Life insurance myths information

Home » Trending » Life insurance myths informationYour Life insurance myths images are available in this site. Life insurance myths are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance myths files here. Download all royalty-free images.

If you’re searching for life insurance myths pictures information connected with to the life insurance myths interest, you have visit the ideal blog. Our site always gives you suggestions for seeing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

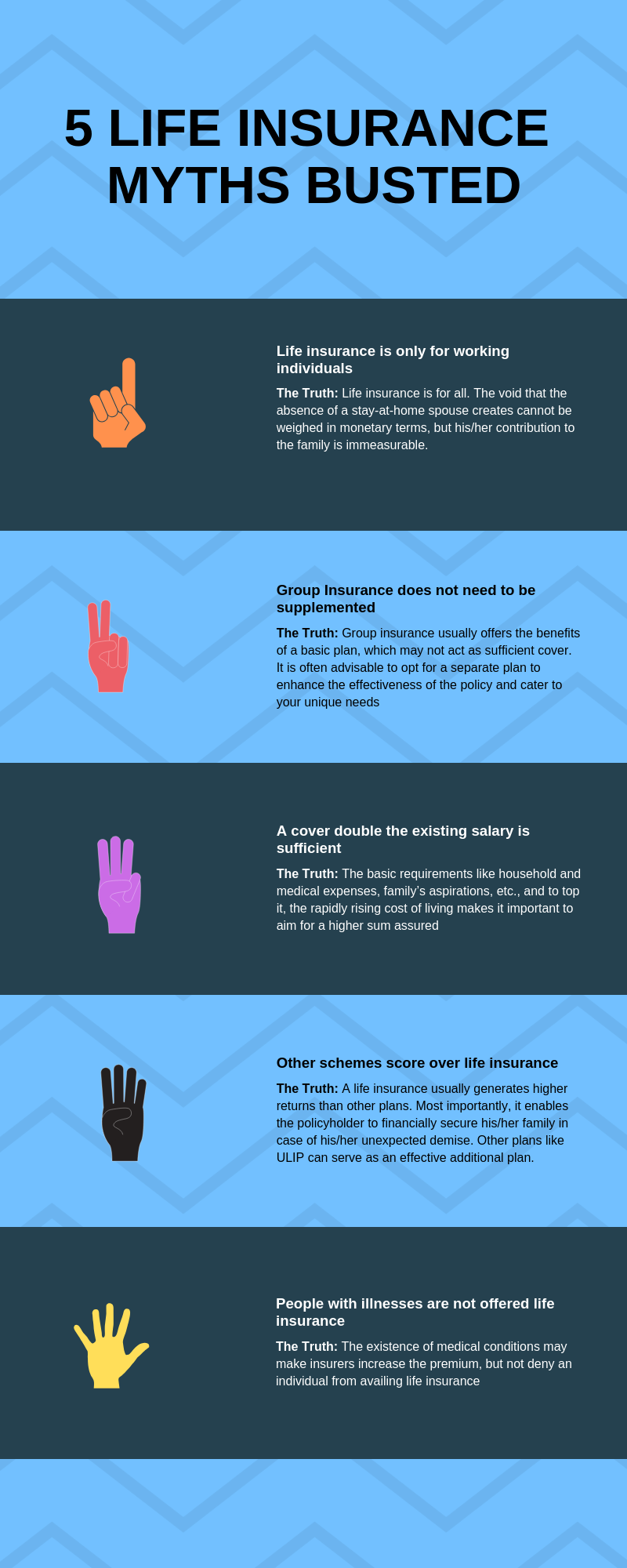

Life Insurance Myths. Continue reading to learn more about life insurance. In general, the younger you are, the more affordable your premiums will be. Following are the most common life insurance myths: Most common life insurance myths:

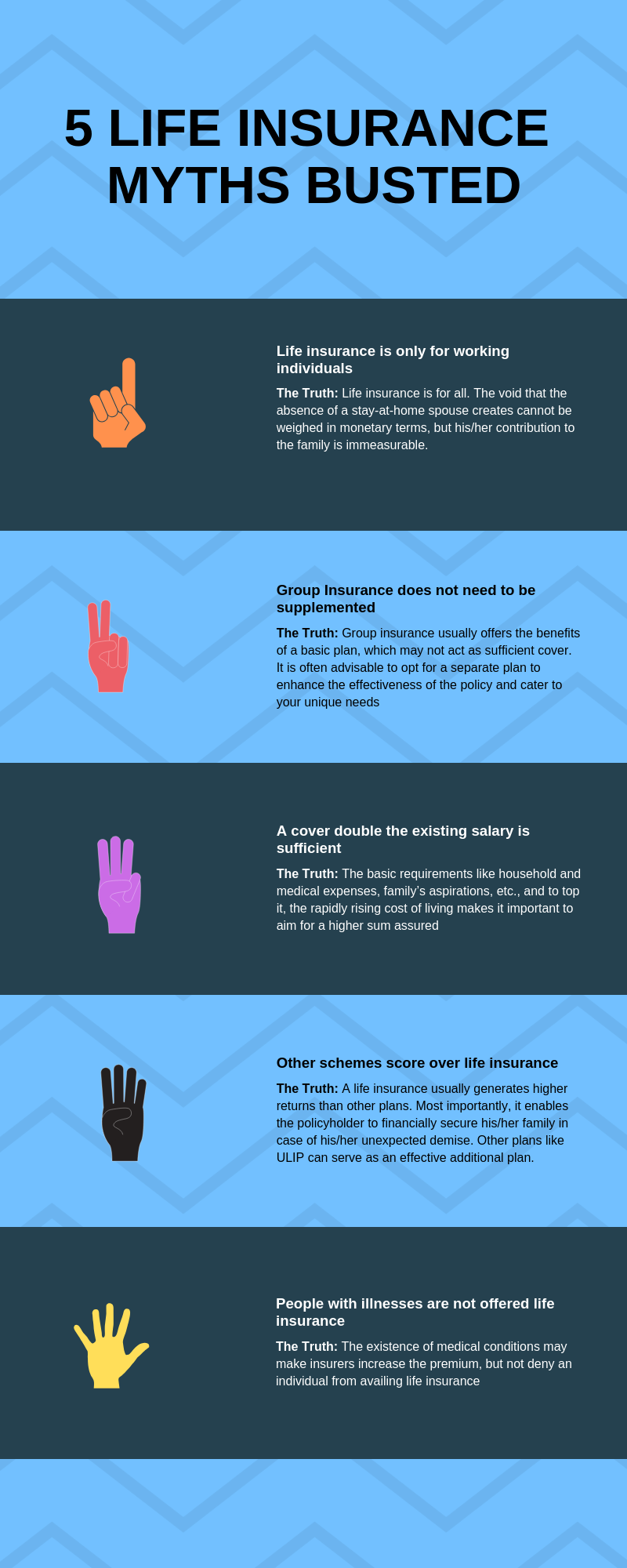

Top Myths and Facts About Life Insurance You Must Know From coverfox.com

Top Myths and Facts About Life Insurance You Must Know From coverfox.com

Life insurance can cost less than your daily cup of coffee. Insurance is only for life protection. Saving tax is just an added advantage of insurance policy. There are many different types of life insurance to meet your needs and your budget. Life insurance is just to bury the dead 2. Life insurance is likely more affordable than you think.

Insurance is for saving tax.

Some young people don’t believe that life insurance is important because they don’t have any dependents or. Insurance is only for life protection. Health and other factors can also affect rates. The following are common myths about life insurance: The amount of coverage i have through my job is enough. Adams continues, “the truth is that a term life policy costs much less than you might think.

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Following are the most common life insurance myths: Protect yourself with a life insurance policy unless you have enough assets to. Some people only want to provide a death benefit for final expenses while others want to leave behind a pool of money for the kid’s college, paying off the mortgage and charitable giving. Life insurance is only for married people with kids or people with dependents. But just now a quick check on policy bazaar showed just how wrong this myth is.

Source: slideserve.com

Source: slideserve.com

Protect yourself with a life insurance policy unless you have enough assets to. Insurance will benefit only after my death. Insurance is for saving tax. For example, some people believe that you don’t need it if you have no children or only need a small policy to take care of your family in the event of your death. Adams continues, “the truth is that a term life policy costs much less than you might think.

Source: youtube.com

Source: youtube.com

The amount of coverage i have through my job is enough. Most common life insurance myths: Insurance is only for life protection. But just now a quick check on policy bazaar showed just how wrong this myth is. Some people only want to provide a death benefit for final expenses while others want to leave behind a pool of money for the kid’s college, paying off the mortgage and charitable giving.

Source: savingsangel.com

Source: savingsangel.com

Although mainly life protection provides death benefits, life insurance also includes coverage covering medical expenses of the cause of death to funeral costs. Life insurance can cost less than your daily cup of coffee. 802 per month from 14 providers. Life insurance is unnecessary because i do not have dependents. I should just get life insurance online 3.

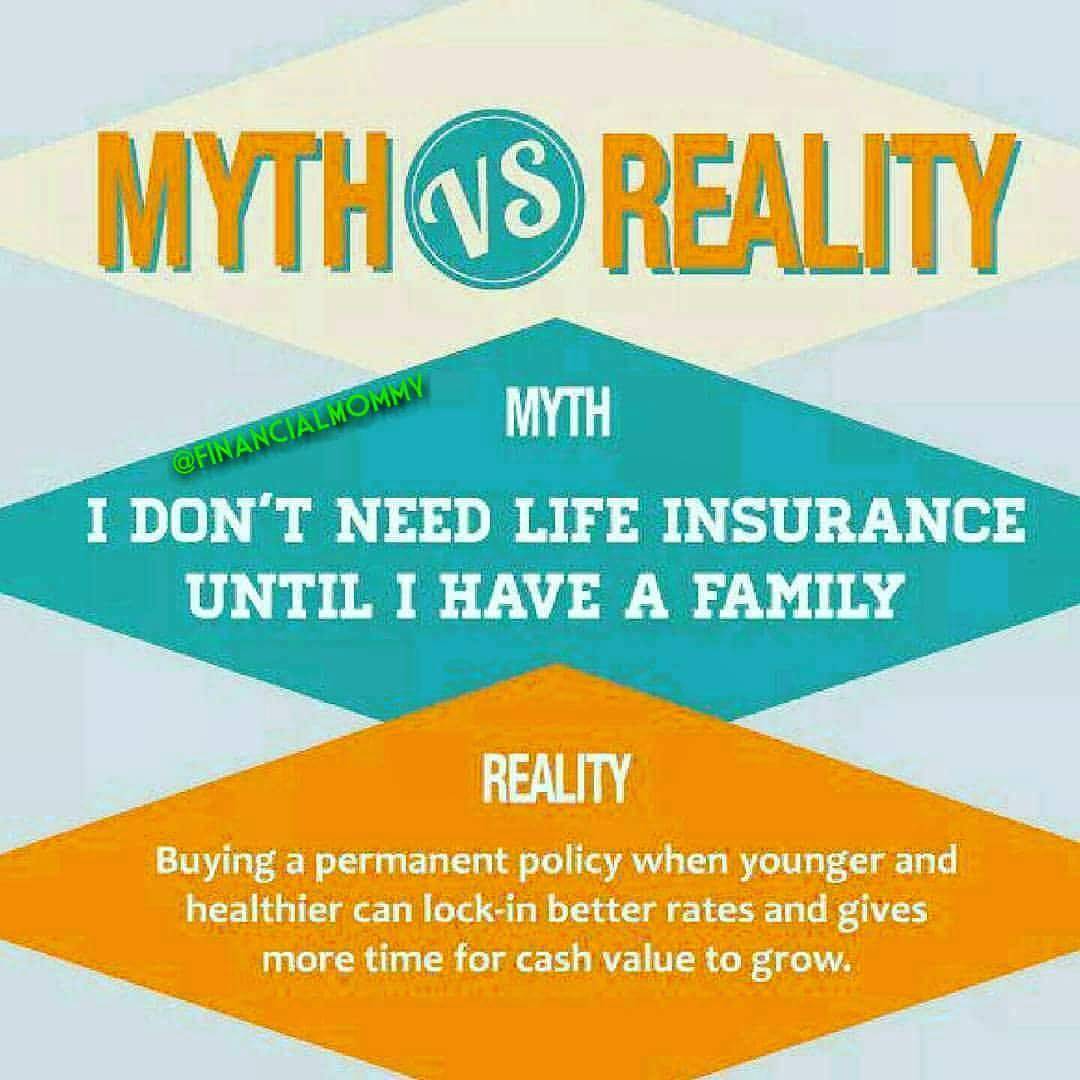

Source: pinterest.com

Source: pinterest.com

But just now a quick check on policy bazaar showed just how wrong this myth is. There are many different types of life insurance to meet your needs and your budget. Insurers won’t pay out if. Life insurance is just to bury the dead 2. Continue reading to learn more about life insurance.

Source: visual.ly

Source: visual.ly

There are many myths and misconceptions about life insurance and we’re here to debunk those myths! Saving tax is just an added advantage of insurance policy. Protect yourself with a life insurance policy unless you have enough assets to. Continue reading to learn more about life insurance. The main objective of insurance is to provide protection to you and your family and to build an assured corpus for your future needs.

Source: pinterest.com

Source: pinterest.com

Insurers won’t pay out if. Continue reading to learn more about life insurance. In this post, we debunk the 10 most common life insurance myths so that you can find a policy that is perfect for you. Saving tax is just an added advantage of insurance policy. I should just get life insurance online 3.

Source: babybudgeting.co.uk

Source: babybudgeting.co.uk

1 crore till the age of 60 years, the premiums ranged from rs. Life insurance is just to bury the dead 2. For instance, only a third (33%) of our respondents feel they know enough about life insurance. Adams continues, “the truth is that a term life policy costs much less than you might think. Life insurance is unnecessary because i do not have dependents.

Source: oneinsure.com

The survey showed some surprising figures. Popular financial publications propagated this myth. Some people only want to provide a death benefit for final expenses while others want to leave behind a pool of money for the kid’s college, paying off the mortgage and charitable giving. There are many different types of life insurance to meet your needs and your budget. The amount of coverage i have through my job is enough.

For example, some people believe that you don’t need it if you have no children or only need a small policy to take care of your family in the event of your death. You need to go through a medical exam to get life insurance. Life insurance is only for married people with kids or people with dependents. On average, millennials overestimate the cost of life insurance by 213%! Saving tax is just an added advantage of insurance policy.

Source: financialmommy.tumblr.com

Source: financialmommy.tumblr.com

There are many myths about life insurance. This is one of the biggest misconceptions about life insurance. Adams continues, “the truth is that a term life policy costs much less than you might think. 541 per month to rs. For example, some people believe that you don’t need it if you have no children or only need a small policy to take care of your family in the event of your death.

Source: youtube.com

Source: youtube.com

Life insurance is complicated and slow to get. 541 per month to rs. Insurance will benefit only after my death. Health and other factors can also affect rates. There are many different types of life insurance to meet your needs and your budget.

Source: yourstory.com

Source: yourstory.com

Life insurance is just to bury the dead 2. Health and other factors can also affect rates. Insurers won’t pay out if. Adams continues, “the truth is that a term life policy costs much less than you might think. The amount of coverage i have through my job is enough.

Source: slideshare.net

Source: slideshare.net

In general, the younger you are, the more affordable your premiums will be. 802 per month from 14 providers. Top life insurance myths 1. Insurance is for saving tax. A myth i have held on to for quite some time.

Source: blakelywalters.com

Source: blakelywalters.com

Insurance will benefit only after my death. There are many different types of life insurance to meet your needs and your budget. This is one of the biggest misconceptions about life insurance. Protect yourself with a life insurance policy unless you have enough assets to. For example, some people believe that you don’t need it if you have no children or only need a small policy to take care of your family in the event of your death.

Source: slideshare.net

Source: slideshare.net

Life insurance is complicated and slow to get. A myth i have held on to for quite some time. Insurers won’t pay out if. Life insurance can be tricky to figure out with all its technicalities and rules. Life insurance is just to bury the dead 2.

Source: coverfox.com

Source: coverfox.com

In general, the younger you are, the more affordable your premiums will be. 1 crore till the age of 60 years, the premiums ranged from rs. Insurance is only for life protection. Life insurance is complicated and slow to get. There are many myths about life insurance.

Source: fbfs.com

Source: fbfs.com

The main objective of insurance is to provide protection to you and your family and to build an assured corpus for your future needs. Life insurance is just to bury the dead 2. This guide will dispel six of the most common life insurance myths and help you understand what you need to know about life insurance. You need to go through a medical exam to get life insurance. Saving tax is just an added advantage of insurance policy.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance myths by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.