Life insurance maturity date information

Home » Trending » Life insurance maturity date informationYour Life insurance maturity date images are ready in this website. Life insurance maturity date are a topic that is being searched for and liked by netizens today. You can Download the Life insurance maturity date files here. Find and Download all royalty-free photos.

If you’re looking for life insurance maturity date images information linked to the life insurance maturity date topic, you have pay a visit to the ideal blog. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Life Insurance Maturity Date. The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. When a life insurance policy “matures,” it has reached its maturity date and now owes the cash value or death benefit to the insured. A permanent life insurance policy will remain in force for the insured’s whole life or until the policy’s maturity date, as long as the premiums are paid. Original total sum assured, plus any increased sum assured purchased by exercising the life stage option prior to 12 months from the date of death (due.

LIC Maturity Claim Process for Life Insurance Policy From 99employee.com

LIC Maturity Claim Process for Life Insurance Policy From 99employee.com

These premiums are less costly than an endowment policy, and they are also guaranteed not to change. The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. Not only does your family get death benefits in case of your untimely absence or permanent disability. On this date, which is generally printed on the certificate of. A term life insurance policy covers you for a number of years and then ends, while a permanent life. The money is usually paid out before the maturity date once the policy discharge paper is duly filled and submitted long before the date of maturity.

The maturity of the policy ranges from one policy to another (could be 25 years, 65 years, or even whole life).

A whole life insurance policy is basically an endowment policy with a maturity date that has been extended, usually to ages 100 or 121, which are ages that only a few people will be able to achieve. In general, when the insured lives to the maturity date, the policy pays either the death benefit or the cash value directly to the insured. The date at which your life insurance policy matures, i.e., comes to an end is known as the maturity date of the policy. The maturity of the policy ranges from one policy to another (could be 25 years, 65 years, or even whole life). The life insurance maturity date is the date that the policy ends or when the proceeds are paid. When the cash value or the amount you have paid into your whole life policy matches the death benefit, it has reached its maturity date.

Source: tomorrowmakers.com

The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. In permanent insurance, a maturity date is built. A term life insurance policy covers you for a number of years and then ends, while a permanent life. A maturity date is the exact time at which a financial obligation must be paid in full. When the cash value or the amount you have paid into your whole life policy matches the death benefit, it has reached its maturity date.

Source: guidetoguns.blogspot.com

Maturity dates are based on the age of the insured person and vary, depending on when the policy was issued. In permanent insurance, a maturity date is built. In general, when the insured lives to the maturity date, the policy pays either the death benefit or the cash value directly to the insured. An endowment life insurance policy is a form of insurance that “matures” after a certain length of time, typically 10, 15 or 20 years past the policy’s purchase date, or when the insured reaches a specific age. The date at which your life insurance policy matures, i.e., comes to an end is known as the maturity date of the policy.

Source: finance.zacks.com

Source: finance.zacks.com

A term life insurance policy covers you for a number of years and then ends, while a permanent life. On this date, which is generally printed on the certificate of. A whole life insurance policy is basically an endowment policy with a maturity date that has been extended, usually to ages 100 or 121, which are ages that only a few people will be able to achieve. Not only does your family get death benefits in case of your untimely absence or permanent disability. When a term life policy matures the original premium payment agreement expires and now the policy owner must either pay a higher premium or find another life insurance policy.

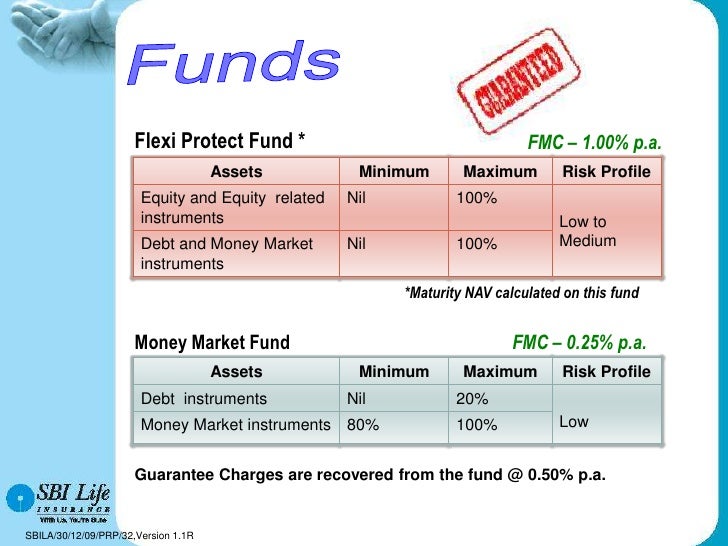

Source: slideshare.net

Source: slideshare.net

What is a life insurance maturity date? The date at which your life insurance policy matures, i.e., comes to an end is known as the maturity date of the policy. What is a life insurance maturity date? A whole life insurance policy is basically an endowment policy with a maturity date that has been extended, usually to ages 100 or 121, which are ages that only a few people will be able to achieve. It is unlike a term plan that only offers death risk cover, wherein the premiums paid to an insurance company do not come back to you on surviving the term.

Source: slideshare.net

Source: slideshare.net

A term life insurance policy covers you for a number of years and then ends, while a permanent life. In general, when the insured lives to the maturity date, the policy pays either the death benefit or the cash value directly to the insured. In insurance, it is the time when the insurer pays the insured the money owed to them, as stipulated in the insurance contract. Premium charges can be made on a monthly or annual basis, as agreed. When a permanent life insurance policy matures, the “maturity value” of the policy is paid out to the policy owner and coverage ends.

Source: taxadda.com

Source: taxadda.com

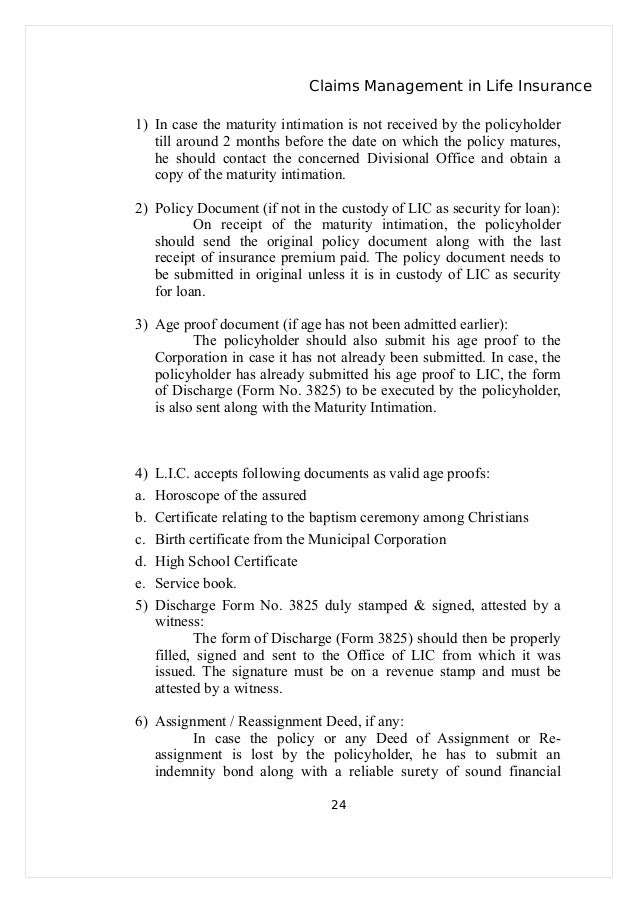

The procedure of paying maturity claim is the simplest among all claims, where the life insured needs to fill up a form called the policy discharge form and the maturity amount is paid out without much hassles. Owners of whole life, universal and other types of permanent life insurance policies may note that the policy mentions a “maturity date,” which often coincides with their own 100th or 121st birthday. But also, if you do live on throughout the term of maturity, there are. If term life, the policy ends and the death benefit is paid at the death of the insured. The life insurance maturity date is the date that the policy ends or when the proceeds are paid.

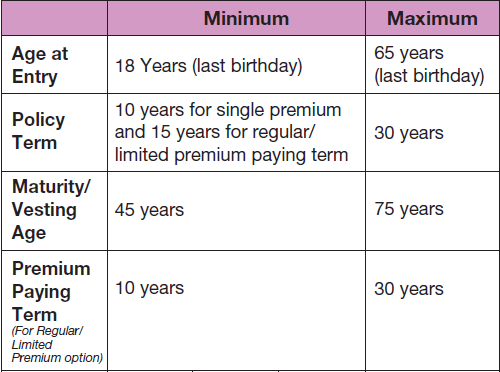

Source: aegonlife.com

Source: aegonlife.com

The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. But also, if you do live on throughout the term of maturity, there are. On the maturity date, you are liable to receive all the maturity benefits. When the cash value or the amount you have paid into your whole life policy matches the death benefit, it has reached its maturity date. If death does not occur during the years of the term, the maturity date passes and no death benefit is paid.

Source: 99employee.com

Source: 99employee.com

When a permanent life insurance policy matures, the “maturity value” of the policy is paid out to the policy owner and coverage ends. On this date, which is generally printed on the certificate of. The maturity date of a life insurance policy is the date at which you no longer need to make premium payments, even though the policy will remain in force. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy. For example, if you have taken a savings plan for 10 years in 2020.

Source: licinsurance.online

Source: licinsurance.online

What is a life insurance maturity date? In insurance, it is the time when the insurer pays the insured the money owed to them, as stipulated in the insurance contract. The life insurance maturity date is the date that the policy ends or when the proceeds are paid. Maturity dates are based on the age of the insured person and vary, depending on when the policy was issued. What is the maturity date of an insurance policy?

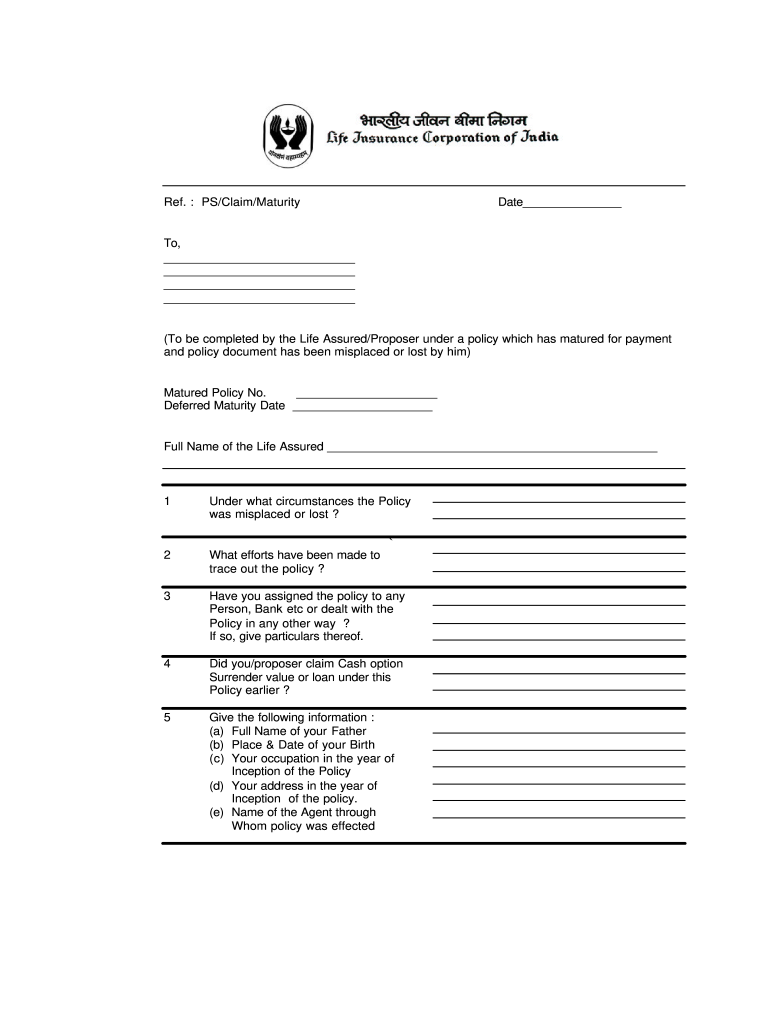

Source: pdffiller.com

Source: pdffiller.com

But also, if you do live on throughout the term of maturity, there are. The maturity date is the date on which the principal amount of a note, draft, acceptance bond or other debt instrument becomes due. The maturity date of a life insurance policy is the date at which you no longer need to make premium payments, even though the policy will remain in force. The life insurance maturity date is the date that the policy ends or when the proceeds are paid. If term life, the policy ends and the death benefit is paid at the death of the insured.

Source: myinvestmentideas.com

Source: myinvestmentideas.com

What is a life insurance maturity date? If death occurs due to suicide within 12 months from the date of exercising life stage option (resulting in the increase in death benefit), the death benefit is the aggregate of the following: It is unlike a term plan that only offers death risk cover, wherein the premiums paid to an insurance company do not come back to you on surviving the term. Original total sum assured, plus any increased sum assured purchased by exercising the life stage option prior to 12 months from the date of death (due. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy.

Source: fascynacjedorotheahh.blogspot.com

Source: fascynacjedorotheahh.blogspot.com

If death does not occur during the years of the term, the maturity date passes and no death benefit is paid. Life insurance maturity is the date at which the face amount of a permanent life insurance policy is paid to the beneficiary stated in the policy (in case of death) or to the policy holder (if the insured is still alive when the maturity date is reached).in whole life, the maturity date coincides with endowment, or the accumulation of cash value to equal the face amount. Premium charges can be made on a monthly or annual basis, as agreed. A whole life insurance policy is basically an endowment policy with a maturity date that has been extended, usually to ages 100 or 121, which are ages that only a few people will be able to achieve. Owners of whole life, universal and other types of permanent life insurance policies may note that the policy mentions a “maturity date,” which often coincides with their own 100th or 121st birthday.

Source: namfisa.com.na

Source: namfisa.com.na

What is a life insurance maturity date? A term life insurance policy covers you for a number of years and then ends, while a permanent life insurance policy usually lasts your whole life. A permanent life insurance policy will remain in force for the insured’s whole life or until the policy’s maturity date, as long as the premiums are paid. Owners of whole life, universal and other types of permanent life insurance policies may note that the policy mentions a “maturity date,” which often coincides with their own 100th or 121st birthday. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

Not only does your family get death benefits in case of your untimely absence or permanent disability. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy. A similar form of life insurance would be a whole life insurance policy. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy. Maturity dates are based on the age of the insured person and vary, depending on when the policy was issued.

Source: bestgradedlifeinsurancenukanchi.blogspot.com

Source: bestgradedlifeinsurancenukanchi.blogspot.com

The life insurance maturity date is the date that the policy ends or when the proceeds are paid. If death does not occur during the years of the term, the maturity date passes and no death benefit is paid. In permanent insurance, a maturity date is built. The date at which your life insurance policy matures, i.e., comes to an end is known as the maturity date of the policy. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy.

Source: slideshare.net

Source: slideshare.net

A maturity date is the exact time at which a financial obligation must be paid in full. A maturity date is the exact time at which a. The maturity date of a life insurance policy is the date at which you no longer need to make premium payments, even though the policy will remain in force. On this date, which is generally printed on the certificate of. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy.

Source: lifeinsurance.satukara.com

Source: lifeinsurance.satukara.com

When a term life policy matures the original premium payment agreement expires and now the policy owner must either pay a higher premium or find another life insurance policy. If death occurs due to suicide within 12 months from the date of exercising life stage option (resulting in the increase in death benefit), the death benefit is the aggregate of the following: A maturity date is the exact time at which a financial obligation must be paid in full. A life insurance policy with maturity benefits allow individuals to get a double advantage from their existing policy. The maturity value to be paid out is specified in the contract.

Source: projectcrush08.blogspot.com

Source: projectcrush08.blogspot.com

A term life insurance policy covers you for a number of years and then ends, while a permanent life insurance policy usually lasts your whole life. The maturity date of a life insurance policy is the date at which you no longer need to make premium payments, even though the policy will remain in force. The procedure of paying maturity claim is the simplest among all claims, where the life insured needs to fill up a form called the policy discharge form and the maturity amount is paid out without much hassles. When a permanent life insurance policy matures, the “maturity value” of the policy is paid out to the policy owner and coverage ends. Not only does your family get death benefits in case of your untimely absence or permanent disability.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance maturity date by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.