Life insurance kpis information

Home » Trending » Life insurance kpis informationYour Life insurance kpis images are ready in this website. Life insurance kpis are a topic that is being searched for and liked by netizens now. You can Download the Life insurance kpis files here. Get all free photos.

If you’re searching for life insurance kpis pictures information linked to the life insurance kpis topic, you have come to the ideal site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

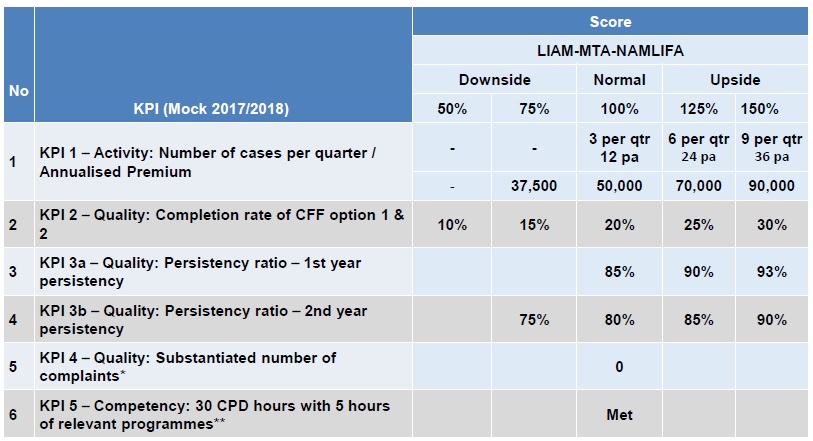

Life Insurance Kpis. Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Calculations and life insurance securitization, canadian gaap actuarial valuation, asset liability management, earnings analysis and public disclosures, experience analysis, capital requirements and product pricing. We’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time.

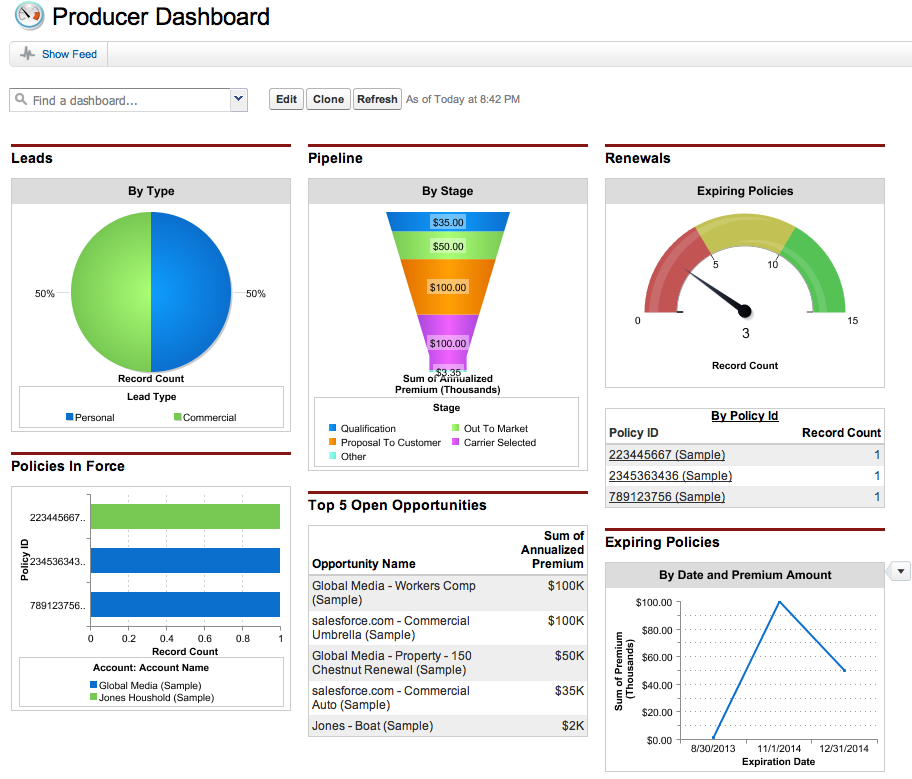

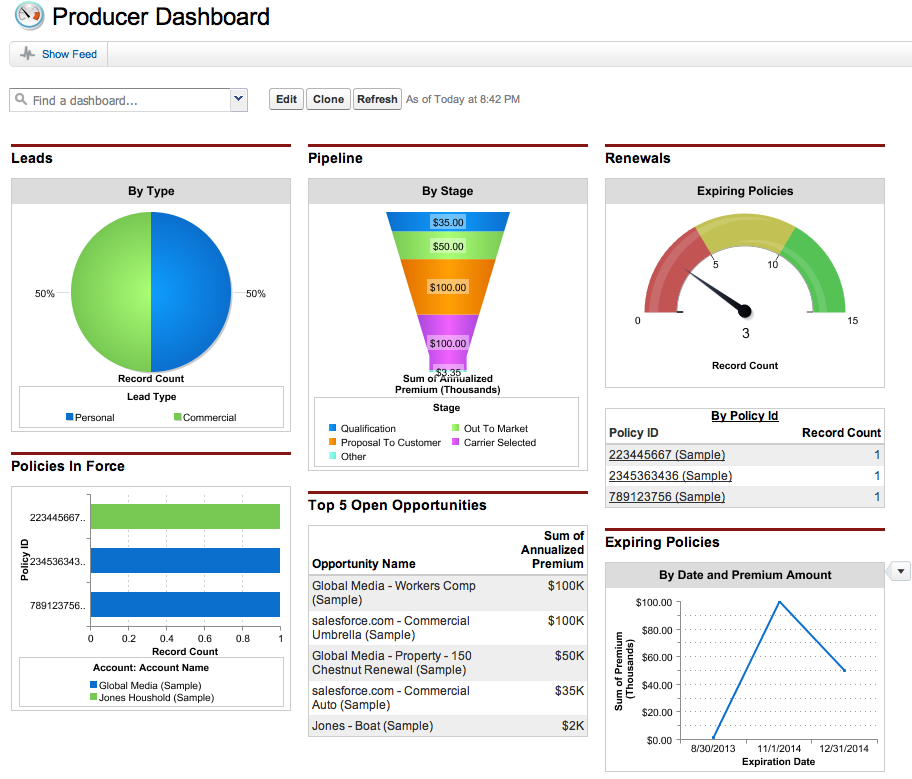

Review of Salesforce Insurance Edition Carriers and From shellblack.com

Review of Salesforce Insurance Edition Carriers and From shellblack.com

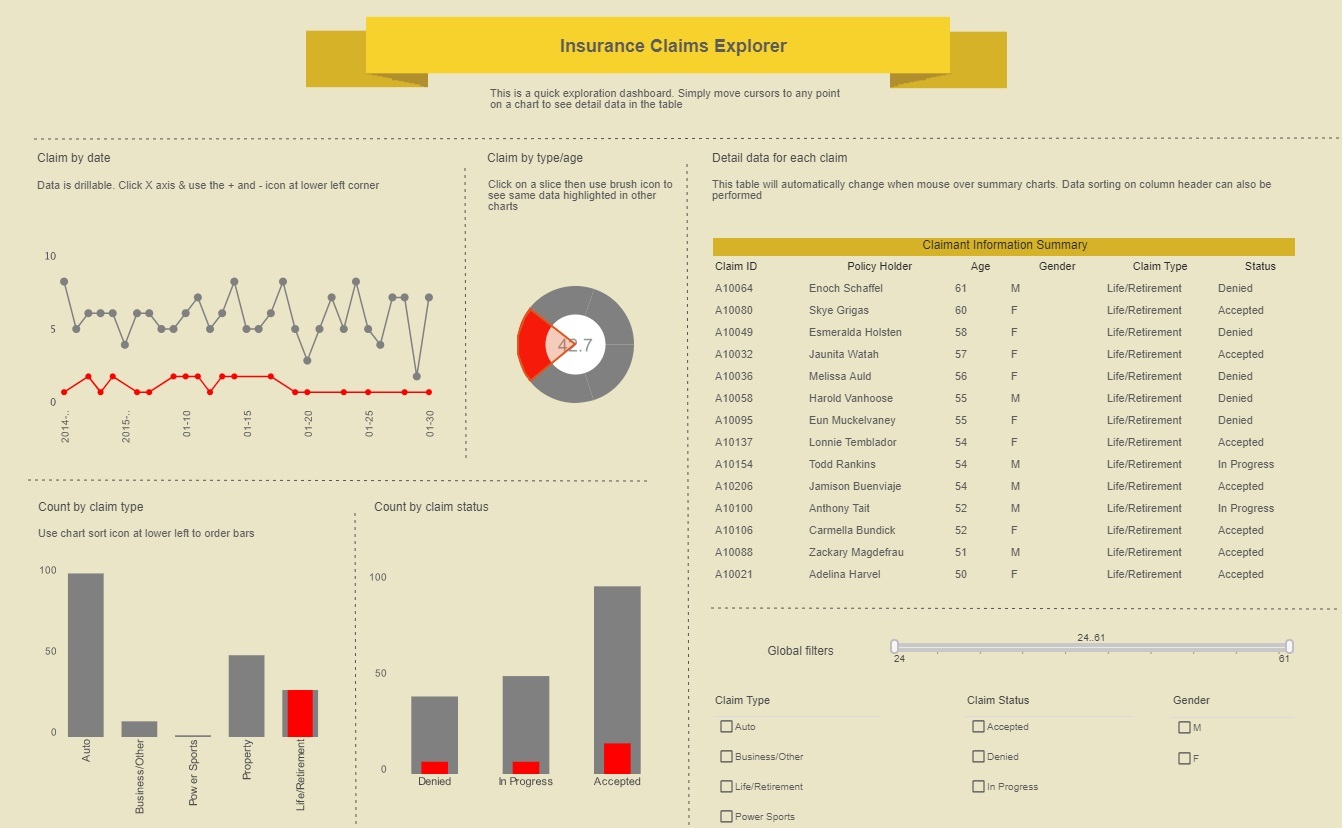

Life insurance kpis are defined as individual units of business measurement or metrics that track life insurance operational performance over a set period of. For example, if the total cost of claims per month is. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. For an insurance dashboard, here is a sample list of kpis lintao recommends (non exhaustive list): The european insurance industry is the second largest worldwide, accounting for almost one third of premiums written during 2018 globally. Life insurance performance metrics (also called kpis) vary by work product and department within the company.

However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis.

We’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Life insurance performance metrics (also called kpis) vary by work product and department within the company. You’ll also be able to track customer life stages, customize the insurance kpi lists most important to your agency’s growth, and identify the types of clients and scenarios that are most likely to result in a cancellation based on the data you’ve collected. Average cost per claim measures how much your organization pays out for each claim filed by your customers. These sample kpis reflect common metrics for both departments and industries. Insurance kpi dashboards help you identify areas of success and improvement, which means you can make educated decisions based on numbers instead of hunches.

Source: insuranceanalytics.graymatter.co.in

Source: insuranceanalytics.graymatter.co.in

Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. Commissions, new business, agent production, marketing, and customer satisfaction. Our life insurance blog offers excellent producer education and training, effective sales ideas, and unrivaled support to independent insurance agents. These metrics cover meaningful areas of your business:

Source: opsdog.com

Source: opsdog.com

The european insurance industry is the second largest worldwide, accounting for almost one third of premiums written during 2018 globally. A fortune 100 life insurance company; Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Regulatory environment at a minimum, uk companies have to comply with the business review legislation. The average cost per claim kpi measures how much your organization pays out for each claim filed by your customers.

Source: shellblack.com

Source: shellblack.com

What is an insurance kpi? Insurance kpis key performance indicators are used to measure the realized progress towards a strategic objective. Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. Use these insurance kpis and metrics to learn how to balance the risks and rewards that are part and parcel of the insurance business. Insurance kpi dashboards help you identify areas of success and improvement, which means you can make educated decisions based on numbers instead of hunches.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

These sample kpis reflect common metrics for both departments and industries. Our life insurance blog offers excellent producer education and training, effective sales ideas, and unrivaled support to independent insurance agents. Regulatory environment at a minimum, uk companies have to comply with the business review legislation. You’ll also be able to track customer life stages, customize the insurance kpi lists most important to your agency’s growth, and identify the types of clients and scenarios that are most likely to result in a cancellation based on the data you’ve collected. What is an insurance kpi?

Source: opsdog.com

Source: opsdog.com

A fortune 100 life insurance company; The european insurance industry is the second largest worldwide, accounting for almost one third of premiums written during 2018 globally. However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: A fortune 100 life insurance company;

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Calculations and life insurance securitization, canadian gaap actuarial valuation, asset liability management, earnings analysis and public disclosures, experience analysis, capital requirements and product pricing. These metrics cover meaningful areas of your business: Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time. Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Insurance kpis key performance indicators are used to measure the realized progress towards a strategic objective.

Source: lintao-dashboards.com

Source: lintao-dashboards.com

152021 an insurance key performance indicator kpi or metric is a measure that an insurance company uses to monitor its performance and efficiency. 6 kpi’s for all life insurance agents to track now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents. Life insurance performance metrics (also called kpis) vary by work product and department within the company. Ralph is the willis towers watson global lead on. Commissions, new business, agent production, marketing, and customer satisfaction.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

For an insurance dashboard, here is a sample list of kpis lintao recommends (non exhaustive list): For example, if the total cost of claims per month is. Our life insurance blog offers excellent producer education and training, effective sales ideas, and unrivaled support to independent insurance agents. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Key performance indicators (kpis) are a powerful tool for supervisors to regularly evaluate the development, soundness and appropriateness of the inclusive insurance (ii) sector. Key performance indicators of life insurance operations in india 127 impact factor(jcc): Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Commissions, new business, agent production, marketing, and customer satisfaction. Ralph is the willis towers watson global lead on.

Source: abinsura.blogspot.com

Source: abinsura.blogspot.com

Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. Our life insurance blog offers excellent producer education and training, effective sales ideas, and unrivaled support to independent insurance agents. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. 6 kpi’s for all life insurance agents to track now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents.

Source: ezdatamunch.com

Source: ezdatamunch.com

With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. We’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile:

Source: casualtyinsuranceashitaga.blogspot.com

Source: casualtyinsuranceashitaga.blogspot.com

152021 an insurance key performance indicator kpi or metric is a measure that an insurance company uses to monitor its performance and efficiency. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful. Ralph is the willis towers watson global lead on. For an insurance dashboard, here is a sample list of kpis lintao recommends (non exhaustive list): Insurance kpi dashboards help you identify areas of success and improvement, which means you can make educated decisions based on numbers instead of hunches.

Source: lifeinsurancecompanyshikamon.blogspot.com

Source: lifeinsurancecompanyshikamon.blogspot.com

The european insurance industry is the second largest worldwide, accounting for almost one third of premiums written during 2018 globally. Here are 6 insurance kpis that are broadly applicable: Average cost per claim measures how much your organization pays out for each claim filed by your customers. Average insurance policy size claims (#) cost per claim (€) customer satisfaction clains ratio earned premium expenses exposure Life insurance performance metrics (also called kpis) vary by work product and department within the company.

Source: insuranceclaimszoekiya.blogspot.com

Source: insuranceclaimszoekiya.blogspot.com

Use these insurance kpis and metrics to learn how to balance the risks and rewards that are part and parcel of the insurance business. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. Salesforce empowers life insurance giant to exceed kpi targets client success snapshot client profile: Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. 6 kpi’s for all life insurance agents to track now every type of business has different kpis that make sense for them, but below are the 6 digital marketing kpis we believe are most important to independent internet life insurance agents.

Source: sandeepbhowmick.blogspot.com

Source: sandeepbhowmick.blogspot.com

A fortune 100 life insurance company; With this kpi (as with other insurance kpis), it’s important to categorize based on the type of claim, since each type of claim will differ in cost. Insurance kpis key performance indicators are used to measure the realized progress towards a strategic objective. An insurance key performance indicator (kpi) or metric is a measure that an insurance company uses to monitor its performance and efficiency. A fortune 100 life insurance company;

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

A fortune 100 life insurance company; However, we feel there are five kpis that all life and health insurance agencies should consider tracking and analyzing on a regular basis. Commissions, new business, agent production, marketing, and customer satisfaction. Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. We’ve assembled a collection of sample key performance indicators for you to use as a starting point when building scorecards.

Source: famperikelen.blogspot.com

Source: famperikelen.blogspot.com

Dashboards eliminate data “clutter” by streamlining the time and energy it takes to collect, organize, and deploy important information. The average cost per claim kpi measures how much your organization pays out for each claim filed by your customers. For example, if the total cost of claims per month is. Key performance indicators of life insurance operations in india 127 impact factor(jcc): Average cost per claim measures how much your organization pays out for each claim filed by your customers.

Source: insuranceagencyfushioi.blogspot.com

Source: insuranceagencyfushioi.blogspot.com

Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time. And while there may be differences in operations based on the product (e.g., processing a life insurance claim is different than processing an auto claim), there are certain kpis that will apply regardless of product. Life insurance kpis are defined as individual units of business measurement, or metrics, that track life insurance operational performance over a set period of time. Average cost per claim measures how much your organization pays out for each claim filed by your customers. Insurance metrics can help a company identify areas of operational success, and areas that require more attention to make them successful.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance kpis by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.