Life insurance for type 1 diabetes Idea

Home » Trending » Life insurance for type 1 diabetes IdeaYour Life insurance for type 1 diabetes images are ready in this website. Life insurance for type 1 diabetes are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance for type 1 diabetes files here. Get all free photos and vectors.

If you’re searching for life insurance for type 1 diabetes pictures information linked to the life insurance for type 1 diabetes topic, you have come to the right site. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

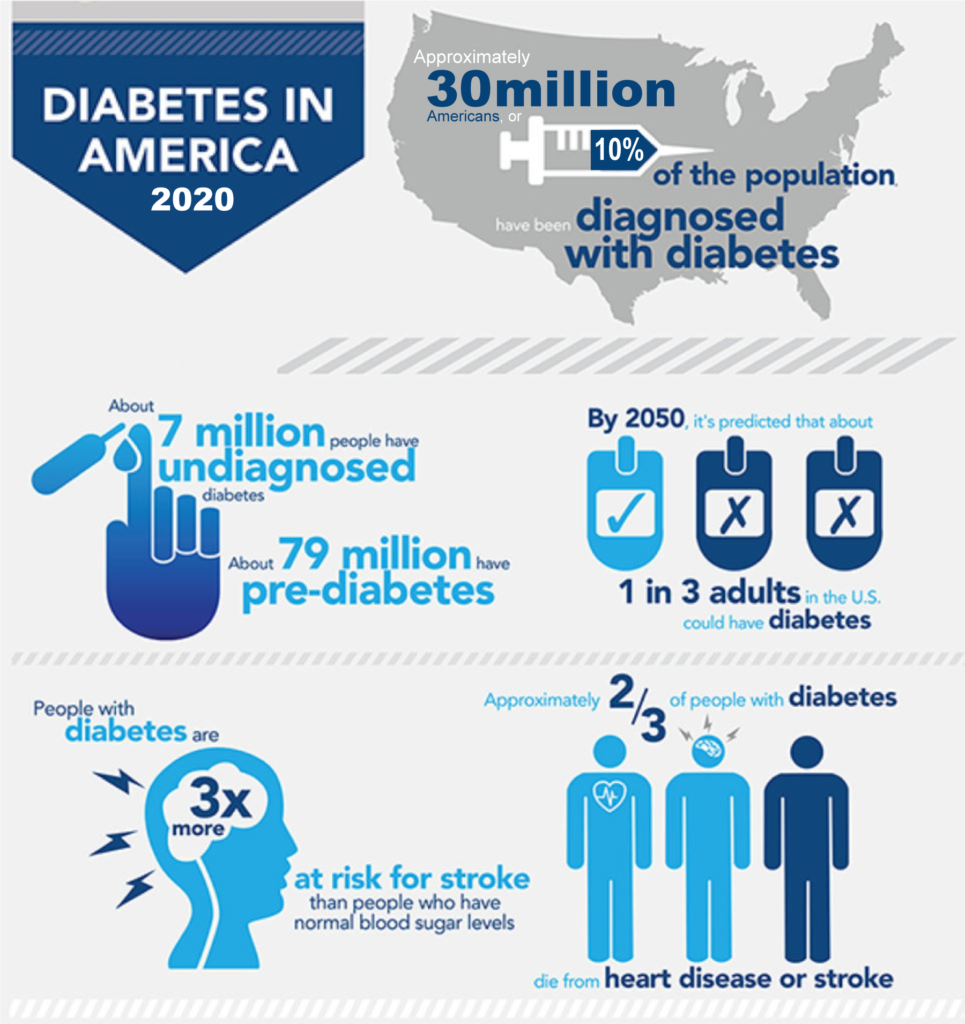

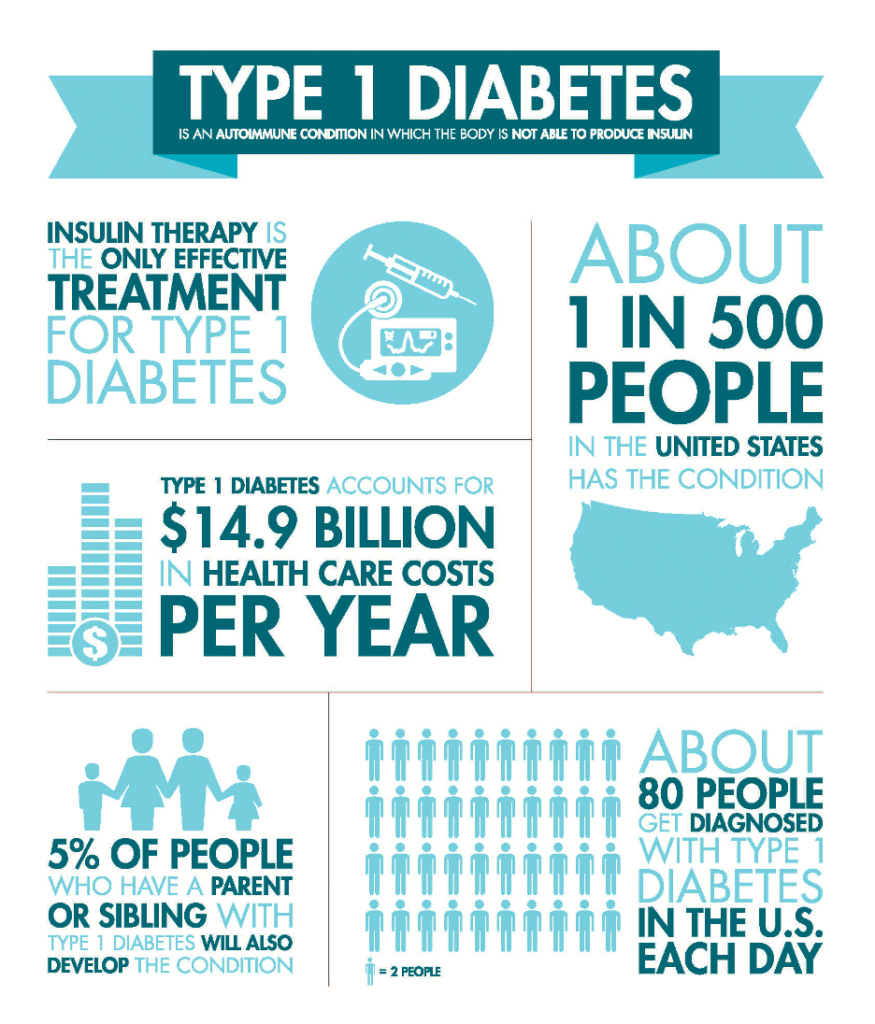

Life Insurance For Type 1 Diabetes. Life insurance for diabetics type 1. Here is how life insurance works. Life insurance companies will view you as a higher risk, and most likely your premiums will be higher. Approval for a life insurance policy with type 1 diabetes (insulin dependent diabetes) was virtually impossible just a few short years ago.

Can I Get Life Insurance With Type 1 Diabetes? LION.ie From lion.ie

Can I Get Life Insurance With Type 1 Diabetes? LION.ie From lion.ie

Unlike term life insurance, these permanent products will cover a person’s entire life, with premiums that do not increase. We recommend you get life insurance immediately. That’s why jdrf is committed to supporting you by providing tools to help you navigate healthcare and health insurance. If you do not declare that you have diabetes when you apply for life insurance, your insurer will not pay out if you die. Here is how life insurance works. Below are some factors that life insurance company underwriters take under consideration with regard to your diabetes when they assess their risk to insure your life.

Life insurance for diabetics type 1.

Type 1 diabetes is a condition where you can’t produce any insulin naturally. Below are some factors that life insurance company underwriters take under consideration with regard to your diabetes when they assess their risk to insure your life. That’s why jdrf is committed to supporting you by providing tools to help you navigate healthcare and health insurance. When should i get life insurance if i am a type 2 diabetic? But there are still options with companies like mutual of omaha.and while it’s not the most affordable coverage for people who don’t have diabetes, mutual of. Approval for a life insurance policy with type 1 diabetes (insulin dependent diabetes) was virtually impossible just a few short years ago.

Source: lion.ie

Source: lion.ie

We are seeing the same top 3 life insurance carriers as mentioned below give the most competitive rates available. Higher blood sugar level than the. Yes, it’s possible to secure life cover if you’re living with type 1 diabetes. Due to medical advances and new types of treatments and monitoring systems, it is now more possible to manage diabetes mellitus type 1 and get approved for insurance. Currently, we offer two great insurance companies that offer coverage without an exam!

Source: the-insurance-surgery.co.uk

Source: the-insurance-surgery.co.uk

From a life insurance perspective, type 1 diabetes is considered to carry a higher risk than type ii diabetes. If you’ve been declined life insurance due to diabetes, just relax. We are seeing the same top 3 life insurance carriers as mentioned below give the most competitive rates available. You just need to work with diabetes life insurance specialists such as diabetes life solutions. Life insurance policy options for diabetics | fidelity life.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

No medical exam life insurance for type 1 diabetics: That is because this important tool, life insurance, can play a key role in ensuring that your loved ones will not have to dip into personal savings or other assets in order to pay off debts, take care of final expenses, or continue to pay ongoing living expenses. Life insurance for diabetics type 1. Life insurance companies will view you as a higher risk, and most likely your premiums will be higher. It can be a little bit daunting and difficult to get a life insurance if you’re a type 1 diabetic.

Source: lion.ie

Source: lion.ie

Having type 1 diabetes used to mean an automatic decline from life insurance underwriters. When creating your overall financial plan, it is important not to leave life insurance out. 1) anico (american national) offers up to a maximum of $250,000 face coverage on a 10, 15, 20 or 30 year term policy. Higher blood sugar level than the. Health insurance guide when you have health needs due to a chronic condition like type 1 diabetes (t1d), having health insurance is critical in helping you manage and treat your condition.

Source: bestlifequote.com

Source: bestlifequote.com

If you have type 1 diabetes, life insurance coverage will be more expensive. Higher blood sugar level than the. There are three main types of permanent life insurance products: That’s why jdrf is committed to supporting you by providing tools to help you navigate healthcare and health insurance. Type 1 diabetes is a condition where you can’t produce any insulin naturally.

Source: diabetes365.org

Source: diabetes365.org

No hassle and no medical involvement! Currently, we offer two great insurance companies that offer coverage without an exam! Life insurance companies will view you as a higher risk, and most likely your premiums will be higher. Due to medical advances and new types of treatments and monitoring systems, it is now more possible to manage diabetes mellitus type 1 and get approved for insurance. That is because this important tool, life insurance, can play a key role in ensuring that your loved ones will not have to dip into personal savings or other assets in order to pay off debts, take care of final expenses, or continue to pay ongoing living expenses.

Source: futureproofinsurance.co.uk

Source: futureproofinsurance.co.uk

If you’ve been declined life insurance due to diabetes, just relax. With the help of specialist insurers, it’s completely possible to obtain life insurance with type 1 diabetes. But there are still options with companies like mutual of omaha.and while it’s not the most affordable coverage for people who don’t have diabetes, mutual of. Almost all life insurance companies have life insurance products that will cover you and your type 1 diabetes. 1) anico (american national) offers up to a maximum of $250,000 face coverage on a 10, 15, 20 or 30 year term policy.

Source: focusorm.co.uk

Source: focusorm.co.uk

Currently, we offer two great insurance companies that offer coverage without an exam! Yes, you can get life insurance if you have diabetes. That is because this important tool, life insurance, can play a key role in ensuring that your loved ones will not have to dip into personal savings or other assets in order to pay off debts, take care of final expenses, or continue to pay ongoing living expenses. From a life insurance perspective, type 1 diabetes is considered to carry a higher risk than type ii diabetes. If you’ve been declined life insurance due to diabetes, just relax.

Source: chooseterm.com

Source: chooseterm.com

Yes, but the premiums for a diabetes life insurance policy are likely to be more expensive. A typical offer for a healthy well controlled type 1 diabetic is 250% of the standard rate with the best case being 200%. That’s why jdrf is committed to supporting you by providing tools to help you navigate healthcare and health insurance. Yes, you can get life insurance if you have diabetes. Health insurance guide when you have health needs due to a chronic condition like type 1 diabetes (t1d), having health insurance is critical in helping you manage and treat your condition.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Yes, you can get life insurance if you have diabetes. It’s a common misconception that you’ll be declined for life insurance due to your condition, but this isn’t the case. Currently, we offer two great insurance companies that offer coverage without an exam! You just need to work with diabetes life insurance specialists such as diabetes life solutions. Getting life insurance with any form of diabetes can be difficult, but life insurance for type 1 diabetics can still be affordable, and easily obtained.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

We are seeing the same top 3 life insurance carriers as mentioned below give the most competitive rates available. Health insurance guide when you have health needs due to a chronic condition like type 1 diabetes (t1d), having health insurance is critical in helping you manage and treat your condition. No hassle and no medical involvement! A typical offer for a healthy well controlled type 1 diabetic is 250% of the standard rate with the best case being 200%. There are three main types of permanent life insurance products:

Source: life-insurance-cover.co.uk

Source: life-insurance-cover.co.uk

That’s why jdrf is committed to supporting you by providing tools to help you navigate healthcare and health insurance. If you do not declare that you have diabetes when you apply for life insurance, your insurer will not pay out if you die. We are seeing the same top 3 life insurance carriers as mentioned below give the most competitive rates available. Life insurance companies will view you as a higher risk, and most likely your premiums will be higher. 1) anico (american national) offers up to a maximum of $250,000 face coverage on a 10, 15, 20 or 30 year term policy.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

No medical exam life insurance for type 1 diabetics: If you want to have affordable life insurance into your 50’s and beyond then consider level life cover, which may also be available. We recommend you get life insurance immediately. Compare plans for free and save up to 70% diabetes` impact and life insurance for type 1 diabetics between the two types of diabetes, type 1 and type 2, there are several differences but the sufferers have the same problem: With the help of specialist insurers, it’s completely possible to obtain life insurance with type 1 diabetes.

It has no known cure and can develop at any age, though it is usually diagnosed in children, teens,. Health insurance guide when you have health needs due to a chronic condition like type 1 diabetes (t1d), having health insurance is critical in helping you manage and treat your condition. Complications due to type 1 diabetes. 1) anico (american national) offers up to a maximum of $250,000 face coverage on a 10, 15, 20 or 30 year term policy. From a life insurance perspective, type 1 diabetes is considered to carry a higher risk than type ii diabetes.

Source: effortlessinsurance.com

Source: effortlessinsurance.com

We are seeing the same top 3 life insurance carriers as mentioned below give the most competitive rates available. Here is how life insurance works. If you’ve been declined life insurance due to diabetes, just relax. Does life insurance cover diabetes? When creating your overall financial plan, it is important not to leave life insurance out.

Source: nisona.com

Source: nisona.com

Yes, you can get life insurance if you have diabetes. How to get the best cover We recommend you get life insurance immediately. But there are still options with companies like mutual of omaha.and while it’s not the most affordable coverage for people who don’t have diabetes, mutual of. When creating your overall financial plan, it is important not to leave life insurance out.

Source: finvestly.com

Source: finvestly.com

If you have type 1 diabetes, life insurance coverage will be more expensive. Getting life insurance with any form of diabetes can be difficult, but life insurance for type 1 diabetics can still be affordable, and easily obtained. When creating your overall financial plan, it is important not to leave life insurance out. From a life insurance perspective, type 1 diabetes is considered to carry a higher risk than type ii diabetes. It has no known cure and can develop at any age, though it is usually diagnosed in children, teens,.

Source: diabeteslifesolutions.com

Source: diabeteslifesolutions.com

And insurance company will want to see that the person is doing just. And because insurers have a natural aversion to applicants who have chronic health conditions, your chance of getting insured is very minimal. Proper management of the condition by the person who has it is critical in living with it. Can you get life insurance for diabetics? Yes, you can get life insurance if you have diabetes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance for type 1 diabetes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.