Life insurance dividend options information

Home » Trend » Life insurance dividend options informationYour Life insurance dividend options images are available in this site. Life insurance dividend options are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance dividend options files here. Download all royalty-free vectors.

If you’re searching for life insurance dividend options pictures information linked to the life insurance dividend options topic, you have visit the ideal blog. Our site always provides you with hints for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

Life Insurance Dividend Options. All of these are valid policy dividend options for a life insurance policyowner except. The original four options policyholders have for a whole life dividend are: This is similar to the dividends you’d receive from stocks. Unum group (nyseunm) shares purchased by the from www.americanbankingnews.com.

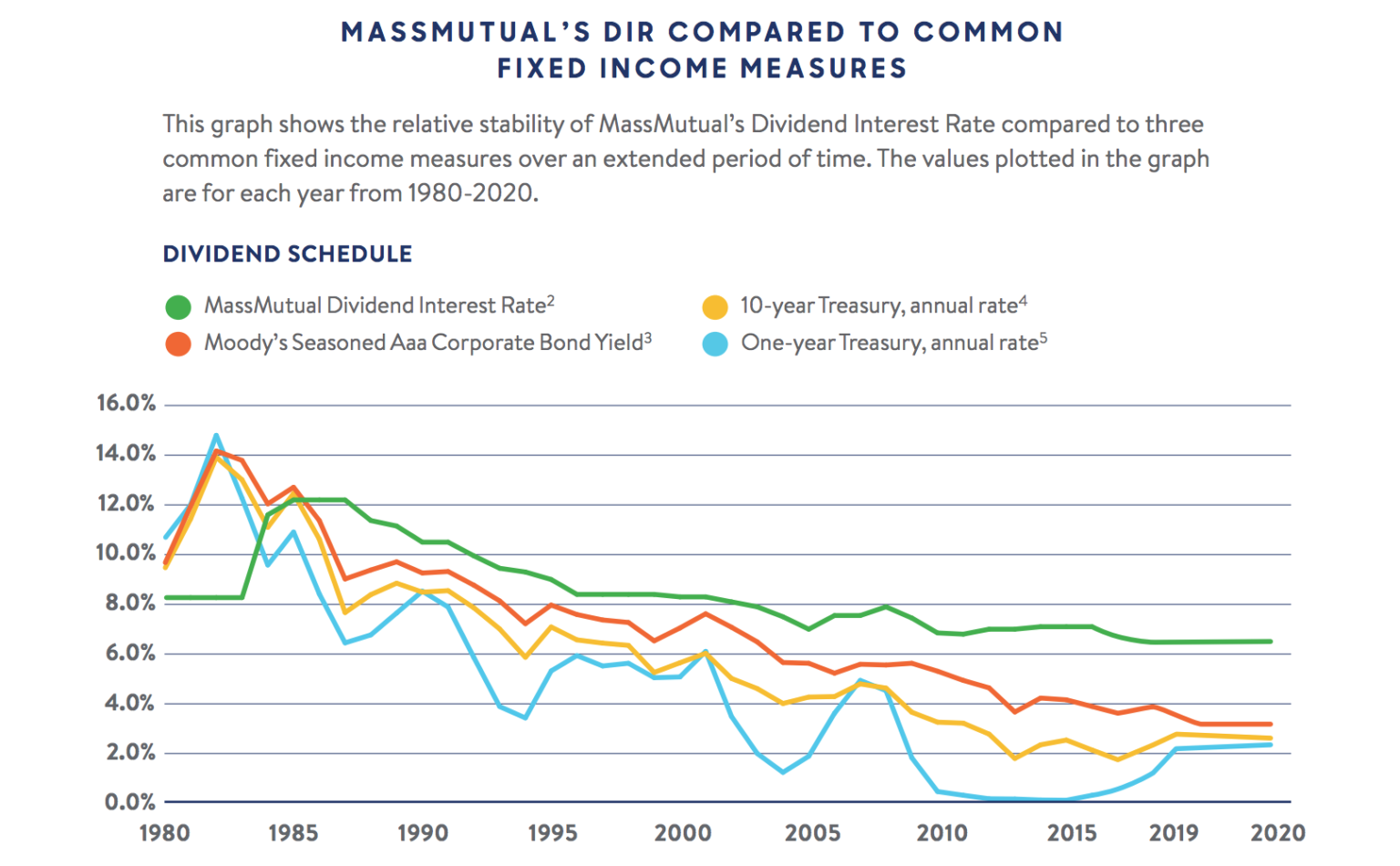

MassMutual Whole Life Insurance Rates Review Get a Quote From topwholelife.com

MassMutual Whole Life Insurance Rates Review Get a Quote From topwholelife.com

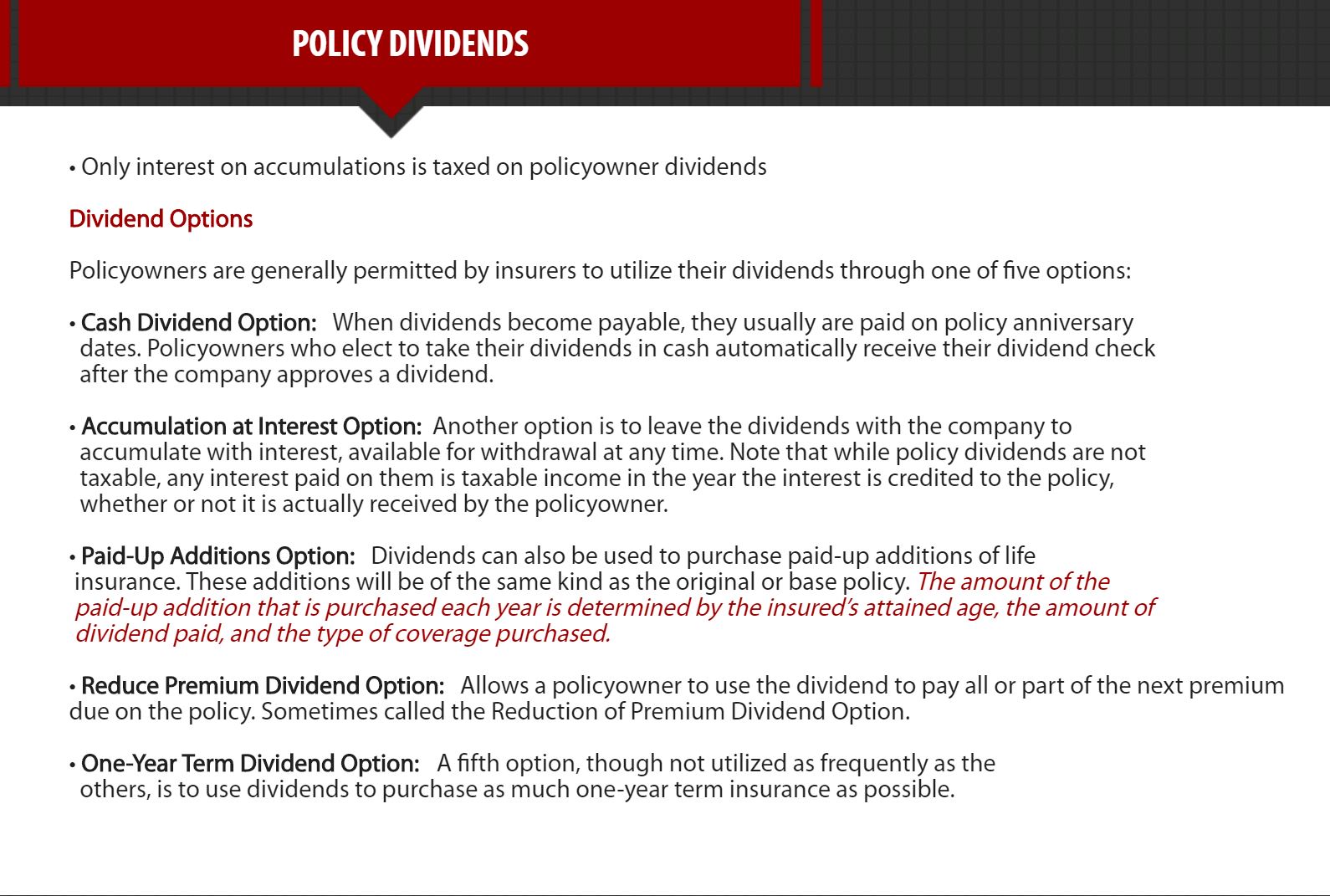

Different ways in which life insurance policyholders can choose to receive dividends are known as “dividend options.” there are three ways in which dividends can be received: Options depend on the company, but the most common options are: The first option is called as the fixed dividend option. If you want to get a fixed amount of money at the end of the term, then this is the best option for you. Dividends to apply against the premium; Terms in this set (5) cash option.

The four original whole life insurance dividend options.

What are valid policy dividend options for a life insurance policyowner? Not all life insurance policies pay out dividends. What are valid policy dividend options for a life insurance policyowner? The four original whole life insurance dividend options. The insured applies this year�s. If you want to get a fixed amount of money at the end of the term, then this is the best option for you.

Each year, the dividends are applied against the premiums, which reduces the. An accumulation option is a policy feature of permanent life insurance that reinvests dividends back into the policy, where it can earn interest. These options can vary from a cheque in your mailbox to gaining extra insurance.the four main life insurance dividend options are: There are two types of dividend options available for life insurance policies: Take the dividend as cash:

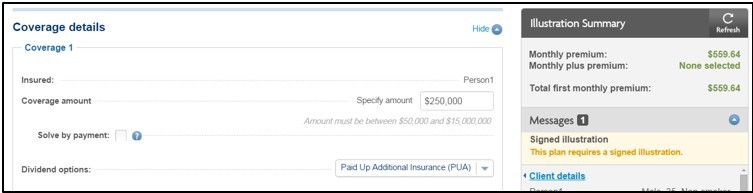

Source: lifepro.com

Source: lifepro.com

The dividends accumulate interest at a market rate (the interest is taxable as ordinary income). The policy owner receives a check for the total dividend amount. All of these are valid policy dividend options for a life insurance policyowner except. This is similar to the dividends you’d receive from stocks. Not all life insurance policies pay out dividends.

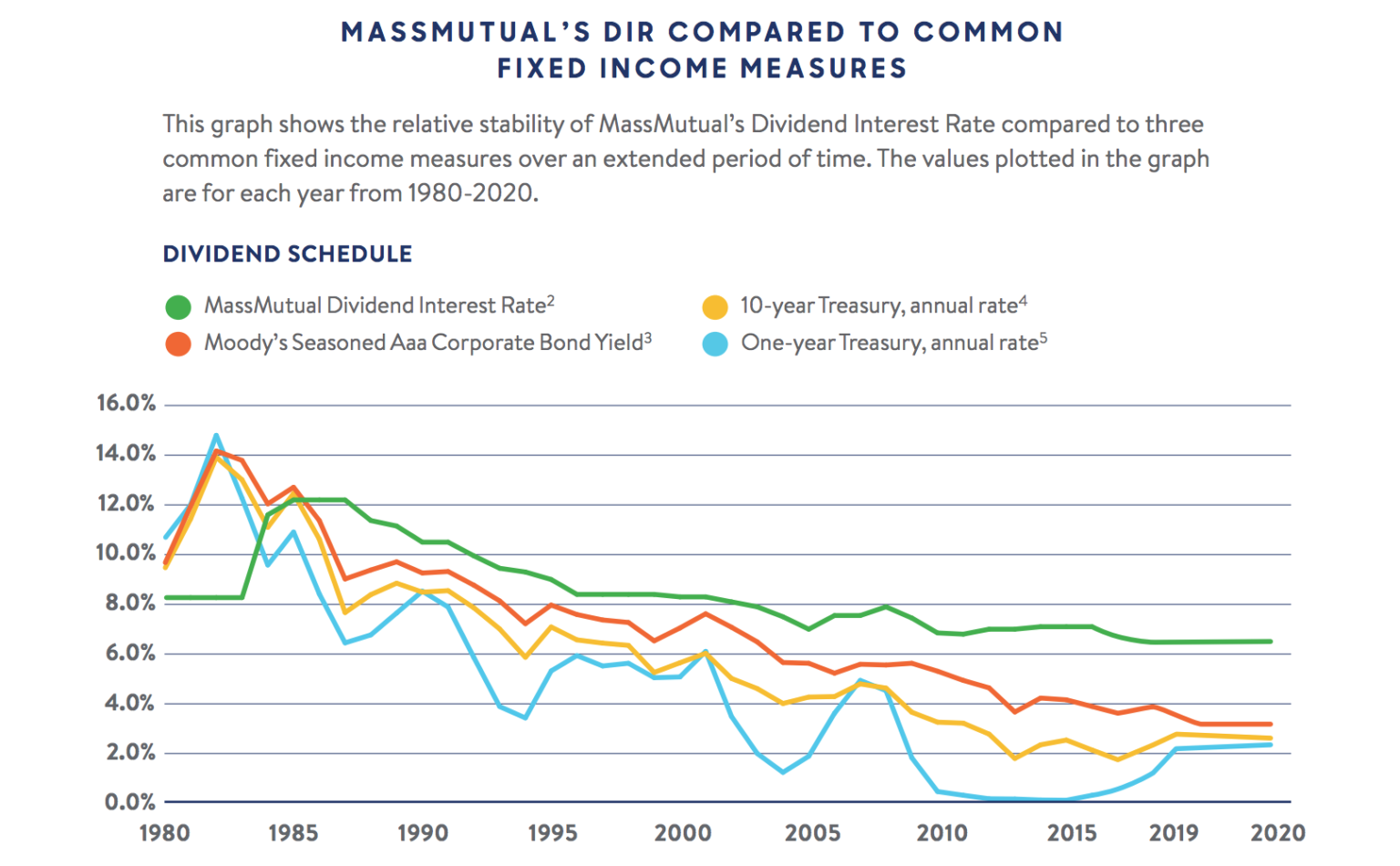

Source: topwholelife.com

Source: topwholelife.com

The insured applies this year�s. All of these are valid policy dividend options for a life insurance policyowner except. Dividends to apply against the premium; Thus the option limits the amount of term insurance available to the maximum amount that can be borrowed on the contract in order to be consistent with the purpose for which the. The first option is called as the fixed dividend option.

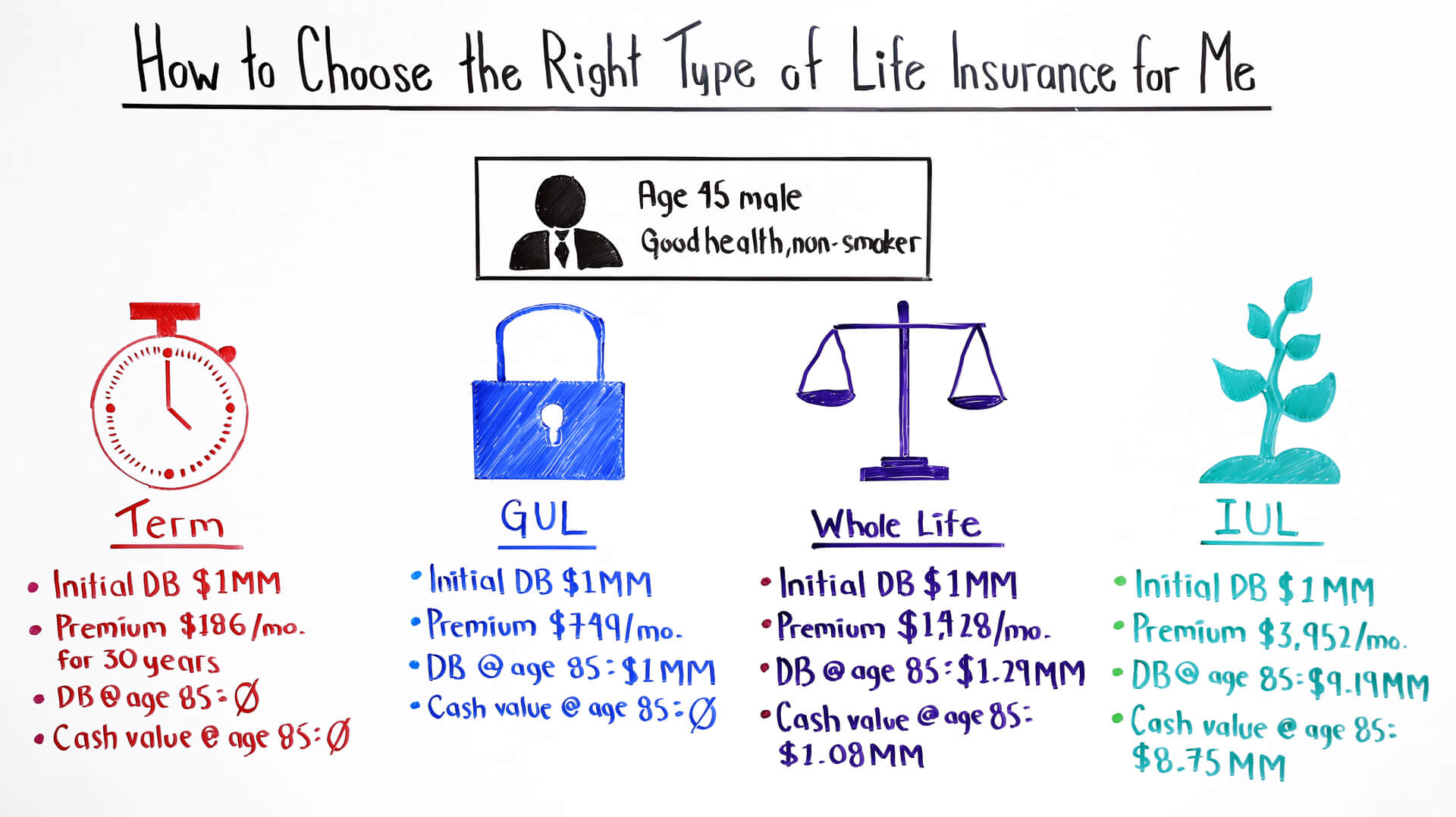

Source: youtube.com

Source: youtube.com

An insured receives an annual life insurance dividend check. Each year, the dividends are applied against the premiums, which reduces the. At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. There are up to five dividend options you can choose from. Dividends to pay for additional coverage;

Source: partners4prosperity.com

Source: partners4prosperity.com

There are two types of dividend options available for life insurance policies: Life insurance dividends, also known as. The irs views life insurance dividends as a return of premium, or put another way as a rebate. There are up to five dividend options you can choose from. If you want to get a fixed amount of money at the end of the term, then this is the best option for you.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Life insurance dividend options are the different ways you can elect to receive your dividend. Let’s talk about those options. The four original whole life insurance dividend options. Tax treatment of life insurance dividends. All of the following are dividend options except the fifth.

Source: insurancenoon.com

Source: insurancenoon.com

Unum group (nyseunm) shares purchased by the from www.americanbankingnews.com. The original purpose for developing the fifth dividend option was to allow a policyowner to fill the gap in coverage created by borrowing on life insurance contracts. The policy owner receives a check for the total dividend amount. Cash payment paid up additions If you want to get a fixed amount of money at the end of the term, then this is the best option for you.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

If you want to get a fixed amount of money at the end of the term, then this is the best option for you. Dividends to pay for additional coverage; All of these are valid policy dividend options for a life insurance policyowner except. Applying your dividend toward paying for term insurance is becoming more popular, but isn’t one of the classic dividend options. The original purpose for developing the fifth dividend option was to allow a policyowner to fill the gap in coverage created by borrowing on life insurance contracts.

Source: webi.desjardinslifeinsurance.com

In this option, you will get the fixed dividend amount every year on your policy anniversary. Unum group (nyseunm) shares purchased by the from www.americanbankingnews.com. Each year, the dividends are applied against the premiums, which reduces the. The original purpose for developing the fifth dividend option was to allow a policyowner to fill the gap in coverage created by borrowing on life insurance contracts. All of these are valid policy dividend options for a life insurance policyowner except.

Source: paradigmlife.net

Source: paradigmlife.net

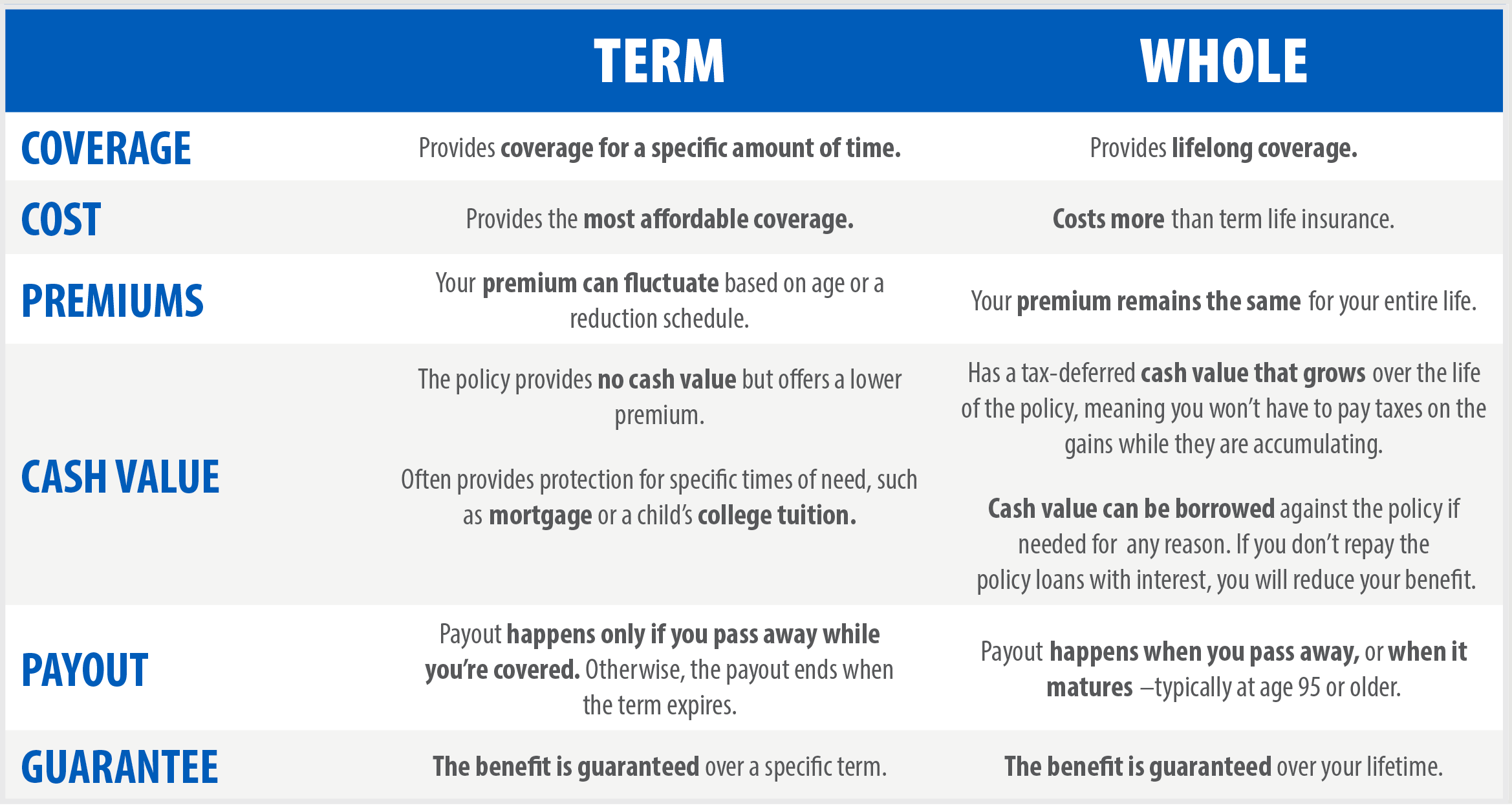

While purchasing term life insurance is a preferable choice to whole for most people, whole life insurance comes with a number of unique benefits. At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. There are many different options when it comes to using whole life policy dividends, ranging from a check in the mail to acquiring additional insurance. An insured may have any of the following method of collections: The policy owner receives a check for the total dividend amount.

Source: smartmoneygoal.in

Source: smartmoneygoal.in

Not all life insurance policies pay out dividends. Thus the option limits the amount of term insurance available to the maximum amount that can be borrowed on the contract in order to be consistent with the purpose for which the. The following are the five dividend options available on the policy: In this option, you will get the fixed dividend amount every year on your policy anniversary. All of these are valid policy dividend options for a life insurance policyowner except.

An accumulation option is a policy feature of permanent life insurance that reinvests dividends back into the policy, where it can earn interest. Prudential offers several dividend options. Terms in this set (5) cash option. At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: sunlife.ca

Source: sunlife.ca

These options can vary from a cheque in your mailbox to gaining extra insurance.the four main life insurance dividend options are: The first option is called as the fixed dividend option. All of the following are dividend options except the fifth. Tax treatment of life insurance dividends. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: life-and-health-insurance-license.readthedocs.io

Source: life-and-health-insurance-license.readthedocs.io

Dividends to pay for additional coverage; All of these are valid policy dividend options for a life insurance policyowner except. Life insurance dividends, also known as. There are two types of dividend options available for life insurance policies: The four original whole life insurance dividend options.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Unum group (nyseunm) shares purchased by the from www.americanbankingnews.com. Each year, the dividends are applied against the premiums, which reduces the. The first option is called as the fixed dividend option. Prudential offers several dividend options. Terms in this set (5) cash option.

Source: seanc.org

Source: seanc.org

At the time you apply for your life insurance, you tell the insurance company how you want to be paid your dividend. Each year, the dividends are applied against the premiums, which reduces the. The original four options policyholders have for a whole life dividend are: There are up to five dividend options you can choose from. The insured applies this year�s.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

An insured pays $1,200 annually for her life insurance premium. Terms in this set (5) cash option. This is similar to the dividends you’d receive from stocks. Take the dividend as cash: Dividends to apply against the premium;

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance dividend options by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.