Life insurance exclusions information

Home » Trending » Life insurance exclusions informationYour Life insurance exclusions images are ready in this website. Life insurance exclusions are a topic that is being searched for and liked by netizens today. You can Get the Life insurance exclusions files here. Get all free photos and vectors.

If you’re looking for life insurance exclusions images information connected with to the life insurance exclusions interest, you have come to the right site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Life Insurance Exclusions. What are the typical exclusions in a life insurance policy? In a few types of life insurance plans, suicide is excluded for 2 years. Assume someone buys a life insurance policy and then commits suicide. While most exclusions can be found after the main coverage sections in your policy ( named perils, personal property, personal liability, additional coverage, and medical payments to others), you’ll.

Common Homeowners Insurance Exclusions ICA Agency From icaagencyalliance.com

Common Homeowners Insurance Exclusions ICA Agency From icaagencyalliance.com

A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit. The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. 5 common life insurance exclusions. Exclusions could include situations such as acts of war, suicide or indulging in dangerous activities. Exclusions are a way for insurance companies to more narrowly define what’s covered and what’s not in your standard home or renters insurance policy. Here are five common exclusions and what they mean for you:

Exclusions are a way for insurance companies to more narrowly define what’s covered and what’s not in your standard home or renters insurance policy.

Exclusions are events or situations that, if they result in the death of the policyholder, are not covered by a life insurance policy. Insurance companies apply exclusions in their insurance agreement to carve out coverage for the risks which they are. However, to minimize losses, the insurance companies talk about exclusions in the cover which they offer. Life insurance exclusions are typically included in the fine print section of your policy documents. Exclusions are a way for insurance companies to more narrowly define what’s covered and what’s not in your standard home or renters insurance policy. A policy provision which eliminates coverage for some types of situations are called exclusions.

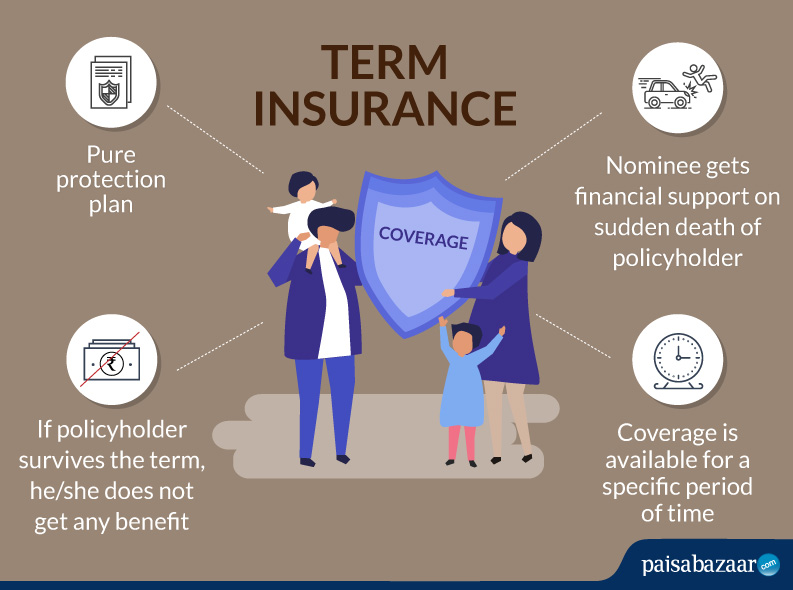

Source: paisabazaar.com

Source: paisabazaar.com

There may be life insurance policies available on a group basis or through the government for active duty personnel. The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. However, to minimize losses, the insurance companies talk about exclusions in the cover which they offer. A policy provision which eliminates coverage for some types of situations are called exclusions. The scope of coverage in an insurance agreement is narrowed by exclusions.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Life insurance contracts have certain specified provisions and clauses which have to be fulfilled so that the claim can be considered valid. A policy provision which eliminates coverage for some types of situations are called exclusions. Grace period provision, ownership clause, change of plan provision, incontestability clause and a reinstatement clause. Term life insurance policy exclusions. Every life insurance policy has exclusions.

Source: slideshare.net

Source: slideshare.net

In fact life insurance claims are rarely denied according to steven. A policy provision which eliminates coverage for some types of situations are called exclusions. Insurance providers aren’t legally obliged to accept your application. Exclusions can be defined as events and. Assume someone buys a life insurance policy and then commits suicide.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

In fact life insurance claims are rarely denied according to steven. If you aren�t aware of the exclusions in your life insurance policy, your family could be left without a life insurance payout. All types of insurance policies have certain exclusions and limitations and may exclude the insured person from cover in certain circumstances. Usually used in times of war, this exclusion excludes payment during times of war. Life insurance exclusions are typically included in the fine print section of your policy documents.

Source: topicstalk.com

Source: topicstalk.com

These are the conditions excluded from the insured event to avoid losses to the company. Exclusions can be defined as events and. In addition to the above provisions, there are also several common exclusions standard to most life insurance policies. The most common life insurance exclusions are: So you�ve got all your bases, read up on these are five instances in which your life insurance may not cover you:

Source: coverfox.com

Source: coverfox.com

A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit. Assume someone buys a life insurance policy and then commits suicide. Insurance companies apply exclusions in their insurance agreement to carve out coverage for the risks which they are. The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. Here are five common exclusions and what they mean for you:

Source: coverfox.com

Source: coverfox.com

Term life insurance policy exclusions. Suicide as exclusion is one of the most common life insurance clauses. The scope of coverage in an insurance agreement is narrowed by exclusions. In addition to the above provisions, there are also several common exclusions standard to most life insurance policies. Exclusions can be defined as events and.

Source: insurancelifeprotective.blogspot.com

Source: insurancelifeprotective.blogspot.com

The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. In a few types of life insurance plans, suicide is excluded for 2 years. The most common life insurance exclusions are: Common exclusions in life insurance policies. Whilst life insurance exclusions may vary, the typical exclusions are:

Source: researchgate.net

Source: researchgate.net

What are life insurance rider exclusions? A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit. Exclusions could include situations such as acts of war, suicide or indulging in dangerous activities. The following are the 5 common exclusions in a life insurance policy. Exclusions are a way for insurance companies to more narrowly define what’s covered and what’s not in your standard home or renters insurance policy.

Source: slideshare.net

Source: slideshare.net

A life insurance plan does not pay out any death/maturity benefit if the policyholder dies due to any mad made disaster such as a riot, nuclear explosion, stampedes or others. An insight into common exclusions in life insurance policies an insurance contract will promise to pay out the sum assured when the premium is paid by the policyholder and an insured event occurs during the contract’s term. Suicide as exclusion is one of the most common life insurance clauses. That is unlike some other types of insurance such as travel insurance which may. Generally speaking, insurance companies will not payout if the individual insured takes their own life within 13 months of signing up for the policy.

Source: youtube.com

Source: youtube.com

Think of the following example: So you�ve got all your bases, read up on these are five instances in which your life insurance may not cover you: Think of the following example: Whilst life insurance exclusions may vary, the typical exclusions are: A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit. A life insurance exclusion is a situation or circumstance that prevents your beneficiaries from receiving your death benefit. The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. In a few types of life insurance plans, suicide is excluded for 2 years. In addition to the above provisions, there are also several common exclusions standard to most life insurance policies.

Source: fr.slideshare.net

Source: fr.slideshare.net

A policy provision which eliminates coverage for some types of situations are called exclusions. Term life insurance policy exclusions. All types of insurance policies have certain exclusions and limitations and may exclude the insured person from cover in certain circumstances. Grace period provision, ownership clause, change of plan provision, incontestability clause and a reinstatement clause. Insurance companies will typically not pay out a death benefit if the insured person commits.

Source: lion.ie

Source: lion.ie

A life insurance plan does not pay out any death/maturity benefit if the policyholder dies due to any mad made disaster such as a riot, nuclear explosion, stampedes or others. The limits and exclusions on a policy usually are places dependent on the specific type of life insurance purchased. Insurance companies will typically not pay out a death benefit if the insured person commits. The vast majority of life insurance contracts in the uk do not have exclusions for any medical conditions including hiv which are diagnosed after your life insurance cover has started. The most common exclusions in life insurance policies are the following:

Source: savingadvice.com

Source: savingadvice.com

The limits and exclusions on a policy usually are places dependent on the specific type of life insurance purchased. Grace period provision, ownership clause, change of plan provision, incontestability clause and a reinstatement clause. For as long as the policy holder is living, that person has the sole right to choose beneficiaries, receive benefits of the policy, changes in policy and. What are life insurance rider exclusions? 5 common life insurance exclusions.

Source: fr.slideshare.net

Source: fr.slideshare.net

Usually used in times of war, this exclusion excludes payment during times of war. Insurance providers aren’t legally obliged to accept your application. Here are five common exclusions and what they mean for you: That is unlike some other types of insurance such as travel insurance which may. These are the conditions excluded from the insured event to avoid losses to the company.

Source: ask.careers

Source: ask.careers

A life insurance provider does not necessarily need to approve every policy, especially when the potential risks are too great or any deaths could have been avoided. These are the conditions excluded from the insured event to avoid losses to the company. A life insurance provider does not necessarily need to approve every policy, especially when the potential risks are too great or any deaths could have been avoided. The limits and exclusions on a policy usually are places dependent on the specific type of life insurance purchased. However, to minimize losses, the insurance companies talk about exclusions in the cover which they offer.

For as long as the policy holder is living, that person has the sole right to choose beneficiaries, receive benefits of the policy, changes in policy and. There may be life insurance policies available on a group basis or through the government for active duty personnel. Here are five common exclusions and what they mean for you: For as long as the policy holder is living, that person has the sole right to choose beneficiaries, receive benefits of the policy, changes in policy and. The suicide clause states that if the life assured dies by suicide within 12 months, their beneficiary will be awarded 80% of the total premiums paid until that day.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance exclusions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.