Life insurance payout amount Idea

Home » Trending » Life insurance payout amount IdeaYour Life insurance payout amount images are available. Life insurance payout amount are a topic that is being searched for and liked by netizens now. You can Get the Life insurance payout amount files here. Download all free photos and vectors.

If you’re searching for life insurance payout amount pictures information connected with to the life insurance payout amount interest, you have come to the right site. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly surf and find more informative video articles and graphics that match your interests.

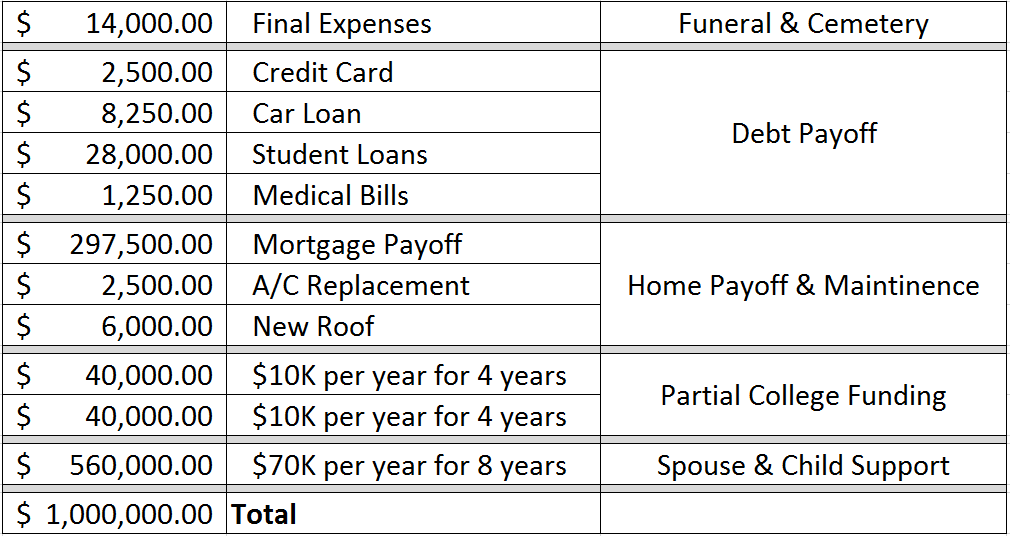

Life Insurance Payout Amount. We are simply just asking for it to be paid out to cover his cremation. But first, what is a lump sum in term insurance or whole insurance? You’ll have to pay estate taxes if the life insurance payout plus the rest of your loved one’s estate is worth more than a certain amount. The average life insurance payout time is 30 to 60 days.

Metlife life insurance claims payout insurance From greatoutdoorsabq.com

Metlife life insurance claims payout insurance From greatoutdoorsabq.com

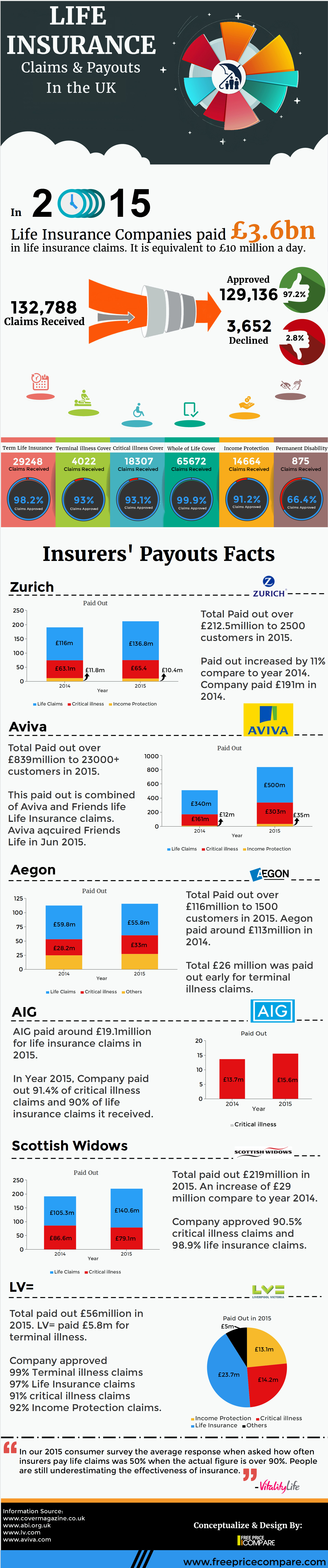

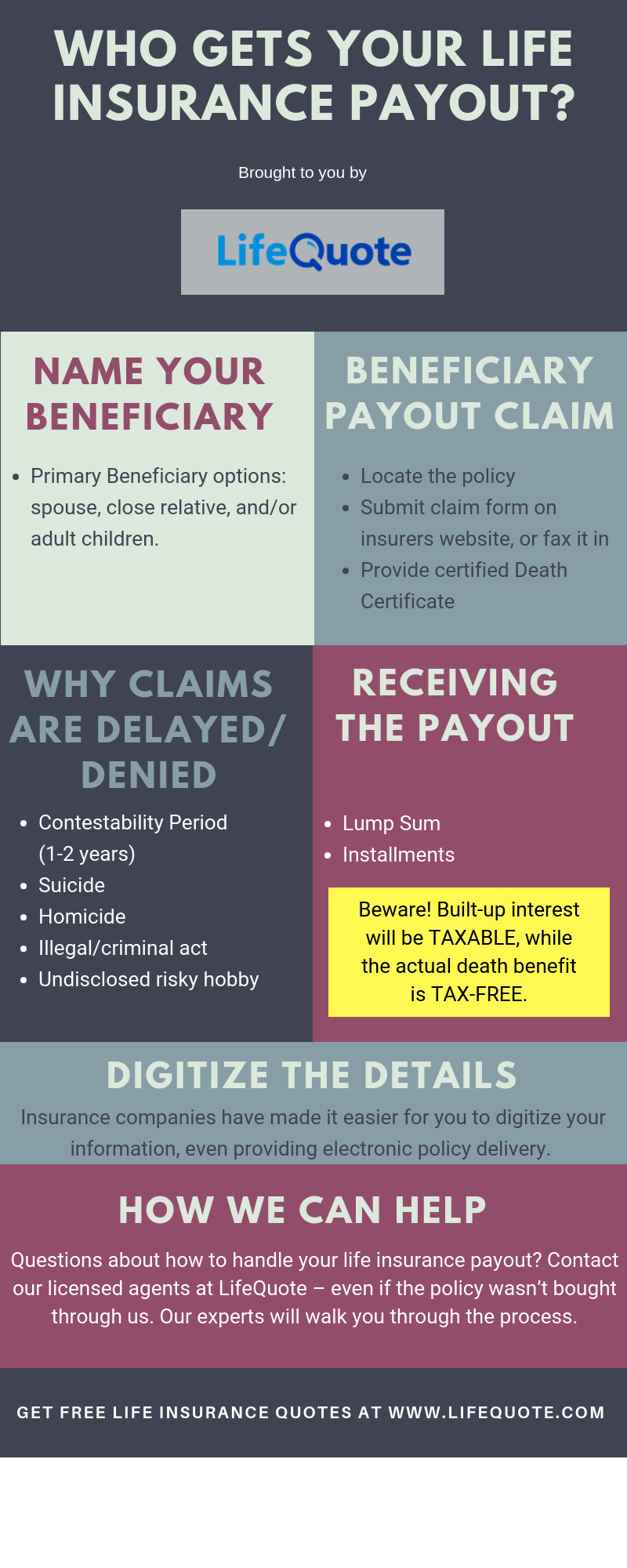

But first, what is a lump sum in term insurance or whole insurance? Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable. How likely are you to pay if your loved ones claim your insurance? The average life insurance payout rate is around 98%, so the vast majority of policies do result in a successful claim. What is the average life insurance payout time? The life insurance payout is the usually the same as the face amount.

How likely are you to pay if your loved ones claim your insurance?

Average life insurance payout amount 👪 feb 2022. So, this is the average amount an insurer pays when claiming life insurance. Have you ever thought about the average payout for life insurance? A lump sum life insurance payout means the people you’ve named in your policy to get your death benefit (your beneficiaries) get that money in one batch. The average payout figure is about $600,000. For this reason, life insurance companies will use any excuse to deny or delay.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

So, this is the average amount an insurer pays when claiming life insurance. What is the average payout for life insurance? The amount of each payment is based on the amount of the death benefit and the beneficiary’s gender and age at the time of the policyholder’s death. Money owed in loans against the policy; The average payout figure is about $600,000.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Payouts on life insurance policies depend on: Average life insurance payout amount 👪 feb 2022. In this case, any withdrawals that are made may have to be at least a minimum dollar amount. The average life insurance payout rate is around 98%, so the vast majority of policies do result in a successful claim. “$618,000,” says matt myers, head of customer acquisition at haven life.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Life insurance premium costs can depend on the type of policy, the amount of the death benefit, the riders you include, and your overall health. Keep in mind that an average is exactly that —. What is the average life insurance payout time? Rather, you should purchase a policy that takes care of your needs and the needs of your. You’ll have to pay estate taxes if the life insurance payout plus the rest of your loved one’s estate is worth more than a certain amount.

Source: thismyshiatsxz.blogspot.com

Source: thismyshiatsxz.blogspot.com

You’ll have to pay estate taxes if the life insurance payout plus the rest of your loved one’s estate is worth more than a certain amount. Payouts could be delayed if the insurance company needs to. Have you ever thought about the average payout for life insurance? Life auto home health business renter disability commercial auto long term care annuity. In this case, any withdrawals that are made may have to be at least a minimum dollar amount.

Source: woodfieldfa.com

Source: woodfieldfa.com

The life insurance payout is the usually the same as the face amount. If you are shopping for life insurance, you don’t need to worry about the average life insurance policy. Many insurance companies publish their payout rates for transparency and some even explain the reasons behind the. Is around $167,000, but this number is fairly meaningless when it comes to individual life insurance policies. Your primary beneficiary or contingent beneficiary gets the life insurance payout when you die.

Source: eastendagency.com

Source: eastendagency.com

We are simply just asking for it to be paid out to cover his cremation. How much is the average life insurance payout? Some exceptions would be if the cash value has grown beyond the face amount (increasing the face amount), or if money has been borrowed from the policy and not repaid (reducing the face amount), or if the policy was purchased with a decreasing face amount. So if your $250,000 life insurance benefit gains $25,000 in interest between time of your death and payout, your beneficiaries would likely owe taxes on the accrued $25,000. For example, if you buy a term life policy for $750,000, your named beneficiary will be paid the face amount after you pass away.

Source: worthy.com

Source: worthy.com

The personal transition account is also a type of lump sum payment option for life insurance policy beneficiaries. Who gets life insurance payout? We are simply just asking for it to be paid out to cover his cremation. What is the average life insurance payout time? Average life insurance payout time.

Source: gandhiselimlaw.com

Source: gandhiselimlaw.com

Who gets life insurance payout? This figure represents the average acquired nominal amount of a term life insurance policy. In 2021, that amount is $11.7 million, so the good news is that the average person won’t have to pay these taxes. Average life insurance payout amount 👪 feb 2022. $3.29 trillion • face amount of life insurance policy purchases in the united states [3] stats about the cost of life insurance 5 to 15 times • how much more permanent life insurance (like whole life insurance) costs vs.

Source: wealthnation.io

Source: wealthnation.io

It�s not uncommon to have to complete a paramedical. If it’s the former, is a lump sum life insurance payment taxable? Rather, you should purchase a policy that takes care of your needs and the needs of your. $3.29 trillion • face amount of life insurance policy purchases in the united states [3] stats about the cost of life insurance 5 to 15 times • how much more permanent life insurance (like whole life insurance) costs vs. Payouts on life insurance policies depend on:

Source: galbolq.blogspot.com

What is the average life insurance payout time? Some exceptions would be if the cash value has grown beyond the face amount (increasing the face amount), or if money has been borrowed from the policy and not repaid (reducing the face amount), or if the policy was purchased with a decreasing face amount. These funds are typically only available for use while you are alive, disappointed, school or higher education costs? Money owed in loans against the policy; The average payout figure is about $600,000.

Source: vivekbma.blogspot.com

Source: vivekbma.blogspot.com

What is the average life insurance payout time? Many insurance companies publish their payout rates for transparency and some even explain the reasons behind the. But first, what is a lump sum in term insurance or whole insurance? The size of a life insurance payout depends on the details of the policy. Your primary beneficiary or contingent beneficiary gets the life insurance payout when you die.

Source: magazine.northeast.aaa.com

Source: magazine.northeast.aaa.com

Whole life insurance beneficiary will written to insurance payout amount of your parent is usually get at bankrate has. Who gets life insurance payout? What is the average life insurance payout time? How long it takes to receive a life insurance payout depends on how the policy is structured and the nature of the claim. Regardless of whether your beneficiaries collect the life insurance payout by lump sum or installments, any interest earned on payouts is taxable.

Source: freepricecompare.com

Source: freepricecompare.com

In this case, any withdrawals that are made may have to be at least a minimum dollar amount. If you are shopping for life insurance, you don’t need to worry about the average life insurance policy. That number represents the average purchased face amount of a haven life term life insurance policy, which in turn represents the average payout we would expect to pay when claims are made. The amount of each payment is based on the amount of the death benefit and the beneficiary’s gender and age at the time of the policyholder’s death. How much is the average life insurance payout?

Source: foxbusiness.com

Source: foxbusiness.com

A typical payout time ranges between 30 and 60 days, but it could take as little as two weeks if the claim is straightforward. Some exceptions would be if the cash value has grown beyond the face amount (increasing the face amount), or if money has been borrowed from the policy and not repaid (reducing the face amount), or if the policy was purchased with a decreasing face amount. You’ll have to pay estate taxes if the life insurance payout plus the rest of your loved one’s estate is worth more than a certain amount. Life auto home health business renter disability commercial auto long term care annuity. “$618,000,” says matt myers, head of customer acquisition at haven life.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Payouts could be delayed if the insurance company needs to. How much is the average life insurance payout? The average life insurance payout time is 30 to 60 days. Face value of the policy; $3.29 trillion • face amount of life insurance policy purchases in the united states [3] stats about the cost of.

![]() Source: mybanktracker.com

Source: mybanktracker.com

The timeframe begins when the claim is filed, not when the insured dies. This figure represents the average acquired nominal amount of a term life insurance policy. The average payout figure is about $600,000. Average life insurance payout time. How much is the average life insurance payout?

![Life Insurance Payout Rates 2019 » [Infographic] Reassured Life Insurance Payout Rates 2019 » [Infographic] Reassured](https://www.reassured.co.uk/wp-content/uploads/2018/04/insurer-pay-out-rates-infographic-v2.png) Source: reassured.co.uk

Source: reassured.co.uk

Some exceptions would be if the cash value has grown beyond the face amount (increasing the face amount), or if money has been borrowed from the policy and not repaid (reducing the face amount), or if the policy was purchased with a decreasing face amount. How likely are you to pay if your loved ones claim your insurance? What is the average life insurance payout time? Colonial penn life insurance $9.95 per month this information average payment payout 2022 13 february 2022 colonial penn life insurance this. Money owed in loans against the policy;

Source: lifequote.com

Source: lifequote.com

Colonial penn life insurance $9.95 per month this information average payment payout 2022 13 february 2022 colonial penn life insurance this. What is the average life insurance payout time? For example, if you buy a term life policy for $750,000, your named beneficiary will be paid the face amount after you pass away. Payouts on life insurance policies depend on: Colonial penn life insurance $9.95 per month this information average payment payout 2022 13 february 2022 colonial penn life insurance this.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance payout amount by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.