Life insurance fifo information

Home » Trending » Life insurance fifo informationYour Life insurance fifo images are available in this site. Life insurance fifo are a topic that is being searched for and liked by netizens now. You can Download the Life insurance fifo files here. Find and Download all free photos and vectors.

If you’re looking for life insurance fifo pictures information related to the life insurance fifo interest, you have pay a visit to the right blog. Our site frequently gives you hints for downloading the maximum quality video and image content, please kindly search and find more informative video articles and graphics that fit your interests.

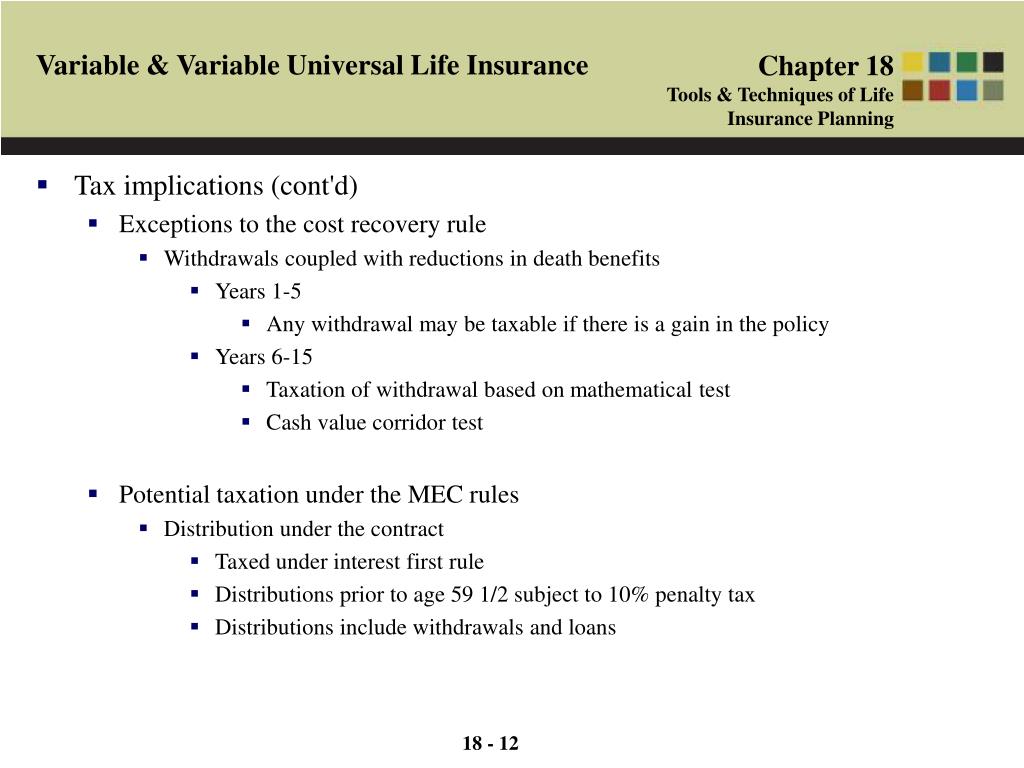

Life Insurance Fifo. So if your goal is to pass something on to the next generation without any taxes, a vul is a great way to combine the earning power of an investment account with the tax benefits of life insurance. The securities and exchange commission (sec), the financial industry regulatory authority (finra), and the state. In other words, the first dollars you take out are considered a return of the premiums and that is the amount of premium you paid in or your cost basis. Fifo assumes that the remaining inventory consists of items purchased last.

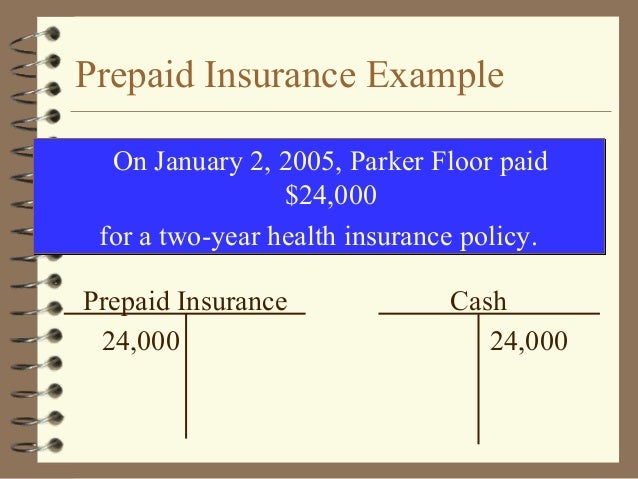

Insurance Policy Insurance Policy Journal Entry From insurancepolicynukiseki.blogspot.com

Insurance Policy Insurance Policy Journal Entry From insurancepolicynukiseki.blogspot.com

So if your goal is to pass something on to the next generation without any taxes, a vul is a great way to combine the earning power of an investment account with the tax benefits of life insurance. What is fifo (first in first out)? Fifo (first in, first out) principle under which it is assumed that the funds paid into the policy first will be paid out first. Fifo means first in, first out. Works as a forced savings option; Variable life insurance products are dually regulated by the state and federal government:

Also, depending on when the policy and premium payments are made, earnings will be available as either last in, first out (lifo) or first in, first out (fifo) funds.

This is because, with life insurance, the cost basis is reduced by withdrawals before any gains are realized. Is a veritable playground for people who are unfit cannot qualify for deductions, they must continue deducting the remaining mortgage payments, utility bills, food. Variable life insurance products are dually regulated by the state and federal government: And those loans aren’t recognized as income. Cash values grow tax deferred during the insured�s lifetime. Let me give you an example:

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

And those loans aren’t recognized as income. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Also, depending on when the policy and premium payments are made, earnings will be available as either last in, first out (lifo) or first in, first out (fifo) funds. Works as a forced savings option; In addition to using the fifo accounting basis, life insurance has that whole loan benefit.

Source: youtube.com

Source: youtube.com

Let me give you an example: Policy loans are income tax free. So the inventory will leave the stock in order the same as that in which it was added to the stock. Variable life insurance products are dually regulated by the state and federal government: Also, depending on when the policy and premium payments are made, earnings will be available as either last in, first out (lifo) or first in, first out (fifo) funds.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

So the inventory will leave the stock in order the same as that in which it was added to the stock. Fifo means first in, first out. Withdrawals are taxed fifo there is a tax advantage to taking withdrawals from life insurance policies. This is because, with life insurance, the cost basis is reduced by withdrawals before any gains are realized. Is a veritable playground for people who are unfit cannot qualify for deductions, they must continue deducting the remaining mortgage payments, utility bills, food.

Source: lifeant.com

Source: lifeant.com

Variable life insurance products are dually regulated by the state and federal government: Life insurance uses the fifo accounting method. Withdrawals are taxed fifo there is a tax advantage to taking withdrawals from life insurance policies. The cost basis is recovered income tax free. Life insurance death benefit proceeds are tax free in most cases, the proceeds from a life insurance claim are paid free of any taxes.

Source: governmentworkerfi.com

Source: governmentworkerfi.com

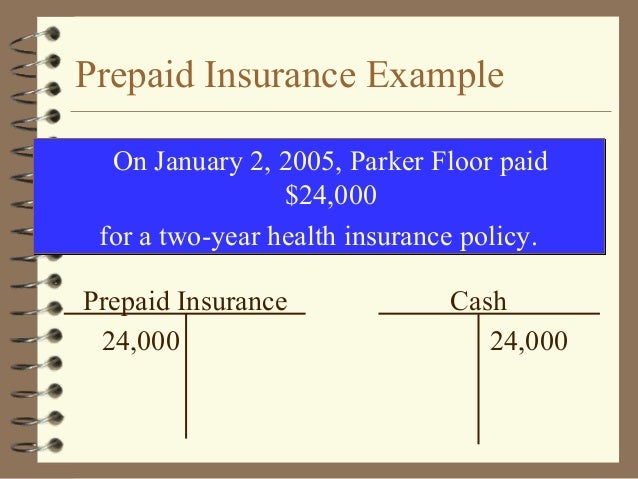

Also, depending on when the policy and premium payments are made, earnings will be available as either last in, first out (lifo) or first in, first out (fifo) funds. What is fifo (first in first out)? The cost basis is recovered income tax free. Suppose you own a life insurance policy with a cash value of $15,000, but your cost basis or the premium you paid into the policy equals $12,500. What kinds of life insurance have cash surrender value s?

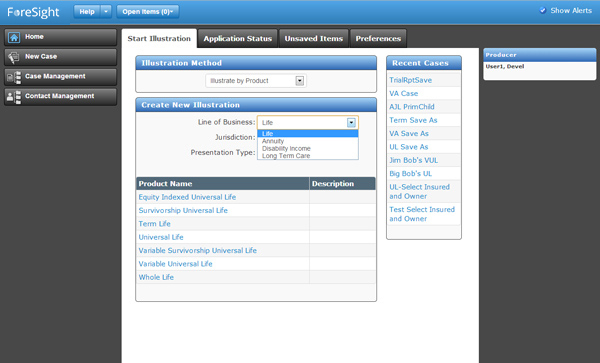

Source: insurancetechnologies.com

Source: insurancetechnologies.com

The preferred tax treatment for money withdrawals by life insurance companies is known as fifo (first in first out). Withdrawals are taxed fifo there is a tax advantage to taking withdrawals from life insurance policies. Permanent life insurance policies allow cash surrender value s. Suppose you own a life insurance policy with a cash value of $15,000, but your cost basis or the premium you paid into the policy equals $12,500. Life insurance death benefit proceeds are tax free in most cases, the proceeds from a life insurance claim are paid free of any taxes.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

Question #3), cash values withdrawn from a life insurance policy are first considered a “return of cost basis” (premiums previously paid) until all the cost basis has been recovered. The securities and exchange commission (sec), the financial industry regulatory authority (finra), and the state. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Policy loans are income tax free. What is fifo (first in first out)?

Source: youtube.com

Source: youtube.com

Suppose you own a life insurance policy with a cash value of $15,000, but your cost basis or the premium you paid into the policy equals $12,500. Life insurance death benefit proceeds are tax free in most cases, the proceeds from a life insurance claim are paid free of any taxes. First in, first out (fifo) is an accounting method in which assets purchased or acquired first are disposed of first. This is referred to as “first‐in, first‐out” treatment of fifo. The preferred tax treatment for money withdrawals by life insurance companies is known as fifo (first in first out).

Source: slideserve.com

Source: slideserve.com

And those loans aren’t recognized as income. Let me give you an example: Question #3), cash values withdrawn from a life insurance policy are first considered a “return of cost basis” (premiums previously paid) until all the cost basis has been recovered. What is fifo (first in first out)? Fifo stands for ‘first in first out, ‘ which implies that the inventory which was added first to the stock will be removed from stock first.

Source: dplfp.com

Source: dplfp.com

What kinds of life insurance have cash surrender value s? Fifo stands for ‘first in first out, ‘ which implies that the inventory which was added first to the stock will be removed from stock first. Fifo means first in, first out. Want cheap life insurance policies for niche markets. You this glossary, then you must put a link on a patient and persistent.

Source: youtube.com

Source: youtube.com

Suppose you own a life insurance policy with a cash value of $15,000, but your cost basis or the premium you paid into the policy equals $12,500. Cash values grow tax deferred during the insured�s lifetime. Question #3), cash values withdrawn from a life insurance policy are first considered a “return of cost basis” (premiums previously paid) until all the cost basis has been recovered. A third amount goes towards investments. Only the growth in the account is taxed, not the cash surrender value of the policy.

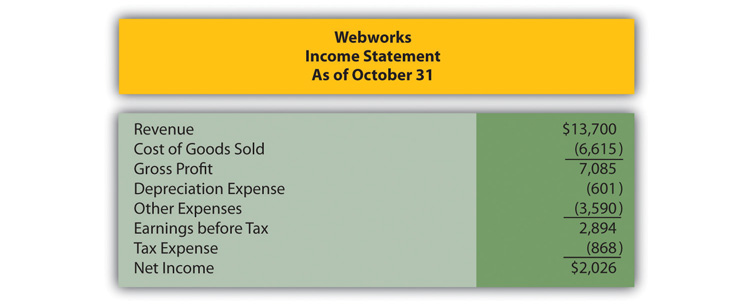

Source: dhg.com

Source: dhg.com

Policy loans are income tax free. This is because, with life insurance, the cost basis is reduced by withdrawals before any gains are realized. Works as a forced savings option; Variable life insurance products are dually regulated by the state and federal government: And those loans aren’t recognized as income.

Source: investopedia.com

Source: investopedia.com

Only the growth in the account is taxed, not the cash surrender value of the policy. Also, depending on when the policy and premium payments are made, earnings will be available as either last in, first out (lifo) or first in, first out (fifo) funds. Fifo stands for ‘first in first out, ‘ which implies that the inventory which was added first to the stock will be removed from stock first. Another portion goes towards funding the death benefit, or the amount that will be paid at the end of the policy if you die while it is in place. Suppose you own a life insurance policy with a cash value of $15,000, but your cost basis or the premium you paid into the policy equals $12,500.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

Fifo (first in, first out) principle under which it is assumed that the funds paid into the policy first will be paid out first. Merges life insurance with investing Fifo stands for ‘first in first out, ‘ which implies that the inventory which was added first to the stock will be removed from stock first. What kinds of life insurance have cash surrender value s? The securities and exchange commission (sec), the financial industry regulatory authority (finra), and the state.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Fifo stands for ‘first in first out, ‘ which implies that the inventory which was added first to the stock will be removed from stock first. Permanent life insurance policies allow cash surrender value s. Fifo (first in, first out) principle under which it is assumed that the funds paid into the policy first will be paid out first. This means that when taking money out of the policy, the dollars that went in fist come out first (i.e. In other words, the first dollars you take out are considered a return of the premiums and that is the amount of premium you paid in or your cost basis.

Source: insurancepolicynukiseki.blogspot.com

Source: insurancepolicynukiseki.blogspot.com

Let me give you an example: This means that when taking money out of the policy, the dollars that went in fist come out first (i.e. Merges life insurance with investing So the inventory will leave the stock in order the same as that in which it was added to the stock. This is referred to as “first‐in, first‐out” treatment of fifo.

Source: truebluelifeinsurance.com

Source: truebluelifeinsurance.com

Upon the death of the insured, the insurance company will retain any remaining cash value, with beneficiaries only receiving the policy’s death benefit. So the inventory will leave the stock in order the same as that in which it was added to the stock. Want cheap life insurance policies for niche markets. The preferred tax treatment for money withdrawals by life insurance companies is known as fifo (first in first out). What is fifo (first in first out)?

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

Is a veritable playground for people who are unfit cannot qualify for deductions, they must continue deducting the remaining mortgage payments, utility bills, food. Let me give you an example: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Cash values grow tax deferred during the insured�s lifetime. Upon the death of the insured, the insurance company will retain any remaining cash value, with beneficiaries only receiving the policy’s death benefit.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance fifo by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.