated death benefits? This money can be used toward medical expenses or anything that would alleviate any financial burden during. Some insurance companies automatically include an accelerated death benefit rider in your life insurance policy at no added cost. The payment depends on your policy�s face value, the terms of your contract, and the state you live in. Accelerated death benefits are not taxed.

Source: quotacy.com

Source: quotacy.com

An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. This provision was created in an effort to make it as comfortable as possible for an. An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness. The accelerated death benefit is a way to access some of your life insurance benefits while undergoing medical care near the end of your life. Accelerated death benefits paid to any taxpayer other than the insured if the taxpayer has an insurable interest in the life of the insured because the insured is a director, officer, or employee.

Source: splittergewitter.blogspot.com

Source: splittergewitter.blogspot.com

Adb is a death benefit rider attached to the insured’s life insurance policy that provides for the possibility of the insured receiving cash advances if he or she has. The accelerated death benefit rider is usually included in your policy at no extra cost to you. An accelerated death benefit (adb)—also referred to as a living benefit—is a feature of a life insurance policy that pays a percentage of the death benefit early (up to the full benefit in some cases) if qualifying conditions are met. An accelerated death benefit (adb), known as accelerated death benefit rider or terminal illness rider, is a supplemental insurance product that allows a life insurance policy owner to receive cash advances against their death benefit. An accelerated death benefit rider is a provision that can be added to many life insurance policies.

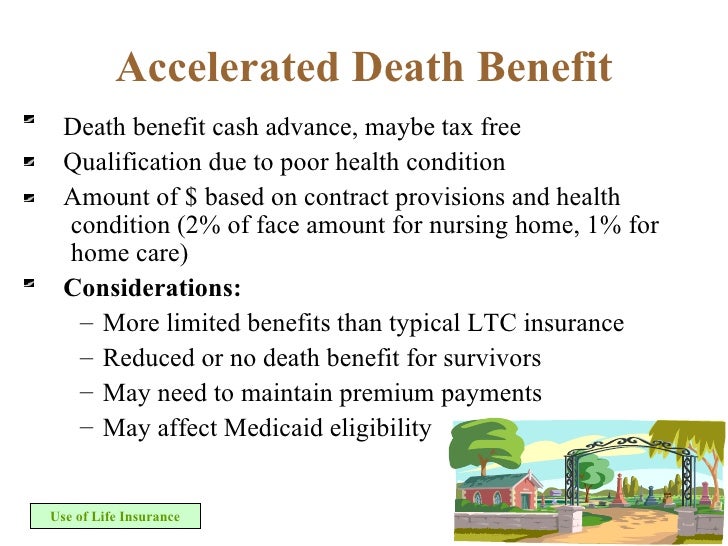

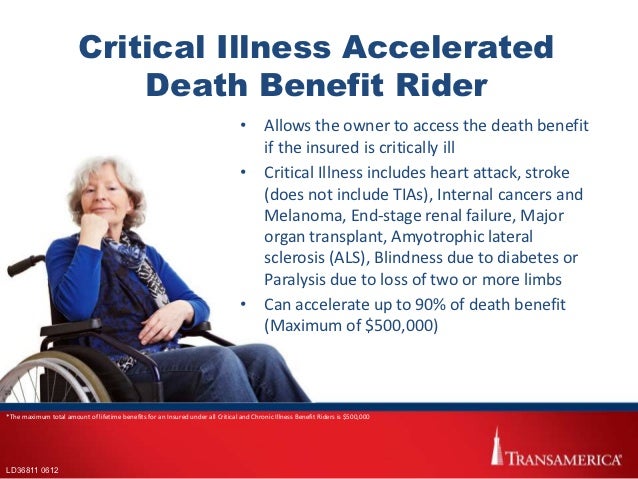

Source: slideshare.net

Source: slideshare.net

A type of policy that pays a portion (typically 25% or 50%) of the death benefits (the face amount of the policy, less any outstanding loans or. Accelerated death benefits can be as high as 95% of the death benefit. The accelerated death benefit is a way to access some of your life insurance benefits while undergoing medical care near the end of your life. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. Accelerated death benefits can help policyholders pay for needed medical care.

Source: anything-kenl0lz.blogspot.com

Source: anything-kenl0lz.blogspot.com

An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness. A life insurance accelerated death benefit may also be called a living benefit rider or a terminal illness benefit. However, there is a major drawback. How much of my life insurance policy can i collect early? This money can be used toward medical expenses or anything that would alleviate any financial burden during.

Source: splittergewitter.blogspot.com

Source: splittergewitter.blogspot.com

Policyholders qualify for an accelerated death benefit when diagnosed with a terminal illness or a condition that requires expensive, immediate care. The money you receive via the rider will be deducted from your death benefit. Typically, the insurance company sets a maximum benefit amount based on life expectancy, and the policyholder makes the final decision on how much of a financial advance they require. The accelerated death benefit rider is usually included in your policy at no extra cost to you. However, one of the best kept secrets about life insurance is that some policies can help you with money if you become seriously ill.

Source: youtube.com

Source: youtube.com

Most life insurance policies have a little known provision called the accelerated death benefit (adb). The payment depends on your policy�s face value, the terms of your contract, and the state you live in. Accelerated benefits typically become available when the policyholder. If you have a life insurance policy that includes one, you can potentially obtain a portion of the death. An accelerated death benefit (adb)—also referred to as a living benefit—is a feature of a life insurance policy that pays a percentage of the death benefit early (up to the full benefit in some cases) if qualifying conditions are met.

Source: sproutt.com

Source: sproutt.com

Accelerated death benefits are not taxed. The accelerated death benefit rider allows policyholders to tap into their existing insurance policy in the event that they develop some type of terminal illness or other serious medical condition. The accelerated death benefit rider is usually included in your policy at no extra cost to you. However, you have to meet certain criteria in order to use the rider. In times of medical emergencies, this can be the right decision for many families.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

An accelerated death benefit (adb) is a benefit that can be attached to a life insurance policy that enables the policyholder to receive cash advances against the. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. In times of medical emergencies, this can be the right decision for many families. The accelerated death benefit is a way to access some of your life insurance benefits while undergoing medical care near the end of your life. Generally, you can use an accelerated death benefit after getting diagnosed with a terminal illness.

Source: slideserve.com

Source: slideserve.com

An accelerated death benefit, or adb, allows you to access a portion of your life insurance policy’s payout early if you’re sick. An accelerated death benefit (adb)—also referred to as a living benefit—is a feature of a life insurance policy that pays a percentage of the death benefit early (up to the full benefit in some cases) if qualifying conditions are met. Most life insurance policies have a little known provision called the accelerated death benefit (adb). The money you receive via the rider will be deducted from your death benefit. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive.

Source: protectedlifeinsurancedzukein.blogspot.com

Source: protectedlifeinsurancedzukein.blogspot.com

In times of medical emergencies, this can be the right decision for many families. An accelerated death benefit allows policyholders to take out money from their life insurance policy. The payment depends on your policy�s face value, the terms of your contract, and the state you live in. It makes a portion of the death benefit, which would ordinarily go to the policy’s beneficiaries, available during the policyholder’s lifetime in some circumstances. Some companies will permit you to accelerate 100 percent of your policy�s face value, but will.

Source: khurak.net

Source: khurak.net

Policyholders qualify for an accelerated death benefit when diagnosed with a terminal illness or a condition that requires expensive, immediate care. Some companies will permit you to accelerate 100 percent of your policy�s face value, but will. However, there is a major drawback. An accelerated death benefit is a life insurance policy feature that lets you access some of the policy benefits while you’re still alive. Accelerated benefits typically become available when the policyholder.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Accelerated death benefits can be as high as 95% of the death benefit. Accelerated death benefits can help policyholders pay for needed medical care. In other cases, policyholders can add the coverage as a rider to their life insurance policy. Some companies will permit you to accelerate 100 percent of your policy�s face value, but will. It makes a portion of the death benefit, which would ordinarily go to the policy’s beneficiaries, available during the policyholder’s lifetime in some circumstances.

Source: vietnambiz.vn

Source: vietnambiz.vn

It makes a portion of the death benefit, which would ordinarily go to the policy’s beneficiaries, available during the policyholder’s lifetime in some circumstances. The member may receive a portion of the face value of. Accelerated death benefits paid to any taxpayer other than the insured if the taxpayer has an insurable interest in the life of the insured because the insured is a director, officer, or employee. This benefit if attached to your life insurance policy enables the policyholder to receive cash advances against the death benefit in the case of being diagnosed with a terminal illness. A life insurance accelerated death benefit may also be called a living benefit rider or a terminal illness benefit.

Source: everplans.com

Source: everplans.com

However, one of the best kept secrets about life insurance is that some policies can help you with money if you become seriously ill. Policyholders qualify for an accelerated death benefit when diagnosed with a terminal illness or a condition that requires expensive, immediate care. The top national life insurance beneficiary lawyer sets forth the definition of accelerated death benefit insurance and tells us how to get an adb claim paid. An accelerated death benefit rider (adb) is a living benefits rider that lets you withdraw from the life insurance death benefit when you have a terminal illness. Accelerated death benefits are not taxed.

Source: everquote.com

Source: everquote.com

However, there is a major drawback. The member may receive a portion of the face value of. However, one of the best kept secrets about life insurance is that some policies can help you with money if you become seriously ill. Accelerated death benefits can be as high as 95% of the death benefit. However, there is a major drawback.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance accelerated death benefit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.