Life insurance portability vs conversion Idea

Home » Trend » Life insurance portability vs conversion IdeaYour Life insurance portability vs conversion images are available in this site. Life insurance portability vs conversion are a topic that is being searched for and liked by netizens today. You can Download the Life insurance portability vs conversion files here. Get all free vectors.

If you’re searching for life insurance portability vs conversion pictures information linked to the life insurance portability vs conversion keyword, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Life Insurance Portability Vs Conversion. Portability generally refers to going to term life and conversion generally refers to changing it to a whole life insurance policy. You can generally convert your group life insurance benefits to an individual whole life insurance policy5 if your coverageterminates in whole or in part due to: The biggest reason is they are uninsurable. The main differences between life insurance portability vs conversion are:

Group Life Insurance Conversion Thismylife Ing From thismylife-ing.blogspot.com

Group Life Insurance Conversion Thismylife Ing From thismylife-ing.blogspot.com

If you are able to continue your life insurance policy, you can port it, which means Here’s how portability and conversion work. The insured may elect one year of preliminary term insurance under the whole life plan. A term life insurance policy with the same death benefit as a whole life insurance policy will always be less expensive than the whole life policy. For group term life insurance coverage through your employer. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

The biggest reason is they are uninsurable.

If your family’s financial security and plans for the future — such as paying for college or staying in your home — are important to you, taking your life insurance (15). Or a total of $500,000 from all reliance standard group life insurance* combined, whichever is less. Life insurance portability is the ability to take your life insurance with you from job to job, state to state, or even country to country. For group term life insurance coverage through your employer. We’ve covered the differences between portability and conversion in the overview above, except for one glaring difference: If you decide to convert your policy to a permanent life insurance policy, the.

Source: blog.nisbenefits.com

The main differences between life insurance portability vs conversion are: Why would someone choose to continue their life insurance? The main differences between life insurance portability vs conversion are: Portability generally refers to going to term life and conversion generally refers to changing it to a whole life insurance policy. This temporary life insurance allows you to have coverage for a set period of time when the loss of your income would hit your family the hardest, like when your children are young or in college.

Source: old.susd12.org

Source: old.susd12.org

An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. In general you need to ask yourself which form. Portable insurance is a continuation of group insurance with group rates. An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Life insurance portability is the ability to take your life insurance with you from job to job, state to state, or even country to country.

Source: wholelifeinsurancesagamei.blogspot.com

Source: wholelifeinsurancesagamei.blogspot.com

An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Here’s how portability and conversion work. The insured may elect one year of preliminary term insurance under the whole life plan. We’ve covered the differences between portability and conversion in the overview above, except for one glaring difference: Conversion with sun life financial group life and ad&d plans, employees can take their coverage with them by porting or converting.

Source: issuu.com

Source: issuu.com

The premiums for porting your life insurance policy will be lower than if you decide to convert it; Portable insurance is a continuation of group insurance with group rates. Life insurance conversion is the ability to change your term life insurance from one that will end a set number of years, to one that will never end. • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Portability generally refers to going to term life and conversion generally refers to changing it to a whole life insurance policy.

Source: internal.cccs.edu

Source: internal.cccs.edu

An employee is eligible for portability (regardless of their health status) as long as they apply within the stated time frame (listed in the certificate of insurance or policy). *including ad&d, if applicable the coverage amount you are approved for is based on the reason conversion is applied for list (see list under the eligibility section). However, what you can convert your policy to varies by state. Conversion allows you to convert all or a portion of your group term life insurance to an individual whole life Both the terms portability and conversion are group life insurance.

We’ve covered the differences between portability and conversion in the overview above, except for one glaring difference: • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Here’s how portability and conversion work. Choosing portability and conversion is more about whether you want to keep your term life insurance coverage or have a whole life policy. When individuals have a life insurance policy provided by their employer, such life coverage is called group life insurance.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Portability generally refers to going to term life and conversion generally refers to changing it to a whole life insurance policy. • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Portability allows you to convert the group life policy to a personal term life insurance policy and conversion allows you to convert the policy to a whole life policy. Here’s how portability and conversion work. Portability allows you to convert the group life policy to a personal term life insurance policy and conversion allows you to convert the policy to a whole life policy.

Source: benehq.com

Source: benehq.com

• retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. However, what you can convert your policy to varies by state. Portability allows you to continue your coverage under the same group policy by paying your premiums directly to the insurance company (age limitations may apply). Conversion means you can change (convert) your coverage to an individual whole life policy.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

Life insurance portability is the ability to take your life insurance with you from job to job, state to state, or even country to country. Or a total of $500,000 from all reliance standard group life insurance* combined, whichever is less. Permanent permanent means that you can take it with you and it stays the same. Portability allows you to continue your coverage under the same group policy by paying your premiums directly to the insurance company (age limitations may apply). In general you need to ask yourself which form.

Source: internal.cccs.edu

Source: internal.cccs.edu

Life insurance portability often comes with an age restriction, whereas conversion doesn’t. Life insurance portability covers you only for a fixed term as decided by your previous employment cover, whereas with conversion, you can keep the insurance running for as long as you want. Conversion means you can change (convert) your coverage to an individual whole life policy. This temporary life insurance allows you to have coverage for a set period of time when the loss of your income would hit your family the hardest, like when your children are young or in college. In certain states, such as new york, conversion is to a universal life insurance policy which gives you more power and flexibility over how the premiums are invested as well as a more defined list of.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

This temporary life insurance allows you to have coverage for a set period of time when the loss of your income would hit your family the hardest, like when your children are young or in college. When individuals have a life insurance policy provided by their employer, such life coverage is called group life insurance. Life insurance portability is the ability to take your life insurance with you from job to job, state to state, or even country to country. Choosing portability and conversion is more about whether you want to keep your term life insurance coverage or have a whole life policy. We’ve covered the differences between portability and conversion in the overview above, except for one glaring difference:

Source: youtube.com

Source: youtube.com

Portable portable means that you can continue a term or whole life insurance policy after you leave employment. Life insurance portability vs conversion.when the insured stops working for the employer, continuous coverage may be available if the group plan offers a conversion and/or portability option that allows the insured to port or convert their group coverage into an individual policy. • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. However, they will increase as you age. Convertible convertible refers to the ability to change a policy from a term policy to a whole life policy.

Source: internal.cccs.edu

Source: internal.cccs.edu

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. To convert your life insurance policy essentially means that you’re changing the group or term life insurance policy that your company has offered into a whole life insurance policy, like whole life insurance; The biggest reason is they are uninsurable. If you decide to convert your policy to a permanent life insurance policy, the. The main differences between life insurance portability vs conversion are:

Source: wholelifeinsurancesagamei.blogspot.com

Source: wholelifeinsurancesagamei.blogspot.com

Eligible persons under your employer’s life insurance plan; Choosing portability and conversion is more about whether you want to keep your term life insurance coverage or have a whole life policy. The biggest reason is they are uninsurable. Rates are significantly higher than. If you are able to continue your life insurance policy, you can port it, which means

Source: internal.cccs.edu

Source: internal.cccs.edu

Life insurance portability often comes with an age restriction, whereas conversion doesn’t. Life insurance portability vs conversion.when the insured stops working for the employer, continuous coverage may be available if the group plan offers a conversion and/or portability option that allows the insured to port or convert their group coverage into an individual policy. Here’s how portability and conversion work. • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: wholelifeinsurancesagamei.blogspot.com

Source: wholelifeinsurancesagamei.blogspot.com

We’ve covered the differences between portability and conversion in the overview above, except for one glaring difference: An employee would be eligible to convert their group term life insurance policy into a personal term life insurance policy if their plan includes portability. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Convertible convertible refers to the ability to change a policy from a term policy to a whole life policy. When the insured stops working for the employer, continuous coverage may be available if the group plan offers a conversion and/or portability option that allows the insured to port or convert their group coverage into an individual policy.

Source: benefits3.filice.com

Source: benefits3.filice.com

You can generally convert your group life insurance benefits to an individual whole life insurance policy5 if your coverageterminates in whole or in part due to: Here’s how portability and conversion work. Portable insurance is a continuation of group insurance with group rates. • retirementor terminationof employment • a changein your employee class conversion is available on all group life insurance coverages. Portability allows you to convert the group life policy to a personal term life insurance policy and conversion allows you to convert the policy to a whole life policy.

Source: thismylife-ing.blogspot.com

Source: thismylife-ing.blogspot.com

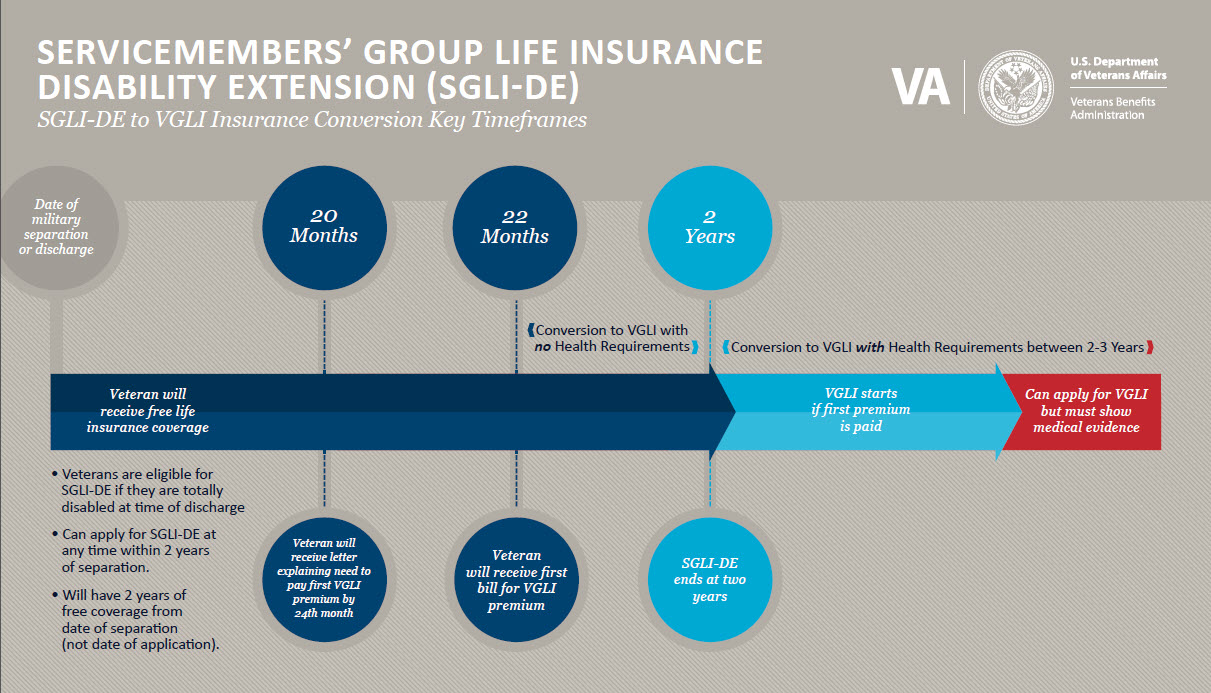

Conversion chart the life insurance program developed by the franklin county board of commissioners and underwritten by dearborn national® life insurance company is designed to offer employees, whose group life insurance coverage is ending, the flexibility of continuing their Or a total of $500,000 from all reliance standard group life insurance* combined, whichever is less. Life insurance portability covers you only for a fixed term as decided by your previous employment cover, whereas with conversion, you can keep the insurance running for as long as you want. To convert your life insurance policy essentially means that you’re changing the group or term life insurance policy that your company has offered into a whole life insurance policy, like whole life insurance; Rates are significantly higher than.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance portability vs conversion by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.