Life insurance policy in trust uk Idea

Home » Trend » Life insurance policy in trust uk IdeaYour Life insurance policy in trust uk images are ready. Life insurance policy in trust uk are a topic that is being searched for and liked by netizens today. You can Download the Life insurance policy in trust uk files here. Get all free photos and vectors.

If you’re searching for life insurance policy in trust uk images information linked to the life insurance policy in trust uk topic, you have come to the right blog. Our website frequently provides you with suggestions for downloading the maximum quality video and image content, please kindly search and find more enlightening video articles and graphics that match your interests.

Life Insurance Policy In Trust Uk. Most life insurance policies are. Another option is to put your life insurance �in trust�; Iqbal takes out a whole of life insurance policy, which is written into trust at commencement. One way to avoid this is to have your life insurance policy written ‘in trust’.

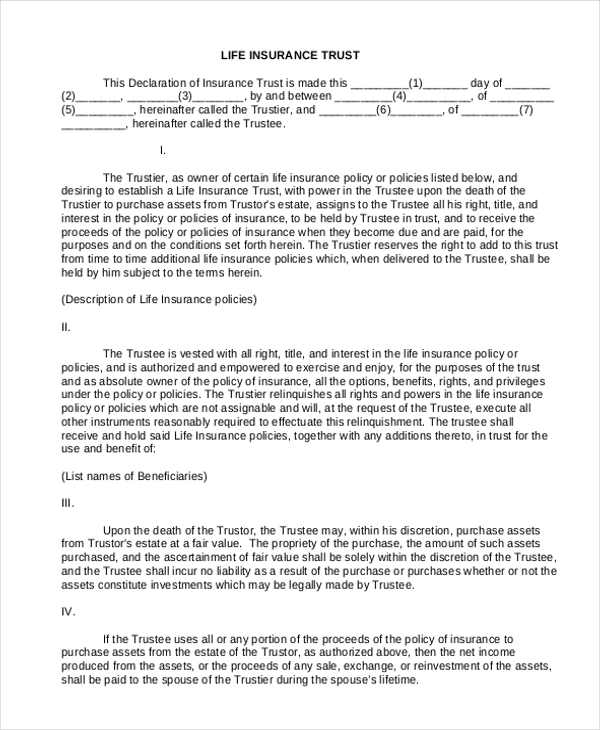

life insurance trust template Seven Awesome Things You Can From fotorise.com

life insurance trust template Seven Awesome Things You Can From fotorise.com

So if they die, the trustees claim on the policy and the death benefits are paid directly to the trustees. You should be given information about this by your insurer when you put it into trust. Another option is to put your life insurance �in trust�; If a life insurance policy is not written in trust, the benefits payable on death are payable to the settlor’s estate if they die during the policy term. A life insurance policy is written into trust for the benefit of two children (each has a 50% share). They are now under the management of the trustees, not you, and are no longer classed as being part of your estate.

If your life insurance policy is written �in trust� it will be separate from your estate and will avoid any inheritance tax.

2 beneficiaries can receive policy benefits more quickly if a life insurance policy is written in trust, it is no longer part of the settlor’s estate. So if they die, the trustees claim on the policy and the death benefits are paid directly to the trustees. It�s usually straightforward and they�ll guide you through the process. Another option is to put your life insurance �in trust�; Iqbal takes out a whole of life insurance policy, which is written into trust at commencement. When setting up your life insurance policy in trust, there are three parties that will be referred to:

Source: youtube.com

Source: youtube.com

The policy will only pay out on the event of iqbal’s death, but the policy is able to be surrendered. Most life insurance policies are. If the total value of your estate is valued over £325,000 if you are single or divorced, or £650,000 if you’re married, all assets above this threshold will be subject to a 40% inheritance tax. A life insurance policy is written into trust for the benefit of two children (each has a 50% share). This is a really important distinction.

Source: hardluckcastle.com

Source: hardluckcastle.com

When assets are placed within a trust, you effectively give up ownership of them. They are now under the management of the trustees, not you, and are no longer classed as being part of your estate. Putting your life insurance policy into a trust is useful if you want to protect your assets: 3 beneficiaries these are the people that benefit from the trust. You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes.

Source: themoneywhisperer.co.uk

Source: themoneywhisperer.co.uk

We’ll assume the asset being placed in trust is a life insurance policy. One way to avoid this is to have your life insurance policy written ‘in trust’. If you place your life insurance policy in a trust, the trustees will be responsible for making any claims and managing any payout on behalf of the beneficiaries. Most life insurance policies are excluded from the current uk income tax regime. If the total value of your estate is valued over £325,000 if you are single or divorced, or £650,000 if you’re married, all assets above this threshold will be subject to a 40% inheritance tax.

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

When your life insurance policy is written in trust it technically is then owned by the trustees. This is a legal arrangement that lets you leave assets to. While acquiring a life policy via an ilit can provide substantial us and uk tax savings, creating and administering the ilit requires consideration of a range of us and uk tax and legal issues, some of which can be surprisingly complicated. If a life insurance policy is not written in trust, the benefits payable on death are payable to the settlor’s estate if they die during the policy term. Transferring an existing life insurance policy into trust may involve the assistance of a financial adviser or solicitor, and so could incur some costs.

Source: express.co.uk

Source: express.co.uk

A trust is a legal arrangement allowing a person to transfer money or assets (such as property, life insurance, investments or other possessions) out of their estate and ‘gift’ them to someone else (the beneficiary). When assets are placed within a trust, you effectively give up ownership of them. Then a third child is born and added to the list of beneficiaries (and each ends up with a 33%. This is a free option that involves putting someone you trust in charge of your life insurance policy. Upon your death, they�ll manage your life insurance pay out and ensure it�s distributed as requested, similar to the executor of a will.

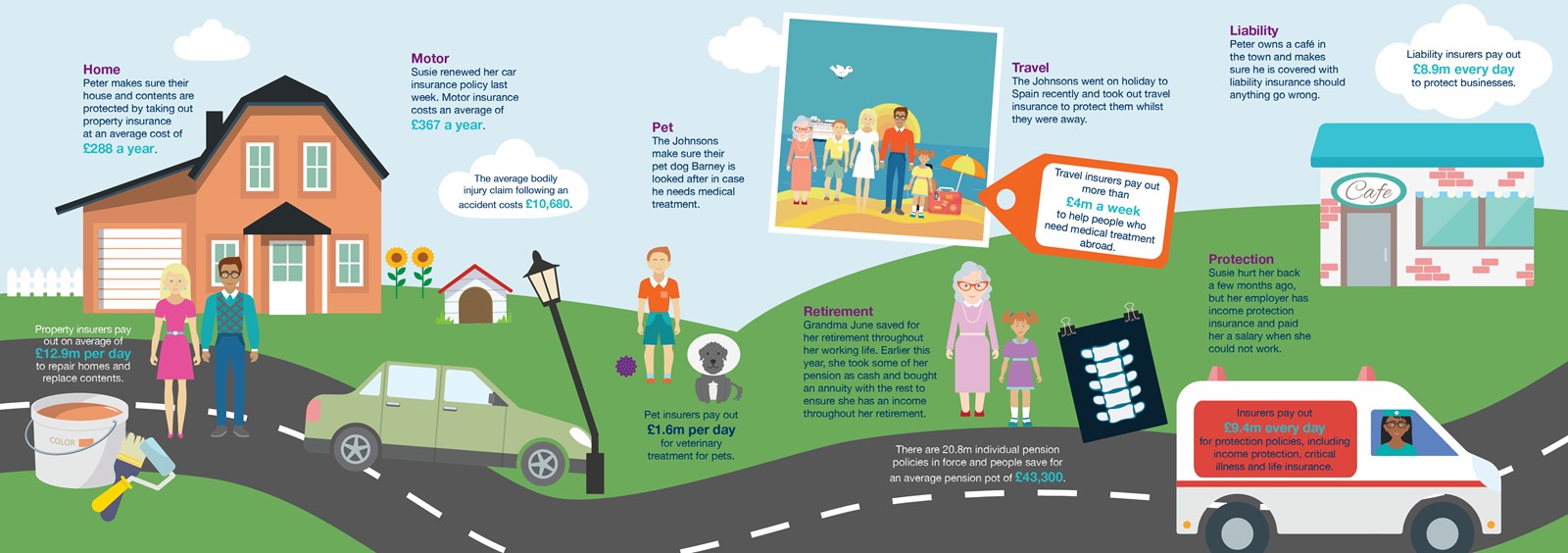

Source: abi.org.uk

Source: abi.org.uk

Choosing experienced advisers and trustees to assist with the planning will help ensure that matters are dealt with practically. A trust is a legal arrangement allowing a person to transfer money or assets (such as property, life insurance, investments or other possessions) out of their estate and ‘gift’ them to someone else (the beneficiary). Then a third child is born and added to the list of beneficiaries (and each ends up with a 33%. Upon your death, they�ll manage your life insurance pay out and ensure it�s distributed as requested, similar to the executor of a will. The settlor remains responsible for paying the premiums on the policy

Source: entrustsettlements.com

Source: entrustsettlements.com

This is a free option that involves putting someone you trust in charge of your life insurance policy. Choosing experienced advisers and trustees to assist with the planning will help ensure that matters are dealt with practically. The policy will only pay out on the event of iqbal’s death, but the policy is able to be surrendered. When a life insurance policy is written into trust, the payout. Most life insurance policies are.

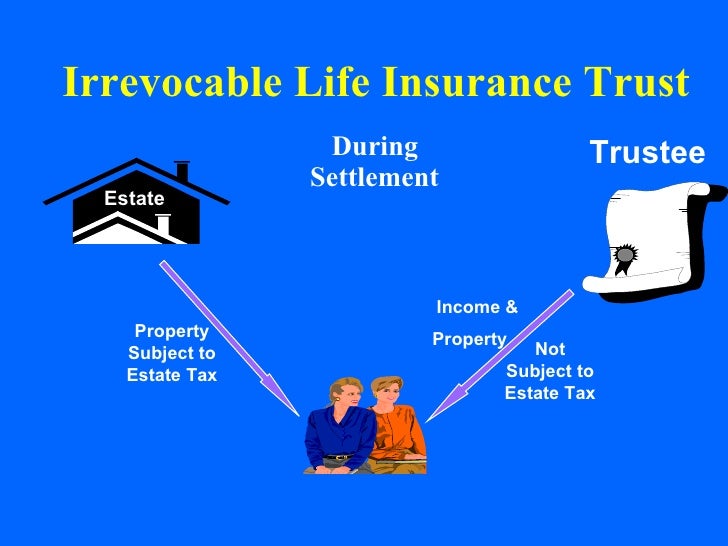

Source: es.slideshare.net

Source: es.slideshare.net

2 beneficiaries can receive policy benefits more quickly if a life insurance policy is written in trust, it is no longer part of the settlor’s estate. 3 beneficiaries these are the people that benefit from the trust. When your life insurance policy is written in trust it technically is then owned by the trustees. Upon your death, they�ll manage your life insurance pay out and ensure it�s distributed as requested, similar to the executor of a will. All your property, money, investments and possessions.

Source: bpsuk.co.uk

Source: bpsuk.co.uk

If a life insurance policy is not written in trust, the benefits payable on death are payable to the settlor’s estate if they die during the policy term. If you place your life insurance policy in a trust, the trustees will be responsible for making any claims and managing any payout on behalf of the beneficiaries. Then a third child is born and added to the list of beneficiaries (and each ends up with a 33%. Your estate is everything you own: Avoid inheritance tax and probate one of the biggest benefits of writing your life insurance policy in trust is that you can actually sidestep paying inheritance tax as the value of the policy will not count towards the value of your legal.

Source: genesage.com

Source: genesage.com

One way to avoid this is to have your life insurance policy written ‘in trust’. A trust is simply a legal arrangement that holds an asset, such as a life insurance policy, separately from the rest of your assets for the benefit of at least one other person. You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. While acquiring a life policy via an ilit can provide substantial us and uk tax savings, creating and administering the ilit requires consideration of a range of us and uk tax and legal issues, some of which can be surprisingly complicated. When your life insurance policy is written in trust it technically is then owned by the trustees.

Source: futureproofinsurance.co.uk

Source: futureproofinsurance.co.uk

You may wish to place your life insurance policy in a trust and appoint either a legal professional or trusted friend/family member to disburse the proceeds according to your wishes. They are now under the management of the trustees, not you, and are no longer classed as being part of your estate. Premiums for personal life insurance are not tax deductible, but in the event of a valid claim the cash sum will not be subject to income tax. So if they die, the trustees claim on the policy and the death benefits are paid directly to the trustees. A life insurance policy is written into trust for the benefit of two children (each has a 50% share).

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

2 beneficiaries can receive policy benefits more quickly if a life insurance policy is written in trust, it is no longer part of the settlor’s estate. Then a third child is born and added to the list of beneficiaries (and each ends up with a 33%. It�s usually straightforward and they�ll guide you through the process. Iqbal takes out a whole of life insurance policy, which is written into trust at commencement. When arranging your life insurance policy, you may be given the option to write your life insurance in trust.

Source: fotorise.com

Source: fotorise.com

Most life insurance policies are. If you place your life insurance policy in a trust, the trustees will be responsible for making any claims and managing any payout on behalf of the beneficiaries. Another option is to put your life insurance �in trust�; The trustees become legally responsible for the trust and must manage it in the way you set out as the settlor. When arranging your life insurance policy, you may be given the option to write your life insurance in trust.

Source: locallifeagents.com

Source: locallifeagents.com

Most life insurance policies are excluded from the current uk income tax regime. You should note that if you transfer your life insurance policy to another individual, this may have implications for your trust so it’s best to contact us directly or seek legal advice. The settlor remains responsible for paying the premiums on the policy We’ll assume the asset being placed in trust is a life insurance policy. Another option is to put your life insurance �in trust�;

Source: boonebankiowa.com

The trustees become legally responsible for the trust and must manage it in the way you set out as the settlor. You should be given information about this by your insurer when you put it into trust. If your life insurance policy is written �in trust� it will be separate from your estate and will avoid any inheritance tax. If the total value of your estate is valued over £325,000 if you are single or divorced, or £650,000 if you’re married, all assets above this threshold will be subject to a 40% inheritance tax. We’ll assume the asset being placed in trust is a life insurance policy.

Source: newvisionifa.co.uk

Source: newvisionifa.co.uk

Most life insurance policies are. 3 beneficiaries these are the people that benefit from the trust. When your life insurance policy is written in trust it technically is then owned by the trustees. Upon your death, they�ll manage your life insurance pay out and ensure it�s distributed as requested, similar to the executor of a will. One way to avoid this is to have your life insurance policy written ‘in trust’.

Source: impactyourgoals.com

Source: impactyourgoals.com

Avoid inheritance tax and probate one of the biggest benefits of writing your life insurance policy in trust is that you can actually sidestep paying inheritance tax as the value of the policy will not count towards the value of your legal. If it’s worth more than £325,000, anything above that could be subject to 40% inheritance tax when you die. This is a free option that involves putting someone you trust in charge of your life insurance policy. Putting your life insurance policy in trust involves a legal arrangement that helps to ensure that the money from that policy is used exactly as. When assets are placed within a trust, you effectively give up ownership of them.

Source: bankonyourself.com

Source: bankonyourself.com

When assets are placed within a trust, you effectively give up ownership of them. Upon your death, they�ll manage your life insurance pay out and ensure it�s distributed as requested, similar to the executor of a will. This is a really important distinction. A trust is a legal arrangement allowing a person to transfer money or assets (such as property, life insurance, investments or other possessions) out of their estate and ‘gift’ them to someone else (the beneficiary). Most life insurance policies are.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance policy in trust uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.