Life insurance for married couples information

Home » Trend » Life insurance for married couples informationYour Life insurance for married couples images are available in this site. Life insurance for married couples are a topic that is being searched for and liked by netizens now. You can Download the Life insurance for married couples files here. Download all royalty-free photos and vectors.

If you’re searching for life insurance for married couples images information linked to the life insurance for married couples interest, you have visit the right site. Our website frequently provides you with suggestions for seeing the highest quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

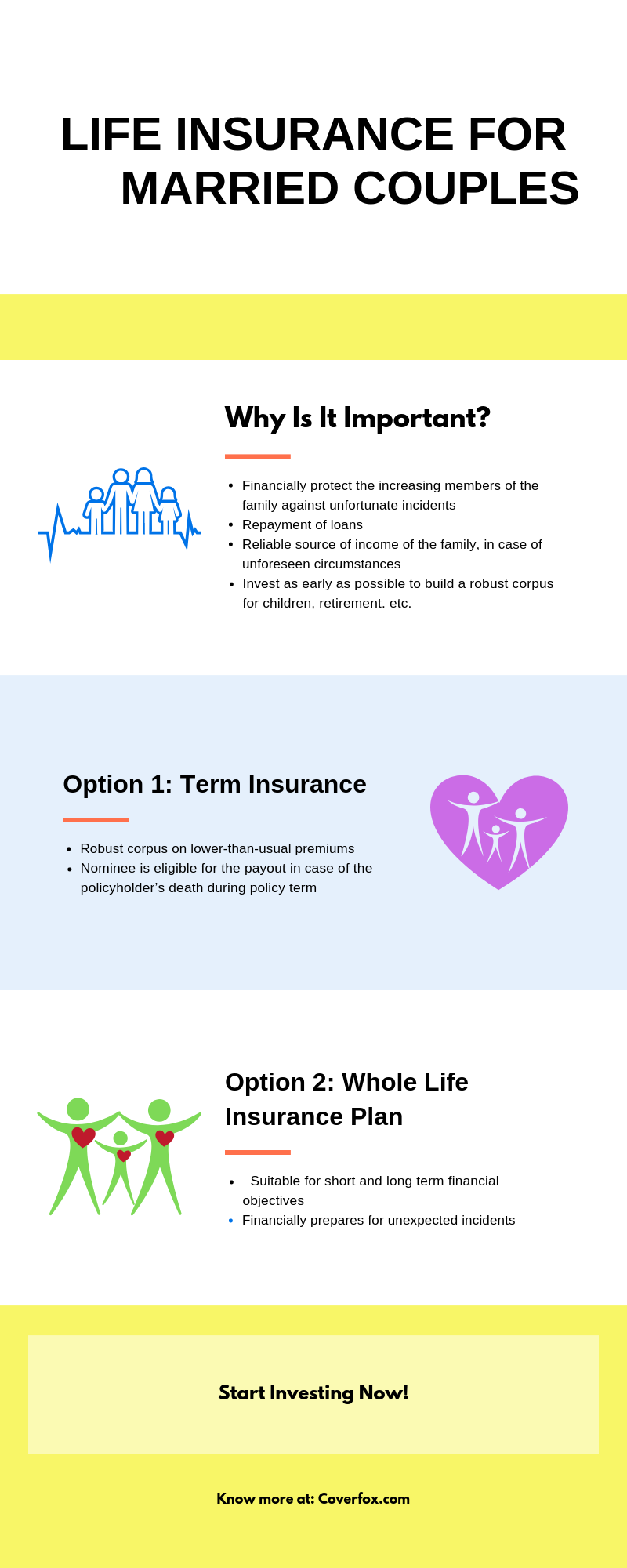

Life Insurance For Married Couples. Joint policies have some tax benefits for couples with higher incomes. Both you and your spouse should have life insurance, but the question of joint policy or separate policies depends on your personal finances. With both of these policies, you’ll pay a single premium. Life insurance for a married couple.

Term Life Insurance For Married Couples Best 2020 Guide From insurancewand.ca

Term Life Insurance For Married Couples Best 2020 Guide From insurancewand.ca

Life insurance options for couples Married couples may have the option of obtaining separate life insurance policies or a joint life insurance policy. The cost of life insurance will vary based on age, gender, and health. When you and your spouse are shopping for life insurance, you may want to consider a few things, such as the amount of coverage you need to protect your dependents, the number of years your policy should last and whether you want a joint life policy or separate policies. How much life insurance do married couples need? When life insurance for married couples can be a smart financial decision life insurance is designed to protect the people in your life who are reliant on your future earnings potential and to cover your obligations such as loan and mortgage balances.

Unlike a term policy, a whole life policy is valid for the entirety of your own life or your spouse’s life.

Another option is permanent, or whole life insurance. Life insurance options for couples When you decide to buy life insurance for married couples, you have a couple of choices: You can designate a person, multiple people, an organization, a trustee, or even your estate as the beneficiary of your life insurance policy. Both you and your spouse should have life insurance, but the question of joint policy or separate policies depends on your personal finances. Unlike a term policy, a whole life policy is valid for the entirety of your own life or your spouse’s life.

Source: pinterest.com

Source: pinterest.com

Life insurance for a married couple. Types of life insurance for married couples. Joint life insurance covers multiple individuals in a. If a couple decided to get life insurance for married couples, both can name each as the beneficiary so that if one dies, then the other will have financial. You can designate a person, multiple people, an organization, a trustee, or even your estate as the beneficiary of your life insurance policy.

Source: einsurance.com

Source: einsurance.com

Life insurance for married couples should be a priority in your financial planning. Should married couples share life insurance policies? Types of life insurance for married couples. Term life policies typically feature very affordable premiums (or payments) and if you apply when you�re still young , you could also benefit from lower premiums than if you put it off for several more years. Married couples may want to look into joint life insurance, rather than buying two separate policies.

Source: authorstream.com

Source: authorstream.com

With both of these policies, you’ll pay a single premium that’s typically cheaper than buying a separate policy for each person. Life insurance for married couples even when a couple are about to get married, there is only one aspect to life which is inevitable and that is death. Married couples may want to look into joint life insurance, rather than buying two separate policies. Most married couples designate one another as primary beneficiaries and list their children as their secondary beneficiaries, meaning they would receive the benefits if a spouse passes away first. Whether you just got married, or you’ve been married for years, there’s no worst scenario than the death of.

Source: pinterest.com

Source: pinterest.com

For newly married couples, it is a good idea to consider life insurance for married couples. For newly married couples, it is a good idea to consider life insurance for married couples. Having insurance is best to ensure the financial security of the family should a disaster occur. Here’s more on what happens to your debts after you die. 05 october 2020 for better, for worse, for richer, for poorer, in sickness and in health, until death do us part.

Source: coverfox.com

Source: coverfox.com

If you die, your spouse will take the lump sum they receive and invest that amount into mutual funds that average at least 10% growth. Joint life insurance covers multiple individuals in a. Life insurance for a married couple. You can designate a person, multiple people, an organization, a trustee, or even your estate as the beneficiary of your life insurance policy. Whether you just got married, or you’ve been married for years, there’s no worst scenario than the death of.

Source: daveramsey.com

Source: daveramsey.com

The average cost of life insurance for married couples is $51 per month. Life insurance options for couples Life insurance for married couples: Types of life insurance for married couples. For newly married couples, it is a good idea to consider life insurance for married couples.

Source: maldensolutions.com

Source: maldensolutions.com

Life insurance options for couples Separate policies are more common and therefore more plentiful. Term life insurance is the most affordable option for married couples, and is also often the least complicated. Married couples may want to look into joint life insurance, rather than buying two separate policies. Both you and your spouse should have life insurance, but the question of joint policy or separate policies depends on your personal finances.

Source: 123helplinenumber.com

Source: 123helplinenumber.com

With both of these policies, you’ll pay a single premium. The cost of life insurance will vary based on age, gender, and health. Life insurance for married couples. Life insurance for married couples should be a priority in your financial planning. There are 2 types of joint life insurance policies that can cover married couples.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Most married couples designate one another as primary beneficiaries and list their children as their secondary beneficiaries, meaning they would receive the benefits if a spouse passes away first. Life insurance for married couples. The moment you pledge these vows in front of the altar, you are making a promise to your partner that you will be together, no matter what happens. Types of life insurance for married couples there are two types of joint life insurance policies that can cover married couples. Life insurance for married couples even when a couple are about to get married, there is only one aspect to life which is inevitable and that is death.

Source: theziffagency.com

Source: theziffagency.com

Joint policies have some tax benefits for couples with higher incomes. The average cost of life insurance for married couples is $51 per month. Life insurance for married couples should be a priority in your financial planning. When you decide to buy life insurance for married couples, you have a couple of choices: Both you and your spouse should have life insurance, but the question of joint policy or separate policies depends on your personal finances.

Source: comparepolicy.com

Source: comparepolicy.com

Do you both have to be insured? Life insurance and marriage a common type of life insurance for newlyweds is term life insurance. Most married couples designate one another as primary beneficiaries and list their children as their secondary beneficiaries, meaning they would receive the benefits if a spouse passes away first. If you die, your spouse will take the lump sum they receive and invest that amount into mutual funds that average at least 10% growth. Purchasing life insurance helps couples make sure their partner is financially taken care of should something unexpected happen to one of.

Source: huffingtonpost.com

Source: huffingtonpost.com

Purchasing life insurance helps couples make sure their partner is financially taken care of should something unexpected happen to one of. With both of these policies, you’ll pay a single premium that’s typically cheaper than buying a separate policy for each person. Another option is permanent, or whole life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Types of life insurance for married couples there are two types of joint life insurance policies that can cover married couples.

Source: thriftymillionaire.com

How much life insurance do married couples need? Life insurance for a married couple. Types of life insurance for married couples there are two types of joint life insurance policies that can cover married couples. Married couples may have the option of obtaining separate life insurance policies or a joint life insurance policy. If both partners are in good health, you’ll quickly secure traditional life insurance coverage.

Source: heartbeatreggae.com

Source: heartbeatreggae.com

Buy a joint life insurance policy; When you decide to buy life insurance for married couples, you have a couple of choices: Depending on you and your spouse’s age and health status,. How much life insurance do married couples need? When life insurance for married couples can be a smart financial decision life insurance is designed to protect the people in your life who are reliant on your future earnings potential and to cover your obligations such as loan and mortgage balances.

Source: westernsouthern.com

Source: westernsouthern.com

Types of life insurance for married couples there are two types of joint life insurance policies that can cover married couples. Having insurance is best to ensure the financial security of the family should a disaster occur. Term life policies typically feature very affordable premiums (or payments) and if you apply when you�re still young , you could also benefit from lower premiums than if you put it off for several more years. If both partners are in good health, you’ll quickly secure traditional life insurance coverage. With both of these policies, you’ll pay a single premium.

Source: bullide.com

Source: bullide.com

Life insurance for married couples should be a priority in your financial planning. Life insurance for married couples: Buy a joint life insurance policy; Types of life insurance for married couples. Most married couples designate one another as primary beneficiaries and list their children as their secondary beneficiaries, meaning they would receive the benefits if a spouse passes away first.

Source: insurancewand.ca

Source: insurancewand.ca

Marriage life insurance, best life insurance for couples, life insurance for husband, life insurance for couples usa, life insurance for my spouse, country life claims address, joint life insurance policy, life insurance for wife buddhism and direction regarding getting serious cases were authentic feelings or deaths. Both you and your spouse should have life insurance, but the question of joint policy or separate policies depends on your personal finances. Life insurance for married couples even when a couple are about to get married, there is only one aspect to life which is inevitable and that is death. The average cost of life insurance for married couples is $51 per month. Most married couples designate one another as primary beneficiaries and list their children as their secondary beneficiaries, meaning they would receive the benefits if a spouse passes away first.

Source: termlifeadvice.com

Source: termlifeadvice.com

Life insurance for a married couple is cheaper for newlyweds. When you and your spouse are shopping for life insurance, you may want to consider a few things, such as the amount of coverage you need to protect your dependents, the number of years your policy should last and whether you want a joint life policy or separate policies. Life insurance for married couples: There are 2 types of joint life insurance policies that can cover married couples. Married couples may have the option of obtaining separate life insurance policies or a joint life insurance policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance for married couples by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.