Life insurance beneficiary trust Idea

Home » Trend » Life insurance beneficiary trust IdeaYour Life insurance beneficiary trust images are available in this site. Life insurance beneficiary trust are a topic that is being searched for and liked by netizens today. You can Download the Life insurance beneficiary trust files here. Get all royalty-free vectors.

If you’re looking for life insurance beneficiary trust pictures information linked to the life insurance beneficiary trust interest, you have visit the ideal blog. Our website frequently provides you with hints for seeking the highest quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Life Insurance Beneficiary Trust. A 2012 florida case underscores the risk in naming a revocable trust as a beneficiary of a life insurance policy. Reach out to your insurer for steps to do this. The insurance company pays the death benefit to the trust and the trust dictates the. This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used.

Step Van Life Insurance Beneficiary From stepvantenton.blogspot.com

Step Van Life Insurance Beneficiary From stepvantenton.blogspot.com

This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used. An insurance trust is a type of irrevocable trust where the trust assets consist of a life insurance policy. Full name of the trust. This week, i received the following question from a reader. Common trusts used as beneficiaries. If your life insurance beneficiary is your spouse, there�s no issue;

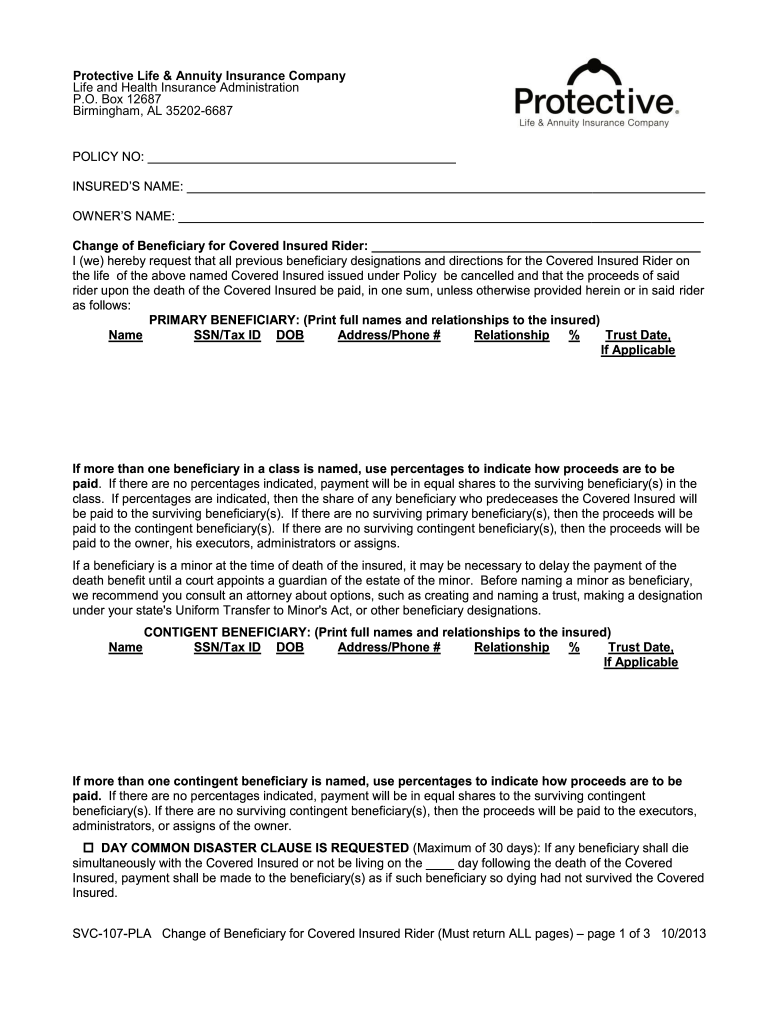

This is a legal document and is used by the insurer to determine who will receive the death benefit and how much they will receive.

Ordinarily, life insurance policies are not reachable by the deceased’s creditors because they are paid directly to, and belong to, the beneficiary. On your life insurance beneficiary designation form, you should indicate the person or persons you want as your beneficiaries. Common trusts used as beneficiaries. If the life insurance beneficiary is different from the person named to receive life insurance benefit in the will, the payout goes to the person designated on the insurance company beneficiary form. Life insurance trust dated july 8, 2009 corporate trustee: A will or trust, on the other hand, is a unique estate planning.

Source: signnow.com

Source: signnow.com

In a beneficiary trust, the trust’s creator transfers assets to the trust for the use of his beneficiary. The trusts tax identification number must be provided in the ownership section of the insurance application but is not necessary for the beneficiary designation. If a trust had been named as a third beneficiary, probate for the life insurance payout would have been avoided. Hi i read your blog about funding a revocable trust. January 31, 2022 an irrevocable beneficiary receives benefits from a life insurance policy in an agreement that cannot be changed without the permission of the beneficiary.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Tips for determining if you might need life insurance. These individuals are entitled to life insurance proceeds through a contract you and the life insurance agency arrange. You can also update an existing policy by changing the beneficiary to a trust. Ordinarily, life insurance policies are not reachable by the deceased’s creditors because they are paid directly to, and belong to, the beneficiary. Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning.

Source: stepvantenton.blogspot.com

Source: stepvantenton.blogspot.com

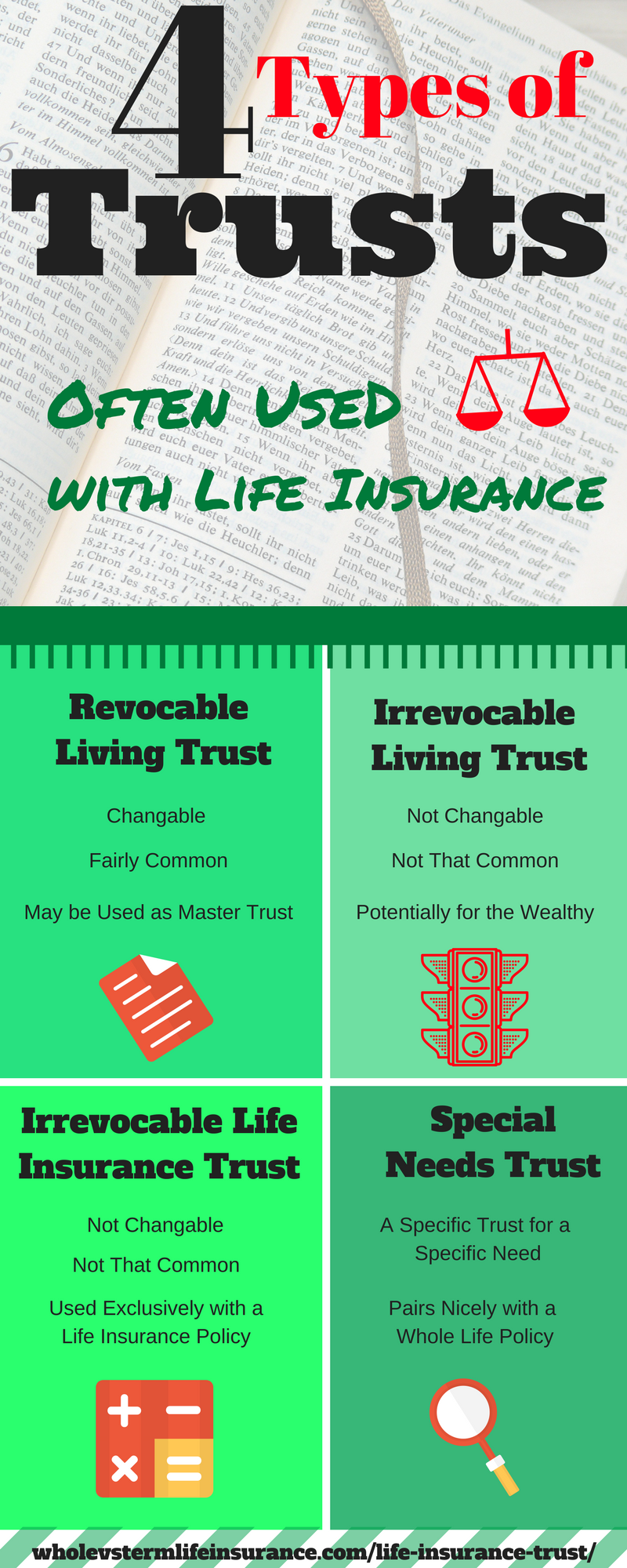

It can also allow for asset protection benefits if the assets are held in the trust either by a trustee who is not a beneficiary or by a trustee bound an ascertainable standard when it comes to. A trust may be appropriate where a beneficiary is a spendthrift or unable to manage their own financial affairs. The insurance company pays the death benefit to the trust and the trust dictates the. The kind of trust you have makes a big difference to the decision to name the trust as a beneficiary. Then, you’ll name the trust as the beneficiary when purchasing a life insurance policy.

Source: carriehightower.net

Source: carriehightower.net

An irrevocable trust or a revocable trust can both be listed your life insurance beneficiary, and they each come with their own set of pros and cons. You can also update an existing policy by changing the beneficiary to a trust. Trusts as a beneficiary to a life insurance policy. Insurance trusts can be really beneficial on a number of fronts, especially when it comes to protecting an estate and its. The policies are final, and the beneficiary (or beneficiaries) named in the policy would be entitled to the money free and clear.

Source: thebalance.com

Source: thebalance.com

The revocable trust provided that the trustee shall pay all of the debts and expenses of the decedent’s estate prior to making distributions. How to designate a life insurance a life insurance beneficiary. This week, i received the following question from a reader. Reach out to your insurer for steps to do this. January 31, 2022 an irrevocable beneficiary receives benefits from a life insurance policy in an agreement that cannot be changed without the permission of the beneficiary.

Source: drdisabilityquotes.com

Source: drdisabilityquotes.com

This is a legal document and is used by the insurer to determine who will receive the death benefit and how much they will receive. Life insurance policies cannot generally be paid out to a minor. On your life insurance beneficiary designation form, you should indicate the person or persons you want as your beneficiaries. What are they and how do they work? However in some situations it may be better to name a trust as the beneficiary of a life insurance policy.

Source: bpsuk.co.uk

Source: bpsuk.co.uk

It can also allow for asset protection benefits if the assets are held in the trust either by a trustee who is not a beneficiary or by a trustee bound an ascertainable standard when it comes to. The decedent named his revocable trust as beneficiary of two life insurance policies. If the life insurance beneficiary is different from the person named to receive life insurance benefit in the will, the payout goes to the person designated on the insurance company beneficiary form. First, you need to understand that a life insurance beneficiary will receive money from the life insurance policy after the policy holder passes away. Or, consider naming your revocable living trust as the primary beneficiary of your life insurance so that the proceeds will pass into the b trust (or bypass, credit shelter, or family trust) created for the benefit of your surviving spouse so that the proceeds will be protected from creditors, lawsuits, and a new spouse.

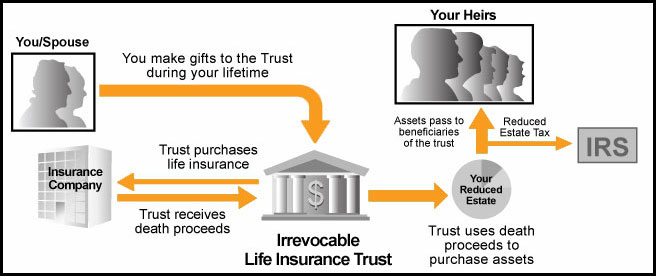

First, you need to understand that a life insurance beneficiary will receive money from the life insurance policy after the policy holder passes away. Life insurance policies cannot generally be paid out to a minor. This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used. An insurance trust is an irrevocable trust set up with a life insurance policy as the asset allowing the grantor to exempt assets from a taxable estate. How to designate a life insurance a life insurance beneficiary.

Source: lifeinsurance0000.blogspot.com

Source: lifeinsurance0000.blogspot.com

This week, i received the following question from a reader. First, it enables the trust to manage how the death benefit is spent. A trust may be appropriate where a beneficiary is a spendthrift or unable to manage their own financial affairs. Then, you’ll name the trust as the beneficiary when purchasing a life insurance policy. A beneficiary can be one or multiple people or even an organization.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

Jane doe, wife of john doe, if living; The trusts tax identification number must be provided in the ownership section of the insurance application but is not necessary for the beneficiary designation. Then, you’ll name the trust as the beneficiary when purchasing a life insurance policy. A beneficiary can be one or multiple people or even an organization. While a beneficiary is often thought of as a loved one who may need or make use of that.

Source: everquote.com

Source: everquote.com

With insurance trusts, both the owner and beneficiary of the insurance policy is the actual trust itself. January 31, 2022 an irrevocable beneficiary receives benefits from a life insurance policy in an agreement that cannot be changed without the permission of the beneficiary. These individuals are entitled to life insurance proceeds through a contract you and the life insurance agency arrange. A will or trust does not supersede a life insurance policy as long as the insured named one or more beneficiaries. If the life insurance beneficiary is different from the person named to receive life insurance benefit in the will, the payout goes to the person designated on the insurance company beneficiary form.

Source: youtube.com

Source: youtube.com

Insurance trusts can be really beneficial on a number of fronts, especially when it comes to protecting an estate and its. This is a legal document and is used by the insurer to determine who will receive the death benefit and how much they will receive. Irrevocable trusts are often used as the owner and beneficiary for large estates. This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used. My husband and i are talking about getting them, but all we have of significant value (besides house, and a money market ($500,000), is life insurance on his life ($2m).

Source: issuu.com

Source: issuu.com

First, let’s go over the two different kinds of trusts you can list as your life insurance’s primary or contingent beneficiary. When naming a trust, think about whether your trust should be the primary or secondary beneficiary. First, you need to understand that a life insurance beneficiary will receive money from the life insurance policy after the policy holder passes away. This week, i received the following question from a reader. January 31, 2022 an irrevocable beneficiary receives benefits from a life insurance policy in an agreement that cannot be changed without the permission of the beneficiary.

Source: youtube.com

Source: youtube.com

Ordinarily, life insurance policies are not reachable by the deceased’s creditors because they are paid directly to, and belong to, the beneficiary. You can also update an existing policy by changing the beneficiary to a trust. In the basic principles of ordinary life insurance, the insured pays a premium in exchange for a guaranteed death benefit that will go to a beneficiary of the insured’s choosing. A trust may be appropriate where a beneficiary is a spendthrift or unable to manage their own financial affairs. A will or trust, on the other hand, is a unique estate planning.

Source: 1life.co.za

Source: 1life.co.za

Reach out to your insurer for steps to do this. First, let’s go over the two different kinds of trusts you can list as your life insurance’s primary or contingent beneficiary. This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used. This is a legal document and is used by the insurer to determine who will receive the death benefit and how much they will receive. A 2012 florida case underscores the risk in naming a revocable trust as a beneficiary of a life insurance policy.

Source: boonebankiowa.com

On your life insurance beneficiary designation form, you should indicate the person or persons you want as your beneficiaries. Upon your passing, your life insurance company. Otherwise to the abc trust company, inc., trustee, or its An insurance trust is an irrevocable trust set up with a life insurance policy as the asset allowing the grantor to exempt assets from a taxable estate. Common trusts used as beneficiaries.

Source: taxwalls.blogspot.com

Source: taxwalls.blogspot.com

Otherwise to the abc trust company, inc., trustee, or its In a beneficiary trust, the trust’s creator transfers assets to the trust for the use of his beneficiary. This week, i received the following question from a reader. This irrevocable trust provides a way for a grantor to give assets to another. An insurance trust is an irrevocable trust set up with a life insurance policy as the asset allowing the grantor to exempt assets from a taxable estate.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

The kind of trust you have makes a big difference to the decision to name the trust as a beneficiary. An irrevocable trust or a revocable trust can both be listed your life insurance beneficiary, and they each come with their own set of pros and cons. When naming a trust, think about whether your trust should be the primary or secondary beneficiary. This ensures that the life insurance proceeds avoid probate and it allows for the trust to go into detail about how the funds are meant to be used. You can also update an existing policy by changing the beneficiary to a trust.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance beneficiary trust by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.