Life insurance nonforfeiture options Idea

Home » Trending » Life insurance nonforfeiture options IdeaYour Life insurance nonforfeiture options images are available. Life insurance nonforfeiture options are a topic that is being searched for and liked by netizens now. You can Get the Life insurance nonforfeiture options files here. Download all royalty-free photos.

If you’re searching for life insurance nonforfeiture options pictures information linked to the life insurance nonforfeiture options topic, you have pay a visit to the right site. Our website always provides you with hints for viewing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

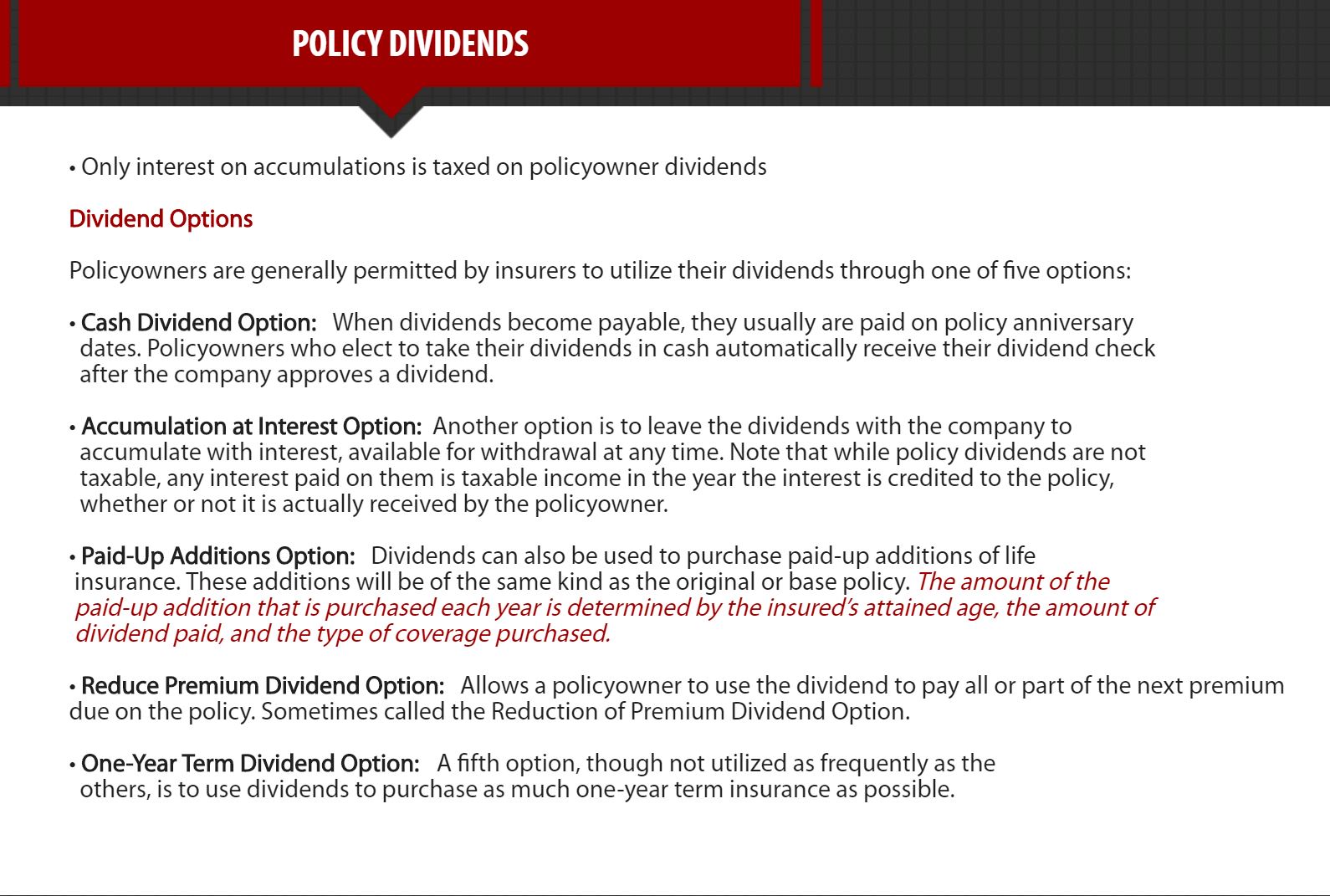

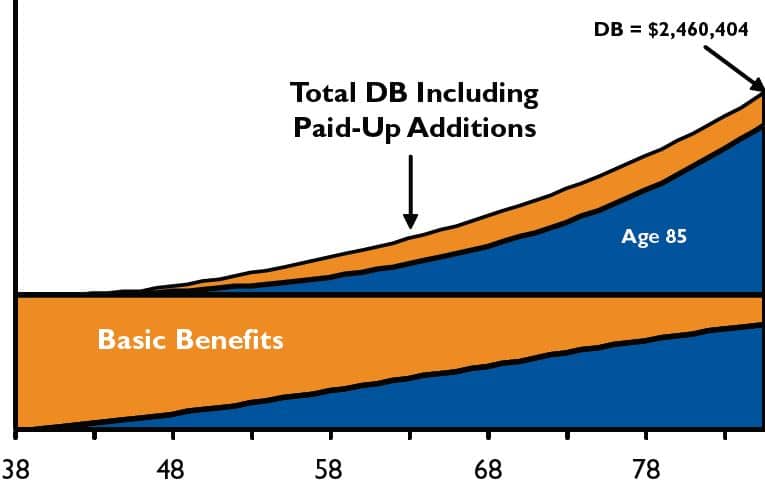

Life Insurance Nonforfeiture Options. In response to this problem, many life insurance companies adopted the nonforfeiture option, which means you are allowed to stop paying premiums and not forfeit any of the equity in the policy. What is a nonforfeiture option? There are three nonforfeiture options: A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy.

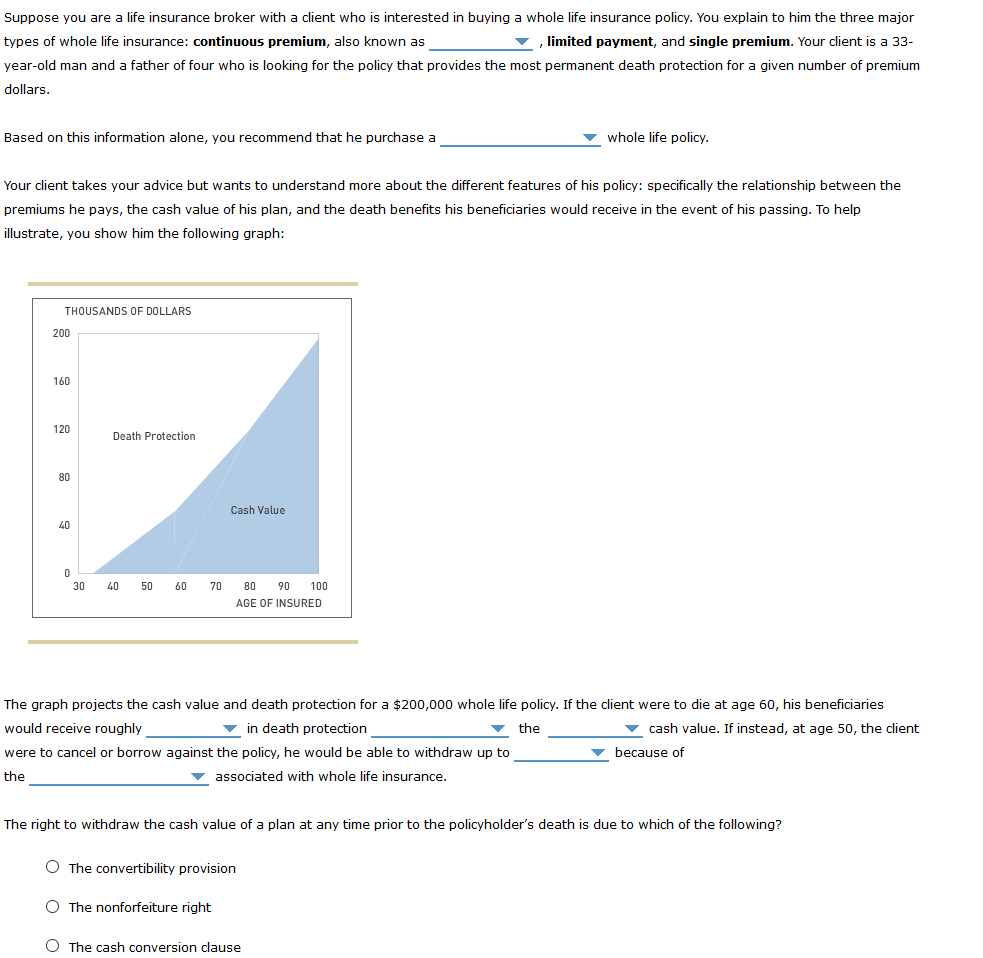

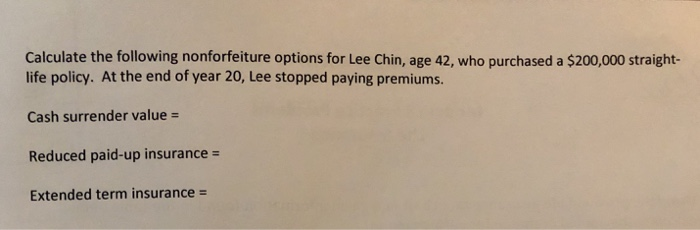

The Options For The Blanks For Part 1 Are Direct From chegg.com

The Options For The Blanks For Part 1 Are Direct From chegg.com

In response to this problem, many life insurance companies adopted the nonforfeiture option, which means you are allowed to stop paying premiums and not forfeit any of the equity in the policy. An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. Nonforfeiture options primarily apply to a life insurance policy that accumulates cash value. John, age 55, owns a whole life policy with a face amount of $100,000 for which the annual premium is $1,000. If a policy owner chooses the cash surrender value option, the insurer will pay the remaining cash value within six months. Legally, nonforfeiture options protect policyholders from losing life insurance coverage for missed payments.

Life insurance policyholders can select one of four nonforfeiture benefit options:

A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy. A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan. A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy. Should the policyowner get into a situation in which he cannot continue to make the required premium. Nonforfeiture benefit, a cash surrender value of such amount as may be hereinafter specified. The amount of cash value will be reduced by any loans you have taken out of it, whether.

Source: chegg.com

Source: chegg.com

A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy. In simple terms, you have three options on how you want to surrender your policy. Such an option considers the saving component of the policy. What nonforfeiture option allows a policyowner to use the existing cash value to purchase a policy of the same face amount as the original policy but for a reduced amount of time? Whole life insurance nonforfeiture options 👪 sep 2021.

Source: homeworklib.com

Source: homeworklib.com

And (3) extended term insurance. What nonforfeiture option allows a policyowner to use the existing cash value to purchase a policy of the same face amount as the original policy but for a reduced amount of time? These include the option for some or all of the premiums to be returned, the policy to be changed to a paid up policy, or the cash value to be paid to the policy owner. What is a nonforfeiture option in life insurance? However, you are still entitled to full or partial benefits or a refund of premiums.

Source: clipsbyrafe.blogspot.com

Source: clipsbyrafe.blogspot.com

(or clause) is a provision included in certain life insurance policies stipulating that the policyholder will not forfeit the value of the policy if the policy lapses after a defined period due to missed premium payments. In simple terms, you have three options on how you want to surrender your policy. What nonforfeiture option allows a policyowner to use the existing cash value to purchase a policy of the same face amount as the original policy but for a reduced amount of time? Life insurance policyholders can select one of four nonforfeiture benefit options: A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy.

Source: businessyield.com

Source: businessyield.com

Nonforfeiture options primarily apply to a life insurance policy that accumulates cash value. A nonforfeiture option in a permanent life insurance policy has the purpose of protecting the consumer in case something were to happen, such as surrendering the policy or being unable to pay premiums. Whole life insurance nonforfeiture options 👪 sep 2021. Nonforfeiture options primarily apply to a life insurance policy that accumulates cash value. A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan.

Source: epahepaee.blogspot.com

Source: epahepaee.blogspot.com

Nonforfeiture options primarily apply to a life insurance policy that accumulates cash value. Life auto home health business renter disability commercial auto long term care annuity. If a policy owner chooses the cash surrender value option, the insurer will pay the remaining cash value within six months. Legally, nonforfeiture options protect policyholders from losing life insurance coverage for missed payments. In a whole life policy, there will be a table of guaranteed

Source: clips-khrime.blogspot.com

Source: clips-khrime.blogspot.com

A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan. What is a nonforfeiture option in life insurance? There are three nonforfeiture options: A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan. Once cash value has accumulated within a policy (which can take up to three years), the owner of the policy has the right to enact any one of the following three nonforfeiture options:

Source: bankingtruths.com

Source: bankingtruths.com

A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan. What is a nonforfeiture option in life insurance? Which is the nonforfeiture option in life insurance policy? Once cash value has accumulated within a policy (which can take up to three years), the owner of the policy has the right to enact any one of the following three nonforfeiture options: Privileges allowed under the terms of a life insurance contract after cash values have been created are referred to as nonforfeiture options.

Source: life-and-health-insurance-license.readthedocs.io

Source: life-and-health-insurance-license.readthedocs.io

If a policy owner chooses the cash surrender value option, the insurer will pay the remaining cash value within six months. The amount of cash value will be reduced by any loans you have taken out of it, whether. Should the policyowner get into a situation in which he cannot continue to make the required premium. These include the option for some or all of the premiums to be returned, the policy to be changed to a paid up policy, or the cash value to be paid to the policy owner. Consequently, what is nonforfeiture option in life insurance?

Source: clips-khrime.blogspot.com

Source: clips-khrime.blogspot.com

An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. If you have a nonforfeiture option in your policy, you can choose from four different benefits. Such an option considers the saving component of the policy. A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy. In simple terms, you have three options on how you want to surrender your policy.

Source: life-and-health-insurance-license.readthedocs.io

Source: life-and-health-insurance-license.readthedocs.io

In response to this problem, many life insurance companies adopted the nonforfeiture option, which means you are allowed to stop paying premiums and not forfeit any of the equity in the policy. Legally, nonforfeiture options protect policyholders from losing life insurance coverage for missed payments. If you miss your life insurance payments, you will surrender your policy back to the company. John explains to his agent that he lost his job and. A nonforfeiture clause is triggered when a policyholder stops paying premiums or surrenders their permanent life insurance policy.

Source: youtube.com

Source: youtube.com

If you miss your life insurance payments, you will surrender your policy back to the company. Should the policyowner get into a situation in which he cannot continue to make the required premium. An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. Nonforfeiture options primarily apply to a life insurance policy that accumulates cash value. A nonforfeiture clause in life insurance will make allowances if the policy lapses or is terminated.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Whole life insurance offers three nonforfeiture options that ensure policy owners receive value from their policies should they cancel them prior to death. There are three nonforfeiture options: Which is the nonforfeiture option in life insurance policy? An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. The following are the payout options outlined in the nonforfeiture clause of a whole life insurance policy:

Source: chegg.com

Source: chegg.com

The following are the payout options outlined in the nonforfeiture clause of a whole life insurance policy: An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. Consequently, what is nonforfeiture option in life insurance? Life auto home health business renter disability commercial auto long term care annuity. Legally, nonforfeiture options protect policyholders from losing life insurance coverage for missed payments.

Source: clipsbyrafe.blogspot.com

Source: clipsbyrafe.blogspot.com

A nonforfeiture option is a clause in your policy that allows you to receive full or partial benefits from your life insurance if the policy lapses or you want to cancel the plan. Which is the nonforfeiture option in life insurance policy? Cash surrender option if a policyowner chooses, he/she may request a cash payment of the cash values when the policy is surrendered. In simple terms, you have three options on how you want to surrender your policy. Such an option considers the saving component of the policy.

Source: bankingtruths.com

Source: bankingtruths.com

What is a nonforfeiture option? What is a nonforfeiture option? Such an option considers the saving component of the policy. If a policy owner chooses the cash surrender value option, the insurer will pay the remaining cash value within six months. In response to this problem, many life insurance companies adopted the nonforfeiture option, which means you are allowed to stop paying premiums and not forfeit any of the equity in the policy.

Source: clips-khrime.blogspot.com

Source: clips-khrime.blogspot.com

Such an option considers the saving component of the policy. An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. Legally, nonforfeiture options protect policyholders from losing life insurance coverage for missed payments. In response to this problem, many life insurance companies adopted the nonforfeiture option, which means you are allowed to stop paying premiums and not forfeit any of the equity in the policy. The following are the payout options outlined in the nonforfeiture clause of a whole life insurance policy:

Source: studylib.net

Source: studylib.net

Such an option considers the saving component of the policy. The amount of cash value will be reduced by any loans you have taken out of it, whether. An automatic premium loan is a nonforfeiture option that allows the insurance company to access the accumulated cash value in a permanent life insurance product to pay the premium on a policy that is in risk of lapsing from un paid premium. If you miss your life insurance payments, you will surrender your policy back to the company. Should the policyowner get into a situation in which he cannot continue to make the required premium.

Source: homeworklib.com

Source: homeworklib.com

Nonforfeiture benefit, a cash surrender value of such amount as may be hereinafter specified. Should the policyowner get into a situation in which he cannot continue to make the required premium. John, age 55, owns a whole life policy with a face amount of $100,000 for which the annual premium is $1,000. What nonforfeiture option allows a policyowner to use the existing cash value to purchase a policy of the same face amount as the original policy but for a reduced amount of time? Once cash value has accumulated within a policy (which can take up to three years), the owner of the policy has the right to enact any one of the following three nonforfeiture options:

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance nonforfeiture options by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.