Life insurance distribution models Idea

Home » Trending » Life insurance distribution models IdeaYour Life insurance distribution models images are available in this site. Life insurance distribution models are a topic that is being searched for and liked by netizens today. You can Get the Life insurance distribution models files here. Download all royalty-free photos.

If you’re looking for life insurance distribution models pictures information related to the life insurance distribution models interest, you have come to the right site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

Life Insurance Distribution Models. For example, banks in japan are expected to halve their balance sheets in the Most insurance carriers fall into the following types: The amount you earn in commissions depends on the volume and variety of insurance products you sell. Life and group benefits have their own complexities when compared to p&c.

Bancassurance in the AsiaPacific Region Replacing the From celent.com

Bancassurance in the AsiaPacific Region Replacing the From celent.com

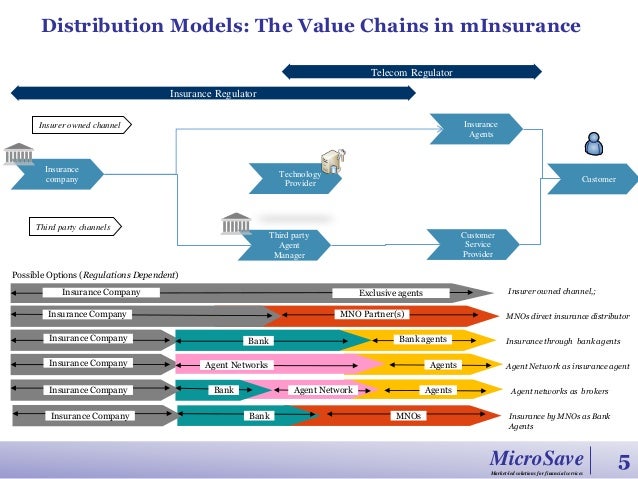

Increased use of social media as a distribution channel 3. It is followed by a discussion of the more general renewal. While for the remaining 1%, premiums are paid through web aggregators or online channels. • mgas receive a trailer commission from the. Life and group benefits have their own complexities when compared to p&c. Traditionally, the distribution model of insurance companies in the country is dominated by individual insurance agents and insurance brokers.

Managing general agencies life insurance distribution model • there are no disclosure requirements from the mga to consumers, and • product suitability remains the responsibility of the representative dealing with the customer, and of the insurer, in.

The market includes 17 major life insurers, 5 major reinsurers and a number of lloyds agencies. Life and group benefits have their own complexities when compared to p&c. Bancassurance is one of th e distribution channel for life insurance industry like agents or brokers through whic h insurance company can access to the doors of c ustomers for the delivery of. Of these distribution channels, the most discu ssed and anticipated channel is the. Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier. Evolving distribution models (goh).docx 2 1.

Source: sec.gov

Source: sec.gov

It draws on more than 50 interviews with senior insurance executives; In annual premiums in force. Life insurance success starts now. Bancassurance is one of th e distribution channel for life insurance industry like agents or brokers through whic h insurance company can access to the doors of c ustomers for the delivery of. • mgas receive a trailer commission from the.

Source: celent.com

Source: celent.com

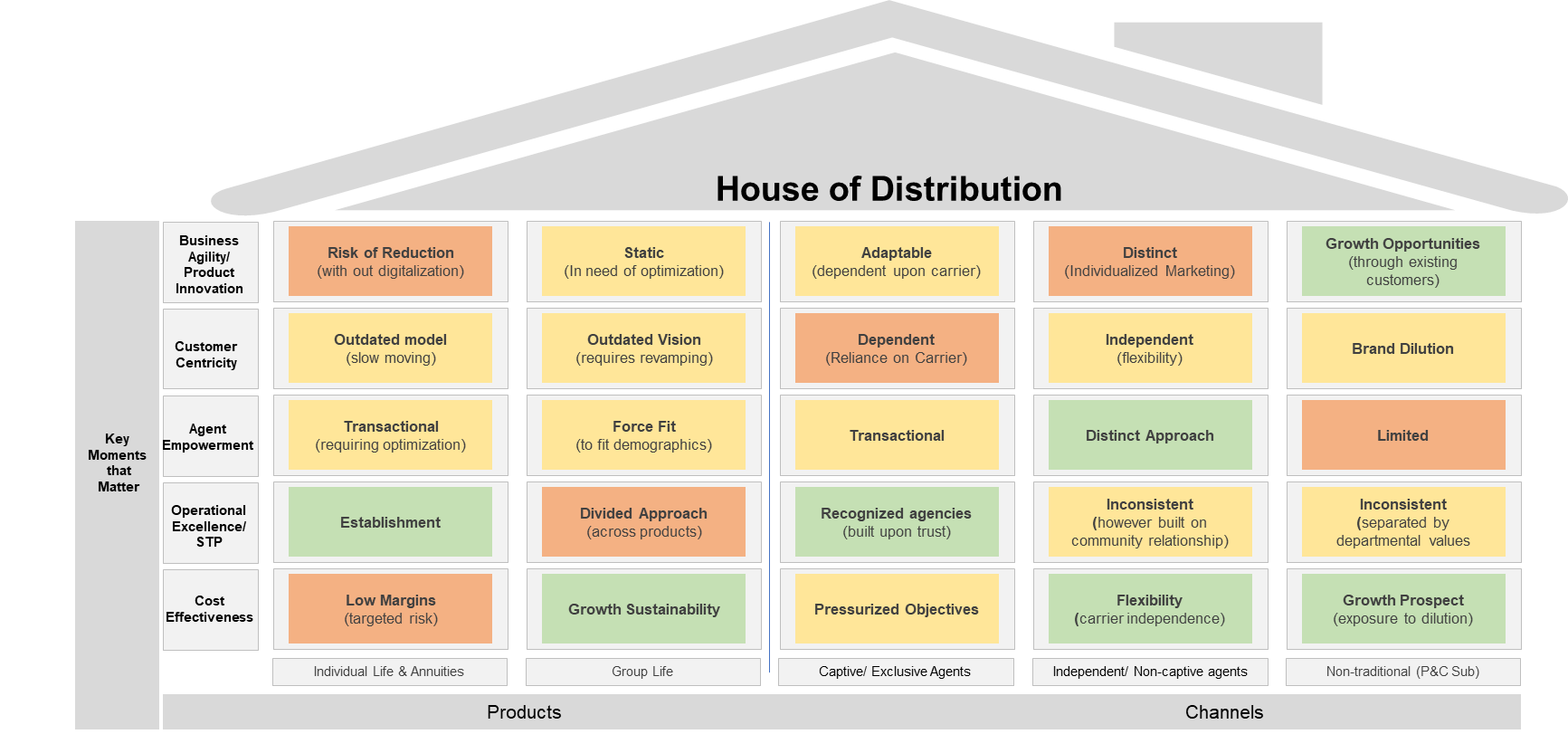

Life and group benefits have their own complexities when compared to p&c. Of these distribution channels, the most discu ssed and anticipated channel is the. Managing general agencies life insurance distribution model • there are no disclosure requirements from the mga to consumers, and • product suitability remains the responsibility of the representative dealing with the customer, and of the insurer, in. The amount you earn in commissions depends on the volume and variety of insurance products you sell. First, distribution almost needs to be looked at as a matrix.

Source: accenture.com

Source: accenture.com

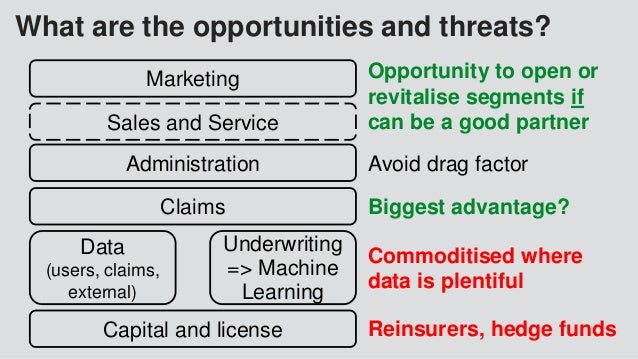

The study managed to distinguish four different models of life insurance distribution in the studied countries. In contrast, insurers in developed markets with high life insurance penetration must prepare for a different shift. Traditionally, the distribution model of insurance companies in the country is dominated by individual insurance agents and insurance brokers. The life insurance industry in australia today is approximately $10b. While for the remaining 1%, premiums are paid through web aggregators or online channels.

Source: noyeshallallen.com

Source: noyeshallallen.com

No matter what specific steps you take to reimagining your business, it’s clear our industry is at an inflection point. The life insurance industry in australia today is approximately $10b. Managing general agencies life insurance distribution model • there are no disclosure requirements from the mga to consumers, and • product suitability remains the responsibility of the representative dealing with the customer, and of the insurer, in. The channel utilizes the respective strengths of insurance carriers and banks to not just distribute insurance policies in a whole new way, but to increase customer satisfaction and maximize. Rise in usage of saas solutions to enable the insurance distribution process across multiple channels 4.

Source: capgemini.com

Source: capgemini.com

Rise in usage of saas solutions to enable the insurance distribution process across multiple channels 4. The type of distribution model depends primarily on the share of the agency and bancassurance channel. Insurance plays a vital part of australia’s financial sector with strong prospects in light of Life insurance success starts now. This often includes support in aligning the manufacturer’s product portfolio,.

Source: ftpartners.com

Source: ftpartners.com

In annual premiums in force. Evolving distribution models (goh).docx 2 1. However, distribution channels might be increasingly blurred as some banks create their own ecosystem models and some agency channels plug into ecosystems. Rise in usage of saas solutions to enable the insurance distribution process across multiple channels 4. It is followed by a discussion of the more general renewal.

Source: insuranceblog.accenture.com

Source: insuranceblog.accenture.com

No matter what specific steps you take to reimagining your business, it’s clear our industry is at an inflection point. It draws on more than 50 interviews with senior insurance executives; First, distribution almost needs to be looked at as a matrix. For example, banks in japan are expected to halve their balance sheets in the Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier.

Own calculations were performed with the use of ibm spss statistics package. With business models, product and service mixes, and technologies all evolving and changing, it’s an exciting time to be a life insurer. For example, banks in japan are expected to halve their balance sheets in the Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier. Rise in usage of technological solutions to automate the underwriting process and increase direct sales technological innovations in the insurance industry have led to a gradual change in

Source: twitter.com

Source: twitter.com

It draws on more than 50 interviews with senior insurance executives; Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier. 10 pwc future of insurance. Rise in usage of saas solutions to enable the insurance distribution process across multiple channels 4. Insurance plays a vital part of australia’s financial sector with strong prospects in light of

Source: slideshare.net

Source: slideshare.net

Traditionally, the distribution model of insurance companies in the country is dominated by individual insurance agents and insurance brokers. Rise in usage of saas solutions to enable the insurance distribution process across multiple channels 4. The market includes 17 major life insurers, 5 major reinsurers and a number of lloyds agencies. 10 pwc future of insurance. Most insurance carriers fall into the following types:

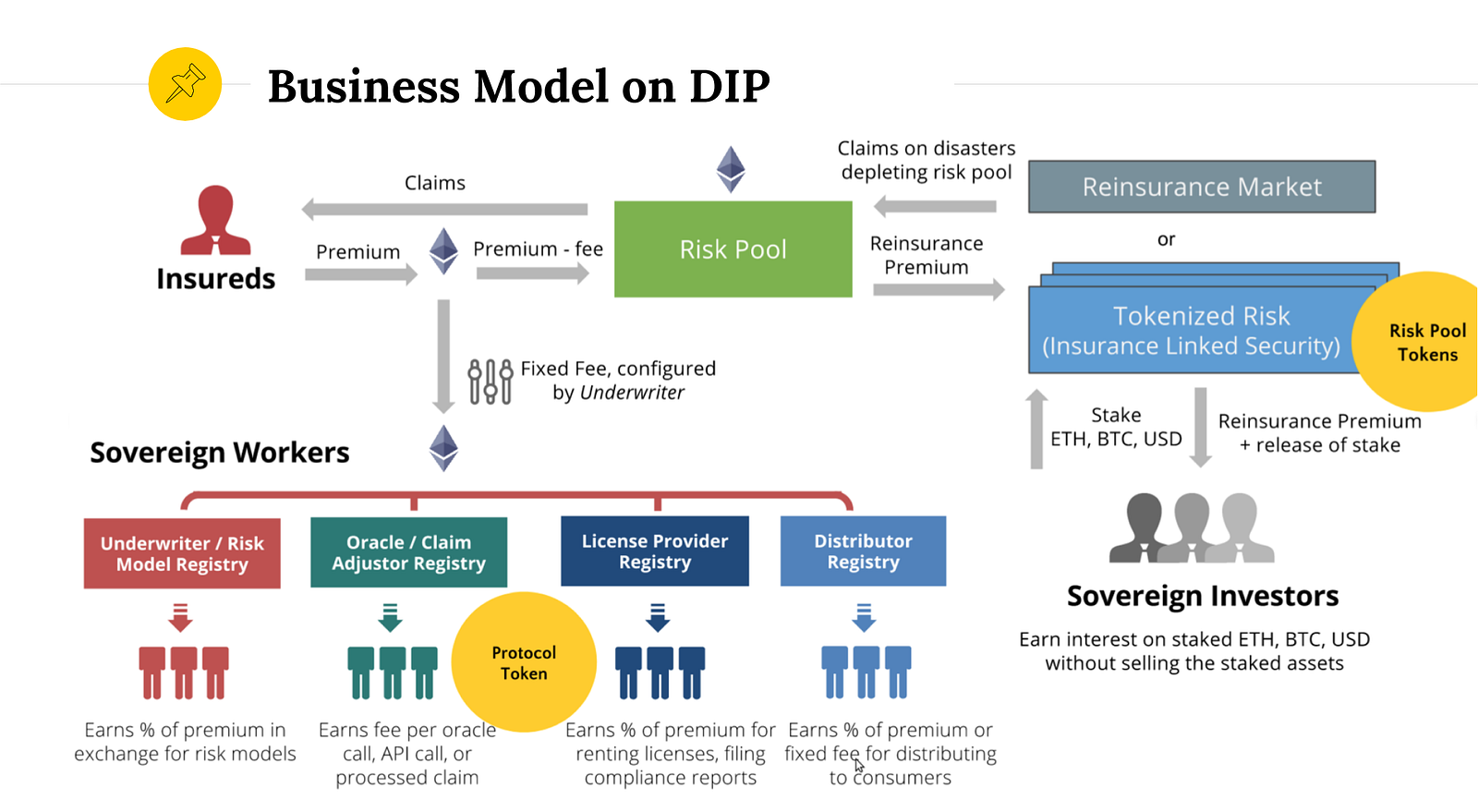

Source: blog.etherisc.com

Source: blog.etherisc.com

A survey of 850 agents in china, india, germany, and the us; The market includes 17 major life insurers, 5 major reinsurers and a number of lloyds agencies. For example, banks in japan are expected to halve their balance sheets in the The study managed to distinguish four different models of life insurance distribution in the studied countries. Increased use of social media as a distribution channel 3.

Source: livingwellmedicalclinic.com

Source: livingwellmedicalclinic.com

A survey of 850 agents in china, india, germany, and the us; • mgas receive a trailer commission from the. Evolving distribution models (goh).docx 2 1. Models of claim arrival process to begin with, the poisson process, which is most widely used for modelling claim arrivals, has been discussed. Of these distribution channels, the most discu ssed and anticipated channel is the.

Source: capgemini.com

Source: capgemini.com

The life insurance industry in australia today is approximately $10b. In contrast, insurers in developed markets with high life insurance penetration must prepare for a different shift. It is followed by a discussion of the more general renewal. Of these distribution channels, the most discu ssed and anticipated channel is the. First, distribution almost needs to be looked at as a matrix.

Source: slideshare.net

Source: slideshare.net

With digital distribution models, creating a virtuous circle of growth for the whole sector, rather than pitting one channel’s sales against another’s. The life insurance industry in australia today is approximately $10b. Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier. Increased use of social media as a distribution channel 3. Own calculations were performed with the use of ibm spss statistics package.

Source: livemint.com

Source: livemint.com

Life insurance success starts now. It is followed by a discussion of the more general renewal. It draws on more than 50 interviews with senior insurance executives; No matter what specific steps you take to reimagining your business, it’s clear our industry is at an inflection point. This often includes support in aligning the manufacturer’s product portfolio,.

Source: researchgate.net

Source: researchgate.net

The type of distribution model depends primarily on the share of the agency and bancassurance channel. First, distribution almost needs to be looked at as a matrix. Rise in usage of technological solutions to automate the underwriting process and increase direct sales technological innovations in the insurance industry have led to a gradual change in However, distribution channels might be increasingly blurred as some banks create their own ecosystem models and some agency channels plug into ecosystems. Life insurance success starts now.

Source: sec.gov

Source: sec.gov

A survey of 850 agents in china, india, germany, and the us; Bancassurance is one of th e distribution channel for life insurance industry like agents or brokers through whic h insurance company can access to the doors of c ustomers for the delivery of. Own calculations were performed with the use of ibm spss statistics package. Managing general agencies life insurance distribution model • there are no disclosure requirements from the mga to consumers, and • product suitability remains the responsibility of the representative dealing with the customer, and of the insurer, in. Commission rates for this insurance distribution model vary by product, typically based on the difficulty of making a sale and the value (profitability) of the risk to the insurance carrier.

Source: www2.deloitte.com

Source: www2.deloitte.com

Of these distribution channels, the most discu ssed and anticipated channel is the. However, distribution channels might be increasingly blurred as some banks create their own ecosystem models and some agency channels plug into ecosystems. The study managed to distinguish four different models of life insurance distribution in the studied countries. With digital distribution models, creating a virtuous circle of growth for the whole sector, rather than pitting one channel’s sales against another’s. With business models, product and service mixes, and technologies all evolving and changing, it’s an exciting time to be a life insurer.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance distribution models by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.