Life insurance face amount information

Home » Trend » Life insurance face amount informationYour Life insurance face amount images are ready in this website. Life insurance face amount are a topic that is being searched for and liked by netizens now. You can Get the Life insurance face amount files here. Download all royalty-free vectors.

If you’re looking for life insurance face amount images information linked to the life insurance face amount topic, you have come to the right site. Our site always provides you with hints for downloading the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

Life Insurance Face Amount. The face amount is stated in the contract or application. It can also be referred to as the death benefit or the face amount of life insurance. After you die, your beneficiaries receive the face amount of your policy in a single lump sum payment. Also, the face amount refers to the total amount of payments made by the plan holder.

Life Insurance Definition Face Amount Life Insurance From lifeinsurance.satukara.com

Life Insurance Definition Face Amount Life Insurance From lifeinsurance.satukara.com

The face worth is usually how a lot your life insurance coverage beneficiaries will obtain in case you die whereas your coverage is in drive. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. The face amount in life insurance means the amount of insurance you buy. How does the face amount work? It is also called the death benefit, coverage amount, or face value. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

It can also be referred to as the death benefit or the face amount of life insurance.

Most life insurance policies intend to provide financial protection for loved ones after you pass. Face amount is the gross total amount of cash quantified in an agreement or insurance policy. You decide on that dollar figure when you buy the policy, and it stays steady until the policy expires or you die. It can also be referred to as the death benefit or the face amount of life insurance. The face value of life insurance is the dollar amount equated to the worth of your policy. When an individual buys a life insurance policy on themselves or someone else, one of the main things they have to decide is the policy’s face amount.

Source: slideserve.com

Source: slideserve.com

Face value can also refer to the. So, in case you purchase a coverage with a $500,000 face worth, normally your life insurance coverage firm pays out $500,000 to your beneficiaries if you die. The face amount in life insurance is how much coverage your life policy has or in other words, how much life insurance money is given to the beneficiary following the premature demise of the policyholder. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. A face amount is the sum of money a life insurance policy will pay out when the insured dies.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

But there are a few things that can cause the face amount — or at. You decide on that dollar figure when you buy the policy, and it stays steady until the policy expires or you die. So, in case you purchase a coverage with a $500,000 face worth, normally your life insurance coverage firm pays out $500,000 to your beneficiaries if you die. But there are a few things that can cause the face amount — or at. The face value of life insurance is the dollar amount equated to the worth of your policy.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

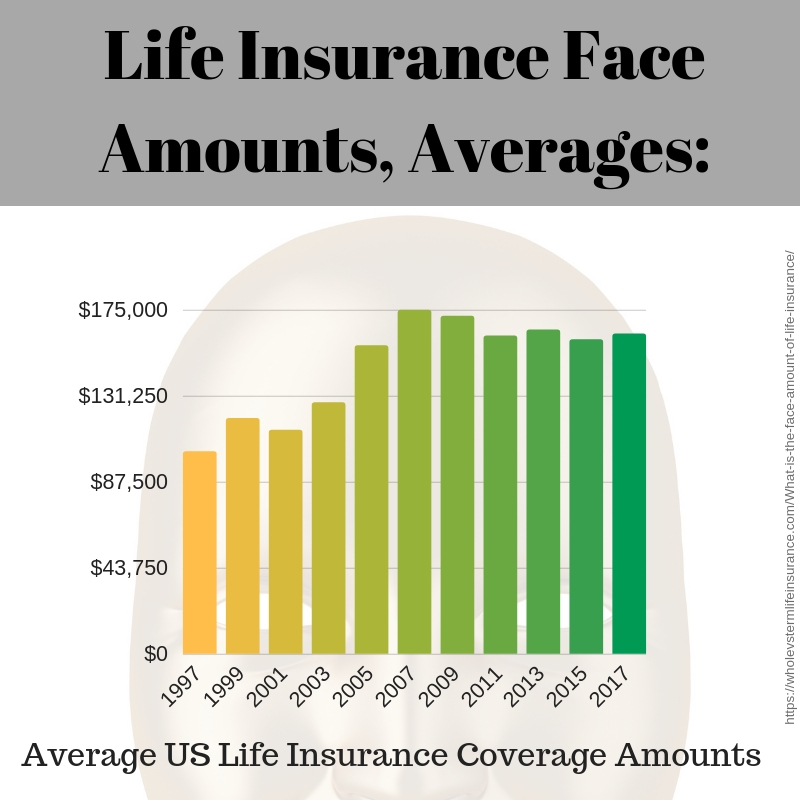

Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. It can also be referred to as the death benefit or the face amount of life insurance. The face amount is stated in the contract or application. When a life insurance policy is identified by a dollar amount, this amount is the face value. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

Source: revisi.net

Source: revisi.net

The face value, or face amount, of a life insurance policy is established when the policy is issued. The death benefit is the amount that is actually paid to the beneficiary when death occurs. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. What does face amount mean on an insurance policy? Company xyz would charge a higher premium for a $500,000 face value term life insurance policy than for a $100,000 face value policy

Source: npa1.org

Source: npa1.org

The face value is different from the cash value, which is the amount you receive on surrendering your policy, if you have a permanent type of life insurance. Face amount in life insurance. When an individual buys a life insurance policy on themselves or someone else, one of the main things they have to decide is the policy’s face amount. Face value is a factor in determining the monthly insurance premiums and shows how much your policy is worth. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die.

Source: alqurumresort.com

Source: alqurumresort.com

According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000. The face value of a life insurance policy is the death benefit, while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. The amount paid out on a life insurance policy (such as $100,000 upon the death of the person named on the policy) is also termed the face amount, because it is stated on the first page (or “face”) of the policy documentation. But there are a few things that can cause the face amount — or at. The death benefit is the amount that is actually paid to the beneficiary when death occurs.

Average life insurance face amounts have come down from a high point of $175,000 in the mid 2000s. In contrast to term plans (which are less costly upfront), permanent insurance has both a face value and a cash value. Nov 18, 2020 — the face value of your life insurance policy is the lump sum paid out to your beneficiaries if you die while the policy is active.what is the face value of life insurance?what is the difference between face. The face value of life insurance is the dollar amount equated to the worth of your policy. The face amount in life insurance is how much coverage your life policy has or in other words, how much life insurance money is given to the beneficiary following the premature demise of the policyholder.

Source: alqurumresort.com

Source: alqurumresort.com

On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company. The face amount is stated in the contract or application. The face value of a life insurance policy or death benefit represents the amount of money that beneficiaries will receive from the insurance company at the time of death. The face worth is usually how a lot your life insurance coverage beneficiaries will obtain in case you die whereas your coverage is in drive. Nov 18, 2020 — the face value of your life insurance policy is the lump sum paid out to your beneficiaries if you die while the policy is active.what is the face value of life insurance?what is the difference between face.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

The face value is the amount of money your insurer has agreed to pay out when you die. The amount paid out on a life insurance policy (such as $100,000 upon the death of the person named on the policy) is also termed the face amount, because it is stated on the first page (or “face”) of the policy documentation. The face amount almost always equals the death benefit in term insurance. How does the face amount work? A face amount is the sum of money a life insurance policy will pay out when the insured dies.

Source: npa1.org

Source: npa1.org

In contrast to term plans (which are less costly upfront), permanent insurance has both a face value and a cash value. The face value, or face amount, of a life insurance policy is established when the policy is issued. Company xyz would charge a higher premium for a $500,000 face value term life insurance policy than for a $100,000 face value policy You choose the life insurance face amount when you buy a. What is the face amount on an insurance policy?

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

The death benefit is the amount that is actually paid to the beneficiary when death occurs. What is the face value of a life insurance policy? The face value is the amount of money your insurer has agreed to pay out when you die. You decide on that dollar figure when you buy the policy, and it stays steady until the policy expires or you die. The face amount of a life insurance policy — also referred to as the death benefit — is the amount of money that is paid to your beneficiaries after you die.

Source: revisi.net

Source: revisi.net

The face amount in life insurance means the amount of insurance you buy. How does the face amount work? What is the face value of a life insurance policy? Face value is calculated by adding the death benefit plus any rider benefits,. The face amount in life insurance means the amount of insurance you buy.

Source: mishkanet.com

Source: mishkanet.com

To clear things up, the face amount of typical life insurance is the total amount of money that is now agreed upon in a contract regarding the insurance policy. The face amount is stated in the contract or application. But there are a few things that can cause the face amount — or at. It’s the amount of death benefit purchased, which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. The face amount in life insurance means the amount of insurance you buy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. When an individual buys a life insurance policy on themselves or someone else, one of the main things they have to decide is the policy’s face amount. A face amount is the sum of money a life insurance policy will pay out when the insured dies. The face worth is usually how a lot your life insurance coverage beneficiaries will obtain in case you die whereas your coverage is in drive. The face value of life insurance is the dollar amount equated to the worth of your policy.

Source: mishkanet.com

Source: mishkanet.com

Nov 18, 2020 — the face value of your life insurance policy is the lump sum paid out to your beneficiaries if you die while the policy is active.what is the face value of life insurance?what is the difference between face. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. In all cases, life insurance face value is the amount of money given to the beneficiary when the policy expires. It is used for life insurance policies. The cash value is often stated on the top sheet of the policy, hence the name face amount.

Source: mishkanet.com

Source: mishkanet.com

In the world of life insurance, the face amount (or face value) is also known as the death benefit. It is also called the death benefit, coverage amount, or face value. The face worth is usually how a lot your life insurance coverage beneficiaries will obtain in case you die whereas your coverage is in drive. According to statista, the average face amount of life insurance purchased in the united states in 2015 was about $160,000. On the contrary, the death benefit is the amount of money that is paid to a beneficiary by an insurance company.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Face value is calculated by adding the death benefit plus any rider benefits,. The cash value is often stated on the top sheet of the policy, hence the name face amount. Nov 18, 2020 — the face value of your life insurance policy is the lump sum paid out to your beneficiaries if you die while the policy is active.what is the face value of life insurance?what is the difference between face. What is the face value of a life insurance policy? Face value is a factor in determining the monthly insurance premiums and shows how much your policy is worth.

Source: erroresseguramente.blogspot.com

Source: erroresseguramente.blogspot.com

Usually, the cash value of the face amount can be found on the paper agreements of the insurance plan. Face value can also refer to the. What is a face amount? In the world of life insurance, the face amount (or face value) is also known as the death benefit. The face amount is stated in the contract or application.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance face amount by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.