Life insurance and health insurance difference information

Home » Trending » Life insurance and health insurance difference informationYour Life insurance and health insurance difference images are available in this site. Life insurance and health insurance difference are a topic that is being searched for and liked by netizens today. You can Get the Life insurance and health insurance difference files here. Download all royalty-free vectors.

If you’re searching for life insurance and health insurance difference pictures information linked to the life insurance and health insurance difference topic, you have come to the right blog. Our website frequently provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video content and images that match your interests.

Life Insurance And Health Insurance Difference. Let�s check out a few key differences between life insurance & a health insurance policy: Health insurance aims at covering the actual cost towards treating illnesses/medical conditions subject to the sum assured. Covers the cost of your family’s survival in the case of your early demise or total disability. Here, we can conclude that the main difference between life insurance and health insurance is the benefits offered.

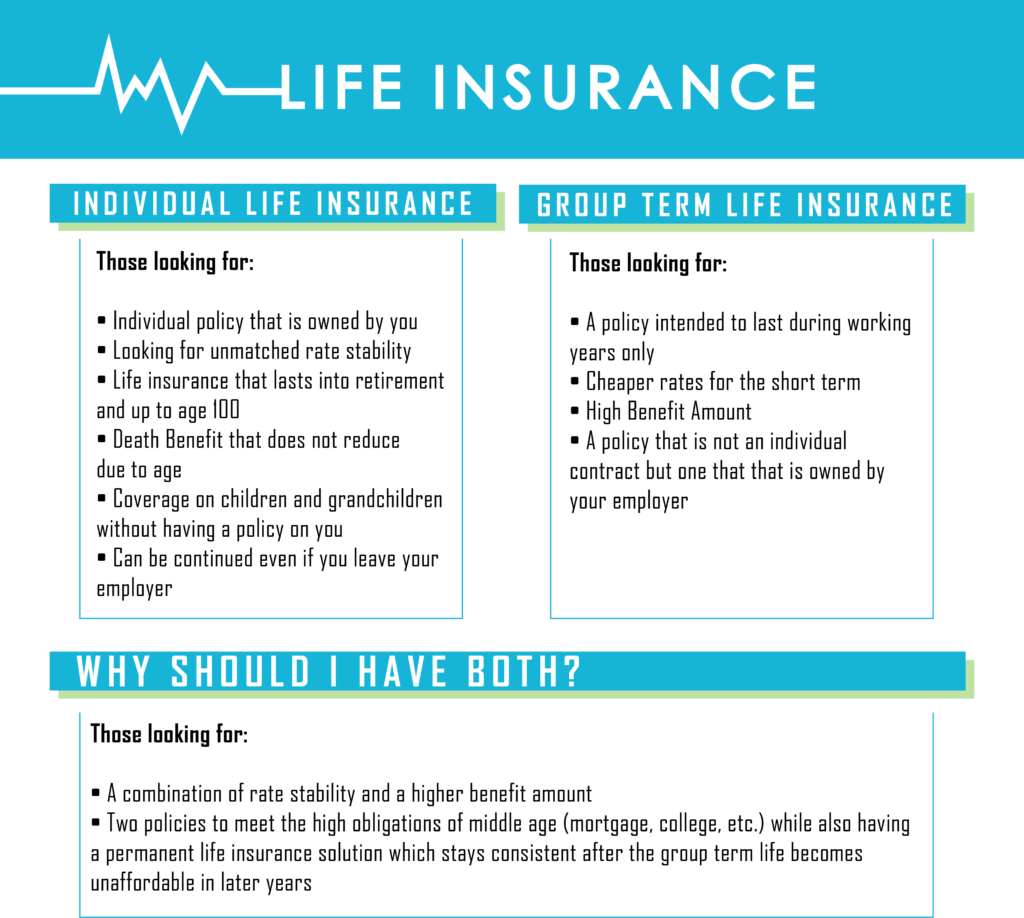

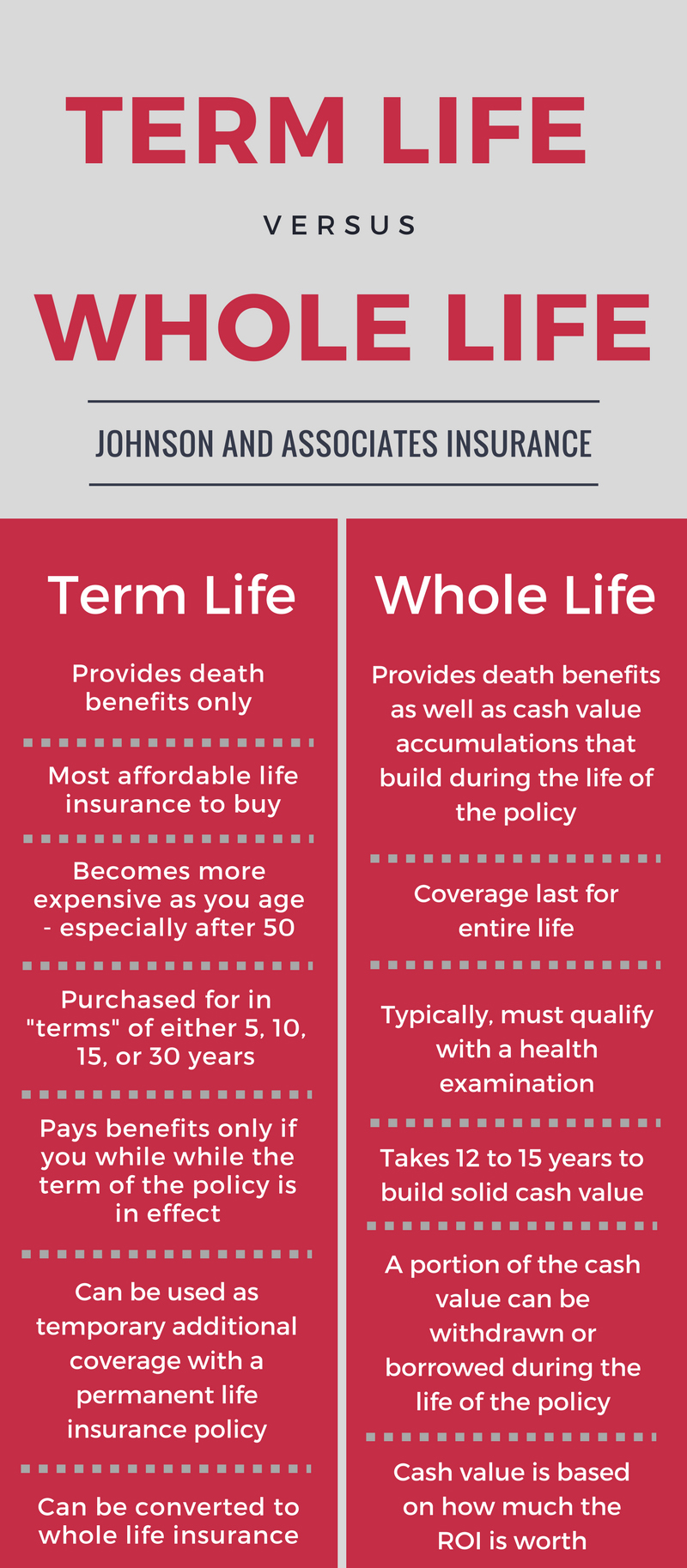

Term vs Whole Life Insurance Be your own BOSS WordPress From nicolask.wordpress.com

Term vs Whole Life Insurance Be your own BOSS WordPress From nicolask.wordpress.com

The benefit amount is fixed and guaranteed for payment to your family upon meeting the coverage conditions. But, they have distinctly different purposes and benefits. Premiums could be higher depending on several factors such as income, age, and existing medical conditions. Here, we can conclude that the main difference between life insurance and health insurance is the benefits offered. In the case of life insurance, the insurer promises to pay the amount decided on the maturity or untimely death of the policyholder. Older people will also have more expensive life insurance than their younger counterparts.

A life insurance plan ranges from 5 to 30 years, which could vary based on your insurer.

Covers the cost of your family’s survival in the case of your early demise or total disability. Health insurance and life insurance share many of the same characteristics: Health insurance pays for expenditures incurred in the event of a medical emergency. Health insurance aims at covering the actual cost towards treating illnesses/medical conditions subject to the sum assured. Life insurance vs health insurance the difference between life insurance and health insurance is that the health insurance company provides payments for medical expenses based on the fixed premium payments by the insured while the life insurance contract gives a nominee a fixed amount when the insured dies. There are three main categories of health insurance:

Source: insurechance.com

Source: insurechance.com

A life insurance plan ranges from 5 to 30 years, which could vary based on your insurer. Health insurance and life insurance share many of the same characteristics: Older people will also have more expensive life insurance than their younger counterparts. 5 rows life insurance is an insurance that covers the risk of life and pays out an assured sum on. Health insurance aims at covering the actual cost towards treating illnesses/medical conditions subject to the sum assured.

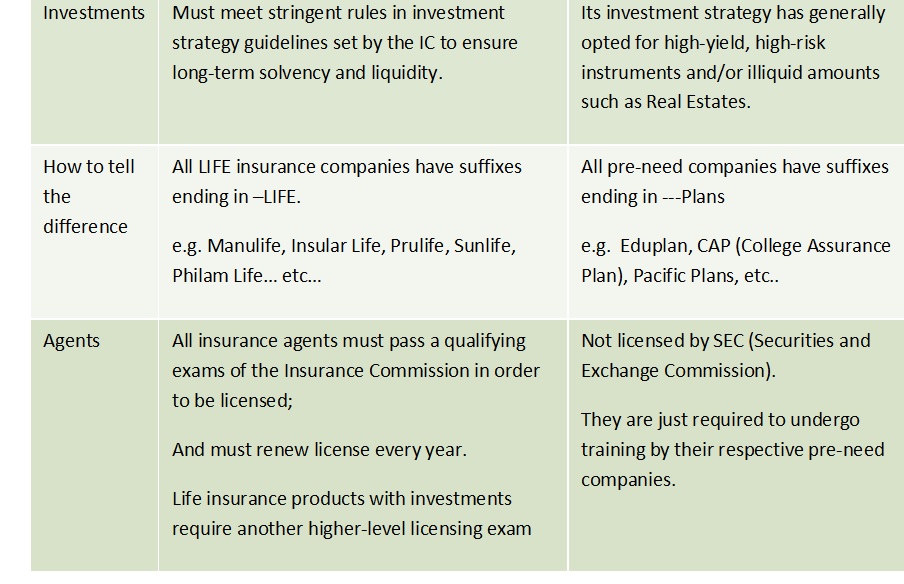

Source: visual.ly

Source: visual.ly

Health insurance is a type of policy that covers the medical expenditure of the policyholder. There are three main categories of health insurance: While healthy young adults often forgo health. Term insurance provides financial assistance to your nominee/beneficiary in case of some unforeseen circumstances such as the death of the life assured. In the case of life insurance, the insurer promises to pay the amount decided on the maturity or untimely death of the policyholder.

Source: everquote.com

Source: everquote.com

Health insurance pays for expenditures incurred in the event of a medical emergency. Here, we can conclude that the main difference between life insurance and health insurance is the benefits offered. Health insurance pays for expenditures incurred in the event of a medical emergency. Let�s check out a few key differences between life insurance & a health insurance policy: Life insurance for men will be more expensive than for women.

Source: myfinancemd.com

Source: myfinancemd.com

Older people will also have more expensive life insurance than their younger counterparts. Health insurance pays for expenditures incurred in the event of a medical emergency. In the case of life insurance, the insurer promises to pay the amount decided on the maturity or untimely death of the policyholder. The benefit amount is fixed and guaranteed for payment to your family upon meeting the coverage conditions. And health insurance cover can be renewed by the policyholder.

Source: jaiinsurance.com

Source: jaiinsurance.com

Health insurance covers an individual or group of an individual for 5 to 10 years. While healthy young adults often forgo health. In the case of life insurance, the insurer promises to pay the amount decided on the maturity or untimely death of the policyholder. Premiums could be higher depending on several factors such as income, age, and existing medical conditions. There is no life cover, meaning there is no payout on death.

Source: personalcapital.com

Source: personalcapital.com

The cost of life insurance policies will vary based on gender, age, type of policy, and overall health. If they are not following the act, we will review your complaint and investigate. The main difference between life insurance and health insurance is that life insurance that gives out an amount of money either on the death of the insured one or after a certain period, and health insurance cover costs of an insured person’s medical and surgical expenditures. The benefit amount is fixed and guaranteed for payment to your family upon meeting the coverage conditions. But, they have distinctly different purposes and benefits.

Source: visual.ly

Source: visual.ly

As for health insurance, you will receive financial support if you have any health problems. Underwriting, premiums, insured individuals, claims payments, and more. Life insurance vs health insurance the difference between life insurance and health insurance is that the health insurance company provides payments for medical expenses based on the fixed premium payments by the insured while the life insurance contract gives a nominee a fixed amount when the insured dies. Here, we can conclude that the main difference between life insurance and health insurance is the benefits offered. Additionally, individual health insurance plans.

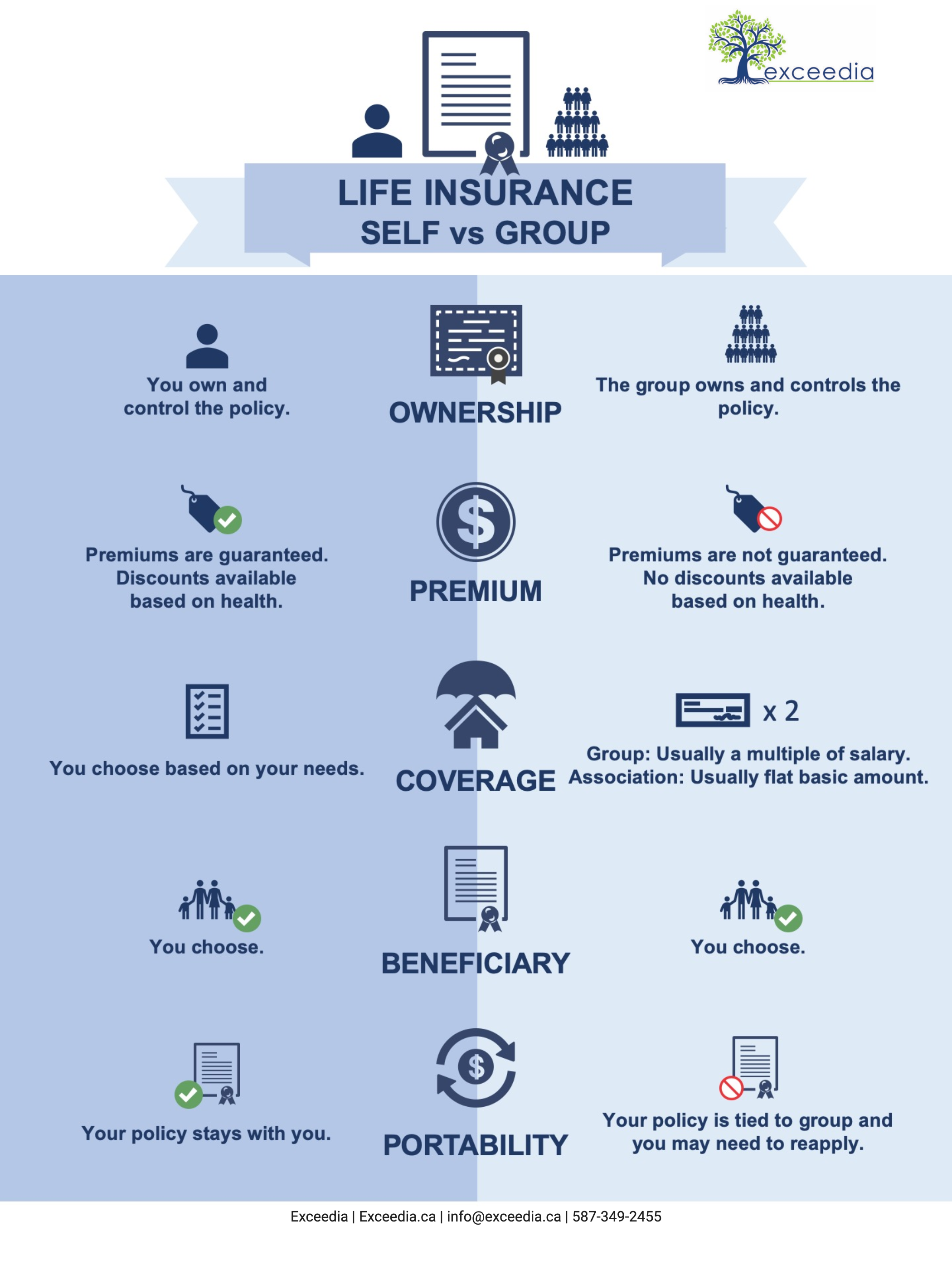

Source: exceedia.ca

Source: exceedia.ca

Health insurance and life insurance share many of the same characteristics: When you buy life or health insurance, fsra protects you by ensuring insurance companies and life and health agents are properly licensed to operate in ontario and that they comply with the ontario insurance act. For a life insurance policy, your named dependents will receive the benefits of financial assistance upon your passing. On the other hand, health insurance is specifically designed to cover all the medical expenses incurred in case of hospitalization or when diagnosed with a critical illness. In the case of life insurance, the insurer promises to pay the amount decided on the maturity or untimely death of the policyholder.

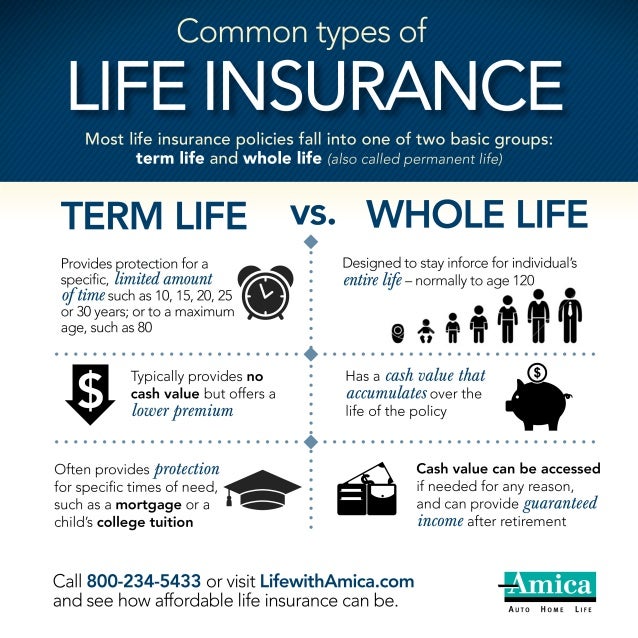

Source: nicolask.wordpress.com

Source: nicolask.wordpress.com

Older people will also have more expensive life insurance than their younger counterparts. Check out the illustration below for a quick view of the difference between life insurance and health insurance. Premiums could be higher depending on several factors such as income, age, and existing medical conditions. There are three main categories of health insurance: Additionally, individual health insurance plans.

Source: differencebetween.net

Source: differencebetween.net

5 rows life insurance is an insurance that covers the risk of life and pays out an assured sum on. Life insurance offers an assured sum to the beneficiaries in the eventuality of the. And health insurance cover can be renewed by the policyholder. As for health insurance, you will receive financial support if you have any health problems. Life insurance vs health insurance the difference between life insurance and health insurance is that the health insurance company provides payments for medical expenses based on the fixed premium payments by the insured while the life insurance contract gives a nominee a fixed amount when the insured dies.

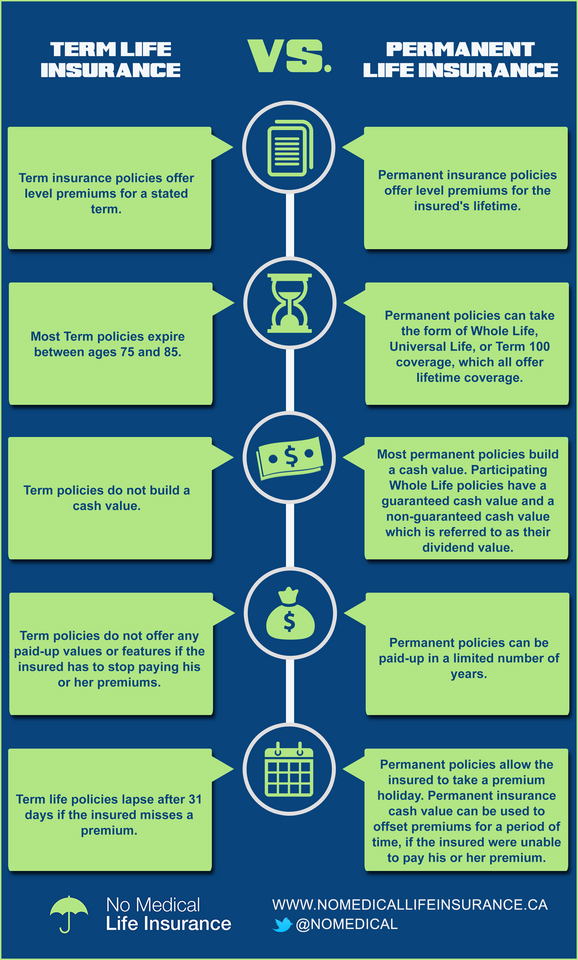

Source: nomedicallifeinsurance.ca

Source: nomedicallifeinsurance.ca

Unlike life insurance plans, a health insurance policy provides payout for availing medical treatment. The main difference between life insurance and health insurance is that life insurance that gives out an amount of money either on the death of the insured one or after a certain period, and health insurance cover costs of an insured person’s medical and surgical expenditures. A life insurance plan ranges from 5 to 30 years, which could vary based on your insurer. Unlike life insurance plans, a health insurance policy provides payout for availing medical treatment. For a life insurance policy, your named dependents will receive the benefits of financial assistance upon your passing.

Source: zerogravityfinancial.com

Source: zerogravityfinancial.com

For a life insurance policy, your named dependents will receive the benefits of financial assistance upon your passing. Premiums could be higher depending on several factors such as income, age, and existing medical conditions. This video gives information regarding the overview of life insurance and health insurance.life insurance is mainly protecting your family/beneficiary/nomine. If they are not following the act, we will review your complaint and investigate. Let�s check out a few key differences between life insurance & a health insurance policy:

Source: pinterest.com

Source: pinterest.com

Additionally, individual health insurance plans. For a life insurance policy, your named dependents will receive the benefits of financial assistance upon your passing. Life insurance vs health insurance the difference between life insurance and health insurance is that the health insurance company provides payments for medical expenses based on the fixed premium payments by the insured while the life insurance contract gives a nominee a fixed amount when the insured dies. The cost of life insurance policies will vary based on gender, age, type of policy, and overall health. Premiums could be higher depending on several factors such as income, age, and existing medical conditions.

Source: pinterest.com

Source: pinterest.com

Health insurance and life insurance share many of the same characteristics: Life insurance is a type of insurance that offers life coverage to the policyholder. The cost of life insurance policies will vary based on gender, age, type of policy, and overall health. While health insurance covers the expenses incurred towards treatment, life insurance can help your family reduce their financial burden in case of your untimely demise. Older people will also have more expensive life insurance than their younger counterparts.

Source: myfinancemd.com

Source: myfinancemd.com

Health insurance covers an individual or group of an individual for 5 to 10 years. The benefit amount is fixed and guaranteed for payment to your family upon meeting the coverage conditions. Health insurance is a type of policy that covers the medical expenditure of the policyholder. This video gives information regarding the overview of life insurance and health insurance.life insurance is mainly protecting your family/beneficiary/nomine. As for health insurance, you will receive financial support if you have any health problems.

Source: policygenius.com

Source: policygenius.com

Here is an introduction and overview of each. Health insurance is a type of policy that covers the medical expenditure of the policyholder. Health insurance and life insurance share many of the same characteristics: On the other hand, health insurance is specifically designed to cover all the medical expenses incurred in case of hospitalization or when diagnosed with a critical illness. A life insurance plan ranges from 5 to 30 years, which could vary based on your insurer.

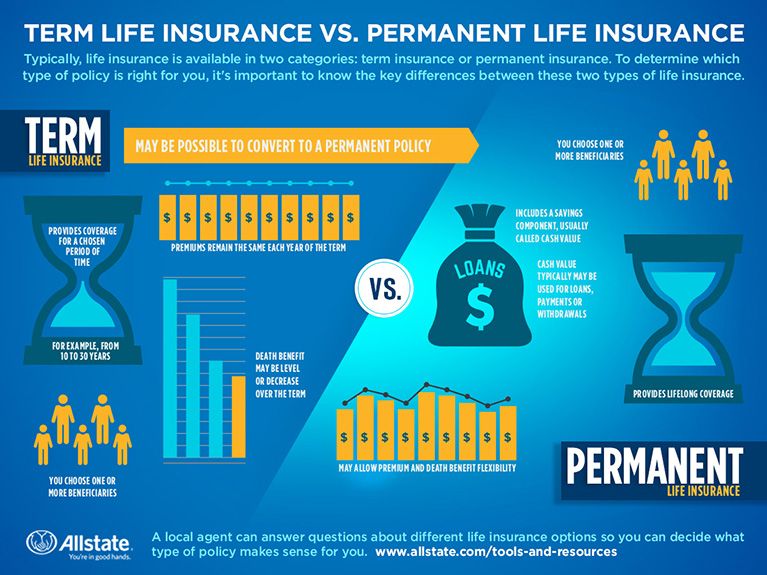

Source: allstate.com

Source: allstate.com

Underwriting, premiums, insured individuals, claims payments, and more. This video gives information regarding the overview of life insurance and health insurance.life insurance is mainly protecting your family/beneficiary/nomine. In the absence of a medical insurance plan, you will need to bear the medical costs in such a situation. Underwriting, premiums, insured individuals, claims payments, and more. Life insurance is a type of insurance that offers life coverage to the policyholder.

Source: slideshare.net

Source: slideshare.net

This video gives information regarding the overview of life insurance and health insurance.life insurance is mainly protecting your family/beneficiary/nomine. Life insurance for men will be more expensive than for women. The main difference between life insurance and health insurance is that life insurance that gives out an amount of money either on the death of the insured one or after a certain period, and health insurance cover costs of an insured person’s medical and surgical expenditures. Unlike life insurance plans, a health insurance policy provides payout for availing medical treatment. And health insurance cover can be renewed by the policyholder.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance and health insurance difference by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.