Life insurance estate tax planning information

Home » Trending » Life insurance estate tax planning informationYour Life insurance estate tax planning images are ready. Life insurance estate tax planning are a topic that is being searched for and liked by netizens today. You can Find and Download the Life insurance estate tax planning files here. Get all royalty-free photos and vectors.

If you’re searching for life insurance estate tax planning images information connected with to the life insurance estate tax planning keyword, you have pay a visit to the ideal site. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

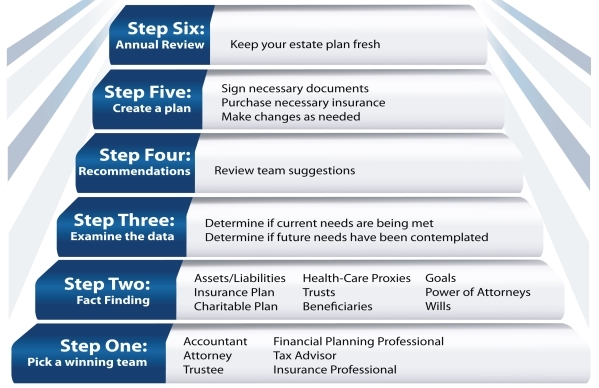

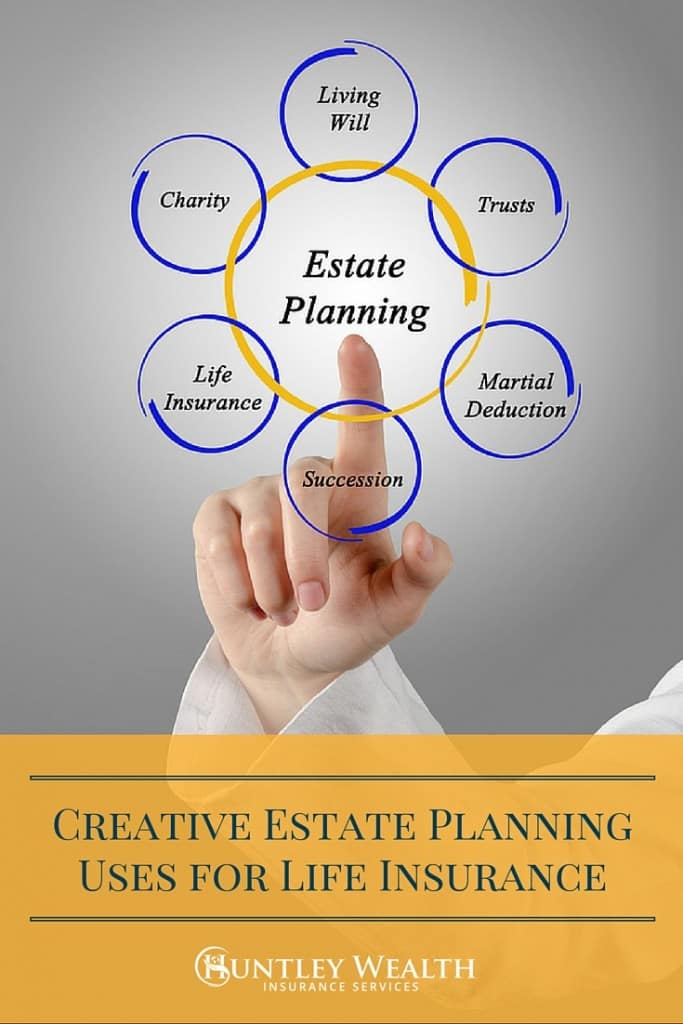

Life Insurance Estate Tax Planning. An irrevocable life insurance trust, or ilit, is an estate planning tool that prevents the benefits of a life insurance policy from being subject to the estate tax. Upon your death, you can use the life insurance proceeds to pay for estate taxes as well as provide financial resources to your heirs. Whole life insurance is the best financial product for estate planning. A life insurance policy can meet estate planning needs whenever an estate is composed of assets that cannot be divided through gifts or other means over the years, or when the assets are illiquid and you do not want to risk having them sold.

How to Use Life Insurance Under the New Estate Tax Laws From retirementwatch.com

How to Use Life Insurance Under the New Estate Tax Laws From retirementwatch.com

It also gives your family the liquidity they need by circumventing probate in most states. Estate planners often advised against the strategy in the past because the life insurance would be included in the estate. It�s easy to see what the tax perk has been. An irrevocable life insurance trust, or ilit, is an estate planning tool that prevents the benefits of a life insurance policy from being subject to the estate tax. As a result, insurance can be a great tool in the estate planning process. A life insurance policy can meet estate planning needs whenever an estate is composed of assets that cannot be divided through gifts or other means over the years, or when the assets are illiquid and you do not want to risk having them sold.

The life insurance trust provides many benefits for estate planning purposes.

Estate planners often advised against the strategy in the past because the life insurance would be included in the estate. With the higher estate tax exemption, however, fewer people need to worry about the estate taxes and can focus on the benefits of owning life insurance through a retirement plan. If you are the owner and insured on a life insurance policy, the proceeds. Quite often it�s the estate�s personal assets that are used to cover tax debt. Life insurance pays your beneficiaries directly, quickly, and most of. With the current estate tax exemption at $11.7 million, $2.3 million of that $14 million estate would incur the 40% estate tax — a bill of $920,000.

Source: retirementwatch.com

Source: retirementwatch.com

It�s easy to see what the tax perk has been. With the higher estate tax exemption, however, fewer people need to worry about the estate taxes and can focus on the benefits of owning life insurance through a retirement plan. A life insurance trust is used in estate planning to exclude the value of the insurance proceeds from the taxable estate for estate tax purposes; To prevent the unfortunate scenarios mentioned above, parents should get a life insurance plan that will pay the estate tax after their death. The results are that max’s business and other assets stay intact and the estate taxes are fully paid.

Source: youtube.com

Source: youtube.com

It involves transfer of the policy, but this is considered a gift to the recipient. Life insurance and estate tax planning: Life insurance payouts are usually ringfenced outside of the estate of the deceased which means that they are not subject to any inheritance taxes. It would amount to saving $250,000 in tax if the policy were for $500,000, and the estate were in the 50% estate tax bracket. Estate planning using life insurance 4.

Source: gatewayinv.com

Source: gatewayinv.com

Life insurance can be a versatile tool and offer powerful benefits to enhance your legacy and complement your overall financial strategy. It keeps more of your money in your family’s pockets, or in the hands of a charity you designate, rather than giving your hard earned wealth to the government in the form of taxes. While you can give away or gift cash or certain possessions while you are still alive, or set up joint tenancy arrangements, it requires you to give up control of those assets when you may still need and want those assets to live your life to the fullest. Clients can use these policies to create enough value in. “the potential for higher federal estate or income taxes adds up to the need for more efficient tax planning when discussing a legacy,” said jeffrey rotman, principal of the wealth management firm rotman & associates in fort lauderdale, florida.

Source: topwholelife.com

Source: topwholelife.com

Life insurance can be a versatile tool and offer powerful benefits to enhance your legacy and complement your overall financial strategy. Life insurance payouts are usually ringfenced outside of the estate of the deceased which means that they are not subject to any inheritance taxes. Whether choosing universal or whole policies, permanent life insurance has the potential to be an excellent source of liquidity for estates. The results are that max’s business and other assets stay intact and the estate taxes are fully paid. A life insurance trust is used in estate planning to exclude the value of the insurance proceeds from the taxable estate for estate tax purposes;

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

It involves transfer of the policy, but this is considered a gift to the recipient. If you are the owner and insured on a life insurance policy, the proceeds. Life insurance payouts are usually ringfenced outside of the estate of the deceased which means that they are not subject to any inheritance taxes. Estate tax funding through life insurance federal estate tax rates can be a significant percentage of your gross estate and must be paid in cash within nine months of your death. With the current estate tax exemption at $11.7 million, $2.3 million of that $14 million estate would incur the 40% estate tax — a bill of $920,000.

Source: yellowpages.ca

Source: yellowpages.ca

Life insurance & estate planning right after you pass away, your family has an immediate need for money. With the current estate tax exemption at $11.7 million, $2.3 million of that $14 million estate would incur the 40% estate tax — a bill of $920,000. Life insurance can preserve the value of your estate by helping you manage certain costs (like taxes and probate fees) that can chip away at the inheritance you want to leave your heirs. As a result, insurance can be a great tool in the estate planning process. It�s easy to see what the tax perk has been.

Source: edgenorth.ca

Source: edgenorth.ca

The life insurance trust can be used to reduce estate taxes, among others. With the higher estate tax exemption, however, fewer people need to worry about the estate taxes and can focus on the benefits of owning life insurance through a retirement plan. The bottom line changing ownership of a life insurance policy can be an important estate planning technique. The life insurance trust provides many benefits for estate planning purposes. A life insurance policy can meet estate planning needs whenever an estate is composed of assets that cannot be divided through gifts or other means over the years, or when the assets are illiquid and you do not want to risk having them sold.

Source: blog.theretirementgroup.com

Whether choosing universal or whole policies, permanent life insurance has the potential to be an excellent source of liquidity for estates. Life insurance proceeds to pay estate tax. Life insurance and estate tax planning: It involves transfer of the policy, but this is considered a gift to the recipient. A life insurance policy can also be a key part of an effective estate planning strategy, both providing cash when needed and shielding assets you intended for your heirs from sizable estate taxes.

Source: michiganestateplanning.com

Source: michiganestateplanning.com

Whether choosing universal or whole policies, permanent life insurance has the potential to be an excellent source of liquidity for estates. It�s easy to see what the tax perk has been. The benefits pass directly to beneficiaries upon the death of the trust grantor without estate tax consequences. Life insurance proceeds to pay estate tax. Estate planners often advised against the strategy in the past because the life insurance would be included in the estate.

Source: freezesulkov.com

Source: freezesulkov.com

Estate planners often advised against the strategy in the past because the life insurance would be included in the estate. Getting your taxes and paperwork in order is crucial, but it pays to think outside the box when creating your financial plan. Estate planning using life insurance 4. It keeps more of your money in your family’s pockets, or in the hands of a charity you designate, rather than giving your hard earned wealth to the government in the form of taxes. With the higher estate tax exemption, however, fewer people need to worry about the estate taxes and can focus on the benefits of owning life insurance through a retirement plan.

Source: accountingtaxescenter.com

Source: accountingtaxescenter.com

Whole life insurance is the best financial product for estate planning. Say a person dies owning a $3 million home, $7 million in retirement accounts and $4 million of life insurance not held in a trust. To prevent the unfortunate scenarios mentioned above, parents should get a life insurance plan that will pay the estate tax after their death. Life insurance and estate tax planning: It would amount to saving $250,000 in tax if the policy were for $500,000, and the estate were in the 50% estate tax bracket.

Source: peoples.com

Source: peoples.com

Quite often it�s the estate�s personal assets that are used to cover tax debt. Life insurance pays your beneficiaries directly, quickly, and most of. It is a highly attractive tool in an estate plan compared to other more traditional asset classes. A life insurance trust is used in estate planning to exclude the value of the insurance proceeds from the taxable estate for estate tax purposes; This way, parents would not worry about estate tax after their death because the proceeds from their life insurance policies will cover it.

Source: mavrideslaw.com

Source: mavrideslaw.com

Upon your death, you can use the life insurance proceeds to pay for estate taxes as well as provide financial resources to your heirs. The results are that max’s business and other assets stay intact and the estate taxes are fully paid. Upon your death, you can use the life insurance proceeds to pay for estate taxes as well as provide financial resources to your heirs. A life insurance trust is used in estate planning to exclude the value of the insurance proceeds from the taxable estate for estate tax purposes; It keeps more of your money in your family’s pockets, or in the hands of a charity you designate, rather than giving your hard earned wealth to the government in the form of taxes.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

Whole life insurance is the best financial product for estate planning. Life insurance payouts are usually ringfenced outside of the estate of the deceased which means that they are not subject to any inheritance taxes. “the potential for higher federal estate or income taxes adds up to the need for more efficient tax planning when discussing a legacy,” said jeffrey rotman, principal of the wealth management firm rotman & associates in fort lauderdale, florida. Life insurance and estate tax planning: Whether choosing universal or whole policies, permanent life insurance has the potential to be an excellent source of liquidity for estates.

Source: slideshare.net

Source: slideshare.net

It involves transfer of the policy, but this is considered a gift to the recipient. It is a highly attractive tool in an estate plan compared to other more traditional asset classes. Whole life insurance is the best financial product for estate planning. A life insurance trust is used in estate planning to exclude the value of the insurance proceeds from the taxable estate for estate tax purposes; Say a person dies owning a $3 million home, $7 million in retirement accounts and $4 million of life insurance not held in a trust.

Source: ldstrategies.com

Source: ldstrategies.com

The bottom line changing ownership of a life insurance policy can be an important estate planning technique. “life insurance can play a key part in that as death benefits are passed on tax free. With the higher estate tax exemption, however, fewer people need to worry about the estate taxes and can focus on the benefits of owning life insurance through a retirement plan. It keeps more of your money in your family’s pockets, or in the hands of a charity you designate, rather than giving your hard earned wealth to the government in the form of taxes. Getting your taxes and paperwork in order is crucial, but it pays to think outside the box when creating your financial plan.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

Life insurance and estate tax planning: It involves transfer of the policy, but this is considered a gift to the recipient. Life insurance proceeds to pay estate tax. Life insurance & estate planning right after you pass away, your family has an immediate need for money. “life insurance can play a key part in that as death benefits are passed on tax free.

Source: mywisefinances.com

Source: mywisefinances.com

Life insurance proceeds to pay estate tax. The results are that max’s business and other assets stay intact and the estate taxes are fully paid. Quite often it�s the estate�s personal assets that are used to cover tax debt. With the current estate tax exemption at $11.7 million, $2.3 million of that $14 million estate would incur the 40% estate tax — a bill of $920,000. The situation makes this a very effective way to ensure that you can max out the amount of money from your estate that your family gets and minimise the amount taken as estate tax or inheritance tax.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance estate tax planning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.