Life insurance accidental death benefit information

Home » Trending » Life insurance accidental death benefit informationYour Life insurance accidental death benefit images are ready in this website. Life insurance accidental death benefit are a topic that is being searched for and liked by netizens now. You can Download the Life insurance accidental death benefit files here. Download all royalty-free vectors.

If you’re looking for life insurance accidental death benefit images information linked to the life insurance accidental death benefit keyword, you have come to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Life Insurance Accidental Death Benefit. You can buy accidental life insurance with rates as low as $7/month. It is especially advantageous for those who work in risky occupations. No waiting periods apply for accidental death. In this instance our definition of an accident is where a bodily injury is sustained, caused by accidental, violent, external and visible means, which solely and independently of.

Accidental Death Benefit (ADB) & Permanent Total From mahalaxmilife.com.np

Accidental Death Benefit (ADB) & Permanent Total From mahalaxmilife.com.np

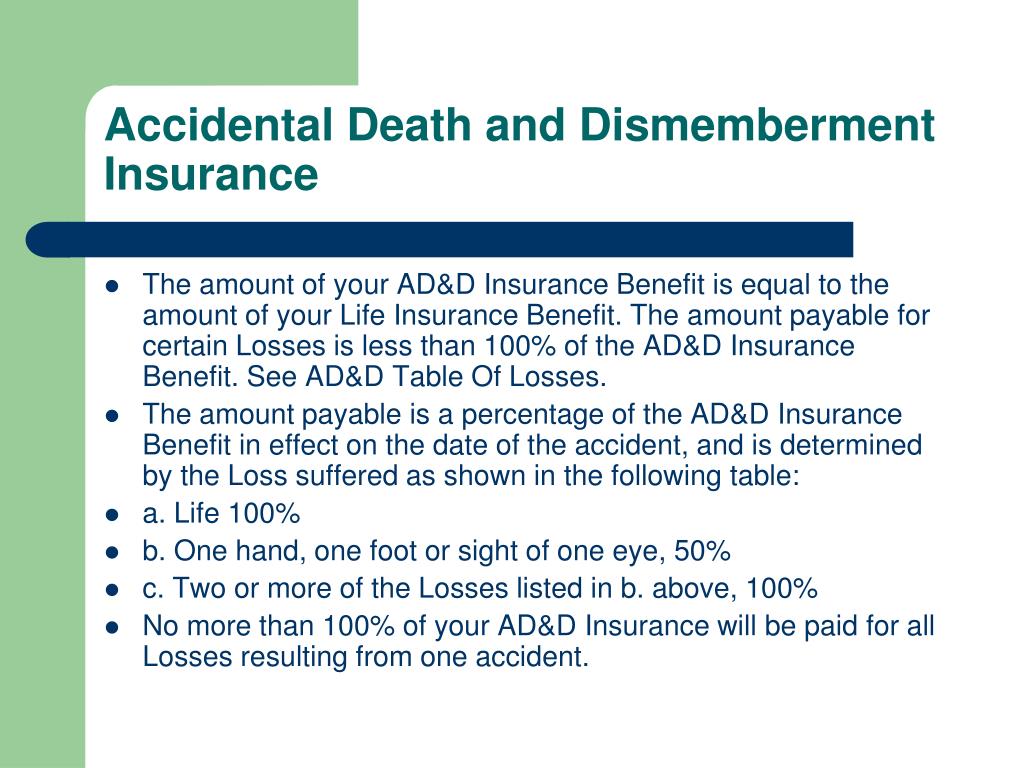

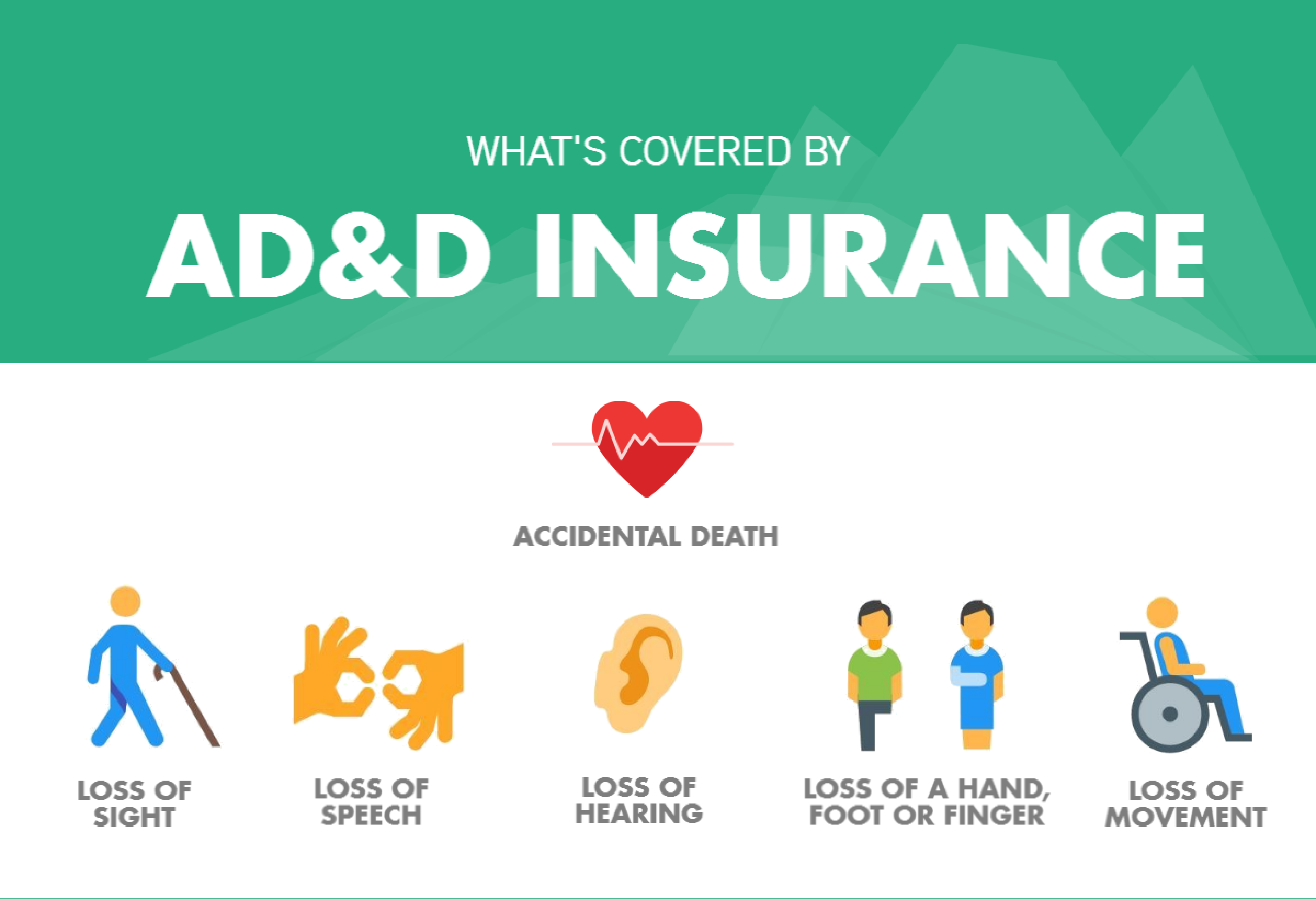

1 to help cover all your bases, an accidental death benefit added to your life insurance policy can help with costs associated with a fatal accident. It covers loss of some part of the body, hearing loss, paralysis, burns that affect more than 20% of the body. An accidental death benefit rider (also known as a “double indemnity rider”) is an optional feature you can add to your life insurance policy. It also may pay for dismemberment or loss of limbs. Click to rate this post! The overall idea of having an insurance is to have adequate financial cover at all times for you and your family, so.

The overall idea of having an insurance is to have adequate financial cover at all times for you and your family, so.

An accidental death benefit, however, will pay out a death benefit if you die by accident but not by natural causes or illnesses. An accidental death benefit, however, will pay out a death benefit if you die by accident but not by natural causes or illnesses. At the end of the term, you can decide if you’d like to renew based on your needs and current state. Term life insurance policies that cover accidental death can provide insurance coverage for 10, 20 or 25 years, or however long is specified in the policy. An experienced agent from coach b. 1 to help cover all your bases, an accidental death benefit added to your life insurance policy can help with costs associated with a fatal accident.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

It is also for the insured who survives an accident. You can buy accidental life insurance with rates as low as $7/month. Accidental death benefit in term insurance the uncertain nature of life makes humans vulnerable to death due to several causes. If you opt for the accidental death benefit rider while buying term insurance, it will provide an additional sum of money to your family if your death happens due to an accident. An accidental death benefit rider (also known as a “double indemnity rider”) is an optional feature you can add to your life insurance policy.

Source: slideserve.com

Source: slideserve.com

It covers loss of some part of the body, hearing loss, paralysis, burns that affect more than 20% of the body. Accidental death life insurance quotes are an inexpensive way to get accidental death and dismemberment insurance (ad&d), which is a policy that pays out a death benefit when the insured dies from an accident. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. Get cheap accidental death insurance quotes online for free. It also may pay for dismemberment or loss of limbs.

Source: youtube.com

Source: youtube.com

Accidental death insurance, also known as accidental life insurance, is a type of policy that pays out a benefit if the insured person dies due to an accident. Unlike conventional underwritten life insurance that requires the applicant to provide proof of good health to determine eligibility for coverage, there are no health or lifestyle questions necessary to obtain accidental death and dismemberment (ad&d) coverage. Accidents are one of such common causes of death, and a term plan with accidental benefit is a way to take care of that possibility financially. This can be an excellent option for people concerned about their health and who want to make sure their loved ones are taken care of in the event of an accidental death. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: teamsterslocal896.org

Source: teamsterslocal896.org

Accidental death life insurance covers your loved ones in case you die of an accident. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. You can add an accidental death. In this instance our definition of an accident is where a bodily injury is sustained, caused by accidental, violent, external and visible means, which solely and independently of. Except for death due to suicide in the first year of buying the policy, all types of death is covered by term life insurance including accidental death.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You also get these great benefits with your 1life policy: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Get cheap accidental death insurance quotes online for free. Term life insurance policies that cover accidental death can provide insurance coverage for 10, 20 or 25 years, or however long is specified in the policy.

![]() Source: jpgonzalez-sirgo.com

Source: jpgonzalez-sirgo.com

So, it means that an accidental death benefit does not only cover for death. The death benefit is an integral part of every life insurance plan and helps make the most use of your savings. Life cover (accidental death benefit only) no hiv tests required. In this instance our definition of an accident is where a bodily injury is sustained, caused by accidental, violent, external and visible means, which solely and independently of. It is also for the insured who survives an accident.

Source: globelifeofnewyork.com

Source: globelifeofnewyork.com

So, it means that an accidental death benefit does not only cover for death. Accidents are one of such common causes of death, and a term plan with accidental benefit is a way to take care of that possibility financially. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. Accidental death life insurance quotes are an inexpensive way to get accidental death and dismemberment insurance (ad&d), which is a policy that pays out a death benefit when the insured dies from an accident. In this instance our definition of an accident is where a bodily injury is sustained, caused by accidental, violent, external and visible means, which solely and independently of.

Source: slideserve.com

Source: slideserve.com

An experienced agent from coach b. Life insurance can explain to you more about your coverage. Accidental death benefit pays out a cash sum if you die within 90 days of an accident. No waiting periods apply for accidental death. You can add an accidental death.

Source: emmallina.blogspot.com

Source: emmallina.blogspot.com

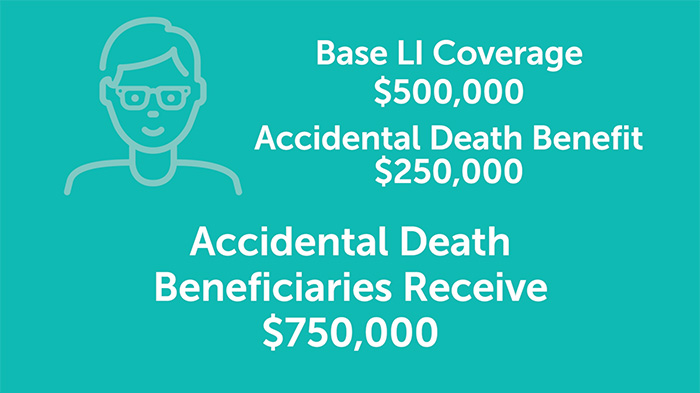

It then pays half of the face value of the policy until the policy expires. How does an accidental death benefit work? The accidental death benefit is an amount paid out from your standalone adb policy, or in addition to your standard life insurance death benefit as a rider. Some life insurance policies also offer accidental death benefit as a rider which can be attached to the base plan for an extra premium. The term accidental death benefit refers to a payment due to the beneficiary of an accidental death insurance policy, which is often a clause or riderconnected to a life insurance policy.

Source: emmallina.blogspot.com

Source: emmallina.blogspot.com

Term life insurance policies that cover accidental death can provide insurance coverage for 10, 20 or 25 years, or however long is specified in the policy. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. Accidental death life insurance covers your loved ones in case you die of an accident. The death benefit is an integral part of every life insurance plan and helps make the most use of your savings. Accidental death benefit pays out a cash sum if you die within 90 days of an accident.

Source: emmallina.blogspot.com

Source: emmallina.blogspot.com

Accidental death benefit pays out a cash sum if you die within 90 days of an accident. At the end of the term, you can decide if you’d like to renew based on your needs and current state. Some life insurance policies also offer accidental death benefit as a rider which can be attached to the base plan for an extra premium. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. You can buy accidental life insurance with rates as low as $7/month.

Source: askadamskutner.com

Source: askadamskutner.com

Your life insurance policy will pay a death benefit in most cases of death, including accident or illness. An accidental death benefit, however, will pay out a death benefit if you die by accident but not by natural causes or illnesses. A “rider” is an added benefit that you can include in a policy you already have. No waiting periods apply for accidental death. Your life insurance policy will pay a death benefit in most cases of death, including accident or illness.

Source: emmallina.blogspot.com

Source: emmallina.blogspot.com

The accidental death benefit is usually paid in additi… Accidental death life insurance covers your loved ones in case you die of an accident. It is especially advantageous for those who work in risky occupations. Get cheap accidental death insurance quotes online for free. An accidental death benefit rider provides a higher payout if the insured dies in an accident.

Source: life-insurance-lawyer.com

Source: life-insurance-lawyer.com

An adb policy typically pays out in full until you reach a predetermined age. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. An accidental death benefit rider (also known as a “double indemnity rider”) is an optional feature you can add to your life insurance policy. Ad&d provides coverage to the insured in case of dismemberment or accidental death due to an unexpected. It functions as a double indemnity rider, ensuring that accidental death is covered by both the life insurance policy and the rider’s amount.

Source: slideserve.com

Source: slideserve.com

It then pays half of the face value of the policy until the policy expires. At the end of the term, you can decide if you’d like to renew based on your needs and current state. Your life insurance policy will pay a death benefit in most cases of death, including accident or illness. Life cover (accidental death benefit only) no hiv tests required. It can also provide benefits to you if you become disabled or paralyzed as the result of an accident.

Source: revisi.net

Source: revisi.net

A “rider” is an added benefit that you can include in a policy you already have. Accidental injury has become the third leading cause of death in the united states. It then pays half of the face value of the policy until the policy expires. Life insurance can explain to you more about your coverage. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: michigan.gov

Source: michigan.gov

You can buy accidental life insurance with rates as low as $7/month. You can buy accidental life insurance with rates as low as $7/month. The overall idea of having an insurance is to have adequate financial cover at all times for you and your family, so. An accidental death rider makes your plan more comprehensive and provides additional protection for unexpected situations. It then pays half of the face value of the policy until the policy expires.

Source: gabar.memberbenefits.com

Source: gabar.memberbenefits.com

It can also provide benefits to you if you become disabled or paralyzed as the result of an accident. Accidents are one of such common causes of death, and a term plan with accidental benefit is a way to take care of that possibility financially. Accidental injury has become the third leading cause of death in the united states. The accidental death benefit is an amount paid out from your standalone adb policy, or in addition to your standard life insurance death benefit as a rider. Life cover (accidental death benefit only) no hiv tests required.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance accidental death benefit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.