Life insurance for sba loan information

Home » Trend » Life insurance for sba loan informationYour Life insurance for sba loan images are available in this site. Life insurance for sba loan are a topic that is being searched for and liked by netizens today. You can Download the Life insurance for sba loan files here. Find and Download all royalty-free photos.

If you’re searching for life insurance for sba loan pictures information linked to the life insurance for sba loan topic, you have come to the right site. Our site always gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

Life Insurance For Sba Loan. Let’s take a look at some of the key things to consider. Lenders will accept permanent life insurance as collateral for an sba loan. Talk with an expert shop &. The need for life insurance can often slow down the sba loan process.

Life Insurance and a SBA Loan From diabeteslifesolutions.com

Life Insurance and a SBA Loan From diabeteslifesolutions.com

When scouting for life insurance for sba loans, consider looking at term life insurance. In addition, borrowers aren’t always told they’ll need life insurance until very late in the process, leading to a scramble. If a new policy, a decreasing term policy is most appropriate. Most often it is best to purchase term life life insurance when needed for an sba loan. Most of the money lending institutions are for a set number of years, typically between 10 and 30 years. Consistent with size and term of the sba loan.

Typical term life insurance for an sba loan goes through an underwriting process where you need to go through a full medical examination to determine the risk of insuring you, depending on the state of your current health.

Life insurance comes into play, because it may be required as a source of collateral for the loan. This is because most of the time a small business has one or a few “key” people whom the business might not survive without. When applicants need life insurance to get an sba loan a life insurance policy is required when the business is “tied to an individual or individuals,” under sba sop 50 10 5 (b). Term life insurance is the common type of life insurance usually purchased for sba loans. When scouting for life insurance for sba loans, consider looking at term life insurance. If you’re an entrepreneur looking to take out an sba loan to make your business goals a reality, life insurance is a must.

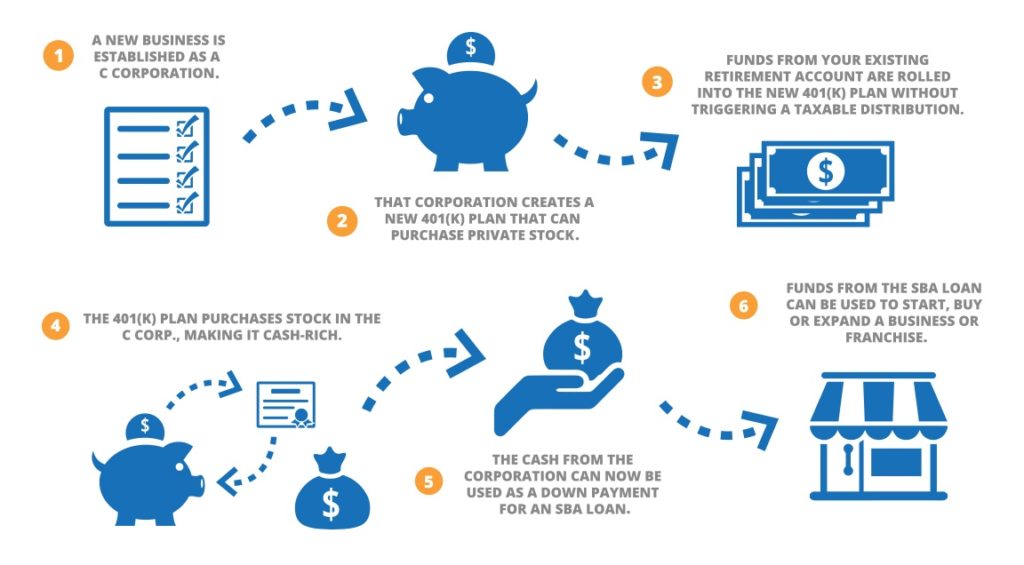

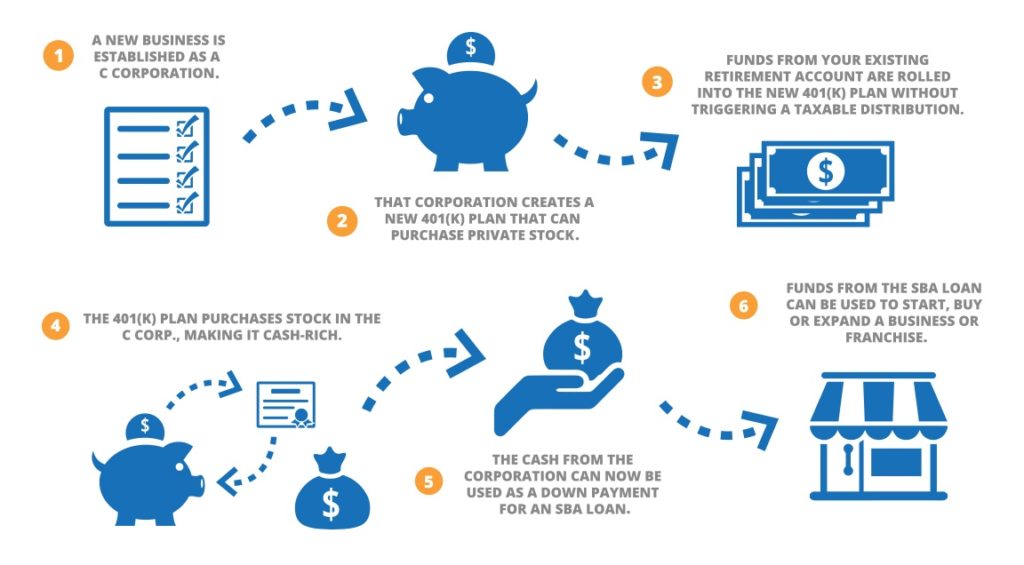

Source: guidantfinancial.com

Source: guidantfinancial.com

This agreement ensures the debt will be repaid no matter what. In 2003, i saw a need for a new business model that would expedite the process of acquiring life insurance for business owners obtaining sba loans. Most sba loans require borrowers to have life insurance before the loan is finalized. When life insurance for sba loans is required, sop 50 10 5(b) must be followed by lenders. Borrower may pledge an existing policy.

Source: inszoneinsurance.com

Source: inszoneinsurance.com

“lender must determine if the viability of the business is tied to an individual or individuals. Permanent life insurance for small business administration (sba) loans lenders will accept permanent life insurance as collateral for an sba loan. This agreement ensures the debt will be repaid no matter what. Let’s take a look at some of the key things to consider. One week life insurance approval for sba loan we have the fast solution if you need life insurance for sba loan in a hurry…but this can be very expensive.

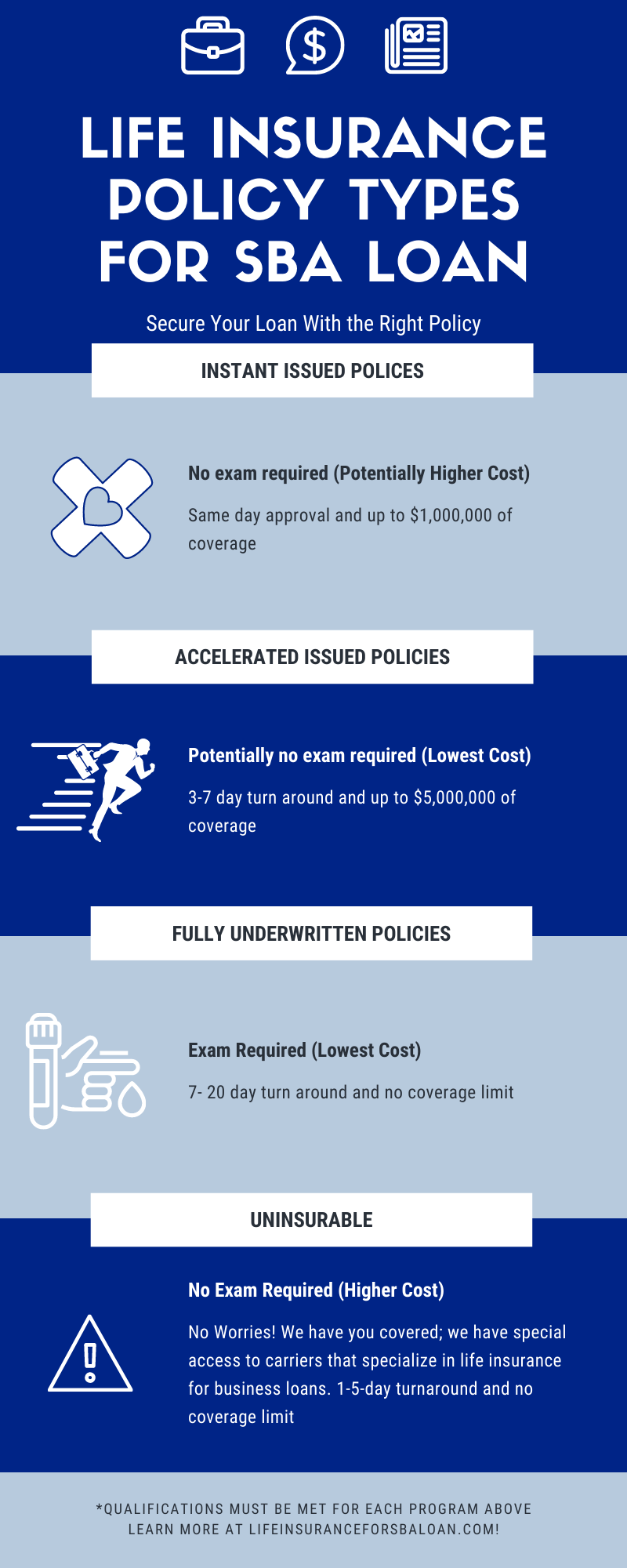

Source: lifeinsuranceforsbaloan.com

Source: lifeinsuranceforsbaloan.com

Sba loans will require life insurance as part of the collateral assignment process. Most often it is best to purchase term life life insurance when needed for an sba loan. A permanent life insurance policy with a cash value reassures the lender that they sep 15, 2020 · uploaded by quotacy (1). The short answer is probably. Small business administration (sba) loans and life insurance.

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

The short answer is probably. The short answer is probably. Each policy must have a collateral assignment for sba. Sba loans and “key man” life insurance. I’m charles bailey, and i am a business owner like you.

Source: lifeinsuranceforsbaloan.com

Source: lifeinsuranceforsbaloan.com

Most sba loans require borrowers to have life insurance before the loan is finalized. The short answer is probably. When life insurance for sba loans is required, sop 50 10 5(b) must be followed by lenders. Sba loans will require life insurance as part of the collateral assignment process. The sba requires lenders to require many borrowers to carry some amount of life insurance as a condition of receiving financing.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Small business administration (sba) loans and life insurance. Similarly, the sba requires that loan applicants obtain a collateral assignment of life insurance in favor of the lender when the business is formed as a sole proprietorship or single member llc and is otherwise dependent on one owner’s active. Most sba loans require borrowers to have life insurance before the loan is finalized. The short answer is probably. In addition, borrowers aren’t always told they’ll need life insurance until very late in the process, leading to a scramble.

Source: blogpapi.com

Source: blogpapi.com

Credit life insurance or whole life insurance would not be required. Sba loans will require life insurance as part of the collateral assignment process. Anything can happen along the way, but by starting early, we can get the right policy at the best price for your situation. Talk with an expert shop &. The short answer is probably.

Source: mycastleintheclouds2.blogspot.com

Source: mycastleintheclouds2.blogspot.com

The need for life insurance can often slow down the sba loan process. Consistent with size and term of the sba loan. When applicants need life insurance to get an sba loan a life insurance policy is required when the business is “tied to an individual or individuals,” under sba sop 50 10 5 (b). The short answer is probably. The short answer is probably.

Source: cfainsure.com

Source: cfainsure.com

The life insurance used to obtain an sba loan must be collaterally assigned, through an agreement between both parties regarding the distribution of the policy’s death benefit. For example, we just shopped a case for a 55 year old gentleman who needed $1,000,000 of life insurance for loan right away. When life insurance for sba loans is required, sop 50 10 5(b) must be followed by lenders. This agreement ensures the debt will be repaid no matter what. This is because most of the time a small business has one or a few “key” people whom the business might not survive without.

Source: youtube.com

Source: youtube.com

Sba loans and “key man” life insurance. Sba loans and “key man” life insurance. One week life insurance approval for sba loan we have the fast solution if you need life insurance for sba loan in a hurry…but this can be very expensive. This is because most of the time a small business has one or a few “key” people whom the business might not survive without. Sba loans will require life insurance as part of the collateral assignment process.

Source: jrcinsurancegroup.com

Source: jrcinsurancegroup.com

This is because most of the time a small business has one or a few “key” people whom the business might not survive without. If you find yourself in this position, continue reading on how it all works, or you can start comparing life insurance quotes right on this page. Most of the money lending institutions are for a set number of years, typically between 10 and 30 years. When life insurance for sba loans is required, sop 50 10 5(b) must be followed by lenders. I’m charles bailey, and i am a business owner like you.

Source: quotacy.com

Source: quotacy.com

Borrower may pledge an existing policy. Borrower may pledge an existing policy. Credit life insurance or whole life insurance would not be required. This is because most of the time a small business has one or a few “key” people whom the business might not survive without. Lenders will accept permanent life insurance as collateral for an sba loan.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

When life insurance for sba loans is required, sop 50 10 5(b) must be followed by lenders. This is because most of the time a small business has one or a few “key” people whom the business might not survive without. The term life offers coverage for a specified number of years. Term life insurance is the common type of life insurance usually purchased for sba loans. Trust us to guide you to through the process of the sba loan life insurance requirement and we’ll do our part to keep your loan closing on time.

Source: thebaileygp.com

Source: thebaileygp.com

For example, we just shopped a case for a 55 year old gentleman who needed $1,000,000 of life insurance for loan right away. Sba loans will require life insurance as part of the collateral assignment process. Borrower may pledge an existing policy. Most often it is best to purchase term life life insurance when needed for an sba loan. A permanent life insurance policy with a cash value reassures the lender that they sep 15, 2020 · uploaded by quotacy (1).

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

Borrower may pledge an existing policy. It would take up to eight weeks (or longer) for this type of policy to be approved. I’m charles bailey, and i am a business owner like you. In addition, borrowers aren’t always told they’ll need life insurance until very late in the process, leading to a scramble. Most of the money lending institutions are for a set number of years, typically between 10 and 30 years.

Source: ptmoney.com

Source: ptmoney.com

If a new policy, a decreasing term policy is most appropriate. When scouting for life insurance for sba loans, consider looking at term life insurance. The term life offers coverage for a specified number of years. A permanent life insurance policy with a cash value reassures the lender that they will be able to reclaim their costs with access to the cash value to use as loan payment if the borrower defaults. Let’s take a look at some of the key things to consider.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance for sba loan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.