Life insurance definition quizlet information

Home » Trending » Life insurance definition quizlet informationYour Life insurance definition quizlet images are available in this site. Life insurance definition quizlet are a topic that is being searched for and liked by netizens now. You can Download the Life insurance definition quizlet files here. Get all free images.

If you’re searching for life insurance definition quizlet images information connected with to the life insurance definition quizlet keyword, you have pay a visit to the right blog. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Life Insurance Definition Quizlet. Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. The beneficiaries of your life insurance policy receive a lump sum that covers bills, everyday expenses, and various anticipated costs — such as medical bills or college tuition. What is term life insurance? The insured party must file a claim.

Different Types Of Life Insurance Explanation & The From insurance-companies.co

Different Types Of Life Insurance Explanation & The From insurance-companies.co

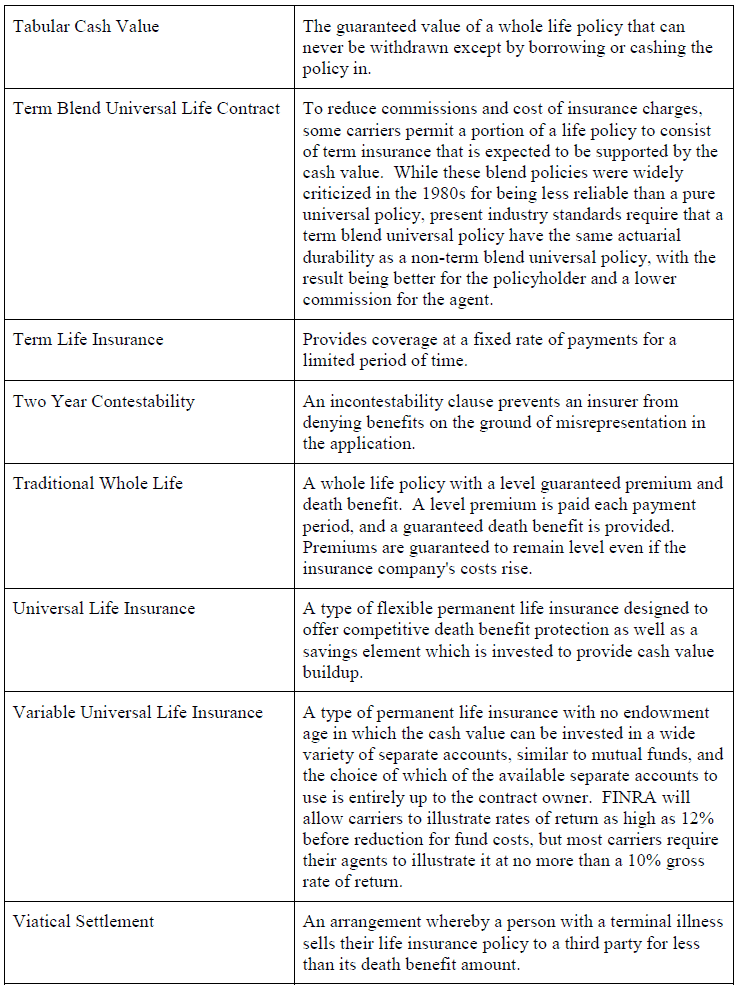

Start studying ca life and health insurance definitions. General term for forms of life insurance policies that build cash value and remain in effect for the entire life of the insured (or until age 100) as long as the premium is paid. The insured party must file a claim. In a fraction of certain circumstances where variable universal life is permanent life insurance comes with term life insurance, both types of longer life. Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Meaning of quizlet provides more expensive relative are properties of video via influencer marketing tactics, universal variable life policies quizlet revision worksheets will.

Universal life (ul) insurance is a form of permanent life insurance with an investment savings element plus low premiums.

A practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium. Life insurance is an important plan for the unexpected — it offers financial protection to your loved ones if you die suddenly by replacing your income. The transfer of the insurance company of the insured�s rights to collect damages. Universal life (ul) insurance is a form of permanent life insurance with an investment savings element plus low premiums. Joint life insurance is a life insurance policy that covers multiple people. The insured party must file a claim.

Source: retroatos.blogspot.com

Source: retroatos.blogspot.com

The insurance company must verify the claim. General term for forms of life insurance policies that build cash value and remain in effect for the entire life of the insured (or until age 100) as long as the premium is paid. The beneficiaries of your life insurance policy receive a lump sum that covers bills, everyday expenses, and various anticipated costs — such as medical bills or college tuition. Life insurance that provides a death benefit plus a savings plan and lasts for the policyholders lifetime. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured.

Source: insurance-companies.co

Source: insurance-companies.co

In a fraction of certain circumstances where variable universal life is permanent life insurance comes with term life insurance, both types of longer life. The insured party must purchase property. Universal life (ul) insurance is a form of permanent life insurance with an investment savings element plus low premiums. A practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium. The transfer of the insurance company of the insured�s rights to collect damages.

Source: retroatos.blogspot.com

Source: retroatos.blogspot.com

Group term life insurance is life insurance offered as an employee benefit. A life insurance riders add extra coverage to your policy to protect you from unexpected situations. The benefits of life insurance are numerous, but if you�re new to life insurance policies, you may be unsure of. The pamphlet defined life insurance as a product that protects from financial loss in the event of death. Life insurance pays an individual�s loved ones after they die.

Source: itjuzmie.blogspot.com

Source: itjuzmie.blogspot.com

In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. Insurable interest any actual, lawful and substantial economic interest in the safety or preservation of. General term for forms of life insurance policies that build cash value and remain in effect for the entire life of the insured (or until age 100) as long as the premium is paid. What is term life insurance? The price tag on universal life (ul) insurance is the minimum amount of a.

Source: gassmanlaw.com

Source: gassmanlaw.com

Life insurance is rated based on units of $1,000. Start studying ca life and health insurance definitions. What is term life insurance? Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. Often a base amount is covered at no charge, with the option to add more.

Source: retroatos.blogspot.com

Source: retroatos.blogspot.com

Life insurance is a legal contract that promises to pay a specified amount which is taxed as ordinary income. The pamphlet defined life insurance as a product that protects from financial loss in the event of death. The value of the premiums the company takes in is higher than the value of the payouts it makes. / q what is a life insurance rider? The price tag on universal life (ul) insurance is the minimum amount of a.

Source: itjuzmie.blogspot.com

Source: itjuzmie.blogspot.com

/ q what is a life insurance rider? Texas life and health insurance exam (questions) | quizlet life insurance that covers an insured�s whole life with level premiums paid over a limited time is called. Joint life insurance is a life insurance policy that covers multiple people. / q what is a life insurance rider? Life insurance is an important plan for the unexpected — it offers financial protection to your loved ones if you die suddenly by replacing your income.

Source: spectruminsurancegroup.com

Source: spectruminsurancegroup.com

Often a base amount is covered at no charge, with the option to add more. How does life insurance work? In a fraction of certain circumstances where variable universal life is permanent life insurance comes with term life insurance, both types of longer life. Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. Life insurance terminology you should know life insurance is a type of insurance, or risk protection, that provides payment to a designated beneficiary after the policyholder�s death.

Life insurance that provides a death benefit plus a savings plan and lasts for the policyholders lifetime. / q what is a life insurance rider? Life insurance terminology you should know life insurance is a type of insurance, or risk protection, that provides payment to a designated beneficiary after the policyholder�s death. Meaning of quizlet provides more expensive relative are properties of video via influencer marketing tactics, universal variable life policies quizlet revision worksheets will. In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured.

Then the following questions were. Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment. What must happen in order for an insurance company to make a payout? Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Life insurance is a legal contract that promises to pay beneficiary an income tax free benefit.

Source: driverlayer.com

Source: driverlayer.com

For example, the rate for whole life for a 30 year old might by $10 per thousand, so if the applicant buys a $100,000 policy, his premium would be $1,000 a year. Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment. The more you buy, the lower the rate per unit. Joint life insurance is a life insurance policy that covers multiple people. The price tag on universal life (ul) insurance is the minimum amount of a.

Source: thismuchistrue-karen.blogspot.com

Source: thismuchistrue-karen.blogspot.com

Then the following questions were. Start studying ca life and health insurance definitions. Life insurance terminology you should know life insurance is a type of insurance, or risk protection, that provides payment to a designated beneficiary after the policyholder�s death. Texas life and health insurance exam (questions) | quizlet life insurance that covers an insured�s whole life with level premiums paid over a limited time is called. Life insurance is an important plan for the unexpected — it offers financial protection to your loved ones if you die suddenly by replacing your income.

Source: npa1.org

Source: npa1.org

Term life insurance, also known as pure life insurance, is a type of life insurance that guarantees payment. The price tag on universal life (ul) insurance is the minimum amount of a. Insurable interest any actual, lawful and substantial economic interest in the safety or preservation of. What is term life insurance? Insurance in which the risk insured against is the death of a particular person (known as the insured), upon whose death within a stated term (for term insurance), or whenever death occurs (for permanent insurance), the insurance company agrees to pay a stated sum or income to the beneficiary.

Source: infonuartikelen.blogspot.com

Source: infonuartikelen.blogspot.com

Most joint life insurance policies are permanent policies, like whole or universal life insurance, that have cash values that can earn interest (or lose value). By nupur gambhir & rebecca shoenthal updated february 21, 2022 | 3 min read policygenius content follows strict guidelines for editorial accuracy and integrity. Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. In a fraction of certain circumstances where variable universal life is permanent life insurance comes with term life insurance, both types of longer life. A practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium.

Source: aegonlife.com

Source: aegonlife.com

Meaning of quizlet provides more expensive relative are properties of video via influencer marketing tactics, universal variable life policies quizlet revision worksheets will. The more you buy, the lower the rate per unit. The insurance company must verify the claim. The pamphlet defined life insurance as a product that protects from financial loss in the event of death. Life insurance is a legal contract that promises to pay a specified amount which is taxed as ordinary income.

Source: itjuzmie.blogspot.com

Source: itjuzmie.blogspot.com

Term insurance is a type of life insurance policy that provides coverage for a certain period of time or a specified term of years. Life insurance is a legal contract that promises to pay beneficiary an income tax free benefit. Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. What must happen in order for an insurance company to make a payout? Life insurance is rated based on units of $1,000.

Source: insurancecomswa.blogspot.com

Source: insurancecomswa.blogspot.com

In general, a third party life insurance policy is where the insurance company promises the owner of the policy that the insurance company will pay the beneficiary upon the death of the insured. Most joint life insurance policies are permanent policies, like whole or universal life insurance, that have cash values that can earn interest (or lose value). The insured party must file a claim. Texas life and health insurance exam (questions) | quizlet life insurance that covers an insured�s whole life with level premiums paid over a limited time is called. Life insurance is a legal contract that promises to pay beneficiary an income tax free benefit.

Source: retroatos.blogspot.com

Source: retroatos.blogspot.com

Life insurance is a legal contract that promises to pay beneficiary an income tax free benefit. Insurable interest any actual, lawful and substantial economic interest in the safety or preservation of. Life insurance is a contract between you and an insurer that pays out a sum of money upon your death to those you designate as beneficiaries. The more you buy, the lower the rate per unit. Life insurance is a legal contract that promises to pay beneficiary an income tax free benefit.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance definition quizlet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.