Life insurance beneficiary vs will information

Home » Trending » Life insurance beneficiary vs will informationYour Life insurance beneficiary vs will images are available in this site. Life insurance beneficiary vs will are a topic that is being searched for and liked by netizens today. You can Find and Download the Life insurance beneficiary vs will files here. Get all royalty-free photos and vectors.

If you’re searching for life insurance beneficiary vs will images information linked to the life insurance beneficiary vs will interest, you have visit the right blog. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Life Insurance Beneficiary Vs Will. A life insurance beneficiary is the person or entity that will receive the money from your policys death benefit when you pass away. In cases of a named life insurance beneficiary versus a will, the life insurance beneficiary designation will almost always override the will. Each of these are defined below with examples of the common designations. They can be different people.

How to Choose a Beneficiary Hightower Insurance Agency From carriehightower.net

How to Choose a Beneficiary Hightower Insurance Agency From carriehightower.net

If you designate your trust, and if you still have the policy on your death, then it will pay to your trust and go as an asset as you direct. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Changes to your will do not affect your life insurance beneficiaries. The insurer is obligated to pay the policy amount to the beneficiary named in the policy. The life insurance beneficiary does not need to be the same person as the one appointed in the will. Person whose life is insured.

A life insurance beneficiary can be one person or several people, depending on how you want to guarantee financial protection in the aftermath of your death.

Life insurance beneficiary vs will. First, you need to understand that a life insurance beneficiary will receive money from the life insurance policy after the policy holder passes away. Life insurance beneficiary vs will. Each of these are defined below with examples of the common designations. How a beneficiary designation works. While these documents sound very similar, the important difference between a beneficiary designation and a will is that they pertain to different assets.

Source: fbsbenefits.com

Source: fbsbenefits.com

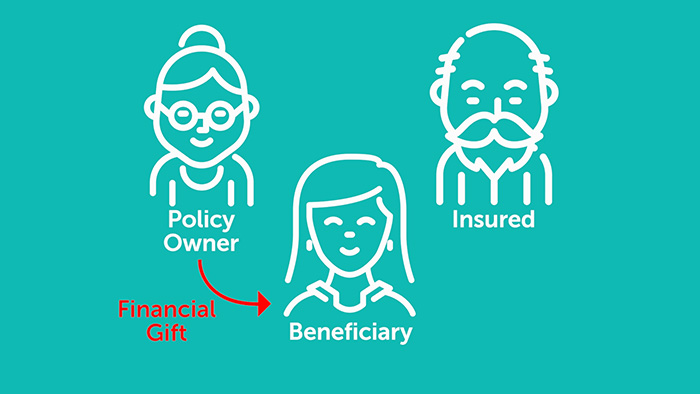

All life insurance policies have three primary parties that are required as part of the application process: Each of these are defined below with examples of the common designations. A life insurance beneficiary can be one person or several people, depending on how you want to guarantee financial protection in the aftermath of your death. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The insured in any life insurance policy, the insured is the person on…

Source: br.pinterest.com

Source: br.pinterest.com

For example, let’s say you purchase a life insurance policy. A beneficiary can be one or multiple people or even an organization. Each of these are defined below with examples of the common designations. Person who collects the death benefit (1). Upon your death, the beneficiary can claim the asset you named for.

Source: gromowskilawfirm.com

Source: gromowskilawfirm.com

A beneficiary designation is a document that names the individual who will receive an asset in the case of your passing. A beneficiary designation is a document that names the individual who will receive an asset in the case of your passing. Just as a life insurance policy always has an owner, it also always has a beneficiary. The life insurance beneficiary does not need to be the same person as the one appointed in the will. A will, on the other hand, is an estate planning instrument that allows one to instruct how assets present in your estate should be distributed or administered or.

Source: revisi.net

Source: revisi.net

Meanwhile, valuable assets such as a family home may have to be sold to pay the bills. Life insurance beneficiary vs owner. Person who owns the policy. For example, let’s say you purchase a life insurance policy. A life insurance policy is a contract, like the deed to a house, and legally is more binding than a will, particularly one that hasn’t yet been probated.

Source: dandzelia-z.blogspot.com

Source: dandzelia-z.blogspot.com

For example, let’s say you purchase a life insurance policy. In most cases, beneficiaries are loved ones or family friends, though a beneficiary may also be (for tax purposes) an estate or trust created in your name. The beneficiary of a life insurance policy is very different from the beneficiary of a will. The insured in any life insurance policy, the insured is the person on… A life insurance beneficiary can be one person or several people, depending on how you want to guarantee financial protection in the aftermath of your death.

Source: revisi.net

Source: revisi.net

Meanwhile, valuable assets such as a family home may have to be sold to pay the bills. A will, on the other hand, is an estate planning instrument that allows one to instruct how assets present in your estate should be distributed or administered or. Life insurance beneficiary vs will. If you designate your trust, and if you still have the policy on your death, then it will pay to your trust and go as an asset as you direct. Certain assets let you name beneficiaries to receive them after you die.

Source: indianmoney.com

Source: indianmoney.com

A beneficiary can be irrevocable or revocable. A life insurance beneficiary will receive the amount from the life policy after the demise of the policyholder. The policyowner cannot however change an irrevocable beneficiary without the beneficiarys consent. Life insurance beneficiary vs owner. The life insurance policy is a contract and any proceeds will go to whomever you designate.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

The insurer is obligated to pay the policy amount to the beneficiary named in the policy. Beneficiary designations are unique to each asset and are managed by the entity that holds said asset. They can be different people. A will covers any assets that you name within the document while a beneficiary designation is a document you specifically create for a single asset. The policyowner cannot however change an irrevocable beneficiary without the beneficiarys consent.

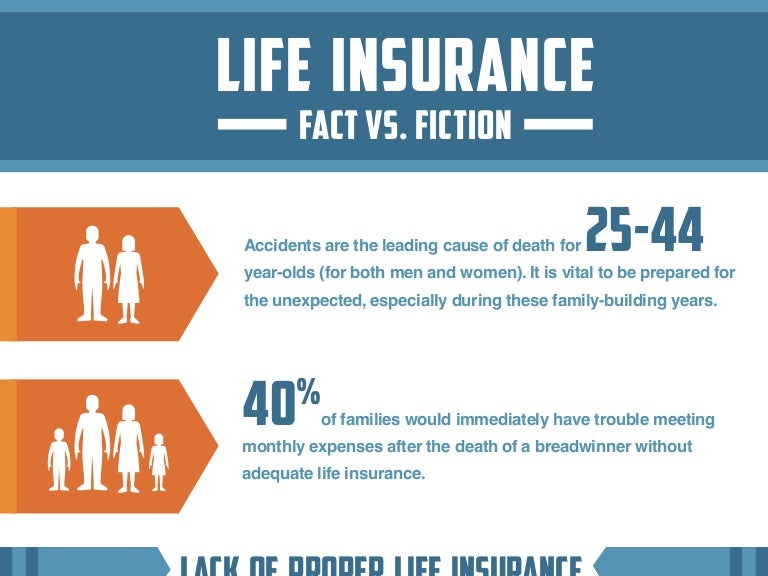

Source: slideshare.net

Source: slideshare.net

A beneficiary can be one or multiple people or even an organization. The life insurance beneficiary does not need to be the same person as the one appointed in the will. A beneficiary can be irrevocable or revocable. A life insurance beneficiary will receive the amount from the life policy after the demise of the policyholder. A life insurance beneficiary is the person or entity that will receive the money from your policys death benefit when you pass away.

Source: everquote.com

Source: everquote.com

The insured in any life insurance policy, the insured is the person on… A beneficiary can be one or multiple people or even an organization. Person who owns the policy. A life insurance beneficiary can be one person or several people, depending on how you want to guarantee financial protection in the aftermath of your death. How a beneficiary designation works.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

For example, let’s say you purchase a life insurance policy. The life insurance policy is a contract and any proceeds will go to whomever you designate. The beneficiary of a life insurance policy is very different from the beneficiary of a will. Meanwhile, valuable assets such as a family home may have to be sold to pay the bills. Just as a life insurance policy always has an owner, it also always has a beneficiary.

Just as a life insurance policy always has an owner, it also always has a beneficiary. Another difference between the beneficiary and the successor considers how the insured individual prefers distribution of the insurance payout. All life insurance policies have three primary parties that are required as part of the application process: In a life insurance policy, a beneficiary is the person or organization that receives the life insurance death benefit upon the passing of the insured policy owner. A life insurance policy is a contract, like the deed to a house, and legally is more binding than a will, particularly one that hasn’t yet been probated.

Source: carriehightower.net

Source: carriehightower.net

The insurer is obligated to pay the policy amount to the beneficiary named in the policy. Meanwhile, valuable assets such as a family home may have to be sold to pay the bills. Certain assets let you name beneficiaries to receive them after you die. A beneficiary designation is a document that names the individual who will receive an asset in the case of your passing. Person who collects the death benefit (1).

Source: eho-pirmadienanaujinamai.blogspot.com

Source: eho-pirmadienanaujinamai.blogspot.com

Life insurance beneficiary vs owner. The beneficiary is the person who will receive the life insurance benefit when the policy owner passes away. Life insurance beneficiary vs owner. For example, let’s say you purchase a life insurance policy. The insured, the policy owner and the beneficiary(s).

Source: youtube.com

Source: youtube.com

How a beneficiary designation works. The insured in any life insurance policy, the insured is the person on… The life insurance beneficiary does not need to be the same person as the one appointed in the will. A life insurance beneficiary is the person or entity that will receive the money from your policys death benefit when you pass away. For example, let’s say you purchase a life insurance policy.

Source: friendship-f0rever.blogspot.com

Source: friendship-f0rever.blogspot.com

Nov 19, 2020 — the policyholder: Changes to your will do not affect your life insurance beneficiaries. By far the biggest disadvantage to naming a trust as life insurance beneficiary is that rusts needs to be administered which takes time. Person who collects the death benefit (1). Beneficiary designations are unique to each asset and are managed by the entity that holds said asset.

Source: takemycounsel.com

Source: takemycounsel.com

The policyowner cannot however change an irrevocable beneficiary without the beneficiarys consent. Meanwhile, valuable assets such as a family home may have to be sold to pay the bills. Life insurance beneficiary vs will. A beneficiary can be irrevocable or revocable. For example, let’s say you purchase a life insurance policy.

Source: revisi.net

Source: revisi.net

The will is different from a trust and cannot change the beneficiary named in the life insurance policy. A life insurance policy is a legal document that bypasses probate. Upon your death, the beneficiary can claim the asset you named for. Each of these are defined below with examples of the common designations. Changes to your will do not affect your life insurance beneficiaries.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance beneficiary vs will by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.