Life insurance creditor protection by state Idea

Home » Trending » Life insurance creditor protection by state IdeaYour Life insurance creditor protection by state images are available in this site. Life insurance creditor protection by state are a topic that is being searched for and liked by netizens now. You can Get the Life insurance creditor protection by state files here. Find and Download all free vectors.

If you’re looking for life insurance creditor protection by state pictures information linked to the life insurance creditor protection by state topic, you have visit the ideal blog. Our website always provides you with suggestions for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

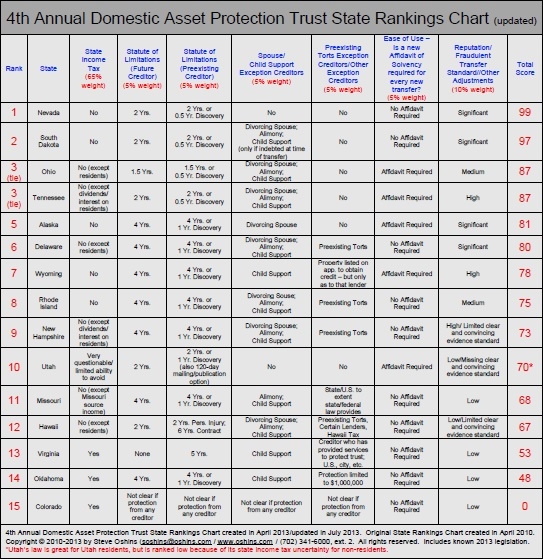

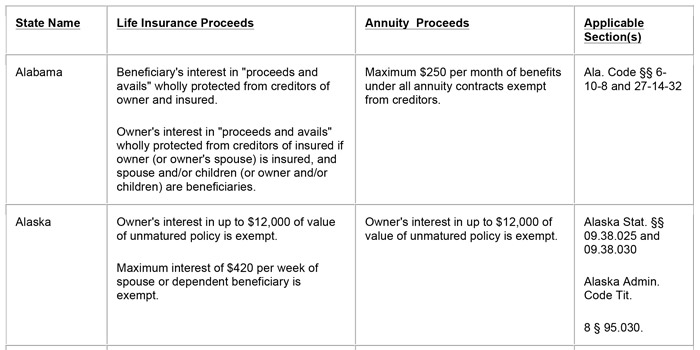

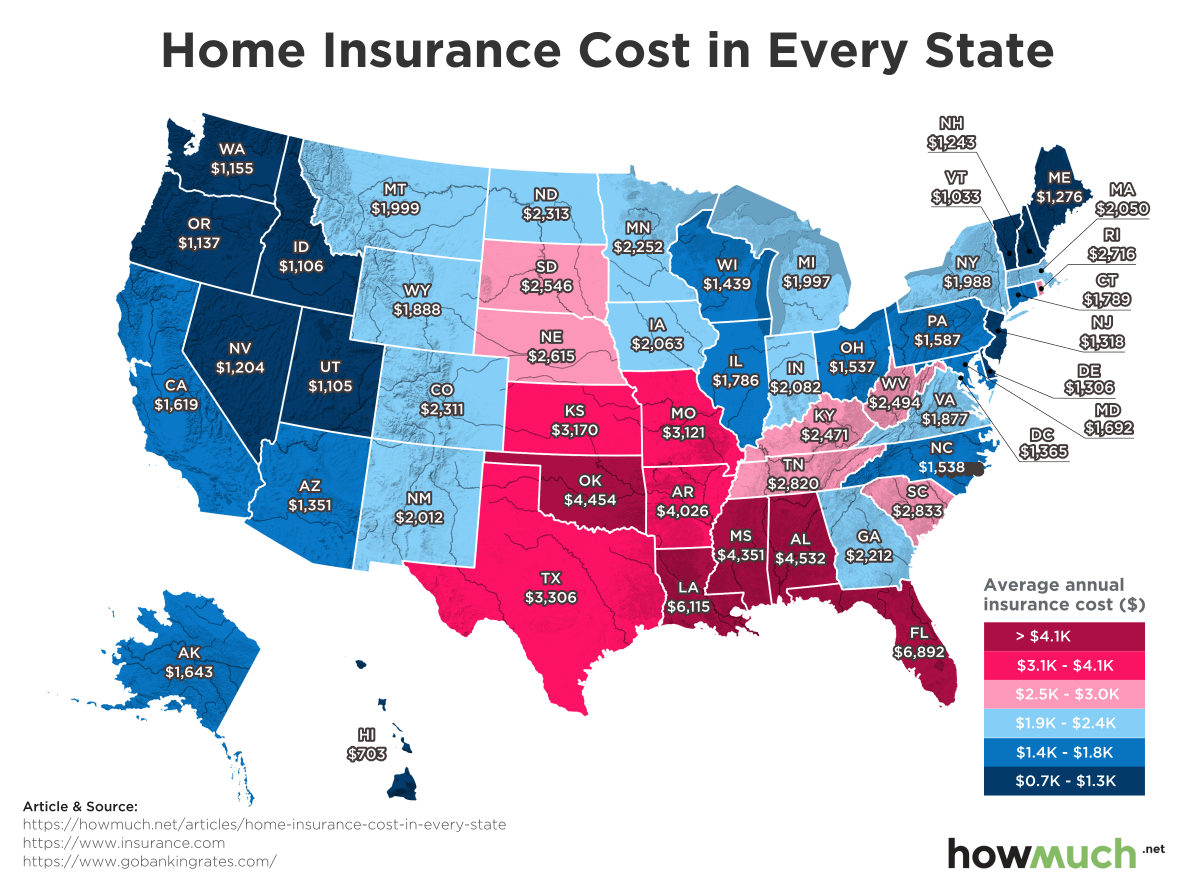

Life Insurance Creditor Protection By State. A “credit life insurance contract” is taken out to pay off the remainder of outstanding loans in the event of death. Cash value life insurance creditor protection and bankruptcy protection by state cash value life insurance includes whole life and universal life insurance. Life insurance and other insurance products like annuities and segregated funds can give you creditor protection for your assets. As the cliche goes, the only things guaranteed in life, are death and taxes.

Who Needs Life Insurance Coverage? EINSURANCE From einsurance.com

Who Needs Life Insurance Coverage? EINSURANCE From einsurance.com

•life insurance should not be considered solely as an asset protection tool. In a life insurance policy is protected from claims of the creditors of both the owner of the policy and the insured). So, use the list below to see if your state offers the exemption for the traditional or roth ira. An often overlooked feature of life insurance is the asset protection that many states provide for life insurance against the claims of judgment creditors. The many benefits of whole life insurance policies and universal life insurance extend far beyond just providing. At the highest level, creditor and asset protection is about keeping your wealth safe from.

Here at the asset protection society (aps™) we stress the importance of protecting all of your assets.

Traditionally, life insurance products have been given special protection against the claims of creditors under provincial. However, as with most states, properly structured life insurance policies can be protected from creditors. Both are excellent ways to provide some safeguards against life’s uncertainties. Every state has a creditor protection statute which addresses the issue of whether death proceeds and cash values are fully or partially exempt from the claims of creditors. The law relating to protected insurance products. This benefit to society is why these exemption laws exist.

Source: einsurance.com

Source: einsurance.com

Listing someone by name and their relationship to you is always better. The proceeds from a life insurance policy called the death benefit are typically protected from a creditor or liability claim. Life insurance, like all insurance, transfers risk away from the policyholder. Protection from creditors always depends on the type of asset and the state (or country) you live in. Any type of ira is protected from creditors for residents of washington state.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

The proceeds from a life insurance policy called the death benefit are typically protected from a creditor or liability claim. Credit life insurance contracts are not protected under § 513.430(7). Below is a table that shows ira creditor protection by state. As a general rule, all assets of an individual or entity are security for unpaid debts owing to a creditor. An often overlooked feature of life insurance is the asset protection that many states provide for life insurance against the claims of judgment creditors.

Source: businessinworld.com

Source: businessinworld.com

The owner of a life insurance policy, regardless of the identity of the insured, is entitled to accelerated payment of the death benefit. Whatever protection is listed below is nullified when a fraudulent conveyance is involved. Traditionally, life insurance products have been given special protection against the claims of creditors under provincial. The owner of a life insurance policy, regardless of the identity of the insured, is entitled to accelerated payment of the death benefit. So, use the list below to see if your state offers the exemption for the traditional or roth ira.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

As a general rule, all assets of an individual or entity are security for unpaid debts owing to a creditor. Take an ira for example. First, there are laws setting forth protections for specified kinds of benefits, such as life insurance benefits, payable on death account benefits, or retirement benefits provided by state or local governments. The owner of a life insurance policy, regardless of the identity of the insured, is entitled to accelerated payment of the death benefit. How to protect your life insurance from creditors.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

So, use the list below to see if your state offers the exemption for the traditional or roth ira. Whatever protection is listed below is nullified when a fraudulent conveyance is involved. •life insurance should not be considered solely as an asset protection tool. The debtor is the insured and creditors are the beneficiaries. For state bankruptcy exemptions, one of two options (but not a combination) can be chosen as described below:

Source: businessinworld.com

Source: businessinworld.com

Because the life insurance proceeds are for the benefit of the beneficiary, life insurance offers protection under both federal and state law. The proceeds from a life insurance policy called the death benefit are typically protected from a creditor or liability claim. So, use the list below to see if your state offers the exemption for the traditional or roth ira. Cash value life insurance creditor protection and bankruptcy protection by state disclaimer: However, the proceeds will be subject to the claims of the.

Source: sr22insurancenews.com

Source: sr22insurancenews.com

However, as with most states, properly structured life insurance policies can be protected from creditors. Protection from creditors always depends on the type of asset and the state (or country) you live in. Unmatured life insurance policy owned by debtor may be exempted up to $14,325 (amount adjusted every three years) of debtor’s aggregate Each state is different with regard to the extent by which iras are protected. Cash value life insurance creditor protection and bankruptcy protection by state disclaimer:

Source: fulcrumconsult.com

Source: fulcrumconsult.com

An often overlooked feature of life insurance is the asset protection that many states provide for life insurance against the claims of judgment creditors. •life insurance cannot be used to defraud creditors. The creditor’s insurable interest is limited to the amount of the debt owed. Asset protection of cash value life insurance, annuities, and iras. Listing someone by name and their relationship to you is always better.

Source: retirementestateplan.com

Source: retirementestateplan.com

The owner of a life insurance policy, regardless of the identity of the insured, is entitled to accelerated payment of the death benefit. Each state is different with regard to the extent by which iras are protected. Any type of ira is protected from creditors for residents of washington state. Listing someone by name and their relationship to you is always better. The many benefits of whole life insurance policies and universal life insurance extend far beyond just providing.

Source: newsroom.statefarm.com

Source: newsroom.statefarm.com

However, the proceeds will be subject to the claims of the. Asset protection of cash value life insurance, annuities, and iras. Life insurance, like all insurance, transfers risk away from the policyholder. Be specific when naming beneficiaries. Credit life insurance contracts are not protected under § 513.430(7).

Source: clublexus.com

Source: clublexus.com

Take an ira for example. The law relating to protected insurance products. The proceeds from a life insurance policy called the death benefit are typically protected from a creditor or liability claim. Asset protection of cash value life insurance, annuities, and iras. Listing someone by name and their relationship to you is always better.

Source: clark.com

Source: clark.com

•life insurance should not be considered solely as an asset protection tool. So, use the list below to see if your state offers the exemption for the traditional or roth ira. However, the proceeds will be subject to the claims of the. As a general rule, all assets of an individual or entity are security for unpaid debts owing to a creditor. The proceeds from a life insurance policy called the death benefit are typically protected from a creditor or liability claim.

Source: revisi.net

Source: revisi.net

Traditionally, life insurance products have been given special protection against the claims of creditors under provincial. Because the life insurance proceeds are for the benefit of the beneficiary, life insurance offers protection under both federal and state law. As the cliche goes, the only things guaranteed in life, are death and taxes. In a life insurance policy is protected from claims of the creditors of both the owner of the policy and the insured). However, the proceeds will be subject to the claims of the.

Source: thesimpledollar.com

Source: thesimpledollar.com

Creditor protection is not guaranteed. In general, a life insurance policy’s proceeds are exempt from the policyowner’s creditors unless the death benefit proceeds are paid to his or her estate. Each state is different with regard to the extent by which iras are protected. You can list beneficiaries by name and title (jane doe, spouse) or using broader terms (current spouse). For state bankruptcy exemptions, one of two options (but not a combination) can be chosen as described below:

Source: thebalance.com

Source: thebalance.com

Whatever protection is listed below is nullified when a fraudulent conveyance is involved. Life insurance, like all insurance, transfers risk away from the policyholder. So, use the list below to see if your state offers the exemption for the traditional or roth ira. Life insurance and other insurance products like annuities and segregated funds can give you creditor protection for your assets. First, there are laws setting forth protections for specified kinds of benefits, such as life insurance benefits, payable on death account benefits, or retirement benefits provided by state or local governments.

Source: playlouder.com

Source: playlouder.com

Protection from creditors always depends on the type of asset and the state (or country) you live in. The owner of a life insurance policy, regardless of the identity of the insured, is entitled to accelerated payment of the death benefit. At the highest level, creditor and asset protection is about keeping your wealth safe from. Asset protection of cash value life insurance, annuities, and iras. You can list beneficiaries by name and title (jane doe, spouse) or using broader terms (current spouse).

Source: aspen-creek.net

Source: aspen-creek.net

Take an ira for example. Ira creditor protection by state table. Take an ira for example. So, use the list below to see if your state offers the exemption for the traditional or roth ira. Is life insurance creditor protected?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance creditor protection by state by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.