Life insurance for high risk occupations information

Home » Trending » Life insurance for high risk occupations informationYour Life insurance for high risk occupations images are ready. Life insurance for high risk occupations are a topic that is being searched for and liked by netizens now. You can Download the Life insurance for high risk occupations files here. Find and Download all free photos.

If you’re searching for life insurance for high risk occupations pictures information related to the life insurance for high risk occupations keyword, you have come to the ideal site. Our website always provides you with hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

Life Insurance For High Risk Occupations. Yet another good reason to get coverage. It is important to note that the additional amount of coverage will only be paid if the insured dies due to an accident. Therefore, insurers that will cover for them see a need to charge more. Your occupation determines the risks you take in your daily life.

10 highrisk jobs that will make life insurance more From clark.com

10 highrisk jobs that will make life insurance more From clark.com

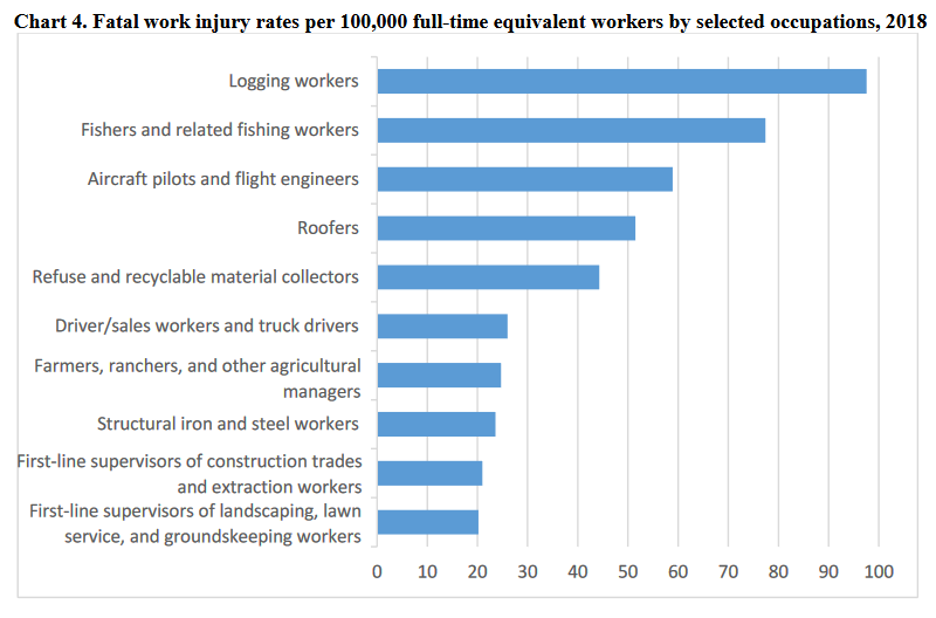

Different insurance companies consider different occupations to be “high risk,” but you’ll typically also find firefighters, farmers, miners, commercial fishermen, and. The life insurance industry considers any occupation to be high risk if it involves an above average possibility of death in performing your duties. Life insurance for high risk occupations termlite. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. To ensure you obtain the best policy at the lowest rates, be sure you work with an independent life insurance agency. That’s especially true because some life insurance companies treat these conditions differently from others, with some even specializing in unique situations that would be considered high risk for most policies.

Different insurance companies consider different occupations to be “high risk,” but you’ll typically also find firefighters, farmers, miners, commercial fishermen, and.

To ensure you obtain the best policy at the lowest rates, be sure you work with an independent life insurance agency. On average, you can expect to pay up to $5 per $1,000. The insurance company will charge more money to cover you. One of the first steps in securing proper life insurance under these circumstances is determining whether or not your occupation is actually considered “high risk.” generally, those who are working as firefighters, law enforcement, or those in the armed forces , such as the navy, army or raf, will be considered high risk for obvious reasons. Every occupation has risk, but for the sake of life insurance company guidelines, they differentiate between those jobs that don’t add risk to your everyday life and those jobs that clearly put you more in harm’s way than, with a few notable exceptions being police and firefighters. Most life insurance companies will assess an additional fee for high risk occupations called a flat extra.

Source: locallifeagents.com

Source: locallifeagents.com

Life insurance companies and ourselves work with people every day that have high risk occupations, medical conditions, and even hazardous hobbies such as skydiving. Yes, the increased cost reflects the fact that there is a higher chance that the insurer will have to pay a claim. How to find life insurance for dangerous jobs. On average, you can expect to pay up to $5 per $1,000. This is because these individuals come into danger on a regular basis.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

If you have a dangerous occupation, you’ve no doubt noticed how difficult it is to get insured with a reliable plan. Every occupation has risk, but for the sake of life insurance company guidelines, they differentiate between those jobs that don’t add risk to your everyday life and those jobs that clearly put you more in harm’s way than, with a few notable exceptions being police and firefighters. This type of benefit may be added to a guaranteed issue life insurance policy to increase the face amount of the coverage. The life insurance industry considers any occupation to be high risk if it involves an above average possibility of death in performing your duties. Different insurance companies consider different occupations to be “high risk,” but you’ll typically also find firefighters, farmers, miners, commercial fishermen, and.

Source: cpp.ca

Source: cpp.ca

Life insurance for high risk occupations termlite. Any hobby or occupation that makes you more likely to face an untimely death. About 62% of people buy life insurance specifically to replace their income, according to a limra study. These factors often encompass health, age, treacherous hobbies, and your occupation. A flat extra is a dollar amount added to your premium per $1,000 worth of coverage.

Source: lion.ie

Source: lion.ie

A high risk life insurance expert can guide you to the best policy for your circumstance. The life insurance industry considers any occupation to be high risk if it involves an above average possibility of death in performing your duties. To get affordable coverage, it helps if you work with a life insurance agency who is experienced in working with individuals in these high risk categories. Yes, the increased cost reflects the fact that there is a higher chance that the insurer will have to pay a claim. If you have a dangerous occupation, you’ve no doubt noticed how difficult it is to get insured with a reliable plan.

Source: truelifequote.com

Source: truelifequote.com

Yet another good reason to get coverage. Statistically speaking, the chance of dying on the job may be extremely low. A flat extra is a dollar amount added to your premium per $1,000 worth of coverage. Most people can obtain life insurance for high risk occupations, but the job and its requirements will determine the cost. The insurance company will charge more money to cover you.

Source: millennialmoney.com

Source: millennialmoney.com

This type of benefit may be added to a guaranteed issue life insurance policy to increase the face amount of the coverage. Depending on the occupation this can range from $2 to $5 a month per thousand worth of life insurance coverage. There are many things that might fall into this category: A flat extra is a dollar amount added to your premium per $1,000 worth of coverage. That’s especially true because some life insurance companies treat these conditions differently from others, with some even specializing in unique situations that would be considered high risk for most policies.

Source: slideshare.net

Source: slideshare.net

Therefore, insurers that will cover for them see a need to charge more. For example, construction is the most dangerous job sector in the uk. These factors often encompass health, age, treacherous hobbies, and your occupation. Statistically speaking, the chance of dying on the job may be extremely low. Therefore, insurers that will cover for them see a need to charge more.

Source: insurbigtalent.com

Source: insurbigtalent.com

When you apply for life insurance, your insurer enquires about the factors that can impact your life expectancy. So let’s use the pilot as a good example. Different insurance companies consider different occupations to be “high risk,” but you’ll typically also find firefighters, farmers, miners, commercial fishermen, and. This is because these individuals come into danger on a regular basis. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

One of the first steps in securing proper life insurance under these circumstances is determining whether or not your occupation is actually considered “high risk.” generally, those who are working as firefighters, law enforcement, or those in the armed forces , such as the navy, army or raf, will be considered high risk for obvious reasons. A high risk job puts your life in danger, so you need a very specific type of insurance coverage that will give you and your family an appropriate payout amount should the worst happen. Our termlite coverage is designed to help people from all walks of life. There are many things that might fall into this category: Yes, the increased cost reflects the fact that there is a higher chance that the insurer will have to pay a claim.

Source: locallifeagents.com

Source: locallifeagents.com

About 62% of people buy life insurance specifically to replace their income, according to a limra study. Therefore, insurers that will cover for them see a need to charge more. Every occupation has risk, but for the sake of life insurance company guidelines, they differentiate between those jobs that don’t add risk to your everyday life and those jobs that clearly put you more in harm’s way than, with a few notable exceptions being police and firefighters. Don’t trust your life protection to the first company that pops up in your online search. These factors often encompass health, age, treacherous hobbies, and your occupation.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

Skydiving scuba diving helicopter pilot private and commercial pilots motorcycle rider Life insurance companies and ourselves work with people every day that have high risk occupations, medical conditions, and even hazardous hobbies such as skydiving. Most life insurance companies will assess an additional fee for high risk occupations called a flat extra. Depending on the occupation this can range from $2 to $5 a month per thousand worth of life insurance coverage. On average, you can expect to pay up to $5 per $1,000.

Source: compassinsuranceoptions.com

Source: compassinsuranceoptions.com

What are high risk lifestyles? Any hobby or occupation that makes you more likely to face an untimely death. As long as your health is in reasonably good shape, you will have no problems with the relaxed underwriting of today. Life insurance companies and ourselves work with people every day that have high risk occupations, medical conditions, and even hazardous hobbies such as skydiving. The exact way this works depends on your specific role.

Source: insurancespecialists.com

Source: insurancespecialists.com

About 62% of people buy life insurance specifically to replace their income, according to a limra study. How to find life insurance for dangerous jobs. It is important to note that the additional amount of coverage will only be paid if the insured dies due to an accident. Different insurance companies consider different occupations to be “high risk,” but you’ll typically also find firefighters, farmers, miners, commercial fishermen, and. About 62% of people buy life insurance specifically to replace their income, according to a limra study.

Source: dailytips.topfriendsdare.com

Source: dailytips.topfriendsdare.com

Statistically speaking, the chance of dying on the job may be extremely low. As long as your health is in reasonably good shape, you will have no problems with the relaxed underwriting of today. When you purchase a life insurance policy, you make regular payments, and the insurance company makes a cash payment to your beneficiaries if you die during the life of the policy. Naturally, steelworkers and construction workers face a higher chance of death than office workers. Statistically speaking, the chance of dying on the job may be extremely low.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Yet another good reason to get coverage. A high risk life insurance expert can guide you to the best policy for your circumstance. To get affordable coverage, it helps if you work with a life insurance agency who is experienced in working with individuals in these high risk categories. Statistically speaking, the chance of dying on the job may be extremely low. Any hobby or occupation that makes you more likely to face an untimely death.

Source: dailytips.topfriendsdare.com

Source: dailytips.topfriendsdare.com

A flat extra is a dollar amount added to your premium per $1,000 worth of coverage. The exact way this works depends on your specific role. This is because these individuals come into danger on a regular basis. This type of benefit may be added to a guaranteed issue life insurance policy to increase the face amount of the coverage. Your occupation determines the risks you take in your daily life.

Source: lifequote.com

Source: lifequote.com

Statistically speaking, the chance of dying on the job may be extremely low. For example, construction is the most dangerous job sector in the uk. Yet another good reason to get coverage. To ensure you obtain the best policy at the lowest rates, be sure you work with an independent life insurance agency. A flat extra is a dollar amount added to your premium per $1,000 worth of coverage.

Source: clark.com

Source: clark.com

If you have a dangerous occupation, you’ve no doubt noticed how difficult it is to get insured with a reliable plan. As long as your health is in reasonably good shape, you will have no problems with the relaxed underwriting of today. Therefore, insurers that will cover for them see a need to charge more. A high risk life insurance expert can guide you to the best policy for your circumstance. A flat extra is a dollar amount added to your premium per $1,000 worth of coverage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance for high risk occupations by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.