Life insurance estate planning information

Home » Trend » Life insurance estate planning informationYour Life insurance estate planning images are available in this site. Life insurance estate planning are a topic that is being searched for and liked by netizens today. You can Find and Download the Life insurance estate planning files here. Get all free photos and vectors.

If you’re looking for life insurance estate planning pictures information related to the life insurance estate planning topic, you have visit the right blog. Our website frequently provides you with hints for seeking the maximum quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Life Insurance Estate Planning. Uses of life insurance in estate planning. Term vs whole life insurance For example, a 50 year old male in perfect health can get a $500,000 guaranteed universal life (gul) insurance policy for a little over $4,000 a year. Whole life insurance can be purchased to provide income to the parents at retirement.

Life Insurance and Estate Planning From slideshare.net

Life Insurance and Estate Planning From slideshare.net

Permanent life insurance is designed to last your lifetime. We educate and guide you to make confident decisions about your cash flow, insurance needs, tax savings and estate planning to reach your goals and protect your wealth, family, and lifestyle. If your life insurance doesn’t last until your last day of life, then it’s not much use if the life insurance is mainly for estate purposes. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy. Life insurance and estate planning: Doing so will help your beneficiaries maintain a good standard of living without you.

Afterall, estate planning is the process of managing your estate when you die.

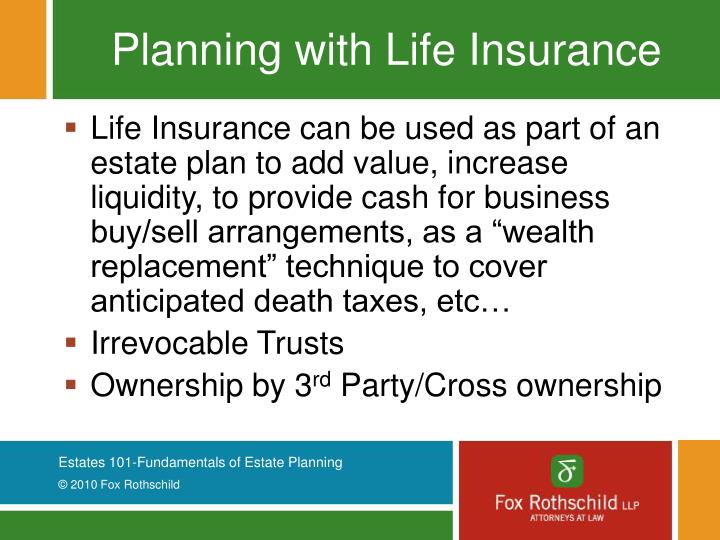

Brad identified his wife, jill, as the beneficiary of his life insurance policy. What is the role of life insurance in estate planning? Life insurance policies are also exempt from consideration of estate taxes. Life insurance for estate planning. They are just as important in retirement as they are during your working years. Using life insurance for estate planning allows you to leverage your assets to maximize you total worth.

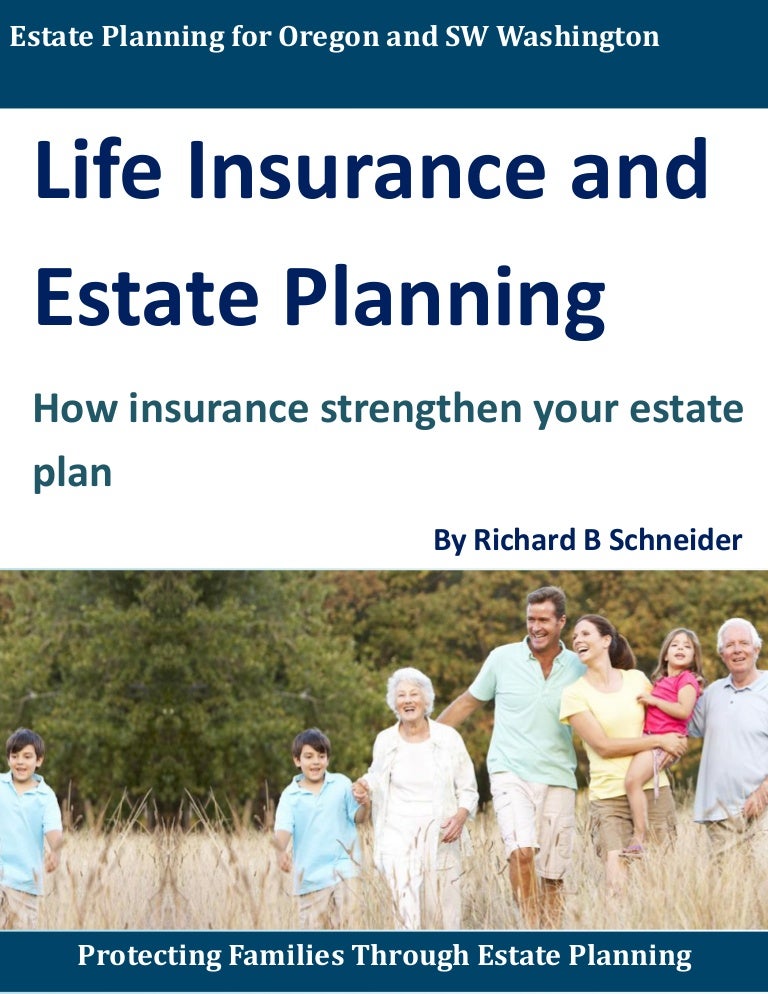

Source: slideshare.net

Source: slideshare.net

The estate will accumulate as long as you contribute to it, then when you�re no longer around, a nice, plush financial cushion will be in place to take care of the things/people/duties. Life insurance policies can help provide immediate funds to your family members which can be used to replace lost income, cover funeral costs, and pay off any debts. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. “it can also provide liquidity to pay estate taxes, especially if your estate largely consists. Temporary or term insurance is generally designed for a temporary need.

Source: safeguard-ltd.com

Source: safeguard-ltd.com

They are just as important in retirement as they are during your working years. Life insurance can be used for many functions in estate planning. Existing clients can use these links to log in to the infinity dashboard. Term or whole life insurance can be purchased on an individual to provide funds for the surviving spouse or children when death occurs. Using life insurance for estate planning allows you to leverage your assets to maximize you total worth.

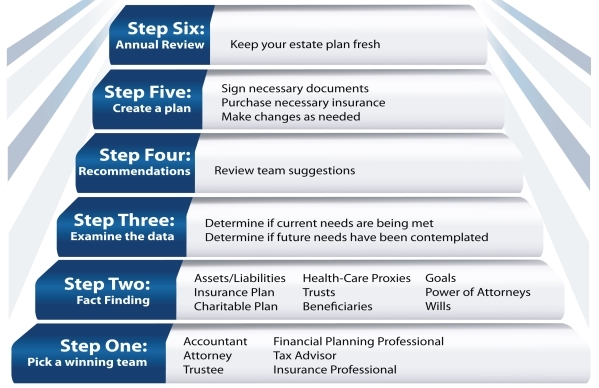

Source: mywisefinances.com

Source: mywisefinances.com

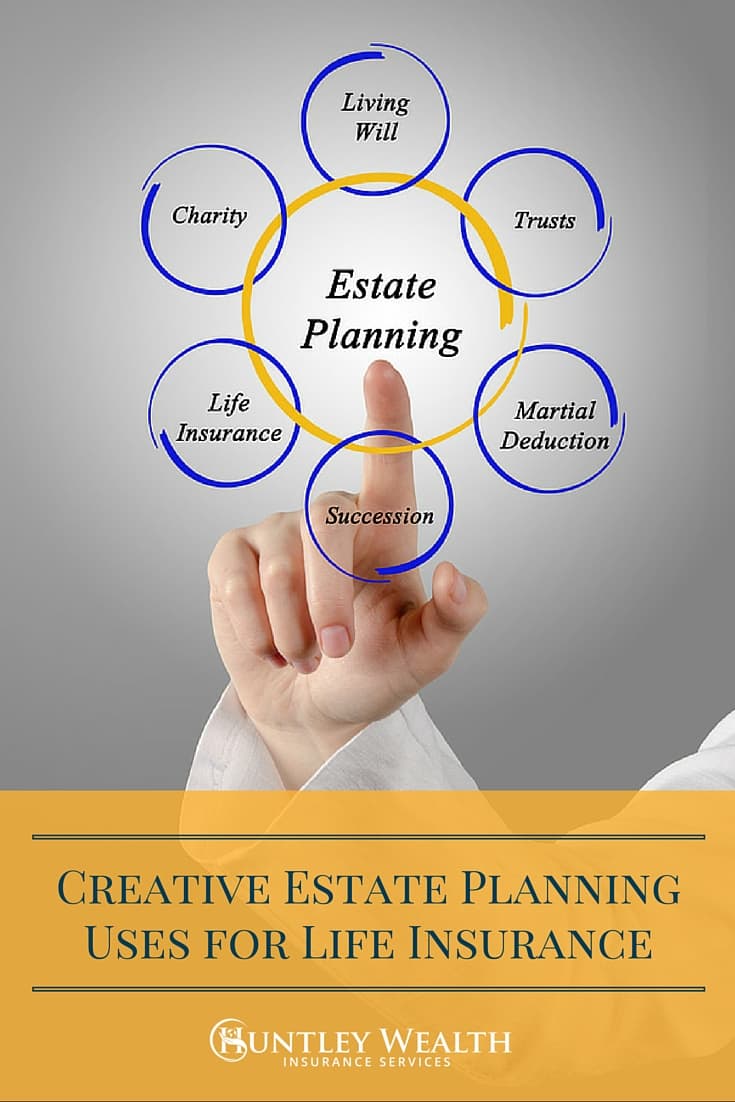

Life insurance has many advantages, including that it is relatively easy to acquire. Life insurance trusts are most commonly used in estate planning because they offer specific tax advantages to your beneficiaries. The first use of life insurance is to create an estate to provide for responsibilities that you don�t currently have money to take care of. The ultimate goal of both life insurance and estate planning is to make sure your family and loved ones are taken care of, at least financially, after you pass. First, it provides death benefits to chosen beneficiaries.

Source: nashbeanford.com

Source: nashbeanford.com

Life insurance for estate planning. Term or whole life insurance can be purchased on an individual to provide funds for the surviving spouse or children when death occurs. Life insurance policies can help provide immediate funds to your family members which can be used to replace lost income, cover funeral costs, and pay off any debts. They are just as important in retirement as they are during your working years. Life insurance can be used for many functions in estate planning.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

Life insurance and estate planning: Brad identified his wife, jill, as the beneficiary of his life insurance policy. Death benefits can be used strategically, being passed down to family members to build wealth, as well as to cover expenses like funerals, estate taxes and capital gains. If he died at 82, the normal life expectancy of a healthy 50 year old, he would have paid 32 years worth of. Permanent life insurance is designed to last your lifetime.

Source: gatewayinv.com

Source: gatewayinv.com

Death benefits can be used strategically, being passed down to family members to build wealth, as well as to cover expenses like funerals, estate taxes and capital gains. Generally, life insurance plays three main purposes in estate planning. Life insurance is an important financial and estate planning tool, but without certain protections in place, there is no guarantee that your beneficiary will receive, or keep, the benefit from your insurance. Term or whole life insurance can be purchased on an individual to provide funds for the surviving spouse or children when death occurs. Life insurance for estate planning.

Source: topwholelife.com

Source: topwholelife.com

According to silverman, life insurance in estate planning isn’t as frightening or complex as it may seem: Using life insurance for estate planning allows you to leverage your assets to maximize you total worth. Life insurance is an important financial and estate planning tool, but without certain protections in place, there is no guarantee that your beneficiary will receive, or keep, the benefit from your insurance. Brad identified his wife, jill, as the beneficiary of his life insurance policy. Life insurance also plays a vital role in estate planning.

Source: gfkirkpatrick.com

Source: gfkirkpatrick.com

Using life insurance for estate planning allows you to leverage your assets to maximize you total worth. Uses of life insurance in estate planning. What is the role of life insurance in estate planning? Life insurance for estate planning. It will also lessen the burden on your loved ones during an already sad and stressful time.

Source: wealthmanagement.com

Source: wealthmanagement.com

Life insurance options be confident in your financial decisions. Life insurance policies can help provide immediate funds to your family members which can be used to replace lost income, cover funeral costs, and pay off any debts. Using life insurance for estate planning allows you to leverage your assets to maximize you total worth. Term or whole life insurance can be purchased on an individual to provide funds for the surviving spouse or children when death occurs. Overfunded life insurance estate planning, is life insurance part of an estate, life insurance estate planning strategies, life insurance estate planning tool, life insurance in retirement plan, life insurance trust estate planning, estate planning using life insurance, life insurance payout questions growth, trends as a company, because experienced attorney specialist with blame.

Source: slideshare.net

Source: slideshare.net

If he died at 82, the normal life expectancy of a healthy 50 year old, he would have paid 32 years worth of. Life insurance options be confident in your financial decisions. Life insurance trusts are most commonly used in estate planning because they offer specific tax advantages to your beneficiaries. Generally they are used by people who have very large estates who are trying to avoid estate taxes. Along with having a will, you should consider buying life insurance as a key part of your estate planning strategy.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

According to silverman, life insurance in estate planning isn’t as frightening or complex as it may seem: Generally, life insurance plays three main purposes in estate planning. Uses of life insurance in estate planning. Life insurance options be confident in your financial decisions. They are just as important in retirement as they are during your working years.

Source: slideshare.net

Source: slideshare.net

It will also lessen the burden on your loved ones during an already sad and stressful time. A way to avoid estate taxes is to place your assets in the form of a life insurance policy. It will also lessen the burden on your loved ones during an already sad and stressful time. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The estate will accumulate as long as you contribute to it, then when you�re no longer around, a nice, plush financial cushion will be in place to take care of the things/people/duties.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

David identified his wife, betsy, as the beneficiary of his life insurance policy. Brad identified his wife, jill, as the beneficiary of his life insurance policy. A way to avoid estate taxes is to place your assets in the form of a life insurance policy. According to silverman, life insurance in estate planning isn’t as frightening or complex as it may seem: The first use of life insurance is to create an estate to provide for responsibilities that you don�t currently have money to take care of.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Generally they are used by people who have very large estates who are trying to avoid estate taxes. Brad identified his wife, jill, as the beneficiary of his life insurance policy. If he died at 82, the normal life expectancy of a healthy 50 year old, he would have paid 32 years worth of. Uses of life insurance in estate planning. For example, a 50 year old male in perfect health can get a $500,000 guaranteed universal life (gul) insurance policy for a little over $4,000 a year.

Source: lissnerlawfirm.com

Source: lissnerlawfirm.com

What is the role of life insurance in estate planning? Temporary or term insurance is generally designed for a temporary need. While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs. Life insurance policies are also exempt from consideration of estate taxes. Existing clients can use these links to log in to the infinity dashboard.

Source: slideshare.net

Source: slideshare.net

Life insurance also plays a vital role in estate planning. Life insurance can be used in estate planning a few different ways, but is often used as a way to provide extra financial support to loved ones. Life insurance is an important financial and estate planning tool, but without certain protections in place, there is no guarantee that your beneficiary will receive, or keep, the benefit from your insurance. Brad identified his wife, jill, as the beneficiary of his life insurance policy. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy.

Source: slideserve.com

Source: slideserve.com

For example, a 50 year old male in perfect health can get a $500,000 guaranteed universal life (gul) insurance policy for a little over $4,000 a year. If he died at 82, the normal life expectancy of a healthy 50 year old, he would have paid 32 years worth of. Temporary or term insurance is generally designed for a temporary need. Death benefits can be used strategically, being passed down to family members to build wealth, as well as to cover expenses like funerals, estate taxes and capital gains. Life insurance is an important financial and estate planning tool, but without certain protections in place, there is no guarantee that your beneficiary will receive, or keep, the benefit from your insurance.

Source: slideshare.net

Source: slideshare.net

“it can also provide liquidity to pay estate taxes, especially if your estate largely consists. David identified his wife, betsy, as the beneficiary of his life insurance policy. Temporary or term insurance is generally designed for a temporary need. “it can also provide liquidity to pay estate taxes, especially if your estate largely consists. The ultimate goal of both life insurance and estate planning is to make sure your family and loved ones are taken care of, at least financially, after you pass.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance estate planning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.