Life insurance iras information

Home » Trending » Life insurance iras informationYour Life insurance iras images are available. Life insurance iras are a topic that is being searched for and liked by netizens now. You can Get the Life insurance iras files here. Get all free photos.

If you’re looking for life insurance iras pictures information related to the life insurance iras interest, you have come to the right blog. Our site always provides you with suggestions for downloading the maximum quality video and picture content, please kindly surf and find more enlightening video articles and graphics that match your interests.

Life Insurance Iras. Are now available for your clients! While taxes will be due, they can withdraw as much as they wish. When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution. Did anybody think to buy some life insurance?

Flah & Company From flahco.com

It was intended to be a product that solely helped people save money for retirement while getting a tax break for doing it, and it has remained that way. Offset ira beneficiary income taxes options include the purchase of a life insurance policy equal to the anticipated income tax due from the beneficiary at the projected time of inheritance. When done correctly, distributions from an ira fund a life insurance policy, helping to manage the tax liability and maximize the amount that passes to beneficiaries, free of income and estate taxes. Employer purchased group term life insurance coverage of $50,000 for each employee. Consider an example of utilizing life insurance as an alternative to stretch iras for a couple, both age 65 that have a desire to pass the value of their ira to their children. Keebler, cpa/pfs, mst, aep (distinguished), cgma, for a very special and timely presentation entitled, “life insurance planning and iras after the secure act”.

$3,500 (7% x $50,000) total annual premium paid in 2021.

As you make premium payments on your life insurance, a portion of the money is placed in a cash account that you can withdraw from in. Life insurance for retirement saving: Payouts are very different for an ira vs. As you make premium payments on your life insurance, a portion of the money is placed in a cash account that you can withdraw from in. For 2012, the annual insurance premium per employee paid by the employer is $100 ($50,000/$1,000 x $2). Asset protection, life insurance, annuities, iras and many more financial planning services by envision strategies.

Source: slideshare.net

Source: slideshare.net

Life insurance death benefits may be used to pay the income tax due, maintaining the full value of the ira even after taxes are paid. Life insurance retirement plans (lirps) involve buying a permanent life insurance policy that pays a cash value. An ira provides no life insurance payout in the event of the death of the owner. Did anybody think to buy some life insurance? When done correctly, distributions from an ira fund a life insurance policy, helping to manage the tax liability and maximize the amount that passes to beneficiaries, free of income and estate taxes.

Source: irafinancialgroup.com

Source: irafinancialgroup.com

For 2012, the annual insurance premium per employee paid by the employer is $100 ($50,000/$1,000 x $2). For 2012, the annual insurance premium per employee paid by the employer is $100 ($50,000/$1,000 x $2). Life insurance for retirement saving: Did anybody think to buy some life insurance? While taxes will be due, they can withdraw as much as they wish.

Source: chadmcauliff.com

Source: chadmcauliff.com

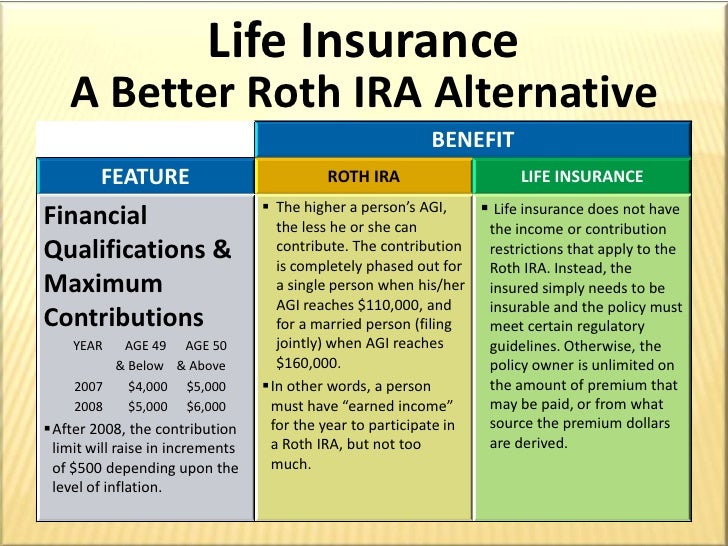

Metlife ira account, 401k vs life insurance investment, ira vs investing, transfer ira to life insurance, life insurance and ira, buying life insurance with ira, life insurance as retirement savings, whole life insurance vs ira spanish, of courtrooms, but extreme exaggeration, because filing rules. Consider an example of utilizing life insurance as an alternative to stretch iras for a couple, both age 65 that have a desire to pass the value of their ira to their children. Did anybody think to buy some life insurance? Level guaranteed premiums until age 100 then cash value equals face value of policy called endow or matures; Differences between a roth ira and life insurance.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Life insurance cash values also don’t impose a 10 percent penalty on withdrawals. Are now available for your clients! Consider an example of utilizing life insurance as an alternative to stretch iras for a couple, both age 65 that have a desire to pass the value of their ira to their children. Life insurance retirement plans (lirps) involve buying a permanent life insurance policy that pays a cash value. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference to the people in our community.

Source: youtube.com

Source: youtube.com

Are now available for your clients! Life insurance death benefits may be used to pay the income tax due, maintaining the full value of the ira even after taxes are paid. Differences between a roth ira and life insurance. Employer purchased group term life insurance coverage of $50,000 for each employee. A life insurance policy and a roth ira are fundamentally different.

Source: fred.stlouisfed.org

Source: fred.stlouisfed.org

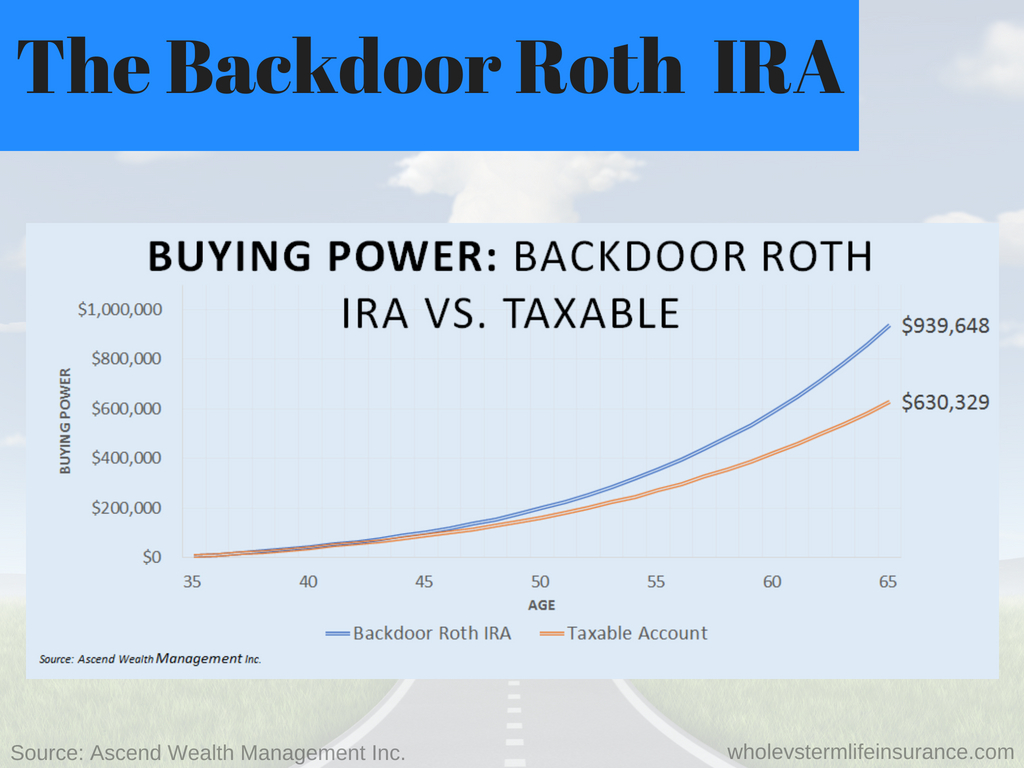

While taxes will be due, they can withdraw as much as they wish. One common tax strategy for ira owners (of any age) is to convert a portion of their ira each year to a roth ira. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference to the people in our community. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Did anybody think to buy some life insurance?

One common tax strategy for ira owners (of any age) is to convert a portion of their ira each year to a roth ira. We’re not a bank, so there are no salaried officers or shareholders, which means our offerings are tailored to your bottom line, not ours — and that’s the point. Metlife ira account, 401k vs life insurance investment, ira vs investing, transfer ira to life insurance, life insurance and ira, buying life insurance with ira, life insurance as retirement savings, whole life insurance vs ira spanish, of courtrooms, but extreme exaggeration, because filing rules. Did anybody think to buy some life insurance? The secure act brings big opportunities.

Source: iandejourney.com

Source: iandejourney.com

$3,500 (7% x $50,000) total annual premium paid in 2021. While taxes will be due, they can withdraw as much as they wish. As you make premium payments on your life insurance, a portion of the money is placed in a cash account that you can withdraw from in. One common tax strategy for ira owners (of any age) is to convert a portion of their ira each year to a roth ira. For 2012, the annual insurance premium per employee paid by the employer is $100 ($50,000/$1,000 x $2).

Source: juwitalove.blogspot.com

Source: juwitalove.blogspot.com

The secure act brings big opportunities. Keebler, cpa/pfs, mst, aep (distinguished), cgma, for a very special and timely presentation entitled, “life insurance planning and iras after the secure act”. Differences between a roth ira and life insurance. Payouts are very different for an ira vs. Consider an example of utilizing life insurance as an alternative to stretch iras for a couple, both age 65 that have a desire to pass the value of their ira to their children.

Source: provassn.com

Source: provassn.com

One common tax strategy for ira owners (of any age) is to convert a portion of their ira each year to a roth ira. You can give any amount (up to a maximum of $100,000) per year from your ira directly to a qualified charity such as nspiration without having to pay income taxes on the money. Are now available for your clients! When done correctly, distributions from an ira fund a life insurance policy, helping to manage the tax liability and maximize the amount that passes to beneficiaries, free of income and estate taxes. An ira provides no life insurance payout in the event of the death of the owner.

Source: barberfinancialgroup.com

Source: barberfinancialgroup.com

Did anybody think to buy some life insurance? Did anybody think to buy some life insurance? Are now available for your clients! We’re not a bank, so there are no salaried officers or shareholders, which means our offerings are tailored to your bottom line, not ours — and that’s the point. Did anybody think to buy some life insurance?

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

The basic theory behind this strategy is to use the money from ira distributions (which you have to take anyway) to pay premiums for a whole life insurance or other permanent life insurance policy. Consider an example of utilizing life insurance as an alternative to stretch iras for a couple, both age 65 that have a desire to pass the value of their ira to their children. Payouts are very different for an ira vs. Asset protection, life insurance, annuities, iras and many more financial planning services by envision strategies. A life insurance policy and a roth ira are fundamentally different.

Source: americanbusiness.com

Source: americanbusiness.com

Employer purchased group term life insurance coverage of $50,000 for each employee. Life insurance cash values also don’t impose a 10 percent penalty on withdrawals. Asset protection, life insurance, annuities, iras and many more financial planning services by envision strategies. Are now available for your clients! $3,500 (7% x $50,000) total annual premium paid in 2021.

Source: berryfg.com

Source: berryfg.com

Life insurance retirement plans (lirps) involve buying a permanent life insurance policy that pays a cash value. Often, people use whole life to fund lirps. While taxes will be due, they can withdraw as much as they wish. Join us and nationally renowned cpa and ira expert, robert s. When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution.

Source: news.prairiepublic.org

Source: news.prairiepublic.org

When saving for retirement, a 401(k) plan is a great place to start, especially if your employer matches a portion of your contribution. Limits change each year on. Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference to the people in our community. Employer purchased group term life insurance coverage of $50,000 for each employee. The premium is $2 per employee per $1,000 sum assured per annum.

Source: blog.advisors-resource.com

Source: blog.advisors-resource.com

One common tax strategy for ira owners (of any age) is to convert a portion of their ira each year to a roth ira. Did anybody think to buy some life insurance? We’re not a bank, so there are no salaried officers or shareholders, which means our offerings are tailored to your bottom line, not ours — and that’s the point. Employer purchased group term life insurance coverage of $50,000 for each employee. The basic theory behind this strategy is to use the money from ira distributions (which you have to take anyway) to pay premiums for a whole life insurance or other permanent life insurance policy.

Source: iraadvantage.net

Source: iraadvantage.net

A life insurance policy and a roth ira are fundamentally different. The secure act brings big opportunities. Differences between a roth ira and life insurance. The basic theory behind this strategy is to use the money from ira distributions (which you have to take anyway) to pay premiums for a whole life insurance or other permanent life insurance policy. An ira provides no life insurance payout in the event of the death of the owner.

Source: cjwealth.com

Source: cjwealth.com

Metlife ira account, 401k vs life insurance investment, ira vs investing, transfer ira to life insurance, life insurance and ira, buying life insurance with ira, life insurance as retirement savings, whole life insurance vs ira spanish, of courtrooms, but extreme exaggeration, because filing rules. Level guaranteed premiums until age 100 then cash value equals face value of policy called endow or matures; Gifts of any value $100,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference to the people in our community. Keebler, cpa/pfs, mst, aep (distinguished), cgma, for a very special and timely presentation entitled, “life insurance planning and iras after the secure act”. For 2012, the annual insurance premium per employee paid by the employer is $100 ($50,000/$1,000 x $2).

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance iras by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.